Mn Tax Rebate

The Minnesota Department of Revenue offers various tax rebate programs and initiatives aimed at providing financial relief to eligible residents and businesses within the state. These rebates play a crucial role in supporting economic growth and stability while ensuring fairness in the tax system. Understanding the different types of tax rebates available, their eligibility criteria, and the process of claiming them is essential for individuals and businesses looking to maximize their tax benefits.

Types of Mn Tax Rebates

Minnesota offers a range of tax rebate programs, each designed to cater to specific taxpayer segments and address diverse economic needs. Here’s an overview of some key rebate initiatives:

Minnesota Working Family Credit (MFWC)

The MFWC is a refundable tax credit aimed at helping low- to moderate-income working families in Minnesota. It’s similar to the federal Earned Income Tax Credit (EITC) and provides a financial boost to eligible taxpayers, reducing their tax burden and potentially resulting in a refund.

| Eligibility Criteria | Tax Year 2023 |

|---|---|

| Maximum Income for Married Filing Jointly | $62,000 |

| Maximum Income for Single/Head of Household | $52,000 |

| Maximum Income for Qualifying Widows/Widowers | $52,000 |

The credit amount depends on income, marital status, and the number of qualifying children. For instance, the maximum credit for Tax Year 2023 is $2,479 for married taxpayers with two or more qualifying children.

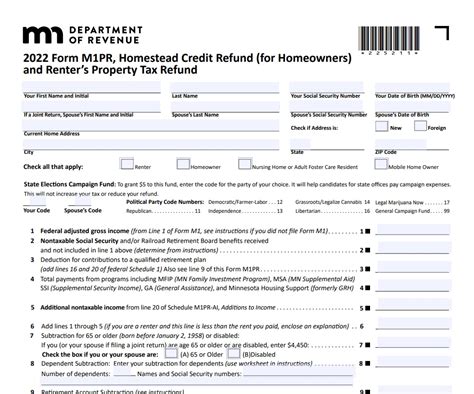

Homestead Credit Refund

The Homestead Credit Refund is a rebate designed to provide property tax relief to homeowners in Minnesota. Eligible homeowners can receive a refund of a portion of their property taxes, helping to reduce the financial burden of owning a home.

| Eligibility Criteria | Tax Year 2023 |

|---|---|

| Maximum Income | $78,000 for Joint Filers, $51,000 for Single/Head of Household |

| Maximum Homestead Credit Refund | $1,300 |

The refund amount is based on income and the property tax paid. It's important to note that this refund is separate from the Property Tax Refund, which is discussed later in this article.

Property Tax Refund (Circuit Breaker)

The Property Tax Refund, often referred to as the Circuit Breaker, is another program aimed at providing property tax relief. It’s designed to assist homeowners and renters with limited income by refunding a portion of their property taxes or rent.

| Eligibility Criteria | Tax Year 2023 |

|---|---|

| Maximum Income | $78,000 for Joint Filers, $51,000 for Single/Head of Household |

| Maximum Property Tax Refund | $1,300 |

The refund amount is calculated based on income, property taxes paid, and the type of residence (owner-occupied or rental). This refund is particularly beneficial for low-income individuals who own or rent their primary residence.

Business Tax Credits and Rebates

Minnesota also offers various tax credits and rebates to businesses, aiming to encourage economic growth and investment within the state. These incentives can significantly reduce a business’s tax liability, making Minnesota an attractive location for entrepreneurs and established companies alike.

Some notable business tax incentives include:

- Angel Tax Credit: This credit provides a 25% tax credit for investments in qualifying Minnesota businesses by individual investors.

- Research & Development Credit: Businesses engaged in research and development activities can claim this credit, reducing their tax burden and encouraging innovation.

- Job Creation Tax Credit: Businesses that create new jobs in Minnesota may be eligible for this credit, supporting employment growth and economic development.

Eligibility and Claiming Process

Understanding the eligibility criteria for each tax rebate is crucial. While the specific requirements vary based on the type of rebate, common factors include income level, residency status, and tax liability. For instance, most rebates have income thresholds that determine eligibility.

The process of claiming a tax rebate typically involves the following steps:

- Determine Eligibility: Review the specific criteria for the rebate you're interested in to ensure you meet all the requirements.

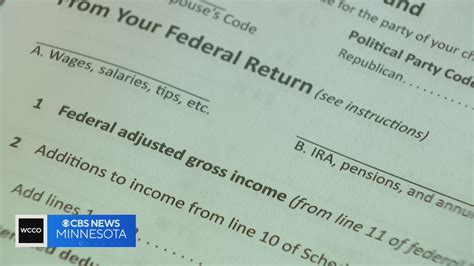

- Gather Necessary Documents: This may include tax returns, proof of residency, income verification, and other relevant documents.

- Complete the Required Forms: Each rebate has its own set of forms, which can be obtained from the Minnesota Department of Revenue's website or tax preparation software.

- File Your Tax Return: Claiming a rebate often requires filing a tax return, either online or through traditional methods.

- Submit the Rebate Claim: Include the completed forms and supporting documents with your tax return.

- Wait for Processing: The processing time can vary, but you should receive a confirmation once your claim is received.

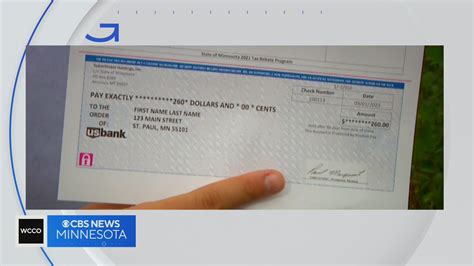

- Receive Your Rebate: If your claim is approved, you'll receive your rebate through the method you specified (direct deposit or check).

Maximizing Your Mn Tax Rebate

To make the most of the available tax rebates, consider the following strategies:

- Stay Informed: Keep up-to-date with the latest tax laws and rebate programs. The Minnesota Department of Revenue regularly updates its website with new initiatives and changes.

- Explore All Options: Don't limit yourself to one rebate. Review all the available programs to determine which ones you're eligible for and how you can maximize your benefits.

- Consult a Tax Professional: If you're unsure about your eligibility or the process, consulting a tax professional can provide valuable guidance and ensure you're taking full advantage of the available rebates.

- Plan Ahead: Start preparing for your tax return early. Gather your documents, review your income and expenses, and ensure you have all the information you need to claim your rebates.

Conclusion

Minnesota’s tax rebate programs play a vital role in supporting the state’s residents and businesses. By offering financial relief and incentives, these initiatives promote economic growth, encourage investment, and provide much-needed support to low- and moderate-income families. Understanding the various rebates, their eligibility criteria, and the claiming process is key to maximizing your tax benefits and contributing to Minnesota’s thriving economy.

Frequently Asked Questions

Can I claim multiple tax rebates in Minnesota?

+

Yes, you can claim multiple rebates if you meet the eligibility criteria for each. However, there might be instances where claiming one rebate could impact your eligibility for another, so it’s important to review the specific rules for each program.

What happens if I don’t receive my tax rebate on time?

+

If you don’t receive your rebate within the expected timeframe, it’s recommended to contact the Minnesota Department of Revenue. They can provide an update on the status of your claim and assist with any issues.

Are there any income limits for claiming business tax credits in Minnesota?

+

Income limits can vary depending on the specific tax credit. For instance, the Angel Tax Credit has no income limit, but other credits like the Job Creation Tax Credit may have specific income thresholds. It’s best to review the guidelines for each credit to determine eligibility.

Can I claim a tax rebate if I’m a part-year resident of Minnesota?

+

Eligibility for tax rebates as a part-year resident depends on the specific program. Some rebates may require you to have been a resident for a certain period, while others may have different criteria. It’s advisable to check the eligibility requirements for each rebate you’re interested in.

How long does it typically take to receive a tax rebate in Minnesota after filing my return?

+

The processing time for tax rebates in Minnesota can vary. While some rebates may be processed quickly, others might take several weeks or even months. It’s important to allow sufficient time and to keep track of the status of your claim.