Prince William County Tax

Welcome to a comprehensive guide on understanding and navigating the intricacies of Prince William County Tax, a vital aspect of financial responsibility for residents and businesses within this vibrant community. Prince William County, located in the Commonwealth of Virginia, boasts a rich history and a dynamic economy, making it essential for property owners and taxpayers to stay informed about the local tax system.

In this article, we will delve deep into the world of Prince William County Tax, covering everything from its historical evolution to the practicalities of tax assessment, payment, and appeals. By the end, you'll have a thorough understanding of your tax obligations and rights, empowering you to manage your financial affairs with confidence.

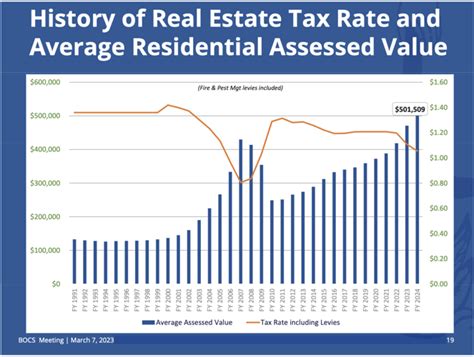

A Historical Perspective: Evolution of Taxation in Prince William County

The roots of taxation in Prince William County can be traced back to the early days of the Commonwealth of Virginia. Since its establishment, the county has played a significant role in shaping the state’s fiscal policies, adapting to changing economic landscapes, and contributing to the development of a robust taxation system.

Over the years, Prince William County has witnessed a transformation in its tax structure, reflecting the growth and diversification of the local economy. From the initial reliance on traditional property taxes to the incorporation of modern taxation methods, the county has adapted to meet the evolving needs of its residents and businesses.

One notable milestone in the county's tax history was the introduction of the Fairness in Taxation Act in 2001. This legislation aimed to ensure equitable tax assessments by introducing standardized valuation methods and establishing a more transparent and consistent tax system. The act not only simplified the taxation process but also enhanced public confidence in the county's fiscal policies.

Key Milestones in Prince William County’s Taxation Journey:

- 1980s: The county began implementing computer-assisted valuation methods, paving the way for more accurate and efficient tax assessments.

- 1990s: Prince William County saw a surge in commercial development, prompting the need for a revised tax code to accommodate the diverse business landscape.

- 2001: The Fairness in Taxation Act was enacted, revolutionizing the tax assessment process and setting a new standard for transparency.

- 2010s: The county embraced online tax services, making it more convenient for taxpayers to access information and manage their obligations remotely.

As we explore the current taxation landscape in Prince William County, it's essential to appreciate the historical context that has shaped the present system. This understanding provides a foundation for making informed decisions and navigating the complexities of tax obligations effectively.

Understanding the Tax Assessment Process: A Step-by-Step Guide

The tax assessment process in Prince William County is a meticulous and well-defined procedure, ensuring that every property owner receives a fair and accurate valuation. Here’s a detailed breakdown of the key steps involved:

1. Data Collection and Analysis

The journey begins with the Department of Tax Administration gathering comprehensive data on every taxable property within the county. This includes information on land value, building characteristics, and recent sales of comparable properties.

Using advanced statistical models, the department analyzes the collected data to establish fair market values for each property. This step ensures that assessments are based on current market conditions and reflect the true value of the properties.

2. Preliminary Assessment Notices

Once the initial assessments are complete, the department issues Preliminary Assessment Notices to all property owners. These notices provide an estimated value of the property and serve as a preview of the upcoming tax assessment.

Property owners are encouraged to review these notices carefully and contact the department if they have any concerns or questions. This stage is crucial for identifying and addressing potential discrepancies before the final assessment.

3. Final Assessment and Notification

After considering any feedback received during the preliminary notice stage, the department finalizes the assessments. Final Assessment Notices are then sent to property owners, detailing the official tax assessment for the upcoming year.

These notices include important information such as the assessed value, the applicable tax rate, and the estimated tax amount. Property owners are advised to review these notices thoroughly and understand the implications for their financial planning.

4. Tax Appeal Process

In the event that a property owner disagrees with the final assessment, Prince William County offers a structured tax appeal process. This process allows taxpayers to challenge their assessments based on factors such as valuation errors, changed circumstances, or other valid reasons.

The appeal process is designed to be transparent and accessible, providing an opportunity for taxpayers to present their case and seek a fair resolution. The county's Board of Equalization plays a crucial role in reviewing appeals and making final determinations.

| Tax Assessment Timeline | Key Dates |

|---|---|

| Preliminary Assessment Notices | Issued in January |

| Deadline for Feedback | Typically 30 days after notices are sent |

| Final Assessment Notices | Sent by April |

| Appeal Deadline | Usually 30 days after final notices |

Understanding the tax assessment process empowers property owners to actively participate in shaping their financial obligations. By staying informed and engaged, taxpayers can ensure that their assessments are accurate and fair, contributing to the overall efficiency of the Prince William County tax system.

Navigating Tax Payment: Options and Resources for Residents and Businesses

Once you understand your tax assessment, the next crucial step is to explore the various options for tax payment in Prince William County. The county offers a range of convenient methods to ensure that taxpayers can fulfill their obligations with ease and efficiency.

1. Online Payment Portal

The Prince William County Online Payment Portal is a user-friendly platform designed to simplify the tax payment process. Residents and businesses can access their accounts, view their tax balances, and make secure payments using a variety of payment methods, including credit cards, debit cards, and electronic checks.

The portal also provides a convenient way to track payment history, ensuring transparency and ease of access for taxpayers. This online system is especially beneficial for those who prefer the convenience of managing their finances remotely.

2. In-Person Payments

For those who prefer traditional methods, Prince William County offers in-person payment options. Taxpayers can visit designated tax collection offices during specified hours to make payments in person. These offices accept various forms of payment, including cash, checks, and money orders.

In-person payments provide an opportunity for taxpayers to seek assistance from tax officials, address any queries, and receive immediate confirmation of their payments.

3. Electronic Funds Transfer (EFT)

As a modern and efficient alternative, the county also offers Electronic Funds Transfer as a payment method. EFT allows taxpayers to authorize the direct transfer of funds from their bank accounts to the county’s tax department. This method is secure, convenient, and eliminates the need for physical checks or visits to collection offices.

To set up EFT, taxpayers can complete a simple enrollment process, providing their banking details and authorizing the county to initiate transfers on specified dates.

4. Payment Plans and Installment Options

Prince William County understands that tax payments can sometimes pose financial challenges. To accommodate the diverse financial situations of taxpayers, the county offers payment plans and installment options. These plans allow taxpayers to spread their tax payments over a predetermined period, making it more manageable to meet their obligations.

To avail of these plans, taxpayers can contact the tax department, discuss their financial circumstances, and work out a suitable repayment schedule.

5. Tax Relief Programs

In recognition of the financial constraints faced by certain segments of the community, Prince William County has implemented tax relief programs. These programs aim to provide assistance to eligible taxpayers, such as senior citizens, disabled individuals, and low-income households.

To qualify for tax relief, taxpayers must meet specific criteria and provide the necessary documentation. The county's tax department can guide eligible individuals through the application process, ensuring that they receive the support they deserve.

By offering a diverse range of payment options and support programs, Prince William County demonstrates its commitment to accommodating the financial needs of its residents and businesses. This approach fosters a sense of community and ensures that taxpayers can fulfill their obligations in a manner that suits their individual circumstances.

Exploring Tax Appeals: Your Rights and the Process

In the realm of taxation, it is essential for property owners to be aware of their rights, especially when it comes to challenging tax assessments. Prince William County recognizes the importance of a fair and transparent tax system, and as such, it provides a structured process for taxpayers to appeal their assessments.

Understanding Your Rights

Every taxpayer has the right to dispute a tax assessment if they believe it is incorrect or unfair. The Prince William County Board of Equalization, an independent body, plays a crucial role in ensuring that taxpayers’ rights are protected and that assessments are reviewed impartially.

Taxpayers have the right to:

- Request a review of their assessment

- Present evidence and arguments to support their case

- Receive a fair and unbiased hearing

- Be informed of the decision and the reasons behind it

The Tax Appeal Process

Initiating a tax appeal in Prince William County involves a series of well-defined steps:

- Notice of Appeal: Taxpayers must file a Notice of Appeal within a specified timeframe after receiving their final assessment notice. This notice should include details about the property, the assessment in question, and the reasons for the appeal.

- Documentation and Evidence: Taxpayers are required to provide supporting documentation, such as comparable sales data, appraisals, or other relevant evidence to strengthen their case.

- Hearing: The Board of Equalization schedules a hearing, during which taxpayers present their arguments and evidence. This is an opportunity to make a persuasive case for why the assessment should be adjusted.

- Decision: After carefully reviewing the evidence and arguments, the Board of Equalization makes a decision. Taxpayers are informed of the outcome, along with the reasons for the decision.

- Appeal Resolution: If the taxpayer is satisfied with the decision, the process is concluded. However, if the taxpayer disagrees, they have the right to further appeal to the Circuit Court of Prince William County.

Expert Tips for a Successful Appeal

The tax appeal process in Prince William County is designed to ensure fairness and accountability. By understanding your rights and following the prescribed procedures, taxpayers can navigate this process confidently, aiming for a resolution that reflects the true value of their property.

The Future of Taxation: Prince William County’s Vision and Initiatives

As we look ahead, Prince William County is poised to embrace innovative strategies and initiatives to enhance its taxation system further. The county’s leadership recognizes the dynamic nature of the local economy and the evolving needs of its residents and businesses.

Modernizing Tax Administration

One of the key focuses of the county’s vision is to modernize tax administration through the integration of advanced technologies. This includes the implementation of:

- A centralized online portal for tax services, providing a one-stop solution for taxpayers.

- Automated processes to streamline tax assessments and improve efficiency.

- Data analytics tools to enhance the accuracy and fairness of tax valuations.

By embracing these technological advancements, Prince William County aims to create a more efficient and user-friendly tax system, benefiting both taxpayers and administrative staff.

Community Engagement and Education

The county understands the importance of fostering a culture of financial literacy and transparency. As such, it is committed to engaging with the community through educational initiatives and outreach programs.

These initiatives aim to:

- Provide taxpayers with the knowledge and tools to understand their tax obligations and rights.

- Offer support and guidance to vulnerable populations, ensuring that everyone has access to essential tax information.

- Encourage community feedback and participation in shaping the future of the county's tax policies.

Sustainable Tax Policies

In line with its commitment to sustainability and environmental stewardship, Prince William County is exploring sustainable tax policies that promote eco-friendly practices and support green initiatives.

Some of the proposed initiatives include:

- Incentives for businesses and residents adopting renewable energy sources.

- Tax breaks for property owners investing in energy-efficient upgrades.

- Development of a green tax credit system to encourage environmentally conscious behaviors.

By integrating sustainability into its taxation framework, the county aims to create a more resilient and environmentally conscious community.

A Collaborative Approach

Prince William County recognizes the value of collaboration and partnership in shaping effective tax policies. As such, it actively seeks input from various stakeholders, including:

- Local businesses and industry leaders

- Community organizations and advocacy groups

- Tax professionals and legal experts

Through these collaborations, the county aims to develop tax policies that are not only fair and efficient but also reflective of the diverse needs and aspirations of its residents and businesses.

As Prince William County embarks on this transformative journey, its vision for the future of taxation is one of innovation, transparency, and community engagement. By staying true to these principles, the county is poised to create a taxation system that serves as a model for other jurisdictions, ensuring a bright and sustainable future for all its residents.

FAQs: Common Questions About Prince William County Tax

What is the deadline for filing tax returns in Prince William County?

+

The deadline for filing tax returns in Prince William County is typically April 15th of each year. However, it’s essential to stay updated with any potential extensions or changes to this deadline, as they may occur due to unforeseen circumstances.

How can I estimate my tax liability before receiving my assessment notice?

+

You can use the Prince William County tax estimator tool, available on the official website. This tool provides an estimate based on your property’s location, type, and other relevant factors. While it’s not an exact assessment, it offers a good starting point for financial planning.

Are there any tax breaks or incentives available for homeowners in Prince William County?

+

Yes, Prince William County offers several tax relief programs, including the Senior Citizen Real Estate Tax Relief Program and the Disabled Veterans Exemption Program. These programs provide eligible homeowners with reduced tax burdens. It’s advisable to check the official website for eligibility criteria and application processes.

Can I make partial payments for my tax obligations in Prince William County?

+

While the county encourages taxpayers to fulfill their obligations in full, it does offer installment plans for those facing financial difficulties. These plans allow taxpayers to make partial payments over a specified period, subject to certain conditions and approval by the tax department.