Is Colorado Accepting Tax Returns

Colorado's tax system is a vital component of the state's economic landscape, and understanding its processes is crucial for both residents and businesses. This comprehensive guide aims to provide an in-depth analysis of the tax return process in Colorado, offering valuable insights for those navigating the state's tax landscape.

The Colorado Tax Return Process: An Overview

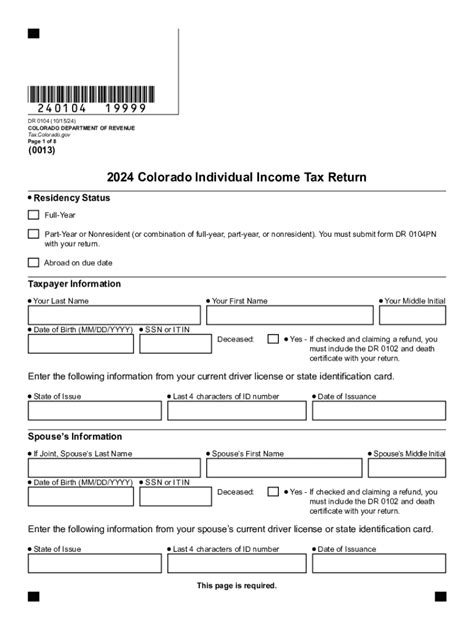

In Colorado, the tax return process is a well-regulated procedure that begins with the collection of various forms and documents, each serving a specific purpose in calculating an individual’s or business’s tax liability. The state’s tax department, the Colorado Department of Revenue (DOR), provides comprehensive resources to guide taxpayers through this process, ensuring a streamlined and accurate submission.

For individual taxpayers, the process typically involves gathering Form 1040, the U.S. Individual Income Tax Return, and any relevant schedules and forms, such as Schedule A for itemized deductions or Schedule C for business income. These forms are essential for declaring income, deductions, and credits, which then determine the taxpayer's overall liability.

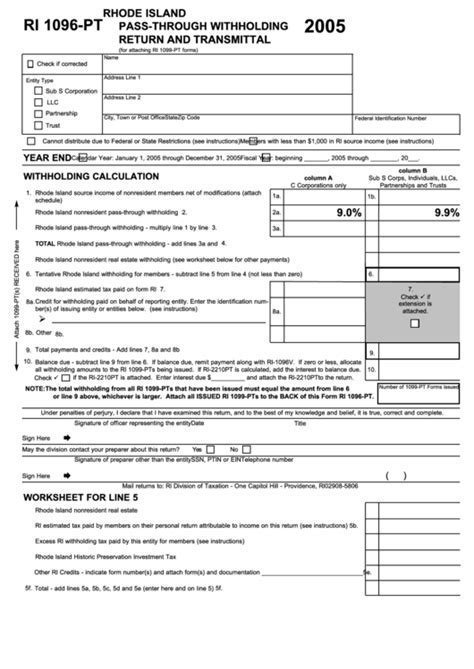

Businesses in Colorado, on the other hand, have a more varied set of forms to contend with. Depending on the business structure, entities may need to file forms such as the C-Corp Income Tax Return (Form 1120), the S-Corp Income Tax Return (Form 1120S), or the Partnership Return (Form 1065). Additionally, sales tax returns (Form RT-100) and employment tax returns (Form CO-941) are crucial for businesses operating in the state.

Key Dates and Deadlines

The Colorado tax calendar is punctuated by several key dates. The traditional deadline for filing federal and state income tax returns is typically April 15th, but this can be extended under certain circumstances. The DOR offers an automatic six-month extension for filing individual income tax returns, which pushes the deadline to October 15th of the same year. However, it’s important to note that while the filing deadline is extended, any taxes owed are still due by the original deadline, and interest and penalties may accrue on unpaid balances.

For businesses, the deadlines vary depending on the type of business and its tax obligations. For instance, quarterly estimated tax payments for individuals and corporations are due on April 15th, June 15th, September 15th, and January 15th of the following year. Sales tax returns are due on the 25th of the month following the taxable period, while employment tax returns are due on the 15th of the month following the taxable period.

| Tax Type | Due Date |

|---|---|

| Individual Income Tax Returns | April 15th (or extended to October 15th) |

| Corporate Income Tax Returns | Varies based on entity type |

| Quarterly Estimated Tax Payments | April 15th, June 15th, September 15th, January 15th |

| Sales Tax Returns | 25th of the month following the taxable period |

| Employment Tax Returns | 15th of the month following the taxable period |

Preparing Your Tax Return: A Step-by-Step Guide

Preparing a tax return can be a complex process, but with the right tools and knowledge, it can be streamlined and efficient. Here’s a step-by-step guide to help you navigate the process successfully.

Step 1: Gather Your Documents

The first step in preparing your tax return is to gather all the necessary documents. This includes your W-2 forms from your employer(s), 1099 forms if you had any freelance income, and any other income statements. If you have deductions or credits to claim, gather the relevant documentation to support these claims. This could include receipts for charitable donations, medical expenses, or education costs.

Step 2: Choose Your Filing Status

Your filing status is an important factor in determining your tax liability. In Colorado, you can choose from several filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er) with Dependent Child. The status you choose will impact your tax rate and any deductions or credits you’re eligible for. Make sure to research and understand which status best applies to your situation.

Step 3: Calculate Your Income

The next step is to calculate your total income for the tax year. This includes wages, salaries, tips, dividends, interest, and any other taxable income. If you’re self-employed, you’ll also need to include your net business income. Be sure to keep track of all your income sources to ensure accuracy.

Step 4: Itemize Deductions or Take the Standard Deduction

In Colorado, you have the option to itemize your deductions or take the standard deduction. Itemizing allows you to deduct specific expenses, such as mortgage interest, state and local taxes, medical expenses, and charitable contributions. If your itemized deductions exceed the standard deduction amount, it may be beneficial to itemize. However, if your expenses don’t exceed the standard deduction, it’s generally simpler to take the standard deduction.

Step 5: Calculate Your Tax Liability

Once you’ve gathered your documents, chosen your filing status, calculated your income, and determined your deductions, it’s time to calculate your tax liability. This involves applying the appropriate tax rates and credits to your taxable income. The Colorado DOR provides tax tables and worksheets to help you with this calculation.

Step 6: Prepare and File Your Return

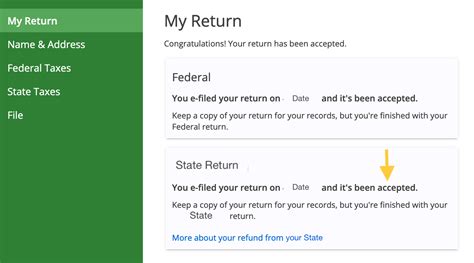

With your tax liability calculated, you’re ready to prepare and file your return. You can choose to file electronically or mail in your return. The Colorado DOR offers an online filing system, Colorado eFile, which is a secure and convenient way to file your return. If you prefer to mail your return, be sure to use the correct address and include all necessary forms and schedules.

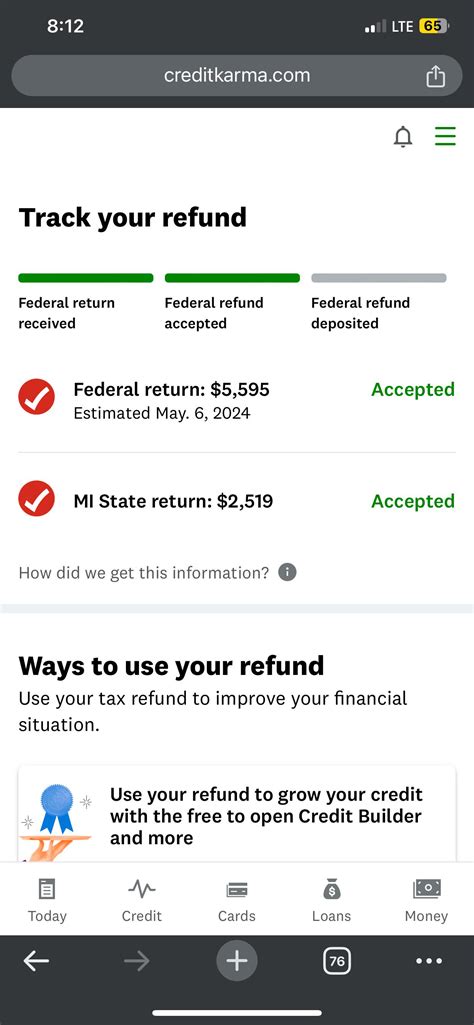

Step 7: Payment or Refund

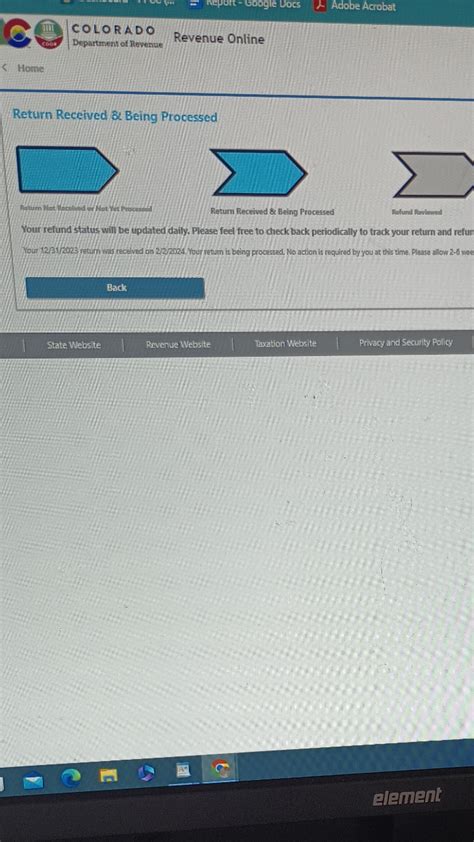

After filing your return, you’ll either owe taxes or be entitled to a refund. If you owe taxes, you can pay online, by mail, or set up a payment plan with the DOR. If you’re due a refund, the DOR will process your return and issue your refund within a few weeks. You can check the status of your refund online using the DOR’s refund tracker.

Colorado Tax Laws and Regulations

Colorado’s tax laws are designed to promote fairness and efficiency in the collection of state revenues. The state’s tax code is governed by a set of principles and regulations that aim to ensure a stable and predictable tax environment for individuals and businesses.

Income Tax Rates and Brackets

Colorado has a progressive income tax system, which means that tax rates increase as income levels rise. The state has five income tax brackets, ranging from 2.55% to 4.55%. These rates apply to both individual and corporate income tax, with adjustments made based on filing status and entity type.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $5,800 | 2.55% |

| $5,800 - $23,200 | 3.25% |

| $23,200 - $46,400 | 4.45% |

| $46,400 - $73,600 | 4.54% |

| Over $73,600 | 4.55% |

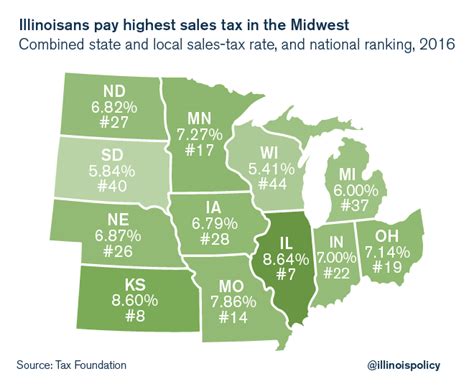

Sales and Use Tax

Colorado imposes a 2.9% state sales and use tax on the sale of tangible personal property. This tax is collected by retailers and remitted to the state. In addition to the state tax, most cities and counties also impose their own sales and use taxes, which can vary significantly. These local taxes are in addition to the state tax and are often included in the total sales tax rate quoted to consumers.

Property Tax

Property tax in Colorado is primarily a local tax, with rates set by individual counties. The state does not impose a statewide property tax. Property taxes are based on the assessed value of the property, which is determined by the county assessor. The tax rate is then applied to this assessed value to calculate the tax liability.

Corporate Tax

Colorado imposes a 4.63% corporate income tax on the net income of corporations doing business in the state. This tax is in addition to the federal corporate income tax. The state also imposes a 0.1% franchise tax on the value of a corporation’s issued and outstanding stock.

Recent Tax Changes and Updates

Colorado’s tax laws are subject to change, often as a result of legislative action or ballot initiatives. In recent years, the state has seen several significant tax changes. For example, in 2020, the state implemented a 0.25% increase in the state sales tax to fund transportation projects. This increase brought the total state sales tax rate to 3.15%, in addition to local sales taxes.

Tax Benefits and Incentives in Colorado

Colorado offers a range of tax benefits and incentives to individuals and businesses, aimed at promoting economic growth and development within the state. These incentives can significantly reduce tax liabilities for eligible taxpayers.

Personal Tax Credits

Colorado offers several personal tax credits, which can reduce the amount of tax owed. These credits include the Child Care Tax Credit, which provides a credit for qualified child care expenses, and the Property Tax Cash Refund, which refunds a portion of property taxes paid by low- and moderate-income taxpayers.

Business Tax Incentives

For businesses, Colorado provides a range of tax incentives to encourage investment and job creation. These incentives include the Enterprise Zone Tax Credits, which offer a variety of tax benefits to businesses that invest in designated economically distressed areas. These benefits can include income tax credits, sales tax exemptions, and property tax abatements.

The state also offers the Advanced Industry Tax Credit, which provides tax credits to businesses operating in targeted advanced industries. These industries include aerospace, bioscience, electronics, and energy. The credit is designed to encourage investment and job growth in these sectors.

Sales Tax Exemptions

Colorado provides several sales tax exemptions, which can significantly reduce the cost of doing business in the state. These exemptions include sales tax holidays, where certain items are exempt from sales tax for a limited time, and exemptions for specific types of businesses or industries, such as manufacturing or agriculture.

Tax-Free Retirement Income

Colorado offers a unique tax benefit for retirees: tax-free retirement income. This means that certain types of retirement income, such as pension payments, 401(k) distributions, and IRA withdrawals, are not subject to state income tax. This benefit can make Colorado an attractive retirement destination for those looking to minimize their tax burden.

Tax Assistance and Support in Colorado

Navigating the tax system can be complex, and many taxpayers may require assistance or support. Colorado offers a range of resources and programs to help taxpayers understand and comply with their tax obligations.

Colorado Department of Revenue (DOR) Resources

The Colorado DOR provides a wealth of resources to assist taxpayers. These include detailed tax guides, forms and instructions, and an online tax calculator. The DOR also offers a Taxpayer Assistance Program, which provides free, confidential assistance to taxpayers who need help preparing their tax returns or resolving tax issues.

Volunteer Income Tax Assistance (VITA) Program

The VITA program is a nationwide initiative that provides free tax preparation assistance to low- to moderate-income individuals and families. In Colorado, VITA sites are located throughout the state, and volunteers are trained to prepare basic tax returns for eligible taxpayers. This program can be especially beneficial for those who may not have the means to hire a professional tax preparer.

Taxpayer Advocate Service

The Taxpayer Advocate Service is a division of the Internal Revenue Service (IRS) that provides personalized, independent assistance to taxpayers who are experiencing economic harm or significant hardship due to the way the tax system is administered. In Colorado, the Taxpayer Advocate Service can help resolve tax issues, provide guidance on tax law, and advocate for taxpayers who are facing difficulties with the IRS.

Tax Preparation Services and Software

For those who prefer to have their tax returns prepared by professionals, there are numerous tax preparation services and software options available. These services can provide expert guidance and ensure accurate and efficient tax filing. Popular options in Colorado include H&R Block, TurboTax, and local accounting firms.

Community Resources and Workshops

Many communities in Colorado offer tax workshops and educational events to help residents understand their tax obligations. These events are often hosted by local libraries, community centers, or non-profit organizations. They provide an opportunity for residents to learn about tax laws, ask questions, and receive guidance from tax professionals.

FAQs

When is the deadline for filing my tax return in Colorado?

+

The traditional deadline for filing tax returns in Colorado is April 15th. However, this deadline may be extended under certain circumstances, such as if you file for an extension or if there is a state-declared disaster or emergency. It’s important to check with the Colorado Department of Revenue for the most up-to-date information on tax deadlines.

What forms do I need to file my tax return in Colorado?

+

The specific forms you need will depend on your individual circumstances, such as your income sources, deductions, and credits. However, common forms include Form 1040 for individual income tax returns, Form 1065 for partnership returns, and Form 1120 for corporate income tax returns. The Colorado Department of Revenue provides a comprehensive list of forms and instructions on their website