Georgia State Income Tax Return

The Georgia State Income Tax Return is an essential process for residents and businesses in the state, ensuring compliance with tax laws and contributing to the state's revenue. This article aims to provide an in-depth guide to the Georgia income tax return, covering everything from filing requirements to potential deductions and credits. With a comprehensive understanding of the process, individuals and businesses can navigate their tax obligations with confidence and efficiency.

Understanding the Georgia Income Tax Structure

Georgia, like many other states in the US, has its own set of income tax laws and regulations. The state’s tax system is designed to generate revenue for various public services, infrastructure development, and government operations. Understanding the unique aspects of Georgia’s income tax structure is crucial for accurate and timely filing.

Tax Rates and Brackets

Georgia operates on a progressive tax system, meaning that higher incomes are taxed at higher rates. The state has six tax brackets, ranging from 1% to 5.75%. These rates apply to taxable income, which is the total income after deductions and exemptions have been taken into account. For the tax year 2023, the brackets are as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 1% | 0 - 1,000 |

| 2% | 1,001 - 2,000 |

| 3% | 2,001 - 3,500 |

| 4% | 3,501 - 7,500 |

| 5.25% | 7,501 - 10,000 |

| 5.75% | Over $10,000 |

It's important to note that these rates are subject to change, and taxpayers should refer to the official Georgia Department of Revenue website for the most up-to-date information.

Taxable Income and Exemptions

Georgia state income tax applies to various sources of income, including wages, salaries, commissions, bonuses, business income, rental income, and interest and dividend income. However, certain types of income are exempt from state taxation. For instance, Social Security benefits and certain retirement income are exempt up to specific limits.

Additionally, Georgia offers standard deductions and personal exemptions to reduce taxable income. For the tax year 2023, the standard deduction is $3,000 for single filers and $6,000 for married couples filing jointly. Personal exemptions are set at $2,000 per dependent, which can significantly reduce the taxable income for families.

Filing Requirements and Deadlines

Meeting the filing requirements and adhering to deadlines is crucial to avoid penalties and ensure a smooth tax return process. Here’s what you need to know:

Who Needs to File

All Georgia residents with income above a certain threshold are required to file a state income tax return. This includes individuals, businesses, trusts, and estates. Even if you don’t owe any state taxes, you may still need to file if your income exceeds the minimum threshold. For non-residents with Georgia-sourced income, such as rental income or business profits, filing may also be necessary.

Filing Deadlines

The deadline for filing Georgia state income tax returns aligns with the federal tax deadline, which is typically April 15th of the following year. However, in the event that April 15th falls on a weekend or a holiday, the deadline is extended to the next business day. For instance, for the tax year 2023, the deadline would be April 17th, 2024, as April 15th falls on a Sunday.

It's important to note that if you are unable to meet the deadline, you can request an extension. However, an extension only grants additional time to file, not to pay any taxes owed. Interest and penalties may still accrue on any unpaid taxes during the extension period.

Preparing Your Georgia Income Tax Return

Proper preparation is key to a successful and stress-free tax return process. Here’s a step-by-step guide to help you through the process:

Gathering Necessary Documents

Before you begin, ensure you have all the necessary documents and information. This includes:

- W-2 forms from all employers for the tax year.

- 1099 forms for any other income sources, such as interest, dividends, or rental income.

- Records of business income and expenses if you are self-employed.

- Receipts and records for any deductions or credits you plan to claim.

- Previous year’s tax returns for reference.

Choosing a Filing Method

Georgia offers several options for filing your income tax return. You can choose to file electronically or by mail, depending on your preference and the complexity of your return.

- Electronic Filing: This method is often the most convenient and efficient. Georgia offers free electronic filing through its official website, Georgia Department of Revenue. You can also use third-party tax preparation software or hire a professional tax preparer for assistance.

- Paper Filing: If you prefer a traditional approach, you can download and print the necessary forms from the Georgia Department of Revenue website. Complete the forms and mail them to the appropriate address.

Completing the Tax Return

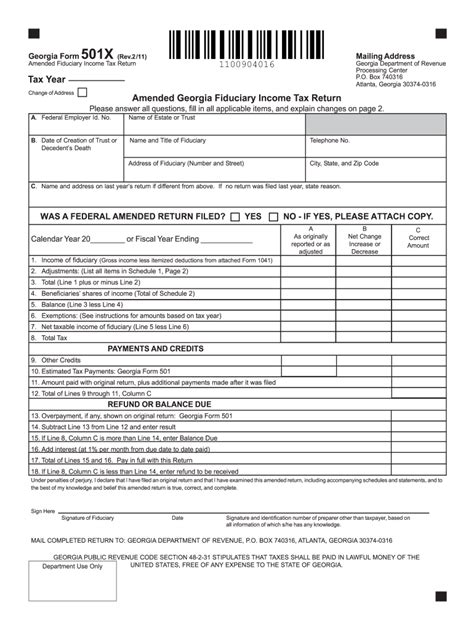

Whether you’re filing electronically or by paper, ensure you have all the required information and forms. The Georgia income tax return typically consists of several forms, including:

- Form 500: Individual Income Tax Return

- Schedule A: Itemized Deductions

- Schedule C: Profit or Loss from Business

- Schedule D: Capital Gains and Losses

- And any other schedules or forms relevant to your specific situation.

Carefully review each form and enter the appropriate information. Ensure accuracy, as mistakes can lead to audits and penalties. If you're unsure about any aspect of the process, consider seeking guidance from a tax professional.

Deductions and Credits

Georgia offers a range of deductions and credits to reduce the tax burden for individuals and businesses. Understanding these opportunities can significantly impact your tax liability.

Deductions

Georgia allows taxpayers to claim deductions to reduce their taxable income. These deductions can be either itemized or taken as a standard deduction. Some common deductions include:

- Medical Expenses: You can deduct unreimbursed medical expenses that exceed a certain threshold of your adjusted gross income.

- Charitable Contributions: Donations to qualified charities are deductible.

- State and Local Taxes: Georgia allows a deduction for state and local income taxes paid.

- Mortgage Interest: Interest paid on a home mortgage is often deductible.

- Education Expenses: Certain education-related expenses, such as tuition and fees, may be deductible.

Credits

Credits are even more valuable than deductions, as they directly reduce your tax liability dollar-for-dollar. Georgia offers several tax credits, including:

- Hope Scholarship Credit: This credit provides a tax credit for qualified education expenses at eligible colleges and universities in Georgia.

- Film Tax Credit: Georgia’s film industry benefits from a tax credit for qualified film production expenses.

- Low-Income Tax Credit: This credit is available to low-income taxpayers and is calculated based on federal tax credit eligibility.

- Estate Tax Credit: For estates subject to federal estate tax, Georgia offers a credit to offset some of the state tax burden.

Filing Status and Tax Planning

Your filing status is a crucial factor in determining your tax liability and potential benefits. Georgia recognizes the same filing statuses as the federal government:

- Single: Unmarried individuals with no qualifying dependents.

- Married Filing Jointly: Married couples filing a joint return.

- Married Filing Separately: Married couples filing separate returns.

- Head of Household: Unmarried individuals who maintain a household for a qualifying dependent.

- Qualifying Widow(er): Taxpayers who have lost their spouse and are caring for dependent children.

Choosing the right filing status can impact your tax liability and eligibility for certain deductions and credits. It's essential to consider your specific circumstances and consult a tax professional if needed.

Common Mistakes and Audits

While the Georgia income tax return process is straightforward for many taxpayers, mistakes can happen. Here are some common errors to avoid:

Mathematical Errors

Simple mathematical mistakes can lead to discrepancies in your tax return. Always double-check your calculations and consider using tax preparation software to minimize the risk of errors.

Incorrect Social Security Numbers

Ensure that you enter the correct Social Security numbers for yourself and any dependents. Incorrect SSNs can delay your refund and may trigger an audit.

Overlooking Deductions and Credits

Taxpayers often miss out on valuable deductions and credits. Take the time to research and understand all the opportunities available to you. Consider consulting a tax professional to ensure you’re maximizing your benefits.

Underreporting Income

Intentionally or unintentionally underreporting income is a serious offense. The Georgia Department of Revenue has systems in place to detect such errors, and it can result in penalties, interest, and even criminal charges.

Future Implications and Tax Reforms

Georgia’s tax system is subject to ongoing reforms and changes. While it’s difficult to predict future developments, understanding the potential implications can help taxpayers prepare.

Potential Tax Rate Changes

Tax rates are a common area of focus for tax reforms. While the current tax rates in Georgia are relatively stable, there have been proposals to introduce a flat tax rate or to modify the existing brackets. Staying informed about any proposed changes can help you plan for potential impacts on your tax liability.

Deduction and Credit Adjustments

Deductions and credits are often adjusted or modified to reflect changing economic conditions and policy priorities. For instance, the Hope Scholarship Credit has been expanded and modified over the years to support education in Georgia. Keeping up with these changes can ensure you’re taking full advantage of available benefits.

Technology and Electronic Filing

The future of tax filing in Georgia, like in many other states, is likely to be increasingly digital. The state is investing in technology to streamline the filing process and enhance security. As electronic filing becomes more prevalent, taxpayers can expect faster refunds and improved accuracy.

Conclusion

The Georgia State Income Tax Return process, while complex, is manageable with the right knowledge and preparation. By understanding the tax structure, meeting filing requirements, and taking advantage of deductions and credits, taxpayers can ensure compliance and minimize their tax burden. As the tax landscape evolves, staying proactive and informed is key to successful tax planning.

Can I file my Georgia income tax return electronically if I don’t have a computer or internet access?

+

Yes, you can still file electronically even without a computer or internet access. Many public libraries and community centers offer free computer and internet access. Additionally, tax preparation software companies often provide options to file electronically from a mobile device, such as a smartphone or tablet. You can also consider visiting a tax professional or using the services of a tax preparation company, who can assist you with electronic filing.

What happens if I miss the filing deadline for my Georgia income tax return?

+

If you miss the filing deadline, you may be subject to penalties and interest on any taxes owed. However, you can request an extension to file your return. Keep in mind that an extension only grants additional time to file, not to pay any taxes owed. It’s important to note that requesting an extension does not automatically waive penalties and interest, so it’s best to file as soon as possible to minimize any additional costs.

Can I claim the Hope Scholarship Credit if I’m not a Georgia resident but attend a college or university in the state?

+

Yes, you can claim the Hope Scholarship Credit even if you’re not a Georgia resident. The credit is available to all students who meet the eligibility requirements, regardless of their state of residence. However, non-residents may have additional requirements or limitations, so it’s important to carefully review the guidelines provided by the Georgia Department of Revenue.

Are there any tax incentives for small businesses in Georgia?

+

Yes, Georgia offers several tax incentives for small businesses. These include tax credits for job creation, investment in certain industries, and research and development activities. Additionally, Georgia has a small business set-aside program, which reserves a portion of state contracts for small businesses. It’s recommended to consult with a tax professional or visit the Georgia Department of Revenue’s website for the most up-to-date information on small business tax incentives.

Can I deduct my commute to work on my Georgia income tax return?

+

No, the cost of commuting to and from work is generally not deductible for federal or state income tax purposes. However, if you have substantial business-related travel expenses, such as travel for meetings or client visits, you may be able to deduct those expenses. It’s important to maintain accurate records and consult with a tax professional to determine which expenses may be deductible in your specific situation.