Nueces County Property Tax Search

Welcome to the comprehensive guide on the Nueces County Property Tax Search, a vital tool for residents and property owners in the vibrant Nueces County, Texas. In this expert-led exploration, we'll delve into the intricacies of the property tax system, providing you with a thorough understanding of how to navigate and utilize this essential service. From searching for property records to assessing tax values, this guide will equip you with the knowledge needed to manage your property tax obligations effectively.

Understanding the Nueces County Property Tax System

The Nueces County Property Tax system is a robust and transparent process, designed to ensure fair taxation for all property owners. It involves a series of assessments, appraisals, and public notifications, ultimately leading to the determination of property tax rates and values. Understanding this process is key to navigating the Nueces County Property Tax Search effectively.

Here's a breakdown of the key stages in the property tax cycle in Nueces County:

- Property Appraisal: The Appraisal District assesses the value of each property annually, considering factors like location, size, improvements, and market conditions.

- Protest Period: Property owners have the right to protest their appraised value during a designated period. This ensures a fair and accurate assessment process.

- Tax Rate Adoption: The county and local taxing units adopt tax rates, which are then applied to the appraised values to calculate property taxes.

- Notice of Appraised Value: Property owners receive notifications of their appraised values and any changes from the previous year.

- Tax Bills: After the tax rate is set, property owners receive their tax bills, detailing the calculated tax amount.

By familiarizing yourself with these stages, you can better understand the context of the property tax information you find through the Nueces County Property Tax Search.

Navigating the Nueces County Property Tax Search

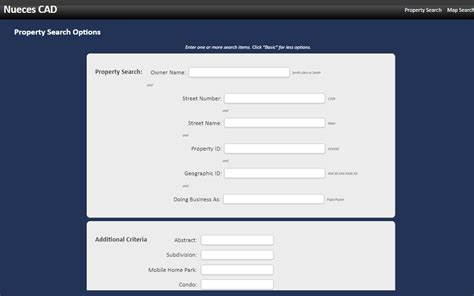

The Nueces County Property Tax Search portal is a user-friendly platform designed to provide easy access to property tax information. Here’s a step-by-step guide to help you navigate it effectively:

-

Access the Portal: Visit the official Nueces County Property Tax Search website. The URL is typically provided by the county government or the Appraisal District.

-

Search by Property Details: You can search for a property by its address, owner's name, or even the unique Appraisal District ID. Enter the relevant details and click "Search".

-

Review Property Information: The search results will display key details about the property, including its location, owner's name, and appraised value. You can also access historical tax information and recent changes.

-

View Tax Bills and Payments: The portal often provides access to current and past tax bills, allowing you to review the calculated tax amounts and payment status. You can also make online payments through the portal.

-

Explore Additional Resources: The Nueces County Property Tax Search portal may offer further resources, such as tax rate information, protest forms, and guides on property tax exemptions. These resources can be invaluable for understanding your tax obligations and rights.

Remember, the Nueces County Property Tax Search is a powerful tool, but it's essential to approach it with a clear understanding of the property tax system and your specific property's context.

Exploring Property Tax Records

The property tax records available through the Nueces County Property Tax Search offer a wealth of information for property owners and interested parties. Here’s a deeper dive into what you can expect to find:

Appraised Value and Assessment Details

The appraised value of a property is a critical piece of information, as it forms the basis for calculating property taxes. The Nueces County Property Tax Search provides access to the current appraised value, as well as historical values, allowing you to track changes over time. Additionally, you can find details about the assessment process, including the factors considered and any adjustments made.

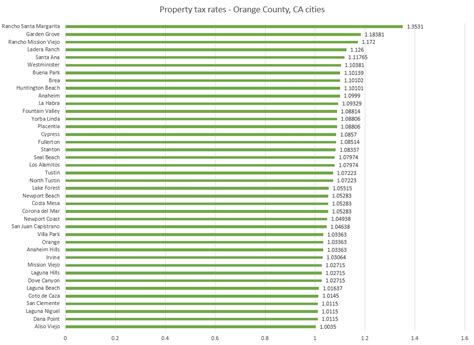

Tax Rate Information

Understanding the tax rate is crucial for calculating the actual tax amount. The Nueces County Property Tax Search typically provides the current tax rate, as well as historical rates, which can help you compare and plan for future tax obligations. The tax rate is usually broken down by taxing unit, such as the county, school district, and municipality, giving you a clear picture of where your tax dollars are allocated.

Property Characteristics and Improvements

Property tax records often include detailed information about the property’s characteristics, such as the type of structure, square footage, number of rooms, and any recent improvements. These details can impact the appraised value and, consequently, the property taxes. The Nueces County Property Tax Search may provide access to these records, allowing you to review and verify the information.

Tax Exemptions and Discounts

Nueces County offers various tax exemptions and discounts to eligible property owners. These can significantly reduce the tax burden. The Nueces County Property Tax Search portal often provides information on these exemptions, including eligibility criteria and the application process. It’s essential to review these to ensure you’re taking advantage of any applicable benefits.

Maximizing the Nueces County Property Tax Search

To make the most of the Nueces County Property Tax Search, here are some tips and best practices:

-

Stay Informed: Keep up-to-date with property tax news and updates from the county. This includes changes in tax rates, assessment methods, and any new exemptions or initiatives.

-

Review Regularly: Make it a habit to review your property tax information annually. This helps you catch any errors or changes that may impact your tax obligations.

-

Understand Your Rights: Familiarize yourself with your rights as a property owner, including the right to protest your appraised value and the process for appealing tax decisions.

-

Explore Exemptions: Research and apply for any tax exemptions or discounts you may be eligible for. This can include homestead exemptions, senior citizen discounts, or disability exemptions.

-

Seek Professional Advice: If you have complex property holdings or unique circumstances, consider consulting a tax professional or accountant to ensure you're optimizing your tax strategy.

By staying proactive and informed, you can effectively manage your property tax obligations and ensure a smooth experience with the Nueces County Property Tax Search.

Conclusion

The Nueces County Property Tax Search is a valuable resource for property owners and stakeholders, offering a transparent and accessible way to manage property tax obligations. By understanding the property tax system and leveraging the features of the search portal, you can navigate the process with confidence. Remember, staying informed and proactive is key to a positive property tax experience.

For more insights and updates on property tax matters in Nueces County, be sure to follow official sources and stay tuned for any announcements or changes.

What if I disagree with my property’s appraised value?

+

If you believe your property’s appraised value is inaccurate, you have the right to protest. The protest process typically involves submitting a formal request and attending a hearing. It’s important to gather supporting evidence, such as recent sales of comparable properties, to strengthen your case. Consult the Nueces County Appraisal District for specific protest procedures and deadlines.

Are there any online tools to estimate my property taxes?

+

Yes, the Nueces County Property Tax Search portal often provides tools to estimate your property taxes. These calculators consider your property’s appraised value and the current tax rate to provide an estimated tax amount. However, remember that this is an estimate, and the actual tax bill may vary due to factors like tax rate changes or exemptions.

How often are property values reassessed in Nueces County?

+

Property values in Nueces County are typically reassessed annually. This ensures that the appraised value reflects the current market conditions and any improvements or changes to the property. The reassessment process is conducted by the Appraisal District, and property owners are notified of any changes.