What Is A K1 Tax Form

The K-1 form, officially known as the "Form K-1: Partner's Share of Income, Deductions, Credits, etc.," is a crucial document in the United States tax system, playing a vital role in reporting an individual's share of income, losses, deductions, and credits from partnerships, S corporations, and certain trusts and estates.

The K-1 form is an essential tool for tax reporting, providing transparency and accountability for both the business entities and their partners or shareholders. It ensures that the Internal Revenue Service (IRS) has accurate information about the financial activities and distributions of these entities, thereby facilitating fair and efficient tax collection.

Understanding the Purpose of the K-1 Form

The primary purpose of the K-1 form is to report an individual’s share of the income, losses, deductions, and credits from a business entity, such as a partnership, S corporation, or certain types of trusts and estates. These entities are pass-through entities, meaning that their profits and losses “pass through” to the owners or shareholders, who then report these on their personal tax returns.

The K-1 form provides a detailed breakdown of an individual's share of the entity's income and expenses. This includes items such as ordinary business income or loss, capital gains or losses, dividends, interest income, and other specific allocations. Each partner or shareholder receives a K-1 form for their respective share, ensuring accurate reporting and taxation of their income.

The complexity of the K-1 form reflects the intricate nature of pass-through entities and their tax obligations. By requiring these entities to provide a comprehensive report of each owner's share, the IRS can effectively enforce tax compliance and ensure that individuals pay taxes on their full share of income, even if the entity itself does not pay taxes directly.

Who Receives and Uses the K-1 Form

The K-1 form is issued by business entities to their owners or shareholders. These entities include:

- Partnerships: A business owned by two or more individuals, where profits and losses are shared among the partners.

- S Corporations: A special type of corporation where, unlike a traditional corporation, profits and losses are passed through to the shareholders, who report these on their personal tax returns.

- Trusts: Legal entities that hold assets and distribute income to beneficiaries. Some trusts are treated as pass-through entities for tax purposes.

- Estates: Legal entities that manage and distribute a deceased person's assets. Like trusts, certain estates are considered pass-through entities for tax purposes.

Each partner, shareholder, or beneficiary of these entities receives a K-1 form, which they must include with their personal tax return. This form provides the necessary information for them to calculate and report their tax liability accurately. Failure to include the K-1 form or report the income correctly can result in penalties and interest charges from the IRS.

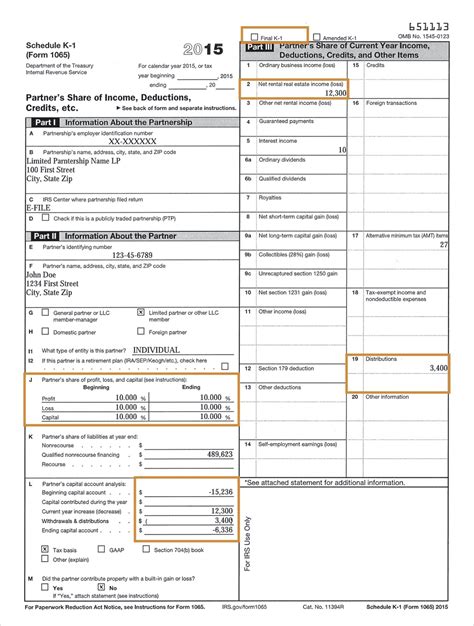

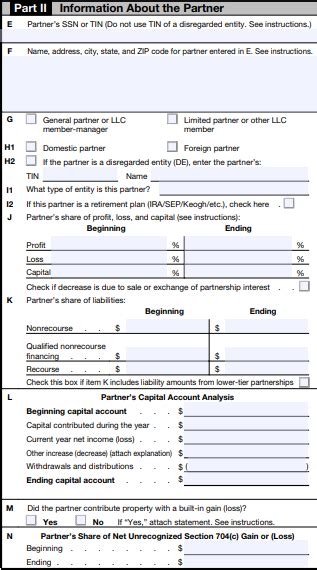

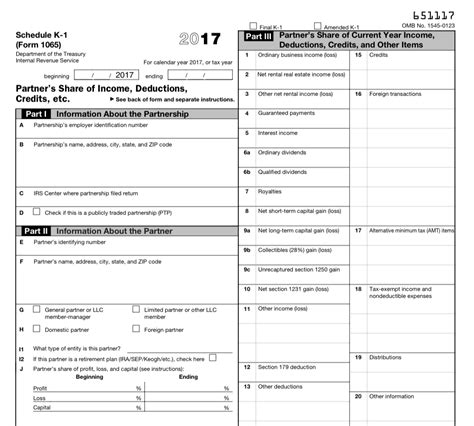

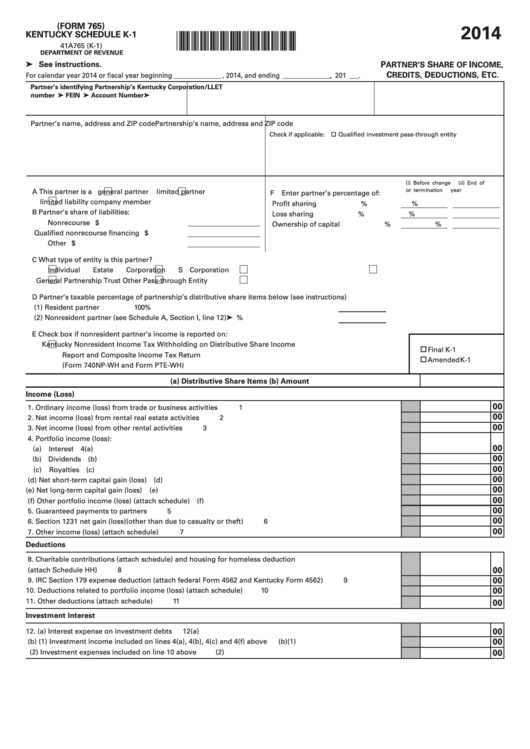

The Information on a K-1 Form

The K-1 form contains a wealth of information, including:

- Owner's Information: Details about the owner, such as name, address, and taxpayer identification number (TIN) or Social Security Number (SSN)

- Entity Information: Basic details about the business entity, including its name, address, and Employer Identification Number (EIN)

- Income and Loss Items: A breakdown of the owner's share of ordinary business income or loss, capital gains or losses, dividends, interest income, and other allocations

- Deductions and Credits: Information about the owner's share of any deductions or credits the entity has claimed

- Taxable Distributions: Details about any distributions made to the owner that are taxable, including the date and amount of each distribution

- Other Information: Additional details that may be relevant, such as the owner's basis in the entity, at-risk amounts, and information on qualified dividend income

The complexity of the K-1 form can be daunting, especially for those who are not tax professionals. It is essential to review and understand the information on the K-1 form carefully, as it directly impacts an individual's tax liability. Any errors or discrepancies should be addressed promptly to avoid potential tax penalties.

Common Uses of the K-1 Form

The K-1 form serves several critical purposes in the tax reporting process:

- Income Reporting: The K-1 form is a key component of an individual's personal tax return, providing the necessary information to report income and calculate tax liability.

- Partnership Taxation: In partnerships, the K-1 form allows each partner to report their share of the partnership's income and losses, ensuring that each partner pays taxes on their fair share.

- S Corporation Shareholder Taxation: Similarly, in S corporations, the K-1 form ensures that each shareholder reports their share of the corporation's profits and losses on their personal tax return.

- Trust and Estate Taxation: For trusts and estates that are treated as pass-through entities, the K-1 form helps beneficiaries report their share of the trust's or estate's income and deductions.

- Business Compliance: Business entities use the K-1 form to maintain compliance with tax laws and regulations, ensuring that they provide accurate and timely information to their owners or shareholders.

The K-1 form is a critical tool in the U.S. tax system, providing transparency and accountability for both business entities and their owners. By understanding the purpose, content, and use of the K-1 form, individuals can navigate the tax reporting process more effectively and ensure compliance with tax laws.

Frequently Asked Questions (FAQs)

What is the difference between a K-1 form and a 1099 form?

+A K-1 form is used for partnerships, S corporations, and certain trusts and estates, reporting an individual’s share of income and losses from these entities. In contrast, a 1099 form is used to report various types of income, such as freelance work, interest, or dividends, and is not specific to business entities.

Do I need to file a tax return if I receive a K-1 form?

+Yes, if you receive a K-1 form, it means you have income or losses from a business entity that you must report on your personal tax return. Failing to file a tax return with the K-1 information can result in penalties and interest charges.

What happens if I lose my K-1 form?

+If you lose your K-1 form, you should contact the entity that issued it to request a replacement. Keep in mind that it is your responsibility to ensure you have all the necessary tax documents, and penalties may apply if you fail to report the income accurately.

Can I file my taxes without my K-1 form?

+It is generally not recommended to file your taxes without your K-1 form, as this form contains crucial information about your income and deductions. However, if you have lost the form and are unable to obtain a replacement, you should consult a tax professional for guidance.

How do I report a discrepancy on my K-1 form?

+If you notice a discrepancy on your K-1 form, you should contact the entity that issued it immediately. They may be able to correct the error and issue a revised form. If the entity is unresponsive or the issue persists, you may need to file a tax return with the information you believe to be correct and explain the discrepancy to the IRS.