San Francisco Tax

Taxes are an essential aspect of any city's economic framework, influencing not only the local economy but also the daily lives of its residents. San Francisco, a vibrant city known for its technological innovation, cultural diversity, and breathtaking scenery, has a unique tax landscape that is worth exploring. In this comprehensive article, we delve into the intricacies of San Francisco's tax system, its impact on businesses and individuals, and its role in shaping the city's future.

Unraveling the San Francisco Tax Landscape

San Francisco’s tax structure is a complex interplay of local, state, and federal regulations, tailored to the city’s specific needs and challenges. Understanding this system is crucial for anyone navigating the financial aspects of life in this vibrant metropolis.

Local Taxes: A City’s Unique Imprint

San Francisco imposes several local taxes that contribute significantly to the city’s revenue. One of the most notable is the San Francisco Business and Occupation Tax (B&O Tax), which is levied on businesses operating within the city limits. This tax varies based on the type of business and its gross receipts, with rates ranging from 0.169% to 1.5%.

Additionally, San Francisco has a Transient Occupancy Tax (TOT) of 14%, applicable to the rental of hotel rooms, apartments, or other temporary accommodations. This tax is often passed on to tourists and visitors, making it a significant revenue generator for the city.

| Tax Type | Rate |

|---|---|

| Business and Occupation Tax (B&O) | 0.169% - 1.5% |

| Transient Occupancy Tax (TOT) | 14% |

The city also imposes a San Francisco Gross Receipts Tax, which is calculated based on a business's total gross receipts from activities within the city. This tax is progressive, with rates increasing as the gross receipts grow. For instance, businesses with gross receipts exceeding $2 million may face a tax rate of up to 1.5%.

State and Federal Taxes: A Broader Perspective

Beyond local taxes, San Francisco residents and businesses are subject to California state taxes and federal taxes administered by the Internal Revenue Service (IRS). These include personal income tax, corporate tax, sales tax, and property tax, each with its own set of rules and regulations.

California's personal income tax rates range from 1% to 13.3%, depending on an individual's income bracket. The state also imposes a sales tax of 7.25% on most goods and services, which is collected by retailers and remitted to the state. Meanwhile, federal income tax rates vary from 10% to 37%, depending on an individual's taxable income and filing status.

Tax Implications for Businesses in San Francisco

The tax environment in San Francisco can significantly impact businesses, influencing their profitability, growth prospects, and overall strategic direction.

Impact on Startups and Small Businesses

For startups and small businesses, the tax landscape in San Francisco can be particularly challenging. The city’s high cost of living and competitive business environment mean that every dollar counts. The cumulative effect of local, state, and federal taxes can be a significant burden, especially for businesses in their early stages.

The San Francisco Business and Occupation Tax, for instance, can be a substantial expense for small businesses with lower gross receipts. Additionally, the city's progressive Gross Receipts Tax means that as a business grows, its tax burden increases, which can be a disincentive for expansion.

Tax Incentives and Strategies

However, it’s not all challenges. San Francisco also offers tax incentives and strategies that can help businesses mitigate their tax liabilities. For example, the city has various tax credits and exemptions available for businesses operating in specific sectors, such as biotechnology, clean technology, and manufacturing.

Moreover, San Francisco's vibrant startup culture and strong innovation ecosystem can provide unique tax advantages. Many tech startups, for instance, can benefit from the Research and Development (R&D) Tax Credit, which allows businesses to claim a credit against their federal income tax for increasing research activities.

Tax Considerations for Individuals in San Francisco

For individuals living and working in San Francisco, the tax landscape is equally important. It influences their purchasing power, savings, and overall financial well-being.

Personal Income Tax and Withholding

San Francisco residents are subject to both California state income tax and federal income tax. The state’s progressive tax structure means that individuals with higher incomes pay a higher tax rate. For instance, an individual with a taxable income of 50,000 may fall into the 6% tax bracket, while someone earning 500,000 may face a tax rate of 13.3%.

To manage their tax liabilities, individuals typically have taxes withheld from their paychecks. This is especially important in San Francisco, where the cost of living is high, and tax liabilities can be substantial.

Property Taxes and Homeownership

Property taxes are another significant consideration for individuals in San Francisco, especially those who own homes. California’s Proposition 13, passed in 1978, limits the amount of property tax increases to 2% per year, unless the property changes ownership. This provides some stability for homeowners, but it also means that property taxes can vary significantly based on the purchase price and date of acquisition.

The Role of Taxes in San Francisco’s Economy

Taxes play a crucial role in shaping San Francisco’s economy, influencing everything from business growth and job creation to public services and infrastructure development.

Funding Public Services and Infrastructure

Tax revenues in San Francisco are a vital source of funding for public services and infrastructure projects. These funds are used to maintain and improve the city’s transportation network, including its renowned cable cars, buses, and light rail systems. They also support the city’s extensive park system, renowned cultural institutions like the San Francisco Museum of Modern Art, and vital public services such as healthcare and education.

Influencing Business and Economic Growth

The tax environment can either incentivize or deter business growth in San Francisco. On the one hand, the city’s high tax rates can make it challenging for businesses to establish and grow. On the other hand, the tax incentives and credits offered by the city and state can attract specific industries and businesses, fostering economic growth and job creation.

For instance, the California Competes Tax Credit program offers tax credits to businesses that create jobs or invest in research and development within the state. This program, along with other tax incentives, has helped attract and retain businesses in San Francisco, contributing to its thriving innovation ecosystem.

Conclusion: Navigating the San Francisco Tax Landscape

The tax system in San Francisco is complex and multifaceted, reflecting the city’s unique economic and social landscape. For businesses, understanding and navigating this system is crucial for success and long-term growth. For individuals, it’s about managing their tax liabilities effectively to maintain financial health and well-being.

As San Francisco continues to evolve, its tax landscape will also likely undergo changes and adaptations. Staying informed and proactive about tax regulations and incentives is essential for anyone with a stake in the city's future.

How does San Francisco’s tax structure compare to other major cities in the US?

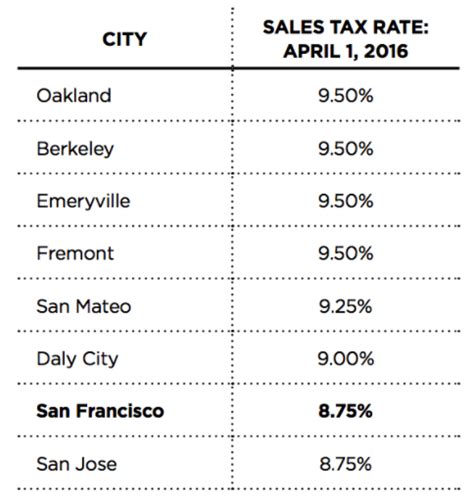

+San Francisco’s tax structure is relatively high compared to many other major US cities. For instance, its sales tax rate of 8.5% (including state and local taxes) is higher than cities like New York (8.875%) and Los Angeles (9.5%). However, it’s important to consider that San Francisco’s tax revenue is often directed towards specific public services and infrastructure projects, which can benefit residents and businesses alike.

What tax incentives are available for businesses in San Francisco?

+San Francisco offers a range of tax incentives, including the San Francisco Small Business Improvement Fund, which provides grants to small businesses for improvements and upgrades. There’s also the San Francisco CleanTech Incubator Program, which offers tax credits and other benefits to clean technology startups. Additionally, the state of California provides various tax credits, such as the Research and Development Tax Credit and the California Competes Tax Credit, which can benefit businesses operating in San Francisco.

How can individuals reduce their tax liabilities in San Francisco?

+Individuals can reduce their tax liabilities by taking advantage of various deductions and credits. For instance, the California Earned Income Tax Credit provides a tax credit for low- to moderate-income individuals and families. Additionally, individuals can contribute to tax-advantaged retirement accounts, such as IRAs or 401(k)s, which can reduce their taxable income. It’s always advisable to consult with a tax professional to explore all available options.