Maryland Income Tax Calculator

Welcome to our comprehensive guide on understanding and managing your income tax obligations in the state of Maryland. In this expert-led article, we will delve into the intricacies of the Maryland income tax system, providing you with a detailed breakdown of tax rates, brackets, and the tools you need to calculate your tax liability accurately. Whether you're a resident, non-resident, or business owner, this guide will equip you with the knowledge to navigate the tax landscape of Maryland efficiently.

Unraveling the Maryland Income Tax Structure

Maryland operates a progressive income tax system, which means that as your income increases, so does the tax rate applied to your earnings. This approach ensures fairness and contributes to the state’s revenue generation. Let’s explore the key components of Maryland’s income tax structure.

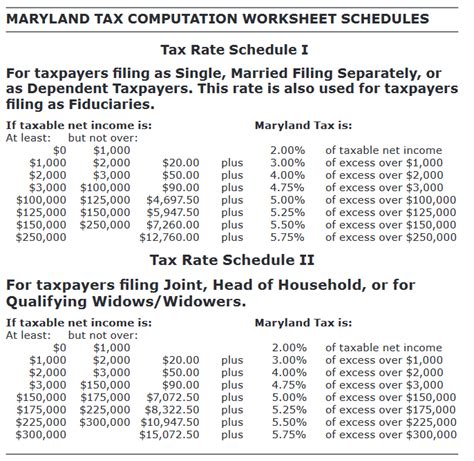

Tax Brackets and Rates

Maryland has established a series of tax brackets, each with its own tax rate. These brackets are designed to accommodate varying income levels and ensure a balanced approach to taxation. As of the latest tax year, the tax brackets and corresponding rates are as follows:

| Tax Bracket (Single Filers) | Tax Rate |

|---|---|

| $0 - $1,000 | 2.00% |

| $1,001 - $3,000 | 2.50% |

| $3,001 - $10,000 | 3.00% |

| $10,001 - $25,000 | 4.00% |

| $25,001 - $125,000 | 4.75% |

| $125,001 - $300,000 | 5.00% |

| $300,001 and above | 5.75% |

It's important to note that these tax rates and brackets are subject to periodic updates by the Maryland Tax Commission. Stay informed about any changes to ensure accurate calculations.

Determining Your Tax Liability

Calculating your income tax liability in Maryland involves a straightforward process. Here’s a step-by-step guide to help you determine your tax obligation:

- Identify Your Taxable Income: Start by calculating your total income for the tax year. This includes all sources of income, such as wages, salaries, investments, and business profits.

- Apply Tax Brackets: Refer to the tax bracket table provided earlier. Determine which bracket your taxable income falls into and note the corresponding tax rate.

- Calculate Tax Liability: Multiply your taxable income by the applicable tax rate to obtain your tax liability. For example, if your taxable income is $50,000 and it falls into the 4.75% bracket, your tax liability would be $2,375 (50,000 x 0.0475).

- Adjustments and Deductions: Maryland offers various deductions and credits that can reduce your tax liability. These may include standard deductions, personal exemptions, and tax credits for specific expenses. Consult the official tax guidelines or seek professional advice to maximize these benefits.

- Final Calculation: Subtract any applicable deductions and credits from your initial tax liability to arrive at your final tax obligation.

It's crucial to maintain accurate records of your income and expenses throughout the year to facilitate a seamless tax calculation process.

Maryland’s Taxable Income Sources

Maryland imposes income tax on a wide range of income sources. Here are some of the key taxable income categories:

- Wages and Salaries: Income earned from employment, including bonuses and commissions, is subject to income tax.

- Self-Employment Income: Business owners and self-employed individuals must report their net profits from business activities.

- Investment Income: This includes dividends, interest, capital gains, and income from rental properties.

- Retirement Income: Certain types of retirement income, such as pensions and annuities, may be taxable.

- Alimony and Child Support: Alimony payments received are considered taxable income, while child support payments are generally not taxable.

It's essential to consult the official tax guidelines or seek professional advice to understand the specific rules and regulations pertaining to each income source.

Utilizing Maryland Income Tax Calculators

To simplify the tax calculation process, Maryland offers various online tools and calculators. These resources provide an efficient way to estimate your tax liability and ensure accuracy. Here are some trusted options:

Maryland Comptroller’s Tax Calculator

The Maryland Comptroller’s Office provides an official income tax calculator on their website. This calculator is designed to guide you through the tax calculation process step by step. It considers your income, deductions, and tax credits to provide an estimate of your tax liability. Access the calculator here.

Tax Software and Apps

Numerous tax preparation software and mobile apps are available to assist with tax calculations. These tools offer user-friendly interfaces and often provide additional features such as tax optimization strategies and filing assistance. Some popular options include TurboTax, H&R Block, and TaxAct.

Professional Tax Advisors

For complex tax situations or if you prefer a personalized approach, consulting a professional tax advisor or accountant can be beneficial. They can provide expert guidance, ensure compliance with tax laws, and help you maximize your deductions and credits.

Filing Your Maryland Income Tax Return

Once you’ve calculated your tax liability, it’s time to file your income tax return with the Maryland Comptroller’s Office. Here’s a brief overview of the filing process:

- Gather Necessary Documents: Collect your income statements, tax forms, and any supporting documentation related to deductions and credits.

- Choose Your Filing Method: Maryland offers both electronic and paper filing options. Electronic filing is generally faster and more convenient, and you can choose from various software providers. Paper filing requires completing the appropriate tax forms and submitting them by mail.

- Prepare and Submit Your Return: Follow the instructions provided by the Comptroller's Office or your tax software to accurately complete your tax return. Ensure all information is correct and submit it before the deadline to avoid penalties.

- Payment Options: If you owe taxes, you can pay online, by mail, or through electronic funds transfer. Consider setting up automatic payments to ensure timely remittance.

- Refunds and Overpayments: If you are due a refund, the Comptroller's Office will process it and issue a payment. Overpayments can be refunded or applied to future tax liabilities.

Staying Informed and Compliant

To ensure compliance with Maryland’s income tax laws and regulations, it’s crucial to stay informed about any updates or changes. The Maryland Comptroller’s Office provides comprehensive resources and guidelines on their website. Regularly check for updates and subscribe to their newsletters to receive important tax-related information.

Common Tax-Related Questions

Here are some frequently asked questions to address common concerns related to Maryland income tax:

When is the deadline for filing my Maryland income tax return?

+The deadline for filing your Maryland income tax return typically aligns with the federal tax deadline, which is April 15th. However, it's important to check for any extensions or changes announced by the Comptroller's Office.

Are there any tax credits or deductions specific to Maryland residents?

+Yes, Maryland offers several tax credits and deductions tailored to its residents. These include the Maryland Resident Income Tax Credit, the Homestead Tax Credit, and deductions for certain expenses like medical costs and education-related expenses. Consult the official tax guidelines for a comprehensive list.

How do I calculate my estimated tax payments for the year?

+Estimated tax payments are required if you expect to owe taxes for the year. You can use the Maryland Comptroller's Estimated Tax Worksheet or consult a tax professional to calculate your estimated tax payments. These payments are typically due in four installments throughout the year.

Can I file my Maryland income tax return electronically?

+Yes, Maryland offers electronic filing options through various tax software providers. This method is secure, efficient, and often preferred by taxpayers. Ensure you use authorized software and follow the instructions provided by the Comptroller's Office.

By staying informed and utilizing the resources available, you can confidently navigate the Maryland income tax landscape and fulfill your tax obligations accurately and efficiently.