Mesa Az Sales Tax

Mesa, Arizona, is a bustling city known for its vibrant culture, beautiful landscapes, and thriving business environment. One aspect that often interests residents, visitors, and businesses alike is the sales tax system. Mesa's sales tax is a vital component of the city's economy, influencing the daily lives of its citizens and shaping the city's financial landscape. In this comprehensive guide, we will delve into the intricacies of Mesa's sales tax, exploring its structure, rates, and the impact it has on various industries and individuals.

Understanding Mesa’s Sales Tax System

The sales tax in Mesa, like in many other cities and states across the United States, is a crucial revenue source for local governments. It is a consumption tax levied on the sale of goods and services, contributing to the city’s infrastructure, public services, and economic development initiatives.

Sales Tax Rates in Mesa

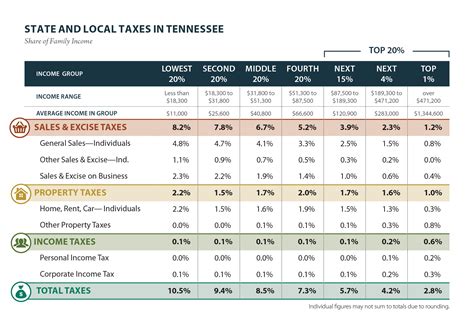

Mesa’s sales tax is composed of a combination of state, county, and city taxes. As of my last update in January 2023, the current sales tax rates in Mesa are as follows:

| Taxing Jurisdiction | Sales Tax Rate |

|---|---|

| State of Arizona | 5.6% |

| Maricopa County | 1.75% |

| City of Mesa | 0.5% |

| Total Sales Tax | 7.85% |

It's important to note that these rates are subject to change, and it is advisable to check the official sources or consult a tax professional for the most up-to-date information.

Taxable Goods and Services

Mesa’s sales tax applies to a wide range of goods and services. This includes tangible personal property, such as clothing, electronics, furniture, and vehicles. Additionally, certain services like hotel accommodations, restaurant meals, and entertainment are also subject to sales tax.

However, there are exemptions and special considerations for certain goods and services. For instance, some essential items like groceries, prescription medications, and certain educational materials are often exempt from sales tax. It's crucial to understand the specific regulations and exemptions to ensure compliance.

The Impact on Businesses

Mesa’s sales tax has a significant influence on the business landscape within the city. For local businesses, especially those in the retail and hospitality sectors, sales tax is a key consideration when pricing their products and services.

Competitiveness and Pricing Strategies

Businesses in Mesa must carefully navigate the sales tax environment to remain competitive. They often incorporate the sales tax into their pricing strategies, ensuring that their products are priced attractively while also covering their costs and contributing to the city’s revenue.

For instance, a local clothing store might offer discounts or promotional prices to attract customers, taking into account the sales tax rate to ensure a competitive advantage over online retailers or neighboring cities with different tax rates.

Compliance and Reporting

Adherence to sales tax regulations is essential for businesses in Mesa. They are responsible for collecting and remitting the appropriate taxes to the relevant taxing authorities. This involves maintaining accurate records, filing periodic tax returns, and ensuring compliance with state and local laws.

Failing to comply with sales tax regulations can result in penalties and legal consequences. Therefore, businesses often rely on accounting professionals or tax software to streamline their tax reporting processes and minimize the risk of errors.

The Experience for Consumers

Mesa’s sales tax also affects the daily lives of consumers, impacting their purchasing decisions and overall financial well-being.

Understanding Sales Tax on Receipts

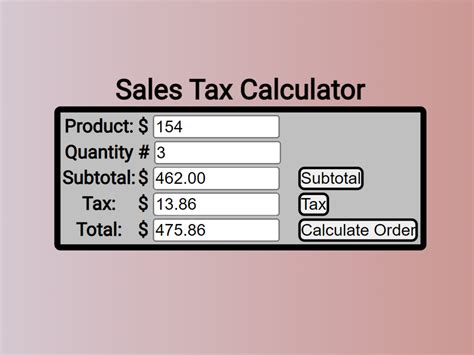

When making purchases in Mesa, consumers will see the sales tax amount clearly displayed on their receipts. This transparency allows them to understand the breakdown of the prices they pay, with the sales tax contributing to the city’s infrastructure and services.

For instance, when buying a new laptop, consumers can expect to see the sales tax amount added to the base price, providing them with a comprehensive understanding of the total cost.

Sales Tax and Budgeting

Incorporating sales tax into their budgeting is essential for Mesa’s residents. It’s crucial to consider the impact of sales tax when planning purchases, especially for big-ticket items or frequent purchases. Understanding the tax rates helps individuals make informed financial decisions.

For example, a family planning a vacation might budget for hotel stays, meals, and entertainment, factoring in the sales tax to ensure they have sufficient funds for their trip.

Special Considerations and Exemptions

Mesa’s sales tax system offers certain exemptions and special considerations to promote economic development and support specific industries.

Sales Tax Holidays

Arizona, including Mesa, sometimes offers sales tax holidays to encourage spending and boost the local economy. During these designated periods, certain items, often related to back-to-school supplies or energy-efficient appliances, are exempt from sales tax.

These tax holidays provide an opportunity for consumers to save money and make larger purchases without the burden of sales tax.

Exemptions for Specific Industries

Mesa, like many other cities, may offer sales tax exemptions or incentives to attract and support specific industries. For instance, the city might provide tax breaks for manufacturing or technology companies to encourage their presence and investment in the area.

These exemptions can be a significant factor in a company's decision to establish or expand its operations in Mesa.

The Future of Mesa’s Sales Tax

As Mesa continues to grow and evolve, its sales tax system will likely undergo changes and adaptations to meet the city’s evolving needs and economic landscape.

Potential Rate Adjustments

Sales tax rates in Mesa, as in many cities, are subject to periodic reviews and adjustments. The city’s leadership may propose changes to the tax rates to address budget shortfalls, invest in new infrastructure projects, or provide tax relief to certain sectors.

Staying informed about potential rate adjustments is crucial for both businesses and consumers to plan their financial strategies accordingly.

Impact of Economic Trends

Mesa’s sales tax revenue is closely tied to the city’s economic health and consumer spending patterns. During economic downturns, sales tax revenue may decline, impacting the city’s budget and the services it provides. Conversely, during periods of economic growth, sales tax revenue can surge, enabling the city to invest in new initiatives.

Understanding these economic trends is essential for stakeholders to make informed decisions and adapt to changing circumstances.

Conclusion

Mesa’s sales tax is a dynamic and influential component of the city’s economic ecosystem. It shapes the business environment, impacts consumer behavior, and contributes to the overall financial health of the community. By understanding the intricacies of Mesa’s sales tax system, residents, businesses, and visitors can make informed decisions and actively contribute to the city’s vibrant future.

What happens if a business fails to collect or remit sales tax in Mesa?

+

Businesses that fail to collect or remit sales tax may face significant penalties and legal consequences. It is crucial for businesses to understand their tax obligations and seek professional advice if needed.

Are there any online resources to help businesses calculate and understand sales tax in Mesa?

+

Yes, there are various online tools and resources available to assist businesses in calculating sales tax. Official government websites often provide calculators and guidelines to ensure accurate tax calculations.

How can consumers dispute sales tax charges on their purchases in Mesa?

+

Consumers who believe they have been overcharged on sales tax should contact the retailer directly to resolve the issue. If necessary, they can seek assistance from consumer protection agencies or tax authorities.