Tennessee Property Tax

Tennessee's property tax system is a vital component of the state's revenue generation, contributing significantly to the funding of local governments and essential public services. Understanding how property taxes work in Tennessee is crucial for homeowners, prospective buyers, and anyone interested in the state's real estate landscape. This comprehensive guide aims to delve into the intricacies of Tennessee property taxes, shedding light on the assessment process, tax rates, exemptions, and more.

Understanding Tennessee’s Property Tax Structure

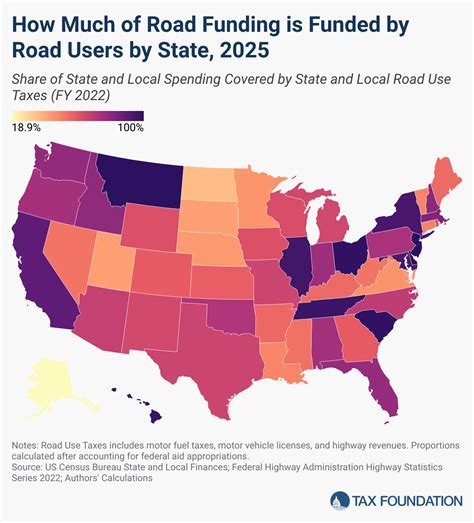

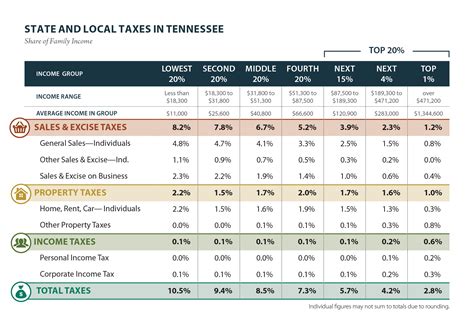

Tennessee, like many other states, relies on property taxes to finance local services and infrastructure. These taxes are typically collected by county governments and used to support various functions, including schools, emergency services, road maintenance, and other community needs.

The property tax system in Tennessee is based on the assessed value of real property, which includes land and improvements (such as buildings and other structures). This assessed value is then multiplied by the applicable tax rate to determine the property tax liability for each owner.

Assessment Process

Tennessee employs a uniform and consistent assessment process to ensure fairness and accuracy in property valuation. County assessors are responsible for assessing the value of all taxable property within their jurisdiction. They do this by considering factors such as market value, recent sales data, and the property’s physical characteristics.

The assessment process usually occurs at regular intervals, often every few years, to account for changes in property values. During an assessment, assessors might visit the property, review recent sales of similar properties, and adjust the value based on market conditions and improvements made to the property.

Tax Rates

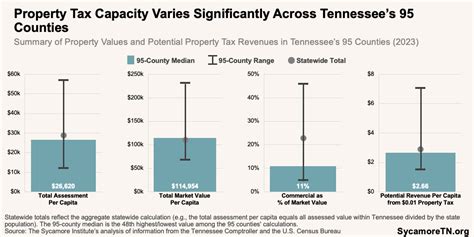

Property tax rates in Tennessee can vary significantly depending on the location and the type of property. Each county sets its own tax rate, which can be expressed as a percentage or a dollar amount per $100 of assessed value. These rates are often referred to as “millage rates” or “tax levies.”

For instance, in a particular county, the tax rate might be set at $2.50 per $100 of assessed value. So, for a property with an assessed value of $200,000, the property tax liability would be calculated as follows: $200,000 x $2.50 / $100 = $5,000.

It's important to note that tax rates can change annually, and they may differ between residential, commercial, and agricultural properties. Additionally, some counties might offer different tax rates for certain types of improvements or green initiatives.

Exemptions and Deductions

Tennessee provides various exemptions and deductions to help reduce the property tax burden for certain individuals and organizations. These exemptions can significantly impact the overall tax liability for eligible property owners.

| Exemption Type | Description |

|---|---|

| Homestead Exemption | Available to homeowners who use their property as their primary residence. This exemption can reduce the assessed value of the property by a certain amount, resulting in lower taxes. |

| Senior Citizen Exemption | Offers relief to homeowners aged 65 and older by reducing the taxable value of their property. The exemption amount varies by county and may be subject to income limits. |

| Disabled Veteran Exemption | Provides a full or partial exemption for certain disabled veterans. The exemption applies to the veteran's primary residence and can significantly reduce their property tax liability. |

| Agricultural Exemption | Available for landowners who use their property for agricultural purposes. This exemption can lower the assessed value of the land, benefiting farmers and ranchers. |

In addition to these exemptions, Tennessee also offers various deductions and credits, such as the Circuit Breaker Tax Credit, which provides relief to low-income homeowners and renters based on their income and property tax liability.

The Impact of Property Taxes on Homeownership

Property taxes are an essential consideration for anyone looking to buy a home in Tennessee. They can significantly impact a homeowner’s financial planning and overall cost of living.

Calculating Property Taxes

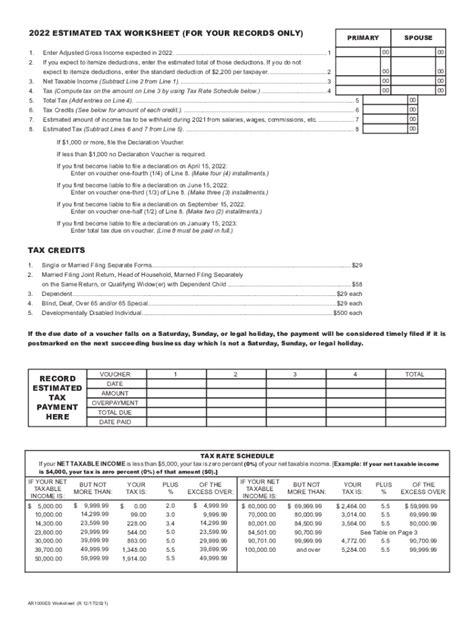

When purchasing a home, it’s crucial to understand the potential property tax liability. Here’s a step-by-step guide to calculating property taxes in Tennessee:

- Determine the assessed value of the property. This value is typically provided in the property listing or can be obtained from the county assessor's office.

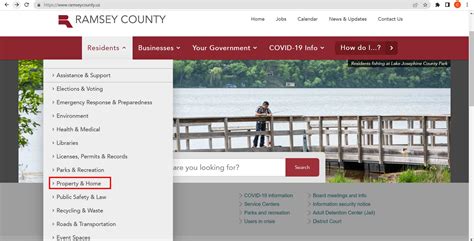

- Check the current tax rate for the county where the property is located. You can find this information on the county's website or by contacting the assessor's office.

- Multiply the assessed value by the tax rate to estimate the annual property tax. For example, if the assessed value is $150,000 and the tax rate is $2.75 per $100 of assessed value, the calculation would be: $150,000 x $2.75 / $100 = $4,125.

- Consider any applicable exemptions or deductions that might reduce the taxable value of the property.

- Add any additional fees or surcharges that might be levied by the county or municipality.

By following these steps, homebuyers can get a clearer picture of the financial obligations associated with owning a specific property.

Property Tax Considerations for Investors

For investors looking to purchase real estate in Tennessee, property taxes are a key factor to consider in their investment strategy. Here are some points to keep in mind:

- Cash Flow Analysis: Property taxes should be included in the cash flow projections for an investment property. Higher taxes can impact the property's profitability.

- Exemption Eligibility: Investors may be eligible for certain exemptions, such as the agricultural exemption, if they use the property for specific purposes.

- Tax Appeals: If an investor believes their property is overassessed, they can file an appeal to have the assessed value adjusted downward, potentially reducing their tax liability.

- Comparison Shopping: When considering multiple investment properties, investors should compare the potential tax liabilities to ensure they're getting the best deal.

Future Trends and Potential Changes

Tennessee’s property tax landscape is subject to change over time, influenced by various factors such as economic conditions, legislative decisions, and public opinion.

Potential Reforms

There have been ongoing discussions about property tax reform in Tennessee, with some advocating for a more simplified and transparent system. Proposed reforms might include a shift towards a single-rate tax structure or a reevaluation of the assessment process to make it more frequent and accurate.

Additionally, there is a growing interest in exploring alternatives to property taxes, such as a land value tax, which focuses on taxing the value of the land itself rather than improvements. Such a system could encourage development and discourage land speculation.

Impact of Economic Changes

Economic fluctuations can significantly impact property values and, consequently, property taxes. During periods of economic growth, property values tend to rise, leading to higher tax assessments. Conversely, economic downturns can result in lower property values and potential tax relief.

Tennessee's economy has been resilient in recent years, with a diverse industrial base and a focus on attracting new businesses. This economic stability has contributed to a generally positive outlook for property values and tax revenues.

Political Influence

Political decisions at the state and local levels play a crucial role in shaping property tax policies. Changes in leadership or shifts in political priorities can lead to amendments in tax laws, assessment procedures, or exemption criteria.

Staying informed about local and state politics can help property owners and investors anticipate potential changes that might affect their tax obligations.

Conclusion

Tennessee’s property tax system is a complex yet essential component of the state’s financial infrastructure. Understanding how property taxes work, from assessment to exemptions, is crucial for homeowners, buyers, and investors alike. By staying informed and actively participating in the process, individuals can navigate the system effectively and ensure they’re getting the most out of their property investments.

How often are property taxes assessed in Tennessee?

+

Property taxes in Tennessee are typically assessed every few years, with the exact frequency varying by county. Assessments ensure that property values remain current and accurate.

Can I appeal my property’s assessed value?

+

Yes, if you believe your property has been overvalued, you have the right to appeal the assessment. The process involves filing an appeal with the county’s Board of Equalization, providing evidence to support your claim, and potentially attending a hearing.

Are there any tax breaks for energy-efficient homes in Tennessee?

+

Yes, Tennessee offers a Green Energy Tax Credit for homeowners who install qualifying renewable energy systems, such as solar panels. This credit can reduce the property’s assessed value, resulting in lower taxes.

How do I pay my property taxes in Tennessee?

+

Property taxes in Tennessee are typically paid in two installments. The exact payment schedule and methods vary by county, but common options include online payments, mail-in checks, or in-person payments at the county tax office.

Can I deduct my property taxes on my federal income tax return?

+

Yes, property taxes paid on your primary residence are typically deductible on your federal income tax return. However, the Tax Cuts and Jobs Act of 2017 placed a cap on the amount of state and local taxes (including property taxes) that can be deducted. It’s important to consult with a tax professional to understand the current limits and your eligibility.