Bonus Tax Rate California

The tax system in California is a complex one, and it often leaves taxpayers and businesses wondering about various aspects, including the bonus tax rate. The bonus tax rate, also known as the bonus depreciation rate, is a crucial component of California's tax landscape, offering both opportunities and complexities for businesses and investors.

Understanding the Bonus Tax Rate in California

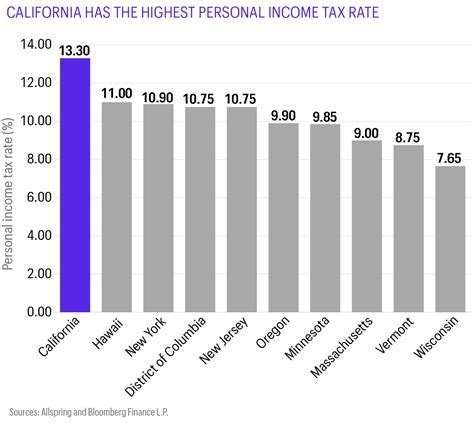

California, being the most populous state in the United States, boasts a diverse economy with a wide range of industries. The state’s tax policies play a significant role in shaping business decisions and investment strategies. Among these policies, the bonus tax rate stands out as a powerful incentive for businesses to invest in new assets and equipment.

The bonus tax rate, as the name suggests, offers a bonus or additional tax benefit to businesses that acquire certain types of assets. It is a form of accelerated depreciation, allowing companies to write off a larger portion of their asset purchases in the initial years, thus reducing their taxable income.

Eligibility and Qualifying Assets

Not all assets are eligible for the bonus tax rate. In California, the primary focus is on tangible personal property, which includes equipment, machinery, and certain vehicles used in business operations. Real estate, on the other hand, is generally not eligible for bonus depreciation.

The qualifying assets must meet specific criteria. They should be new, meaning they have not been previously used, and they must be placed in service by the taxpayer during the applicable tax year. Additionally, the assets must have a useful life of at least one year and be used predominantly in the taxpayer's business.

| Asset Type | Eligibility |

|---|---|

| Equipment | New and used predominantly in business operations. |

| Machinery | New and integral to the production process. |

| Vehicles | New and primarily for business transportation. |

Calculation and Depreciation Methods

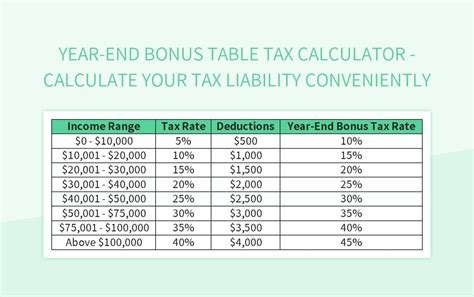

The bonus tax rate in California is calculated based on the Modified Accelerated Cost Recovery System (MACRS). This system determines the depreciation deduction a business can claim for its assets. The MACRS classifies assets into various recovery periods, ranging from 3 to 39 years, depending on the asset type.

Under the bonus tax rate, businesses can choose to deduct a larger percentage of the asset's cost in the first year of its useful life. For example, a 5-year property might be eligible for a 20% bonus depreciation in its first year, effectively reducing the asset's depreciable base by 20% for tax purposes.

This accelerated depreciation method provides a significant tax advantage, as it allows businesses to defer tax liabilities and improve cash flow in the initial years of asset ownership.

Benefits and Implications of the Bonus Tax Rate

The bonus tax rate offers several advantages to businesses operating in California. Firstly, it encourages investment by providing an immediate tax benefit. This incentive can be particularly attractive for startups and small businesses looking to expand their operations and acquire new assets.

Secondly, the bonus depreciation can improve a company's financial statements. By reducing taxable income in the early years of asset ownership, businesses can show improved profitability and cash flow, which can be beneficial for securing loans, attracting investors, or negotiating better terms with suppliers.

However, there are also implications to consider. The bonus tax rate can impact a business's tax liability in subsequent years. As the initial depreciation deductions are higher, the remaining deductions in later years may be reduced, leading to potentially higher tax liabilities as the asset ages.

Furthermore, the bonus tax rate can affect a company's financial planning and strategy. Businesses must carefully consider the long-term tax implications and ensure they have a robust understanding of the tax code to maximize the benefits while minimizing potential pitfalls.

Case Study: Impact on a Small Business

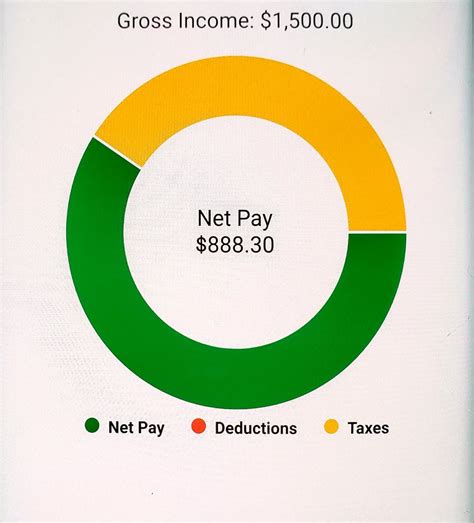

Let’s consider an example to illustrate the impact of the bonus tax rate. Imagine a small manufacturing business in California that decides to invest in new machinery worth 500,000. Under the bonus tax rate, the business can deduct 20% of the machinery's cost in the first year, resulting in a tax savings of 100,000.

This immediate tax benefit can provide a significant boost to the business's cash flow, allowing it to invest further in its operations or even pay down existing debts. The bonus tax rate, in this case, serves as a powerful incentive for small businesses to make strategic investments and grow their operations.

Future Outlook and Potential Changes

The bonus tax rate in California is subject to periodic review and potential changes. While the current system provides a substantial benefit to businesses, there are ongoing discussions and proposals to modify or adjust the bonus depreciation rules.

Some proposals suggest extending the bonus depreciation to a wider range of assets, including certain real estate investments. Others propose limiting the bonus tax rate to specific industries or sectors, targeting economic development in particular areas.

The future of the bonus tax rate is closely tied to the state's economic goals and the need to balance incentives with tax revenue generation. As California's economy continues to evolve, so too will its tax policies, making it essential for businesses to stay updated and adaptable.

Expert Insights and Recommendations

The bonus tax rate offers a unique opportunity for businesses to optimize their tax strategies and enhance their financial performance. However, it requires careful planning and a deep understanding of the tax code. Businesses should consider the long-term implications and seek expert advice to ensure they make informed decisions.

Conclusion

In conclusion, the bonus tax rate in California is a powerful tool for businesses to accelerate their depreciation deductions and reduce taxable income. It provides a significant incentive for investment and can improve a company’s financial health. However, businesses must navigate the complexities and implications of the bonus tax rate to fully leverage its benefits while minimizing potential drawbacks.

FAQ

Can real estate assets qualify for the bonus tax rate in California?

+

No, real estate assets generally do not qualify for bonus depreciation in California. The bonus tax rate primarily applies to tangible personal property, such as equipment and machinery.

How does the bonus tax rate impact a business’s tax liability in the long run?

+

The bonus tax rate can lead to higher tax liabilities in later years as the initial depreciation deductions are higher. Businesses should consider this when planning their tax strategies to avoid unexpected tax burdens.

Are there any restrictions on the type of businesses that can benefit from the bonus tax rate?

+

The bonus tax rate is available to all businesses operating in California that meet the eligibility criteria for qualifying assets. However, certain industries or sectors may have specific rules or limitations, so it’s essential to consult with tax professionals.

How often are the bonus depreciation rules reviewed and updated in California?

+

The bonus depreciation rules are subject to periodic reviews and updates. California’s tax policies are influenced by economic conditions, legislative changes, and the state’s revenue needs. Businesses should stay informed about any updates to ensure compliance and optimize their tax strategies.