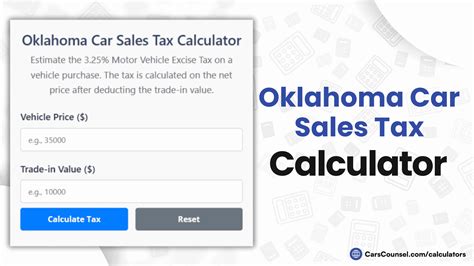

Oklahoma Sales Tax Calculator

The Oklahoma Sales Tax Calculator is an essential tool for businesses and consumers alike, providing a comprehensive and accurate way to calculate sales tax within the state of Oklahoma. With a complex tax system that varies depending on the location and nature of the sale, having an efficient calculator is crucial for compliance and financial planning.

Understanding Oklahoma’s Sales Tax Landscape

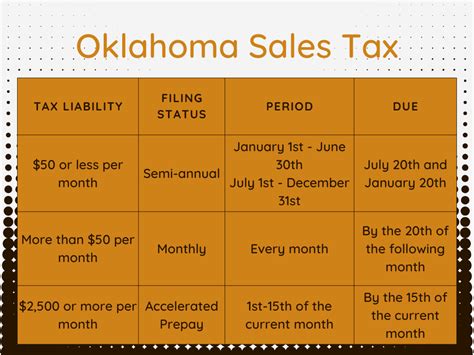

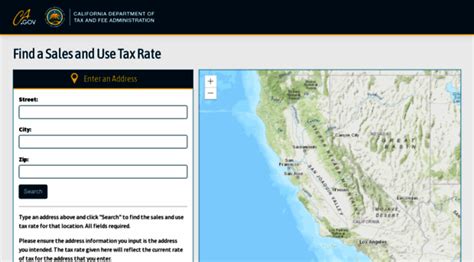

Oklahoma’s sales tax structure is composed of a state sales tax rate and additional local sales tax rates, which can vary significantly across the state. The state sales tax rate is currently set at 4.5%, one of the lowest in the country. However, when combined with local sales taxes, the total sales tax rate can reach as high as 9.5% in certain jurisdictions.

Local sales taxes are imposed by cities, counties, and special purpose districts, and they are often used to fund specific projects or services within the community. These local taxes can add a significant burden to the overall sales tax rate, especially for businesses operating in multiple locations or for consumers who frequently shop across county lines.

The Complexity of Oklahoma’s Sales Tax

The complexity of Oklahoma’s sales tax system arises from the diverse range of tax rates and the specific rules governing different types of goods and services. For example, certain items, such as groceries, are exempt from state sales tax but may still be subject to local sales taxes. Other items, like prepared foods, may have different tax rates depending on the county.

Additionally, Oklahoma offers various tax incentives and exemptions, such as the Manufacturing Machinery and Equipment Exemption and the Resale Exemption, which can significantly impact the total sales tax liability for businesses. Understanding these exemptions and their applicability is crucial for accurate tax calculation and compliance.

| Tax Rate Category | Rate |

|---|---|

| State Sales Tax | 4.5% |

| Highest Local Sales Tax (City) | 4.0% |

| Highest Local Sales Tax (County) | 2.0% |

| Highest Combined Rate (City & County) | 9.5% |

How the Oklahoma Sales Tax Calculator Works

The Oklahoma Sales Tax Calculator is a sophisticated online tool designed to simplify the process of calculating sales tax for businesses and individuals. It takes into account the complex tax structure of Oklahoma, allowing users to input specific details about their purchase or sale to generate an accurate tax calculation.

Key Features of the Calculator

- State and Local Tax Rates: The calculator integrates the latest state and local sales tax rates, ensuring that the calculated tax is precise and up-to-date.

- Location-Based Calculations: Users can specify the city and county where the transaction takes place, allowing the calculator to apply the correct local sales tax rates.

- Exemption Handling: The calculator is capable of recognizing and applying various sales tax exemptions, providing a more accurate representation of the tax liability.

- Taxable Item Identification: Users can categorize their purchase or sale as a taxable or exempt item, further refining the tax calculation.

- Bulk Calculation: For businesses managing multiple transactions, the calculator offers a bulk calculation feature, enabling efficient tax management.

User Experience and Benefits

The Oklahoma Sales Tax Calculator is designed with a user-friendly interface, making it accessible and straightforward to use. It offers a quick and efficient way to calculate sales tax, reducing the time and effort required for tax compliance. By accurately calculating sales tax, businesses can better manage their pricing strategies, and consumers can make more informed purchasing decisions.

Furthermore, the calculator's ability to handle location-specific tax rates and exemptions provides a comprehensive solution for businesses operating in multiple Oklahoma jurisdictions. It streamlines the tax calculation process, reducing the risk of errors and ensuring compliance with Oklahoma's sales tax regulations.

Advanced Features and Customization

The Oklahoma Sales Tax Calculator offers a range of advanced features to cater to specific business needs. These features include:

- Custom Tax Rate Settings: Businesses can input their own custom tax rates, accommodating unique tax structures or specific industry regulations.

- Tax Exemption Rules: The calculator allows for the customization of exemption rules, ensuring that specific business scenarios are accurately represented.

- Historical Tax Rate Data: Users can access historical tax rate data, providing insights into past tax rates and helping with financial analysis and planning.

- API Integration: For businesses with existing systems, the calculator offers API integration, allowing seamless data transfer and calculation within their own software.

Ensuring Accuracy and Compliance

To ensure the calculator’s accuracy, it is regularly updated with the latest tax rates and regulations by a team of tax experts. This rigorous maintenance process guarantees that users receive the most precise and reliable sales tax calculations, reducing the risk of non-compliance and associated penalties.

The calculator also includes a comprehensive help section, providing users with detailed explanations of Oklahoma's sales tax rules and guidance on how to use the calculator effectively. This resource ensures that users can navigate the complexities of Oklahoma's sales tax system with confidence.

The Impact of an Accurate Sales Tax Calculator

Implementing an accurate sales tax calculator like the one designed for Oklahoma brings several significant benefits to businesses and consumers.

Benefits for Businesses

- Compliance Assurance: Accurate sales tax calculation ensures businesses meet their tax obligations, reducing the risk of penalties and legal issues.

- Improved Financial Management: Precise tax calculations help businesses manage their finances more effectively, allowing for better budgeting and planning.

- Enhanced Customer Service: By providing transparent and accurate sales tax information, businesses can build trust with their customers and improve overall satisfaction.

Benefits for Consumers

- Transparency and Trust: Consumers can make informed purchasing decisions, knowing that the sales tax calculation is accurate and fair.

- Price Awareness: Understanding the breakdown of sales tax helps consumers budget effectively and compare prices across different retailers.

- Convenience: With an easy-to-use calculator, consumers can quickly estimate their sales tax liability, saving time and effort.

Future Trends and Developments

As technology advances and tax regulations evolve, the Oklahoma Sales Tax Calculator is poised for continuous improvement. Future developments may include:

- Real-Time Tax Rate Updates: Implementing a system to automatically update tax rates in real-time, ensuring users always have the most current information.

- Mobile Accessibility: Developing a mobile app version of the calculator, making it accessible on the go for both businesses and consumers.

- Integration with Point-of-Sale Systems: Integrating the calculator with popular point-of-sale systems, streamlining the tax calculation process for retailers.

- Advanced Reporting and Analytics: Enhancing the calculator with reporting features, providing businesses with valuable insights into their sales tax liabilities and trends.

By staying ahead of these technological advancements, the Oklahoma Sales Tax Calculator can continue to provide a reliable and efficient solution for sales tax calculations, contributing to the smooth operation of businesses and the satisfaction of consumers in the state.

What is the state sales tax rate in Oklahoma?

+The state sales tax rate in Oklahoma is 4.5%.

How do I calculate sales tax in Oklahoma if I’m a business?

+To calculate sales tax as a business in Oklahoma, you can use the Oklahoma Sales Tax Calculator. This tool takes into account the state and local tax rates, as well as any applicable exemptions, to provide an accurate tax calculation.

Are there any sales tax exemptions in Oklahoma?

+Yes, Oklahoma offers various sales tax exemptions. These include exemptions for certain types of goods, such as groceries, and specific business scenarios like the Manufacturing Machinery and Equipment Exemption.

How often are the sales tax rates updated in the calculator?

+The sales tax rates in the calculator are updated regularly to ensure accuracy. The frequency of updates may vary, but it is designed to reflect the latest tax rates and regulations in Oklahoma.

Can I use the calculator for multiple transactions at once?

+Yes, the Oklahoma Sales Tax Calculator offers a bulk calculation feature, allowing you to input multiple transactions and calculate the sales tax for each one efficiently.