Virginia State Tax Calculator

The Virginia State Tax Calculator is an essential tool for individuals and businesses alike, providing a comprehensive way to estimate and manage their state tax obligations. With a diverse tax landscape, understanding and calculating Virginia state taxes can be a complex task. This guide aims to demystify the process, offering a deep dive into the various tax categories, rates, and exemptions, along with practical tips and real-world examples to ensure compliance and efficient financial planning.

Understanding Virginia’s Tax Structure

Virginia’s tax system is characterized by a combination of income, sales, and property taxes, each with its own set of rules and rates. The state’s income tax, for instance, varies based on an individual’s or business’s taxable income bracket, offering a progressive rate structure. On the other hand, sales tax is a flat rate applied to most transactions, with certain items like groceries and prescription drugs exempt.

Property taxes in Virginia are primarily managed at the local level, with rates varying across counties and cities. These local variations can significantly impact an individual's or business's overall tax burden, making accurate calculation and planning crucial.

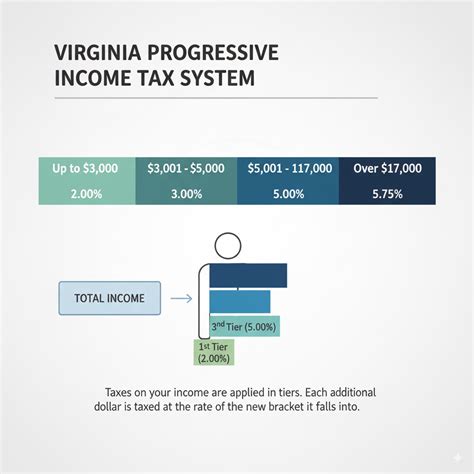

Income Tax: A Progressive Approach

Virginia’s income tax system is designed to be progressive, meaning tax rates increase as taxable income rises. This structure aims to ensure fairness, with those earning more contributing a larger proportion of their income to state coffers. The state currently has five income tax brackets, each with its own tax rate, ranging from 2% to 5.75%.

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $3,000 | 2% |

| $3,001 - $5,000 | 3% |

| $5,001 - $17,000 | 5% |

| $17,001 - $100,000 | 5.5% |

| Over $100,000 | 5.75% |

For instance, an individual with a taxable income of $25,000 would fall into the third and fourth brackets, facing a tax rate of 5% on the first $17,000, and 5.5% on the remaining $8,000.

Sales Tax: A Flat Rate with Exemptions

Virginia imposes a flat sales tax rate of 4.3%, which is applied to most transactions. However, this rate is often combined with local sales tax rates, which can vary and are typically added on top of the state rate. For instance, Arlington County has a local sales tax rate of 1%, bringing the total sales tax rate to 5.3% for those residing in the county.

Certain items are exempt from sales tax in Virginia, including:

- Groceries and food for home consumption

- Prescription drugs

- Nonprescription drugs

- Certain farming equipment

- Residential fuel and power

Understanding these exemptions is crucial, as it can significantly reduce an individual's or business's tax burden. For example, a restaurant owner purchasing groceries for their establishment would not have to pay sales tax on these items, resulting in substantial savings over time.

Property Tax: Local Control and Rates

Property taxes in Virginia are determined at the local government level, with each city or county setting its own tax rate. This rate is typically expressed as cents per $100 of assessed value, with the assessed value determined by the local government’s assessment process.

For instance, Fairfax County's property tax rate for FY 2024 is set at 99.9¢ per $100 of assessed value. This means that for a property with an assessed value of $500,000, the annual property tax would amount to $4,995.

The variation in property tax rates across Virginia underscores the importance of understanding local tax environments, especially for businesses with multiple locations or individuals considering a move.

The Role of the Virginia State Tax Calculator

In the face of Virginia’s complex tax landscape, a state tax calculator serves as a crucial tool for accurate tax estimation and planning. This calculator can provide real-time estimates of tax obligations, taking into account an individual’s or business’s specific circumstances, such as income level, sales volume, and property value.

For instance, a small business owner in Richmond could use the calculator to estimate their income tax liability based on their annual revenue. The calculator would factor in the business's taxable income, applying the appropriate tax rate based on the state's progressive income tax structure. This would provide the business owner with a clear understanding of their tax obligations, helping them plan their finances accordingly.

Calculator Features and Benefits

A robust Virginia State Tax Calculator should offer the following features:

- Income Tax Estimation: The calculator should allow users to input their taxable income and provide an estimate of their income tax liability, taking into account the state’s progressive tax brackets.

- Sales Tax Calculation: It should also accommodate sales tax estimation, considering the state’s flat sales tax rate and any applicable local rates. This is particularly beneficial for businesses, as it helps them understand their tax obligations on sales transactions.

- Property Tax Assessment: For individuals and businesses with property holdings, the calculator should offer a property tax estimation feature. This would require users to input their property’s assessed value and applicable local tax rate to provide an estimate of their annual property tax liability.

- Real-Time Updates: An efficient calculator should be regularly updated to reflect any changes in tax rates or laws. This ensures that users receive accurate and up-to-date tax estimates.

By leveraging these features, individuals and businesses can make informed financial decisions, plan for tax obligations, and ensure compliance with Virginia's tax laws.

Who Should Use the Calculator

The Virginia State Tax Calculator is an invaluable tool for a wide range of individuals and businesses, including:

- Individuals: Whether you’re a resident filing your annual tax return or a new arrival to the state, the calculator can help you understand your tax obligations. It’s particularly useful for those with multiple sources of income or significant property holdings.

- Small Businesses: Small businesses, especially those with online sales or multiple locations, can benefit greatly from the calculator. It can help them estimate their tax liabilities accurately, ensuring they budget appropriately and remain compliant with state tax laws.

- Accountants and Financial Advisors: Professionals in these fields can use the calculator as a tool to provide accurate tax advice and planning services to their clients. It can streamline the tax estimation process, saving time and effort.

In essence, anyone with a need to understand and manage their Virginia state tax obligations can benefit from using a state tax calculator.

Tips for Maximizing the Calculator’s Benefits

To get the most out of the Virginia State Tax Calculator, consider the following tips:

- Understand Your Taxable Income: Accurate calculation of taxable income is key. This involves understanding which income sources are taxable and which may be exempt or subject to special rules. For instance, certain types of investment income may be taxed differently, and understanding these nuances can impact the accuracy of your calculations.

- Stay Informed on Local Tax Rates: For sales and property taxes, knowing the applicable local tax rates is crucial. These rates can vary significantly across different areas of the state, so staying updated on these rates is essential for accurate tax estimation.

- Utilize the Calculator Regularly: The tax landscape can change, and regular use of the calculator can help you stay on top of these changes. Whether it’s a change in tax rates, new tax laws, or adjustments to your income or sales, using the calculator regularly can ensure you’re always prepared.

- Seek Professional Advice: While the calculator is a powerful tool, it’s always beneficial to consult with a tax professional, especially for complex tax situations. They can provide tailored advice and ensure you’re taking advantage of all available tax benefits and exemptions.

Conclusion

The Virginia State Tax Calculator is a powerful tool for navigating the state’s diverse tax landscape. By understanding the various tax categories and rates, and utilizing the calculator’s features effectively, individuals and businesses can ensure compliance, plan their finances efficiently, and maximize their tax benefits. With regular use and professional guidance, the calculator can be a valuable asset in managing state tax obligations.

Frequently Asked Questions

What is the state income tax rate in Virginia?

+

Virginia has a progressive income tax system with five tax brackets ranging from 2% to 5.75%. The tax rate you pay depends on your taxable income.

Are there any sales tax exemptions in Virginia?

+

Yes, Virginia exempts certain items from sales tax, including groceries, prescription drugs, nonprescription drugs, certain farming equipment, and residential fuel and power.

How often are Virginia’s tax rates updated?

+

Virginia’s tax rates can change annually, typically based on legislative decisions. It’s important to stay updated on any changes to ensure accurate tax calculations.

Can the State Tax Calculator be used for business tax estimates?

+

Absolutely! The calculator is designed to accommodate both individual and business tax estimates, taking into account income, sales, and property taxes.

Where can I find more information on Virginia’s tax laws and rates?

+

You can visit the official website of the Virginia Department of Taxation for detailed information on tax laws, rates, and guidelines. They also provide resources and tools to help with tax compliance.