Sacramento City Tax Rate

Sacramento, the vibrant capital of California, is renowned for its diverse cultural attractions, vibrant food scene, and bustling downtown. As one of the largest cities in the state, Sacramento is also a hub for business and commerce, attracting entrepreneurs and established enterprises alike. One critical aspect that impacts businesses and residents in Sacramento is the city's tax structure, particularly the Sacramento City Tax Rate. Understanding the tax landscape is essential for anyone considering relocating, investing, or expanding their business in this dynamic city.

Navigating the Sacramento City Tax Rate: A Comprehensive Guide

Sacramento's tax system, like most urban areas, is multifaceted and comprises various tax types, each serving a specific purpose and contributing to the city's overall revenue. From income taxes to sales taxes, and property taxes, each tax category plays a crucial role in funding public services, infrastructure development, and community initiatives. This guide aims to demystify the Sacramento City Tax Rate, offering a detailed breakdown of each tax type, their rates, and how they impact residents and businesses.

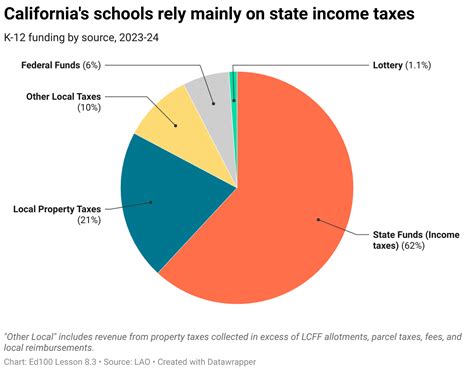

Income Tax: The City's Revenue Backbone

Income tax forms the backbone of Sacramento's tax revenue, with the city imposing a local income tax on both residents and businesses. This tax is levied on personal and business income, with the rates varying based on income brackets and the type of entity. For instance, sole proprietors and partners in a partnership may face different tax rates compared to corporations.

The current income tax rate for Sacramento residents and businesses is set at 0.5% of taxable income. This rate is applied to net income after all deductions and exemptions have been taken into account. It's important to note that this rate is in addition to the state and federal income tax rates, which are also applicable.

| Entity Type | Sacramento Income Tax Rate |

|---|---|

| Sole Proprietorships | 0.5% |

| Partnerships | 0.5% |

| Corporations | 0.5% |

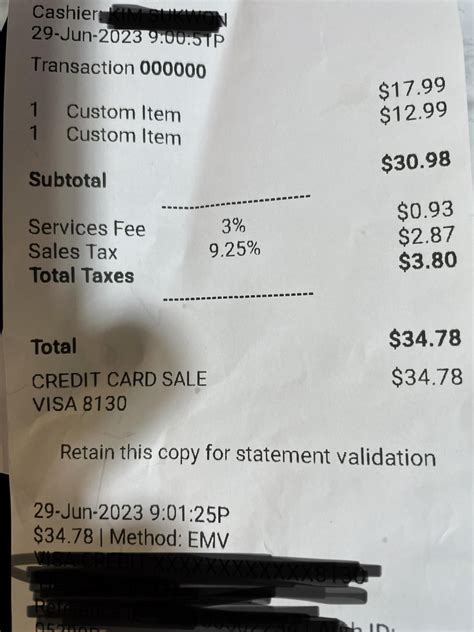

Sales and Use Tax: Impact on Businesses and Consumers

Sacramento, like most cities in California, imposes a sales and use tax on the sale of goods and certain services. This tax is collected by businesses at the point of sale and remitted to the city and state. The sales tax rate in Sacramento comprises both state and local components, with the city's portion contributing to local infrastructure and community projects.

The current sales tax rate in Sacramento is 8.75%, which includes the state base rate of 7.25% and a local rate of 1.5%. This rate is applicable to most tangible personal property and certain services, but there are exemptions and special provisions for specific items and industries.

| Sales Tax Component | Rate |

|---|---|

| State Base Rate | 7.25% |

| Sacramento City Rate | 1.5% |

| Total Sales Tax Rate | 8.75% |

Property Tax: Supporting Local Infrastructure

Property tax is a significant source of revenue for Sacramento, with the proceeds used to fund essential services such as public safety, education, and transportation. The property tax rate is determined by the assessed value of the property and is levied annually.

The property tax rate in Sacramento is set at 1.1468% of the assessed value of the property. This rate is applied uniformly across the city, with the assessed value determined by the Sacramento County Assessor's Office. Properties are reassessed periodically, typically every two years, which can impact the property tax liability.

| Property Tax Rate | Assessed Value | Tax Liability |

|---|---|---|

| 1.1468% | $500,000 | $5,734 |

| 1.1468% | $1,000,000 | $11,468 |

| 1.1468% | $1,500,000 | $17,202 |

Other Taxes and Fees: A Comprehensive Overview

In addition to the primary tax types discussed above, Sacramento also imposes several other taxes and fees to support specific services and initiatives. These include:

- Utility User Tax (UUT): A tax on the usage of certain utilities like electricity, water, and gas, with a rate of 8.5%.

- Transient Occupancy Tax (TOT): A tax on hotel and short-term rental stays, with a rate of 12%.

- Business License Tax: A tax on businesses operating within the city limits, with rates varying based on the type of business and gross receipts.

- Special Assessments: Fees levied on properties to fund specific improvements or services benefiting a particular area or neighborhood.

It's important for businesses and property owners to be aware of these additional taxes and fees to ensure they are compliant with all applicable regulations.

Future Implications and Tax Strategies

As Sacramento continues to evolve and grow, its tax structure is likely to remain a critical factor for businesses and residents. The city's tax revenue is vital for funding essential services and infrastructure development, and changes in tax rates or policies can significantly impact the local economy.

For businesses, staying informed about potential tax changes and developing proactive tax strategies is essential. This may involve seeking professional advice, leveraging tax incentives and credits, and implementing efficient tax planning measures. Additionally, businesses should consider the overall tax burden when making strategic decisions, such as expansion or relocation.

For residents, understanding the tax landscape is crucial for financial planning and decision-making. Whether purchasing a home, starting a business, or simply budgeting for daily expenses, having a clear understanding of the tax rates and their implications can make a significant difference.

In conclusion, the Sacramento City Tax Rate is a multifaceted system, designed to fund the city's operations and development. While it may seem complex, understanding the various tax types and their rates is essential for both businesses and residents. By staying informed and proactive, individuals and businesses can navigate the tax landscape effectively, contributing to the city's growth while also achieving their own financial goals.

How often are property taxes assessed in Sacramento?

+Property taxes in Sacramento are assessed every two years, with the assessment based on the market value of the property as of January 1 of the assessment year. This value is then multiplied by the property tax rate to determine the tax liability.

Are there any tax incentives for businesses in Sacramento?

+Yes, Sacramento offers various tax incentives to attract and support businesses. These include tax credits for job creation, research and development, and certain types of investments. Additionally, the city provides assistance with tax compliance and has programs to encourage business growth and development.

How can residents stay updated on tax changes in Sacramento?

+Sacramento residents can stay informed about tax changes by regularly checking the city’s official website, which provides updates on tax policies and rates. Additionally, subscribing to local news sources and attending community meetings can provide valuable insights into potential tax changes and their implications.