Sales Tax Calculator Ohio

Sales tax is an essential aspect of financial management and compliance, and understanding how it works is crucial for both businesses and consumers. In the state of Ohio, sales tax calculations are unique, and it's important to delve into the specifics to ensure accurate tax assessments. This comprehensive guide will walk you through the intricacies of the Sales Tax Calculator for Ohio, providing you with the tools and knowledge to navigate this complex but vital process.

Understanding the Ohio Sales Tax Landscape

Ohio’s sales tax system is a combination of state and local taxes, creating a dynamic tax environment. The state sales tax rate is a foundation, but it’s the local rates that add complexity and variation. These local rates can differ based on the location of the sale, creating a unique tax scenario for each region.

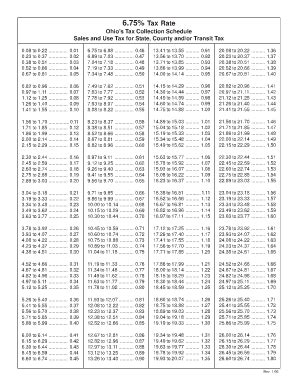

State Sales Tax

The Ohio state sales tax rate stands at 5.75% as of [date of information]. This rate is a standard across the state and is applied uniformly to most retail sales.

Local Sales Taxes

On top of the state sales tax, Ohio municipalities and counties have the authority to impose their own sales taxes. These local sales tax rates can vary significantly, with some areas having no additional tax while others may levy a rate as high as 3% or more. This means that the total sales tax rate can fluctuate considerably depending on the location of the purchase.

| County | City | Sales Tax Rate |

|---|---|---|

| Cuyahoga County | Cleveland | 2.25% |

| Franklin County | Columbus | 2.5% |

| Hamilton County | Cincinnati | 3% |

Using the Sales Tax Calculator

To simplify the process of calculating sales tax in Ohio, a Sales Tax Calculator is an invaluable tool. This online calculator is designed to provide accurate tax assessments based on the specific location of the sale. Here’s a step-by-step guide on how to utilize it effectively.

Step 1: Input Your Location

The first step in using the calculator is to specify your location. This could be the name of your city or county. The calculator will use this information to determine the applicable sales tax rate for your area.

Step 2: Enter the Sale Amount

Next, you’ll need to input the total amount of the sale, including any applicable discounts or promotions. This figure will be used to calculate the sales tax due.

Step 3: Calculate and Review

With your location and sale amount entered, the calculator will generate the total sales tax and the grand total (sale amount plus tax). This provides a clear understanding of the financial obligations associated with the sale.

Step 4: Adjust for Special Circumstances

In some cases, there may be special tax rates or exemptions that apply. The calculator will provide options to adjust for these scenarios, allowing for a more accurate assessment. This could include tax-exempt items, temporary tax holidays, or specific industry rates.

Examples and Real-World Scenarios

To illustrate the practical application of the Sales Tax Calculator, let’s explore a few real-world scenarios and how the calculator can assist in these situations.

Scenario 1: Online Shopping

Consider an online retailer based in Ohio. They sell a product for 100</strong> to a customer in Columbus, Ohio. Using the calculator, they can determine that the total sales tax for this transaction is <strong>8.25, bringing the grand total to $108.25. This ensures accurate pricing and billing for their customers.

Scenario 2: In-Store Purchase

A customer walks into a retail store in Cleveland, Ohio, and purchases an item for 250</strong>. The store can use the calculator to determine that the sales tax for this purchase is <strong>14.63, resulting in a grand total of $264.63. This ensures compliance with local tax laws and provides a transparent transaction for the customer.

Scenario 3: Complex Tax Structures

For businesses operating in multiple locations or selling items with varying tax rates, the calculator becomes even more valuable. Consider a business with stores in both Cleveland and Columbus. They can use the calculator to determine the specific tax rate for each location, ensuring accurate pricing and compliance.

Benefits of the Sales Tax Calculator

The Sales Tax Calculator for Ohio offers several advantages to both businesses and consumers:

- Accuracy: By considering both state and local tax rates, the calculator ensures precise tax assessments.

- Compliance: It helps businesses adhere to Ohio's tax laws, reducing the risk of penalties.

- Transparency: For consumers, it provides clarity on the tax component of their purchases.

- Time-Saving: The calculator simplifies a complex process, saving time for businesses and consumers.

Future Implications and Updates

Ohio’s sales tax landscape is subject to change. Tax rates can be adjusted, and new regulations may be introduced. It’s essential to stay informed about these changes to ensure ongoing compliance. The Sales Tax Calculator will be regularly updated to reflect any modifications to Ohio’s tax structure, providing a reliable resource for accurate tax calculations.

What happens if the sales tax rate changes in my area?

+If there’s a change in the sales tax rate for your location, it’s crucial to update your records and ensure you’re using the correct rate. The Sales Tax Calculator will be updated promptly to reflect any changes, so be sure to check for updates regularly.

Are there any special tax rates for certain industries in Ohio?

+Yes, Ohio has specific tax rates for certain industries, such as food and beverages, and even some unique tax holidays. The Sales Tax Calculator takes these into account, allowing you to calculate taxes accurately for your specific industry.

How often should I check for updates to the Sales Tax Calculator?

+It’s a good practice to check for updates at least once a quarter. This ensures you’re aware of any recent changes to tax rates or regulations. You can also subscribe to notifications to receive updates directly when they’re available.