Summit County Property Tax

Property taxes are an essential component of local government revenue, funding various services and infrastructure. In Summit County, Ohio, understanding the property tax system is crucial for homeowners and prospective buyers. This article aims to provide a comprehensive guide to Summit County's property tax landscape, covering assessment processes, tax rates, and strategies for managing these expenses effectively.

Understanding Summit County Property Tax Assessment

Property tax assessments in Summit County are conducted by the County Auditor’s Office, which evaluates properties based on their fair market value. This value is determined through a comprehensive process that considers various factors, including:

- Sales Data: Recent sales prices of similar properties in the area are a key indicator of a property’s market value.

- Property Features: The Auditor’s Office assesses the unique attributes of each property, such as square footage, number of rooms, and any recent improvements.

- Economic Factors: Market trends and economic conditions in the county play a role in property valuations.

After the assessment, property owners receive a notice of valuation, which details the estimated market value of their property. If a property owner disagrees with the assessed value, they have the right to appeal through a formal process.

Assessment Appeals in Summit County

Property owners in Summit County have the opportunity to challenge their assessed values if they believe the valuation is inaccurate. The appeal process involves the following steps:

- Review and Preparation: Property owners should carefully review their valuation notice and gather evidence to support their case. This may include recent appraisals, comparable sales data, or documentation of property defects.

- Filing an Appeal: Appeals must be filed within a specified timeframe, typically within 30 days of receiving the valuation notice. The County Auditor’s Office provides detailed instructions on how to file an appeal.

- Hearing: If the appeal is accepted, a hearing will be scheduled before the Board of Revision. During the hearing, property owners can present their case and provide evidence to support their argument.

- Decision: The Board of Revision will review the evidence and make a determination, which can result in an adjustment to the property’s assessed value.

| Key Dates | Assessment and Appeal Timeline |

|---|---|

| Valuation Notices Sent | March |

| Appeal Deadline | 30 Days after Valuation Notice |

| Hearing Dates | Varies, typically April to June |

| Decision Notification | Within 60 days of the hearing |

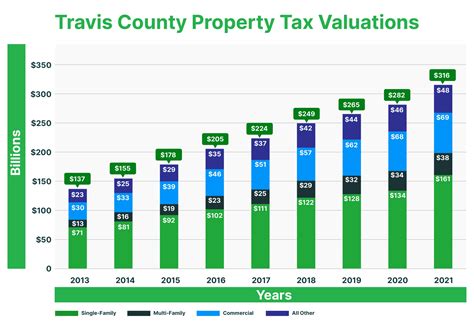

Calculating Property Taxes in Summit County

Once a property’s assessed value is determined, the actual property tax amount is calculated using a formula that considers the assessed value and the applicable tax rate. In Summit County, property taxes are levied by various taxing authorities, including the county government, local municipalities, school districts, and special assessment districts.

Tax Rates and Millage

The tax rate, often referred to as the millage rate, is expressed in mills. One mill is equal to one-tenth of a cent, or $0.001. The millage rate is set by each taxing authority within the county and can vary depending on the services provided by that authority.

| Taxing Authority | Millage Rate |

|---|---|

| Summit County Government | 12.33 mills |

| Akron City School District | 38.45 mills |

| Cuyahoga Falls City School District | 28.43 mills |

| Cuyahoga Falls Municipal Government | 9.90 mills |

| Special Assessment Districts | Varies |

To calculate the property tax amount, the assessed value is multiplied by the millage rate for each taxing authority, and these amounts are then summed to arrive at the total property tax due.

Property Tax Abatements and Exemptions

Summit County offers various tax abatement and exemption programs to eligible property owners. These programs aim to reduce the tax burden for specific types of properties or individuals.

- Homestead Exemption: Qualified homeowners can apply for a reduction in their property taxes based on their primary residence. This exemption is particularly beneficial for senior citizens and those with limited incomes.

- Agricultural Land Tax Valuation: Properties used for agricultural purposes may be eligible for a special valuation method, which considers the property’s agricultural productivity rather than its market value.

- Tax Abatements for New Construction: Some areas in Summit County offer tax abatements to encourage new development and investment. These abatements reduce the tax liability for a set period, typically several years.

Managing Property Taxes: Strategies and Tips

Property taxes are a significant expense for homeowners, and effective management can lead to substantial savings. Here are some strategies to consider:

- Regularly Review Assessments: Stay informed about your property’s assessed value and be prepared to appeal if you believe it is inaccurate. The County Auditor’s Office provides online tools to help property owners track their assessments.

- Understand Tax Rates: Familiarize yourself with the tax rates applicable to your property. This knowledge can help you budget effectively and compare tax burdens when considering a move within the county.

- Explore Abatements and Exemptions: Research the various abatement and exemption programs available in Summit County. Consulting with a tax professional can help you determine if you are eligible for any of these programs.

- Make Timely Payments: Property taxes are typically due in two installments, with the first installment due in January and the second in July. Late payments can incur penalties and interest.

- Consider Escrow Accounts: If you have a mortgage, discuss the option of an escrow account with your lender. This account can help manage property tax payments by setting aside funds each month, ensuring timely payments.

Real-World Example: Tax Savings through Abatements

Consider the case of Mr. Johnson, a homeowner in Akron, Summit County. After purchasing a new home, Mr. Johnson discovered that the property was eligible for a tax abatement program. By applying for this abatement, he was able to reduce his property taxes by $1,200 annually for the next 10 years. This substantial savings allowed him to invest in home improvements and better manage his finances.

The Impact of Property Taxes on Summit County’s Economy

Property taxes are a critical component of Summit County’s economic landscape. They fund essential services, including schools, public safety, and infrastructure development. The tax revenue collected by the county and its municipalities supports the growth and prosperity of the community.

Economic Development and Property Taxes

A well-managed property tax system can attract businesses and investment to Summit County. By offering tax abatements and incentives, the county can encourage new development, create jobs, and enhance the local economy. Additionally, a fair and transparent tax system can foster trust between taxpayers and the government, promoting economic stability.

Conclusion

In conclusion, property taxes in Summit County are an essential part of the local economy, funding vital services and infrastructure. Understanding the assessment process, tax rates, and available abatements and exemptions is crucial for homeowners and prospective buyers. By staying informed and utilizing strategies to manage property taxes, individuals can make informed financial decisions and contribute to the thriving community of Summit County.

How often are property tax assessments conducted in Summit County?

+Property tax assessments are typically conducted every three years in Summit County. However, the County Auditor’s Office may conduct reappraisals more frequently in certain areas to ensure accurate valuations.

Can I appeal my property tax assessment if I disagree with the valuation?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The appeal process involves submitting evidence to support your case and attending a hearing before the Board of Revision.

What is the deadline for filing a property tax appeal in Summit County?

+The deadline for filing a property tax appeal is typically 30 days after receiving the valuation notice. It’s important to act promptly to ensure your appeal is considered.

Are there any tax abatement programs for senior citizens in Summit County?

+Yes, Summit County offers a Homestead Exemption program that provides tax relief for qualified senior citizens. This program can significantly reduce property taxes for eligible individuals.