Wyoming State Income Tax

Wyoming, known for its vast wilderness, breathtaking landscapes, and a unique tax structure, presents an intriguing case study for anyone interested in understanding the intricacies of state-level taxation. In the United States, each state has its own set of tax laws, and Wyoming's approach to income taxation is particularly fascinating. Let's delve into the world of Wyoming's state income tax, exploring its unique features, rates, and the impact it has on individuals and businesses within its borders.

The Wyoming State Income Tax: A Low-Tax Paradise

Wyoming, the "Equality State," has long been recognized for its commitment to a low-tax environment. This commitment extends to its income tax system, which is notably different from many other states across the nation. Wyoming's state income tax is often referred to as a "low-tax paradise" due to its relatively simple structure and, more importantly, its competitive rates.

A Brief History of Wyoming's Income Tax

To truly understand Wyoming's income tax system, we must first take a step back in time. Wyoming's journey with income taxation began relatively recently compared to many other states. The state first introduced an income tax system in the early 1930s, primarily to fund its burgeoning educational system. However, this initial venture was short-lived, and Wyoming repealed its income tax in 1940.

It wasn't until the 1960s that Wyoming reconsidered the idea of an income tax. In 1965, the state legislature proposed a new income tax bill, which was met with significant public opposition. Despite the resistance, the bill was passed, and Wyoming once again had an income tax system in place. This time, the tax was designed to be progressive, with rates ranging from 1% to 6% based on income brackets.

Over the years, Wyoming's income tax structure has undergone several modifications. The most significant change occurred in 1981 when the state implemented a flat tax rate of 3% for all income levels. This flat tax system has remained in place ever since, making Wyoming one of the few states in the country with a single-rate income tax.

Wyoming's Flat Tax: The Key Feature

Wyoming's flat tax rate of 3% is a standout feature of its income tax system. Unlike many other states that employ a progressive tax system with multiple tax brackets, Wyoming's approach is straightforward and consistent. Every resident and business pays the same rate, regardless of their income level.

| Income Bracket | Tax Rate |

|---|---|

| All Income Levels | 3% |

This simplicity has several advantages. It makes tax filing easier for residents and businesses, reduces the complexity often associated with progressive tax systems, and provides a stable and predictable tax environment. However, it's important to note that while the state income tax rate is low and consistent, Wyoming does not have a personal income tax exemption, which means that all income, regardless of source, is taxable.

Taxable Income in Wyoming

Wyoming defines taxable income broadly. It includes income from all sources, such as wages, salaries, bonuses, commissions, interest, dividends, capital gains, rental income, royalties, pensions, annuities, and even gambling winnings. However, there are certain exclusions and deductions that can reduce the taxable income.

One notable exclusion is that Wyoming does not tax Social Security benefits. This is a significant advantage for retirees who rely on Social Security income. Additionally, Wyoming allows standard deductions and personal exemptions, which can further reduce taxable income. It's worth noting that Wyoming's tax system does not offer itemized deductions like many other states.

Impact on Individuals and Businesses

Wyoming's low and flat income tax rate has had a significant impact on both individuals and businesses within the state. For individuals, the 3% flat tax rate means that their tax liability remains relatively predictable and manageable, regardless of their income level. This can provide a sense of financial stability and certainty, especially for those with higher incomes who might face much higher tax rates in other states.

For businesses, Wyoming's tax environment is equally attractive. The flat tax rate of 3% means that businesses, whether they are sole proprietorships, partnerships, or corporations, all face the same tax burden. This simplicity and consistency can be a significant advantage when it comes to financial planning and forecasting. Additionally, Wyoming's lack of personal income tax exemption can be beneficial for business owners, as it allows them to deduct business income and losses on their personal tax returns.

Furthermore, Wyoming's tax structure can be particularly advantageous for businesses looking to expand or relocate. The state's low tax rates and stable tax environment can make it an attractive destination for companies seeking to reduce their tax liabilities. This has contributed to Wyoming's reputation as a business-friendly state, encouraging economic growth and development.

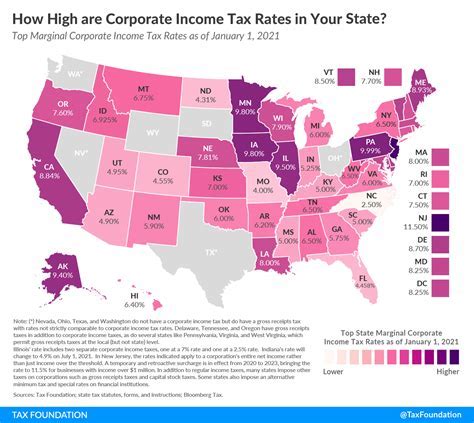

Comparative Analysis: Wyoming vs. Other States

When compared to other states, Wyoming's income tax system stands out for its simplicity and low rates. While many states have progressive tax systems with multiple tax brackets, Wyoming's flat tax rate of 3% is one of the lowest in the nation. This puts Wyoming in a unique position, especially when considering that it also does not have a personal income tax exemption.

| State | Top Income Tax Rate | Personal Income Tax Exemption |

|---|---|---|

| Wyoming | 3% | No |

| California | 13.3% | Yes |

| New York | 8.82% | Yes |

| Texas | 0% | Yes |

| Florida | 5.5% | Yes |

As seen in the table above, Wyoming's income tax rate is significantly lower than many other states, even those that do not have a personal income tax. This comparison highlights the competitive advantage Wyoming holds in terms of income taxation, making it an appealing choice for individuals and businesses seeking a low-tax environment.

Conclusion: A Competitive and Attractive Tax System

Wyoming's state income tax system is a unique and intriguing example of a low-tax environment. With its flat tax rate of 3%, Wyoming offers a simple and consistent approach to income taxation, setting it apart from many other states. This competitive tax system has had a positive impact on the state's economy, attracting individuals and businesses seeking a stable and predictable tax environment.

While Wyoming's income tax structure may not be suitable for everyone, it undoubtedly provides an attractive alternative for those looking to minimize their tax liabilities. As the state continues to thrive economically, its tax system will remain a key factor in its success, offering a model for other states to consider when crafting their own tax policies.

Frequently Asked Questions

Does Wyoming have an income tax?

+

Yes, Wyoming has a state income tax. It imposes a flat tax rate of 3% on all income levels.

What are the tax rates in Wyoming for individuals and businesses?

+

Wyoming has a flat tax rate of 3% for both individuals and businesses, regardless of income level.

Are there any tax exemptions or deductions in Wyoming’s income tax system?

+

Wyoming does not have a personal income tax exemption. However, it allows standard deductions and personal exemptions to reduce taxable income. It does not offer itemized deductions.

How does Wyoming’s income tax system compare to other states?

+

Wyoming’s flat tax rate of 3% is one of the lowest in the nation. While many states have progressive tax systems with multiple tax brackets, Wyoming’s simplicity and low rate make it a competitive choice.

What are the advantages of Wyoming’s income tax system for individuals and businesses?

+

Wyoming’s low and flat tax rate provides individuals with predictable tax liabilities and businesses with a stable tax environment. This can be especially beneficial for high-income earners and businesses seeking to reduce their tax burdens.