Track Tax Refund California

In California, taxpayers eagerly anticipate the arrival of their tax refunds, often counting on these funds to cover various financial obligations or make long-awaited purchases. The process of tracking tax refunds is an essential aspect of tax season, ensuring that taxpayers can stay informed about the status of their refunds and plan their finances accordingly.

The California Franchise Tax Board (FTB) offers several methods for taxpayers to conveniently track their tax refunds. Understanding these tracking options and the factors that can influence refund timing is crucial for effective financial management during tax season.

Understanding the California Tax Refund Process

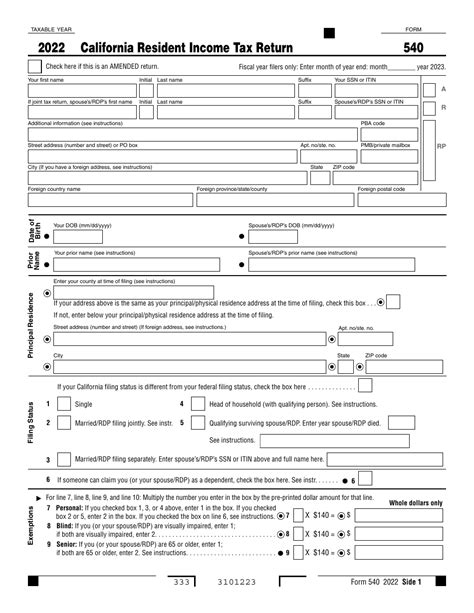

The journey of a tax refund in California begins with the submission of an accurate and complete tax return. Once the FTB receives the return, it undergoes a series of checks and verifications to ensure compliance with state tax regulations.

The processing time for tax refunds can vary depending on several factors, including the method of filing, the complexity of the return, and the accuracy of the information provided. Typically, refunds are issued within a few weeks after the tax return has been successfully processed.

It's worth noting that taxpayers who file their returns electronically and opt for direct deposit generally receive their refunds faster compared to those who file paper returns or choose a refund check. The FTB encourages electronic filing as it not only expedites the refund process but also reduces the risk of errors and delays.

Methods to Track Your California Tax Refund

The FTB provides taxpayers with multiple channels to track the status of their tax refunds, offering convenience and accessibility. Here are the primary methods:

1. Online Refund Status Check

The FTB’s official website offers an online tool specifically designed for taxpayers to check the status of their refunds. By visiting the FTB Refund Status Check page, taxpayers can enter their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), along with other identifying information, to access real-time updates on their refund status.

This online tool provides a quick and efficient way to track refunds, offering details such as the date the refund was issued, the method of payment (direct deposit or check), and any potential delays or issues with the refund.

2. Automated Refund Hotline

For those who prefer a more traditional approach, the FTB operates an automated telephone refund hotline. By calling the dedicated refund hotline at 1-800-852-5711, taxpayers can listen to automated messages that provide updates on their refund status.

This method is particularly useful for individuals who may not have easy access to the internet or prefer a more familiar and straightforward approach to tracking their refunds.

3. Mobile App: MyFTB

In today’s digital age, the FTB has embraced mobile technology by developing a dedicated mobile app, MyFTB. Available for both iOS and Android devices, the app offers a user-friendly interface for taxpayers to manage their accounts and track refunds on the go.

With the MyFTB app, taxpayers can securely log in to their accounts and access real-time information about their tax refunds. The app provides a convenient way to stay updated on refund status, making it an ideal choice for taxpayers who are constantly on the move.

4. Regular Mail Notification

For taxpayers who prefer a more traditional and tangible method of notification, the FTB sends regular mail notifications to inform taxpayers about the status of their refunds. These mailers provide detailed information about the refund, including the amount, the method of payment, and any relevant instructions.

While this method may take longer than digital notifications, it offers a reliable and official record of the refund status, which can be particularly useful for taxpayers who prefer to keep physical records of their financial transactions.

Factors Affecting California Tax Refund Timing

The timing of tax refunds in California can vary depending on several factors, some of which are within the taxpayer’s control, while others are influenced by external factors.

1. Filing Method and Timing

The method and timing of filing tax returns can significantly impact the speed at which refunds are issued. Taxpayers who file their returns electronically and choose direct deposit as their refund method generally receive their refunds faster than those who file paper returns or opt for a refund check.

Additionally, filing taxes early in the tax season can lead to quicker refunds, as the FTB processes returns on a first-come, first-served basis. By being proactive and filing early, taxpayers can reduce the time it takes to receive their refunds.

2. Accuracy and Completeness of Tax Returns

The accuracy and completeness of tax returns play a crucial role in the refund process. Returns that contain errors or missing information may require additional review and verification by the FTB, leading to delays in processing and refund issuance.

Taxpayers should carefully review their returns before submission to ensure accuracy and completeness. This includes verifying personal information, income details, deductions, and credits to minimize the risk of errors that could delay the refund process.

3. Identity Verification and Security Measures

In an effort to combat tax fraud and identity theft, the FTB implements rigorous security measures, including identity verification processes. These measures are designed to protect taxpayers’ information and ensure the integrity of the tax system.

However, these security checks can occasionally result in delays, particularly if the FTB identifies potential issues with a taxpayer's identity or if additional verification steps are required. Taxpayers should be aware of these measures and cooperate with any requested verification processes to expedite the refund process.

4. Seasonal Fluctuations and Taxpayer Volume

The tax season in California experiences seasonal fluctuations in taxpayer volume, with peak periods often leading to increased processing times. During these busy periods, the FTB may prioritize the processing of returns and refunds to manage the high volume of filings.

Taxpayers should anticipate potential delays during peak tax seasons and plan their finances accordingly. By being aware of these fluctuations, taxpayers can better manage their expectations and take necessary precautions to ensure a smooth financial experience during tax season.

What to Do If Your California Tax Refund Is Delayed

In some cases, taxpayers may encounter delays in receiving their tax refunds. If you find yourself in this situation, there are several steps you can take to investigate and resolve the issue:

1. Check Your Refund Status

The first step is to check the status of your refund using one of the methods outlined above. By accessing the FTB’s online tool, automated hotline, or mobile app, you can obtain real-time updates on the progress of your refund.

If the refund status indicates a delay, it's important to carefully review the details provided to identify any potential issues or reasons for the delay.

2. Verify Your Personal Information

Delays in tax refunds can sometimes be attributed to errors or discrepancies in personal information provided on the tax return. It’s crucial to verify that your personal information, including your name, address, and Social Security Number (SSN), is accurate and up-to-date.

If you discover any inaccuracies, promptly correct them by filing an amended tax return or contacting the FTB to update your information. Accurate personal information is essential for the smooth processing of your refund.

3. Review Your Tax Return for Errors

Another common cause of refund delays is errors or inconsistencies in the tax return itself. Take the time to carefully review your tax return, checking for any mistakes in calculations, deductions, or credits claimed.

If you identify any errors, it's important to address them promptly. You can file an amended tax return to correct the errors and ensure that your refund is processed accurately.

4. Contact the FTB for Assistance

If you’ve exhausted the above steps and are still experiencing delays in receiving your tax refund, it’s advisable to reach out to the California Franchise Tax Board for assistance.

The FTB has a dedicated customer service team that can provide guidance and support in resolving refund issues. They can help you investigate the cause of the delay, provide updates on the status of your refund, and offer solutions to expedite the process.

Contact information for the FTB, including phone numbers and email addresses, can be found on their official website. Their team is trained to handle a range of refund-related inquiries and will work with you to resolve any outstanding issues.

California Tax Refund Payment Methods and Timing

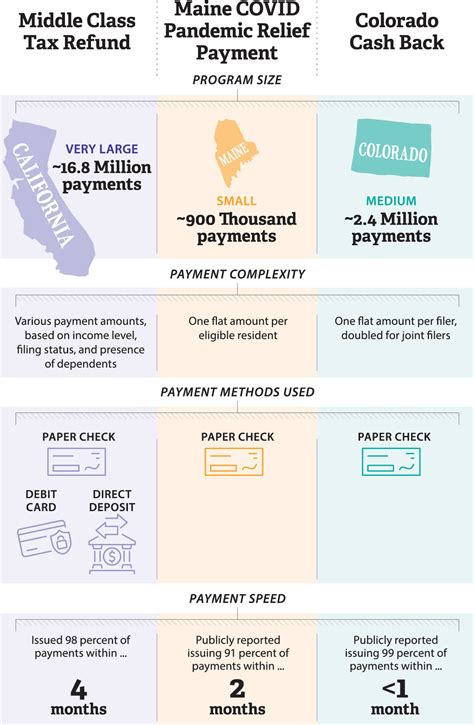

The California Franchise Tax Board offers taxpayers several payment methods for their tax refunds, providing flexibility and convenience. Understanding the available payment methods and their associated timelines is essential for effective financial planning.

1. Direct Deposit

Direct deposit is the fastest and most convenient method for receiving tax refunds. When filing their tax returns, taxpayers have the option to provide their bank account information, allowing the FTB to deposit the refund directly into their account.

The direct deposit method significantly reduces the time it takes to receive a refund, often taking just a few days after the tax return has been processed. This method is not only convenient but also secure, as taxpayers don't need to worry about the potential risks associated with mailing or handling physical refund checks.

| Payment Method | Estimated Timeframe |

|---|---|

| Direct Deposit | 3-5 business days |

| Refund Check | 2-3 weeks |

2. Refund Check

For taxpayers who prefer a more traditional method, the FTB also issues tax refunds in the form of paper checks. These checks are mailed to the taxpayer’s address as indicated on their tax return.

The timeframe for receiving a refund check can vary, typically taking around 2-3 weeks after the tax return has been processed. While this method may be slower compared to direct deposit, it offers a reliable and tangible form of payment for those who prefer physical checks.

3. Special Payment Methods for Specific Circumstances

In certain circumstances, the FTB may offer alternative payment methods to accommodate the needs of specific taxpayers. For instance, taxpayers with special needs or those facing financial hardships may be eligible for expedited refund payments or alternative payment arrangements.

It's important for taxpayers to be aware of these special payment methods and reach out to the FTB if they believe they qualify for such accommodations. The FTB is committed to assisting taxpayers in unique situations and ensuring that refunds are received in a timely and appropriate manner.

California Tax Refund Dispute and Resolution

In rare instances, taxpayers may encounter situations where they disagree with the amount of their tax refund or believe that there has been an error in the processing of their refund.

In such cases, it's crucial to take the necessary steps to address and resolve the dispute promptly. Here's a step-by-step guide to help taxpayers navigate the refund dispute and resolution process in California.

1. Review Your Refund Amount and Details

The first step in resolving a tax refund dispute is to carefully review the amount and details of your refund. The FTB provides taxpayers with a detailed breakdown of their refund, including the calculations and deductions used to determine the refund amount.

By thoroughly examining this information, taxpayers can identify any discrepancies or errors that may have led to an incorrect refund amount. It's important to compare the refund details with the information provided on your tax return to ensure accuracy.

2. Identify the Source of the Dispute

Once you’ve reviewed your refund details, the next step is to identify the specific reason for the dispute. Tax refund disputes can arise from a variety of factors, including:

- Calculation errors in the tax return

- Incorrect application of deductions or credits

- Missing or overlooked income or deductions

- Mistakes in personal information, such as SSN or address

- Issues with identity verification or fraud detection processes

By pinpointing the source of the dispute, taxpayers can better understand the nature of the issue and take appropriate steps to resolve it.

3. Gather Supporting Documentation

To strengthen your case and provide evidence in support of your refund dispute, it’s crucial to gather all relevant documentation. This may include:

- Copies of your tax return and supporting schedules

- Records of income, deductions, and credits

- Correspondence or notices from the FTB related to your refund

- Any other documentation that supports your claim

Having a comprehensive collection of supporting documents will enhance your ability to present a strong case and resolve the dispute efficiently.

4. Contact the FTB to Initiate the Dispute Resolution Process

After gathering the necessary documentation, the next step is to reach out to the California Franchise Tax Board to initiate the dispute resolution process. The FTB has a dedicated team to handle refund disputes, and they can guide you through the necessary steps to resolve your specific situation.

When contacting the FTB, be prepared to provide a clear and concise explanation of the dispute, along with the supporting documentation. Their team will review your case and work with you to find a resolution that addresses your concerns.

5. Follow Up and Stay Informed

Once you’ve initiated the dispute resolution process, it’s important to follow up and stay informed about the progress of your case. The FTB will keep you updated on the status of your dispute, providing regular updates and notifications.

By staying engaged and proactive, you can ensure that your refund dispute is resolved in a timely manner. Keep a record of all communications and updates from the FTB to maintain a clear overview of the progress of your case.

California Tax Refund and Financial Planning

The arrival of a tax refund provides an excellent opportunity for taxpayers to enhance their financial well-being and achieve their financial goals. By strategically planning how to utilize the refund, taxpayers can make informed decisions that align with their financial priorities.

1. Pay Off High-Interest Debt

One of the most effective ways to make the most of your tax refund is to use it to pay off high-interest debt, such as credit card balances or personal loans. By reducing or eliminating these debts, taxpayers can free up their monthly cash flow and minimize the financial burden of interest payments.

Paying off high-interest debt is a smart financial move that can improve your credit score, reduce stress, and provide a sense of financial freedom.

2. Build an Emergency Fund

Building an emergency fund is a crucial aspect of financial planning, as it provides a safety net for unexpected expenses or financial emergencies. Tax refunds can serve as an excellent starting point or a boost to your emergency fund.

By setting aside a portion of your refund for your emergency fund, you can gradually build a financial cushion that can cover unexpected costs, such as medical expenses, car repairs, or home maintenance. Having an emergency fund can provide peace of mind and prevent the need to rely on high-interest debt during unforeseen circumstances.

3. Invest in Your Future

Tax refunds can also be an opportunity to invest in your future and work towards long-term financial goals. Whether it’s contributing to a retirement account, investing in stocks or mutual funds, or saving for a major purchase or life event, tax refunds can serve as a catalyst for financial growth.

By allocating a portion of your refund to investments, you can take advantage of compounding interest and watch your wealth grow over time. It's a proactive approach to financial planning that can pay off significantly in the long run.

4. Plan for Major Purchases or Renovations

For those with specific goals or upcoming major purchases, tax refunds can be a valuable source of funds. Whether it’s saving for a down payment on a home, purchasing a new car, or funding a renovation project, tax refunds can provide a substantial contribution to these endeavors.

By setting aside a portion of your refund for these purposes, you can accelerate your savings and make progress towards your goals. It's a practical way to utilize your refund and work towards achieving your financial aspirations.

5. Give Back to Your Community

Tax refunds also present an opportunity to give back to your community and support causes that are close to your heart. Whether it’s donating to a local charity, sponsoring a community event, or contributing to a nonprofit organization, your refund can