Sc Vehicle Tax

Welcome to this comprehensive guide on South Carolina Vehicle Tax, a crucial aspect of vehicle ownership and registration in the Palmetto State. Navigating the intricacies of vehicle taxation can be challenging, but with the right information, you can ensure compliance and optimize your financial obligations. This article will provide an in-depth analysis of South Carolina's vehicle tax system, covering its structure, rates, exemptions, and the process of calculating and paying these taxes. We'll also explore the impact of vehicle taxes on the state's economy and offer expert insights to help you make informed decisions.

Understanding South Carolina Vehicle Tax

South Carolina, like many states, imposes taxes on vehicles to generate revenue for various government initiatives and infrastructure development. These taxes are an essential component of the state’s revenue stream, contributing to the maintenance and improvement of roads, bridges, and other transportation networks. Understanding the vehicle tax system is vital for both individual vehicle owners and businesses operating fleets, as it ensures compliance with state laws and minimizes potential penalties.

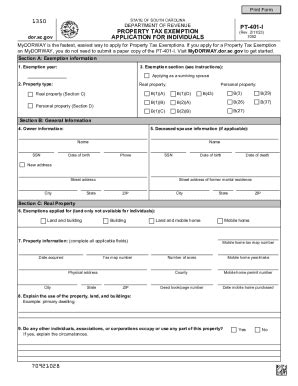

The South Carolina Department of Revenue is responsible for administering and enforcing vehicle tax laws. Their comprehensive guidelines outline the types of vehicles subject to taxation, the applicable tax rates, and the procedures for calculating and remitting these taxes. This article will delve into these guidelines, offering a detailed breakdown of the vehicle tax landscape in South Carolina.

Taxable Vehicles and Exemptions

Not all vehicles in South Carolina are subject to taxation. The state categorizes vehicles into different classes based on their type, usage, and ownership. Understanding these classifications is crucial for determining whether your vehicle is taxable and, if so, at what rate.

Passenger Vehicles

Passenger vehicles, including cars, SUVs, and light trucks, are generally subject to a property tax based on their assessed value. The tax rate for passenger vehicles is determined by the county in which the vehicle is registered. For instance, in Greenville County, the property tax rate for passenger vehicles is 0.72% of the vehicle’s assessed value. This means that for a car valued at 20,000, the property tax would amount to 144.

| County | Property Tax Rate for Passenger Vehicles |

|---|---|

| Charleston County | 0.50% |

| Horry County | 0.60% |

| Spartanburg County | 0.75% |

| Anderson County | 0.65% |

It's important to note that the assessed value of a vehicle is typically lower than its market value. This is because the state uses a depletion schedule, which reduces the vehicle's value over time. For instance, a new vehicle may be assessed at 80% of its market value in the first year, and this percentage decreases annually.

Commercial Vehicles

Commercial vehicles, such as trucks used for business purposes, are subject to a different tax structure. These vehicles are typically assessed based on their gross vehicle weight rating (GVWR) and are taxed at a fixed rate per 100 pounds of GVWR. For instance, a truck with a GVWR of 15,000 pounds would be taxed at a rate of 0.35 per 100 pounds</strong>, resulting in a tax of 525.

Exemptions

South Carolina offers several exemptions from vehicle taxes. These exemptions are designed to alleviate the tax burden on specific types of vehicles or owners. Some common exemptions include:

- Historic Vehicles: Vehicles that are at least 25 years old and have been deemed historic by the South Carolina Department of Motor Vehicles (DMV) are exempt from property taxes.

- Disabled Veterans: Veterans with a service-connected disability rating of 100% are exempt from property taxes on their vehicles.

- Active-Duty Military: Military personnel stationed in South Carolina can apply for a property tax exemption on their vehicles.

- Electric Vehicles: In an effort to promote eco-friendly transportation, South Carolina offers a property tax exemption for electric vehicles.

Calculating and Paying Vehicle Taxes

The process of calculating and paying vehicle taxes in South Carolina involves several steps. It’s essential to follow these steps carefully to ensure accurate calculations and timely payments.

Assessing Your Vehicle’s Value

The first step in calculating your vehicle tax is determining its assessed value. This value is typically based on the vehicle’s make, model, year, and condition. The South Carolina Department of Revenue uses a depletion schedule to determine the assessed value, which takes into account the vehicle’s age and depreciation.

Applying the Tax Rate

Once you have determined your vehicle’s assessed value, you can apply the appropriate tax rate. As mentioned earlier, the tax rate varies depending on the type of vehicle and the county in which it is registered. For instance, a passenger vehicle registered in Greenville County would be taxed at a rate of 0.72% of its assessed value.

Calculating the Tax Amount

To calculate the actual tax amount, you multiply the assessed value of your vehicle by the applicable tax rate. For example, if your passenger vehicle has an assessed value of $20,000 and is registered in Greenville County, the tax calculation would be:

$20,000 (assessed value) x 0.0072 (tax rate) = $144 (tax amount)

Payment Methods

South Carolina offers several methods for paying vehicle taxes. You can choose the method that is most convenient for you, including:

- Online Payment: The South Carolina Department of Revenue offers an online payment portal where you can securely pay your vehicle taxes using a credit or debit card.

- Mail-In Payment: You can also mail your tax payment to the Department of Revenue. Ensure that you include the correct form and documentation with your payment.

- In-Person Payment: Visit a local Department of Revenue office to pay your vehicle taxes in person. This option is ideal if you prefer a more personal interaction.

Impact on the State’s Economy

Vehicle taxes play a significant role in the economic landscape of South Carolina. The revenue generated from these taxes contributes to various state initiatives and infrastructure projects. Understanding the impact of vehicle taxes can provide valuable insights into the state’s financial health and its commitment to transportation development.

Infrastructure Development

A substantial portion of the revenue generated from vehicle taxes is allocated to improving the state’s transportation infrastructure. This includes funding for road repairs, bridge maintenance, and the construction of new highways and interstates. By investing in infrastructure, South Carolina ensures the safe and efficient movement of vehicles and goods across the state.

Economic Stimulus

Vehicle taxes also stimulate the state’s economy by providing funding for various economic development initiatives. These funds can be used to support local businesses, promote job growth, and attract new industries to the state. Additionally, the revenue generated can be used to enhance public services, such as education and healthcare, further contributing to the state’s overall economic prosperity.

State Budget and Financial Stability

Vehicle taxes are a stable source of revenue for the state’s budget. Unlike some other forms of taxation, which may fluctuate with economic conditions, vehicle taxes provide a consistent stream of income. This stability allows the state to plan and budget effectively, ensuring that essential services and infrastructure projects are adequately funded.

Expert Insights and Recommendations

Navigating the intricacies of South Carolina’s vehicle tax system can be complex, but with the right guidance, you can ensure compliance and optimize your financial obligations. Here are some expert insights and recommendations to consider:

Stay Informed

Vehicle tax laws and rates can change over time. It’s essential to stay informed about any updates or amendments to the tax system. The South Carolina Department of Revenue provides regular updates and resources on their website, ensuring that taxpayers have access to the latest information.

Utilize Exemptions Strategically

If you are eligible for any vehicle tax exemptions, take advantage of them. These exemptions can significantly reduce your tax obligations, freeing up funds for other expenses or investments. However, ensure that you meet all the criteria and have the necessary documentation to support your exemption claim.

Plan for Annual Payments

Vehicle taxes in South Carolina are typically due annually. Planning for these payments in advance can help you manage your finances more effectively. Consider setting aside funds specifically for vehicle taxes to ensure you have the necessary resources when payment deadlines approach.

Seek Professional Assistance

If you have complex vehicle ownership structures or are unsure about your tax obligations, consider seeking professional advice. Tax professionals and accountants can provide expert guidance and ensure that you are complying with all applicable laws and regulations.

Stay Updated on Incentives

South Carolina occasionally offers incentives or rebates related to vehicle taxes. These incentives may be tied to specific initiatives, such as promoting electric vehicles or supporting local businesses. Stay updated on these incentives to take advantage of any opportunities that align with your vehicle ownership goals.

Conclusion

South Carolina’s vehicle tax system is a crucial component of the state’s financial landscape, contributing to infrastructure development, economic growth, and financial stability. Understanding the tax rates, exemptions, and payment processes is essential for both individual vehicle owners and businesses. By staying informed, utilizing exemptions, and planning your finances strategically, you can ensure compliance with state laws and optimize your vehicle tax obligations.

What is the current vehicle tax rate in South Carolina?

+The vehicle tax rate in South Carolina varies depending on the type of vehicle and the county in which it is registered. For instance, passenger vehicles are typically taxed at a rate of 0.50% to 0.75% of their assessed value, while commercial vehicles are taxed based on their gross vehicle weight rating (GVWR) at a fixed rate per 100 pounds of GVWR.

Are there any exemptions from vehicle taxes in South Carolina?

+Yes, South Carolina offers several exemptions from vehicle taxes. These include exemptions for historic vehicles, disabled veterans, active-duty military personnel, and electric vehicles. Each exemption has specific criteria and documentation requirements.

How do I calculate my vehicle tax in South Carolina?

+To calculate your vehicle tax in South Carolina, you need to determine your vehicle’s assessed value and apply the appropriate tax rate. The assessed value is typically based on the vehicle’s make, model, year, and condition. Once you have the assessed value, multiply it by the applicable tax rate to find the tax amount.

What are the payment options for vehicle taxes in South Carolina?

+South Carolina offers several payment options for vehicle taxes. You can pay online through the Department of Revenue’s secure payment portal, mail your payment with the correct form and documentation, or visit a local Department of Revenue office to pay in person.

How do vehicle taxes impact the state’s economy in South Carolina?

+Vehicle taxes in South Carolina contribute significantly to the state’s economy. The revenue generated from these taxes is used to fund infrastructure development, support economic initiatives, and provide stable funding for essential services. This ensures the state’s financial stability and promotes economic growth.