Riverside County Property Taxes

Property taxes are an essential component of local government finances, and they play a significant role in funding public services and infrastructure in Riverside County, California. Understanding the intricacies of property taxes, including how they are calculated, the rates applicable, and the process for payment, is crucial for homeowners, businesses, and anyone interested in real estate in this region.

The Fundamentals of Riverside County Property Taxes

Riverside County, located in Southern California, is renowned for its diverse landscapes, from the picturesque mountains and deserts to fertile valleys. With a thriving population and a vibrant economy, the county relies heavily on property taxes to sustain its operations and provide essential services to its residents.

Property taxes in Riverside County are determined based on the assessed value of real property, which includes land and any structures or improvements made to it. The tax is an ad valorem tax, meaning it is proportional to the value of the property. This assessment is conducted by the Riverside County Assessor's Office, which is responsible for appraising all taxable properties within the county.

Assessment Process and Tax Rates

The assessment process involves evaluating the property’s market value, taking into account factors such as location, size, improvements, and recent sales of similar properties. Once the assessed value is determined, it is multiplied by the applicable tax rate to calculate the property tax due.

The tax rate in Riverside County is set annually by the county's Board of Supervisors and varies across different areas within the county. The rate is expressed as a percentage and includes both the general tax rate and any special assessment rates for specific services or improvements. For instance, the general tax rate for the fiscal year 2022-2023 in the City of Riverside was 1.0956%, while the special assessment rate for mosquito and vector control was 0.0036%.

| Assessment Area | General Tax Rate (%) | Special Assessment Rate (%) |

|---|---|---|

| City of Riverside | 1.0956 | 0.0036 |

| City of Corona | 1.1299 | 0.0049 |

| Unincorporated Riverside County | 1.2068 | 0.0169 |

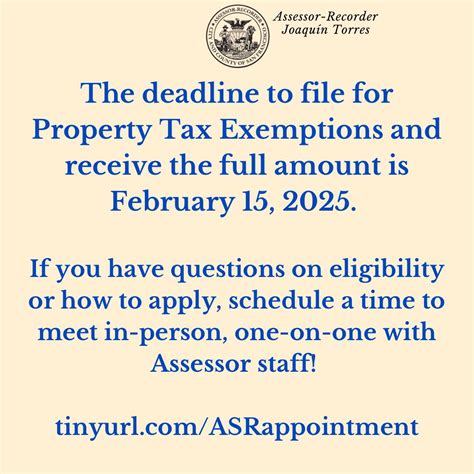

Exemptions and Reductions

Riverside County offers various exemptions and reductions to eligible property owners, which can significantly impact the overall tax liability. These include:

- Homeowner's Exemption: Property owners who occupy their property as their primary residence may be eligible for a reduction in their assessed value, resulting in lower property taxes. The exemption is typically applied automatically upon purchase, but it's essential to confirm with the Assessor's Office.

- Senior Citizen Exemption: Seniors aged 65 and older may qualify for an exemption if their income falls below a certain threshold. This exemption can reduce the assessed value of their property, thus lowering their property taxes.

- Veteran's Exemption: Qualifying veterans may be entitled to an exemption or a reduced assessment based on their service and disability status. This can provide substantial savings on property taxes for eligible veterans.

The Property Tax Cycle: From Assessment to Payment

The property tax cycle in Riverside County is a well-defined process that begins with the assessment of property values and concludes with the payment of taxes. Understanding this cycle is crucial for property owners to ensure timely payments and avoid penalties.

Assessment and Notice of Proposed Assessment

The assessment process typically commences on January 1st of each year. The Assessor’s Office evaluates all taxable properties and determines their assessed values. During this period, property owners may receive a Notice of Proposed Assessment, which outlines the proposed assessed value and any changes from the previous year.

Property owners have the right to appeal the proposed assessment if they believe it is inaccurate or unfair. The appeal process involves submitting evidence and supporting documentation to the Assessment Appeals Board, which reviews and makes a determination on the appeal.

Tax Bills and Payment Due Dates

Once the assessed values are finalized, the County Tax Collector’s Office generates tax bills, which are typically mailed to property owners in late August or early September. These bills detail the assessed value of the property, the applicable tax rates, and the total amount due.

In Riverside County, property taxes are due in two installments. The first installment is typically due on November 1st, with a 5% penalty accruing if not paid by December 10th. The second installment is due on February 1st of the following year, with a 10% penalty applying if not paid by April 10th.

Payment Options and Penalties

Property owners have various payment options, including online payment through the County’s website, payment by phone, or by mailing a check or money order to the Tax Collector’s Office. Late payments incur penalties, as mentioned earlier, and failure to pay property taxes can lead to more severe consequences, including tax default and potential property liens.

The Impact of Property Taxes on Riverside County’s Economy

Property taxes are a critical source of revenue for Riverside County, contributing significantly to the local economy. These taxes fund a wide range of public services and infrastructure projects, including:

- Public schools and educational programs

- Law enforcement and public safety

- Road maintenance and construction

- Fire protection services

- Healthcare facilities and programs

- Parks and recreational areas

- Environmental conservation efforts

The revenue generated from property taxes also supports local businesses and economic development initiatives, creating a thriving business environment and attracting new investments. Additionally, property taxes play a vital role in maintaining property values and ensuring the overall financial health of the county.

The Role of Property Taxes in Community Development

Beyond their economic impact, property taxes in Riverside County have a profound influence on community development and the overall quality of life. The revenue generated is often reinvested into the community through various programs and initiatives, such as:

- Affordable housing projects

- Community improvement grants

- Small business support programs

- Cultural and arts initiatives

- Youth development programs

- Senior citizen services and programs

- Environmental sustainability projects

These investments not only enhance the livability of the county but also foster a sense of community and promote social equity. Property taxes, therefore, serve as a mechanism for residents to contribute to and benefit from the collective growth and well-being of their local area.

Conclusion

Riverside County’s property tax system is a complex yet essential component of the local government’s finances. Understanding the assessment process, tax rates, and payment procedures is crucial for property owners to ensure compliance and take advantage of available exemptions. Moreover, recognizing the economic and community impact of property taxes highlights their significance in sustaining the county’s vibrant economy and high quality of life.

FAQ

What happens if I don’t receive my property tax bill?

+If you do not receive your property tax bill, it is crucial to contact the Riverside County Tax Collector’s Office as soon as possible. They can provide you with a duplicate bill and ensure that you are aware of your payment due dates to avoid any late fees or penalties.

Are there any options for paying property taxes in installments?

+Yes, Riverside County offers a convenient installment payment plan. Property owners can choose to pay their taxes in two installments, with the first installment due on November 1st and the second on February 1st of the following year. This plan helps manage the financial burden and ensures timely payments without incurring penalties.

How can I appeal my property’s assessed value if I believe it is inaccurate?

+If you believe your property’s assessed value is incorrect, you have the right to appeal. The process involves submitting an application to the Assessment Appeals Board, along with supporting evidence and documentation. It’s important to act promptly as there are deadlines for filing appeals. The Board will review your case and make a determination based on the evidence presented.