Utah Tax Refund Status

Utah's tax system, like that of many states, offers residents the opportunity to claim refunds when they overpay their taxes. Understanding the Utah Tax Refund Status process and keeping track of the progress of your refund is essential for financial planning and peace of mind. This comprehensive guide will walk you through the entire process, from the moment you file your taxes to the point when your refund is issued.

The Utah Tax Refund Process: A Step-by-Step Guide

Navigating the tax refund process in Utah involves several key steps. Let’s break it down to make it as straightforward as possible.

Step 1: Filing Your Tax Return

The journey begins with the filing of your tax return. Utah residents have various options for filing their taxes, including online platforms, software, or traditional paper filing. The Utah State Tax Commission provides user-friendly resources to guide taxpayers through the filing process, ensuring accuracy and compliance with state regulations.

When filing, it's crucial to double-check your personal information, income details, and any deductions or credits you're claiming. A simple oversight can lead to delays or errors in processing, so thoroughness is key.

For those who prefer the convenience of e-filing, the Utah Tax Commission's website offers a secure portal. This method is not only efficient but also reduces the chances of errors, as the software often catches common mistakes.

Step 2: Processing Time and Factors

Once your tax return is submitted, the clock starts ticking on the processing time. Utah’s tax authorities aim for efficiency, but various factors can influence how long it takes to receive your refund.

On average, if you e-file your return and opt for direct deposit, you can expect your refund within 7-14 business days. However, this timeline can be impacted by the volume of returns being processed, especially during peak tax season. It's always a good idea to plan ahead and file early to avoid potential delays.

For those who choose to file a paper return, the processing time can be slightly longer, typically taking 4-6 weeks. This is because paper returns require manual processing, which can be more time-consuming.

| Filing Method | Estimated Processing Time |

|---|---|

| E-File with Direct Deposit | 7-14 business days |

| Paper Return | 4-6 weeks |

It's worth noting that the Utah Tax Commission processes refunds on a first-come, first-served basis. So, filing early can be advantageous, especially if you're relying on your refund for specific financial commitments.

Step 3: Tracking Your Refund

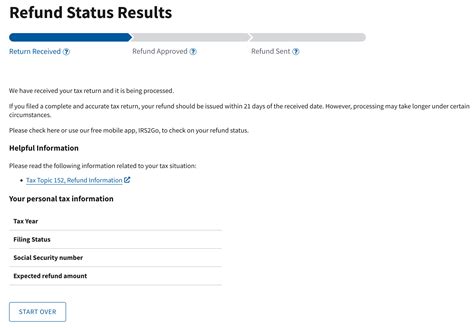

The wait for your refund doesn’t have to be a mystery. Utah offers a convenient Where’s My Refund tool on its official website. This online tracking system provides real-time updates on the status of your refund, giving you clarity and peace of mind.

To use this tool, you'll need some key information from your tax return, including your Social Security Number, filing status, and the exact amount of your expected refund. This ensures that the system can accurately match your details and provide the most up-to-date information.

The Where's My Refund tool is updated regularly, typically every 24 hours, so you can check in frequently to see if there's been any progress. It's a simple and effective way to stay informed about the status of your refund without having to make unnecessary calls or visits.

Step 4: Receiving Your Refund

The moment you’ve been waiting for is finally here: receiving your tax refund. Utah offers multiple refund options to cater to different preferences.

For those who chose direct deposit when filing their taxes, the refund will be deposited directly into the bank account provided. This method is not only secure but also convenient, as you don't have to worry about a physical check getting lost or delayed in the mail.

If you opted for a paper check, you can expect to receive it in the mail within the estimated processing time. It's essential to keep an eye on your mailbox and notify the tax authorities if you haven't received your refund within the expected timeframe.

Step 5: Addressing Delays and Issues

While the Utah Tax Commission strives for efficiency, delays can sometimes occur. Various factors, such as errors on your tax return, missing information, or even technical glitches, can cause a refund to be held up.

If you've been waiting longer than the estimated processing time and are concerned about the status of your refund, it's advisable to contact the Utah Tax Commission's customer service. Their team is well-equipped to handle refund inquiries and can provide specific updates and guidance based on your individual situation.

In some cases, refunds may be delayed due to audits or further review. While this can be worrying, it's important to remember that such reviews are a normal part of the tax process and are conducted to ensure accuracy and compliance.

Understanding Utah’s Tax System: Key Insights

Utah’s tax system is designed to be fair and efficient, with a focus on simplicity and taxpayer convenience. Here are some key insights to enhance your understanding of Utah’s tax landscape.

Tax Rates and Brackets

Utah operates a progressive tax system, which means that higher incomes are taxed at higher rates. The state currently has four tax brackets, ranging from 2.95% to 5%, with the highest rate applicable to incomes over 7,815 for single filers and 15,629 for joint filers.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $2,603 | 2.95% |

| $2,604 - $4,586 | 3.05% |

| $4,587 - $7,815 | 4.25% |

| $7,816 and above | 5% |

It's worth noting that Utah does not impose a local income tax, which means the state tax is the only income tax you'll pay if you're a resident.

Tax Credits and Deductions

Utah offers a range of tax credits and deductions to help residents reduce their taxable income and potentially increase their refund. These include:

- Child and Dependent Care Credit: Helps offset the cost of childcare or dependent care expenses.

- Earned Income Tax Credit: A federal credit that Utah also recognizes, benefiting low- to moderate-income earners.

- Property Tax Credit: Available to homeowners and renters, providing relief on property taxes.

- Education Credits: Various credits are available for tuition and other educational expenses.

Understanding these credits and deductions can be crucial in maximizing your refund or reducing your tax liability.

Sales and Use Tax

In addition to income tax, Utah also imposes a sales and use tax on most goods and services. The general sales tax rate is 4.7%, but local municipalities can add their own sales tax, resulting in a combined rate that can vary across the state.

Utah's sales tax applies to a wide range of items, from clothing and electronics to restaurant meals and entertainment. However, certain necessities like groceries and prescription drugs are exempt.

The Future of Tax Refunds: A Look Ahead

As technology advances and tax systems evolve, the process of claiming and receiving tax refunds is likely to become even more efficient and user-friendly.

Enhanced Digital Tools

The Utah Tax Commission is continuously improving its digital services, including the Where’s My Refund tool. Future enhancements may include real-time notifications, more detailed tracking, and even mobile app integration, making it even easier for taxpayers to stay informed.

Simplified Filing and Refunds

With the rise of user-friendly tax software and online platforms, filing taxes and claiming refunds is becoming more accessible and less daunting. The trend towards simplified forms and user-centric design is likely to continue, making the process more intuitive for all taxpayers.

Increased Use of Direct Deposit

Direct deposit is already a popular choice for receiving tax refunds, and its use is only expected to grow. The convenience and security it offers are significant advantages, especially with the increased focus on digital financial transactions.

Expanded Tax Credits and Relief

As states look to support their residents and stimulate the economy, we may see the introduction of new tax credits or the expansion of existing ones. This could include credits for energy efficiency, healthcare costs, or even specific industries, providing much-needed relief to taxpayers.

Conclusion: A Smooth Tax Refund Journey

Navigating the Utah Tax Refund Status process can be straightforward and stress-free when you have the right information and tools. From understanding the tax rates and brackets to utilizing the Where’s My Refund tool, every step is designed to make your tax refund journey as smooth as possible.

As we look to the future, the evolution of tax systems and digital tools promises even greater convenience and efficiency. Whether you're a long-time Utah resident or new to the state, staying informed and taking advantage of the resources available can make tax time less daunting and more rewarding.

How long does it take to receive my Utah tax refund after filing?

+If you e-file and choose direct deposit, you can typically expect your refund within 7-14 business days. For paper returns, the processing time is 4-6 weeks.

Can I track the status of my Utah tax refund online?

+Yes, Utah provides a Where’s My Refund tool on its official website. You can use this to check the status of your refund by providing your SSN, filing status, and expected refund amount.

What if I don’t receive my Utah tax refund within the estimated timeframe?

+If you’ve waited longer than the estimated processing time, it’s advisable to contact the Utah Tax Commission’s customer service. They can provide specific updates and guidance based on your situation.

Are there any tax credits or deductions I should be aware of in Utah?

+Yes, Utah offers a range of tax credits and deductions, including the Child and Dependent Care Credit, Earned Income Tax Credit, Property Tax Credit, and Education Credits. Understanding these can help maximize your refund or reduce your tax liability.