Washington State Tax Calculator

Welcome to this comprehensive guide on the Washington State Tax Calculator. This article aims to provide an in-depth analysis of the tax system in Washington, offering a valuable resource for individuals and businesses alike. By understanding the intricacies of Washington's tax landscape, you can make informed decisions and navigate the financial obligations with ease.

Understanding the Washington State Tax System

Washington, a beautiful state known for its diverse landscapes and vibrant cities, has a unique approach to taxation. Unlike many other states, Washington does not impose a personal income tax on its residents. This distinction makes it an attractive destination for individuals seeking tax-efficient living.

However, the absence of an income tax does not mean that Washington residents and businesses are free from all tax obligations. The state has implemented a range of other taxes to generate revenue and fund essential services. These taxes cover various aspects of economic activity, from sales and use taxes to business and occupation taxes.

Sales and Use Taxes

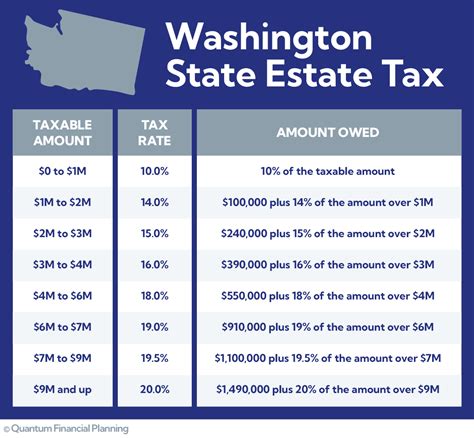

One of the primary sources of revenue for Washington is its Sales and Use Tax. This tax is applied to the retail sale or lease of tangible personal property and certain services. The sales tax rate in Washington varies depending on the location, as local jurisdictions can impose additional taxes. As of [current year], the state sales tax rate is [state sales tax rate]%, while local taxes can range from [lowest local rate]% to [highest local rate]%, making the total sales tax burden a significant consideration for consumers and businesses.

| Sales Tax Rate | Effective Rate |

|---|---|

| State Sales Tax | [state sales tax rate]% |

| Average Local Tax | [average local tax rate]% |

| Highest Local Tax | [highest local tax rate]% |

For businesses operating in Washington, understanding the sales tax obligations is crucial. The state has a Business and Occupation (B&O) Tax, which is a gross receipts tax. This tax is levied on the privilege of doing business in Washington and is calculated based on the gross income or revenue generated by the business. The B&O tax rate varies depending on the business activity, with rates ranging from [lowest B&O rate]% to [highest B&O rate]%.

Business and Occupation (B&O) Tax

The B&O tax is a critical component of Washington’s tax system, as it contributes significantly to the state’s revenue. Businesses are classified into different tax categories based on their primary activity, and each category has a specific tax rate. Here’s a breakdown of some common B&O tax categories and their rates:

- Retail: [retail B&O rate]%

- Wholesale: [wholesale B&O rate]%

- Manufacturing: [manufacturing B&O rate]%

- Service and Other Business Activities: [service B&O rate]%

It's important to note that Washington also offers tax incentives and credits to encourage certain economic activities. For instance, there are tax breaks for manufacturing, research and development, and renewable energy projects. These incentives can significantly reduce the B&O tax liability for eligible businesses.

Calculating Taxes with the Washington State Tax Calculator

To assist individuals and businesses in navigating the Washington tax landscape, the state provides an official Washington State Tax Calculator. This online tool is a valuable resource for estimating tax obligations and understanding the impact of various transactions on tax liability.

Features of the Tax Calculator

The Washington State Tax Calculator offers a user-friendly interface, allowing users to input specific details about their transactions or business activities. Here are some key features:

- Sales Tax Calculation: Users can input the purchase amount and location to estimate the total sales tax owed.

- B&O Tax Estimation: Businesses can input their gross income or revenue to calculate their B&O tax liability for a specific tax category.

- Tax Incentive Analysis: The calculator provides information on available tax incentives and helps assess eligibility for specific business activities.

- Customizable Scenarios: Users can input different transaction values or business parameters to explore various tax scenarios and make informed decisions.

By utilizing the Washington State Tax Calculator, individuals and businesses can gain a clearer understanding of their tax obligations and plan their financial strategies accordingly. The calculator is a valuable tool for budgeting, forecasting, and ensuring compliance with Washington's tax regulations.

Real-World Examples

Let’s consider a few practical scenarios to illustrate the utility of the Washington State Tax Calculator:

- Retail Sales Tax: Imagine a customer purchases a new laptop for $1,500 in Seattle. Using the tax calculator, they can input the purchase amount and location to determine the total sales tax. With a state sales tax rate of [state sales tax rate]% and a local tax rate of [Seattle local tax rate]%, the customer would owe a total sales tax of approximately $[total sales tax amount].

- Wholesale Business Tax: A wholesale distributor with annual gross income of $5 million wants to estimate their B&O tax liability. By selecting the "Wholesale" tax category and inputting their revenue, they can quickly calculate their B&O tax obligation, which would be [wholesale B&O tax amount] based on the applicable rate of [wholesale B&O rate]%.

- Manufacturing Tax Incentives: A manufacturing company is considering expanding its operations in Washington. The tax calculator can help them explore the available tax incentives for manufacturing activities. By inputting their projected investment and production volume, they can assess the potential tax savings and make an informed decision about their expansion plans.

The Impact of Washington’s Tax System

Washington’s tax system has both advantages and challenges for residents and businesses. The absence of a personal income tax makes the state an attractive destination for individuals seeking tax-efficient lifestyles. Additionally, the B&O tax structure, while complex, offers incentives for certain economic activities, encouraging business growth and investment.

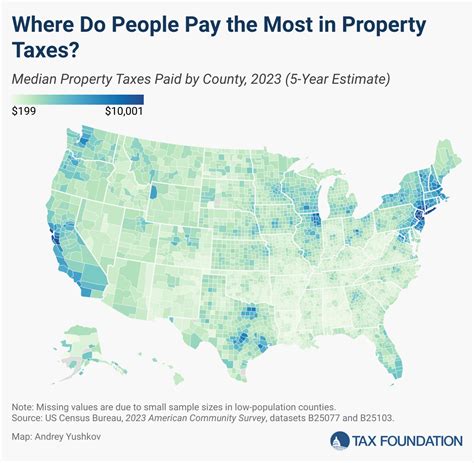

However, the variability of tax rates and the potential for high sales tax burdens in certain areas can impact consumer behavior and business decisions. Understanding these nuances is essential for making informed financial choices and optimizing tax strategies.

Future Considerations

As Washington continues to evolve economically, its tax system may also undergo changes. While the state currently relies heavily on sales and B&O taxes, there is ongoing debate about potential tax reforms. Some policymakers advocate for the introduction of a personal income tax to diversify revenue sources and address funding needs for public services.

Additionally, with the increasing focus on e-commerce and online sales, Washington may need to adapt its tax regulations to keep pace with the changing landscape. The state's tax authorities are actively engaged in discussions and collaborations to ensure that the tax system remains fair, efficient, and responsive to the needs of its residents and businesses.

Can I find a detailed breakdown of tax rates by location in Washington?

+Yes, the Washington State Department of Revenue provides comprehensive information on sales tax rates by location. You can access this data on their official website, which offers a searchable database of tax rates for cities and counties across the state.

Are there any tax exemptions or discounts available for specific products or services in Washington?

+Washington does offer certain tax exemptions and discounts for specific items. For example, there are exemptions for groceries, prescription drugs, and certain agricultural purchases. Additionally, there are tax incentives for renewable energy systems and electric vehicle purchases. It’s advisable to consult the official tax guidelines or seek professional advice to understand the eligibility criteria and requirements.

How often are the tax rates updated in Washington, and where can I find the most recent information?

+Tax rates in Washington are periodically updated to reflect legislative changes and local adjustments. The Washington State Department of Revenue is the primary source for the most recent tax rate information. They regularly publish updates and provide resources to help individuals and businesses stay informed about any changes in tax rates and regulations.