Ct Car Sales Tax

The car sales tax in Connecticut is a significant aspect of purchasing a vehicle in the state, impacting both residents and those considering a move to the Nutmeg State. Understanding the intricacies of this tax is crucial for anyone looking to buy a car, as it can significantly affect the overall cost and financial planning. This article aims to provide a comprehensive guide to Connecticut's car sales tax, covering its calculation, potential exemptions, and the impact it has on consumers.

Understanding the Basics of Ct Car Sales Tax

Connecticut imposes a sales and use tax on the purchase of motor vehicles, which includes new and used cars, motorcycles, and certain other vehicles. The tax is applied to the purchase price of the vehicle, and it is an essential revenue stream for the state government.

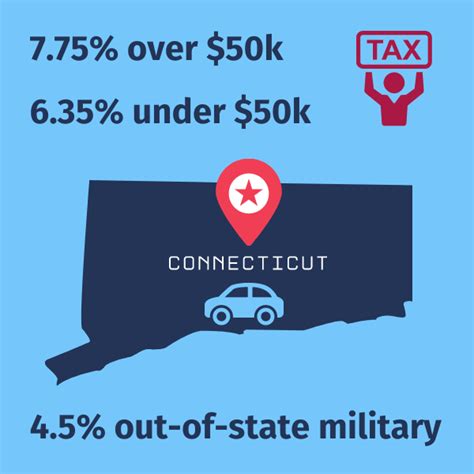

The Ct Car Sales Tax is calculated as a percentage of the total purchase price, with the exact rate depending on the type of vehicle and its intended use. For standard passenger vehicles, the sales tax rate is set at 6.35% as of January 2023. This rate is applied to the total price, including any additional fees and costs associated with the purchase.

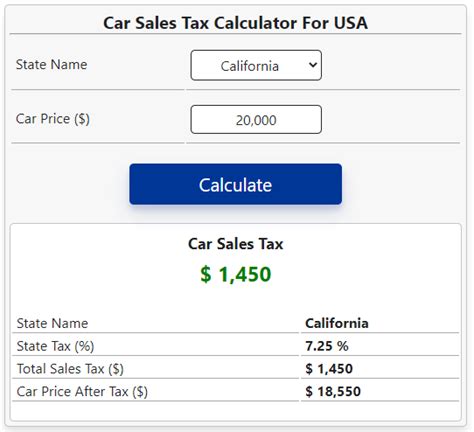

For example, if you're buying a new car priced at $30,000, the sales tax would amount to $1,905 (6.35% of $30,000). This tax is due at the time of purchase and is typically paid to the dealership, who then remits it to the state.

However, it's important to note that the sales tax can vary based on the vehicle's classification. For instance, certain alternative fuel vehicles may be eligible for a reduced tax rate or even a tax exemption. This is part of the state's efforts to promote environmentally friendly transportation options.

| Vehicle Type | Sales Tax Rate |

|---|---|

| Standard Passenger Vehicles | 6.35% |

| Alternative Fuel Vehicles (Electric, Hydrogen) | 3.75% |

| Certain Plug-in Hybrid Vehicles | 0% |

Additionally, there are specific exemptions and deductions that can further reduce the tax burden for certain individuals and vehicles. These include exemptions for military personnel, disabled individuals, and vehicles used for specific purposes like farming or government work.

The Impact of Ct Car Sales Tax on Consumers

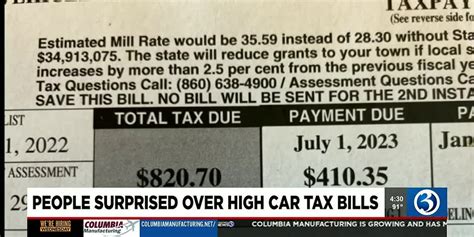

The Ct Car Sales Tax has a direct and significant impact on consumers, influencing their purchasing decisions and overall financial planning. The tax can add a substantial amount to the total cost of a vehicle, making it a crucial consideration for anyone looking to buy a car in Connecticut.

Financial Planning and Budgeting

When budgeting for a new car, it’s essential to account for the sales tax. The 6.35% rate can quickly add up, especially for more expensive vehicles. For example, on a 50,000 car, the sales tax alone would be 3,175. This extra cost needs to be factored into the overall budget, including down payments, financing, and insurance.

Financial planners often recommend setting aside a specific amount for taxes when saving for a car purchase. This ensures that consumers are prepared for the full cost of ownership, including the tax liability.

Impact on Vehicle Affordability

The sales tax can significantly affect the affordability of vehicles, particularly for those on a tight budget. For lower-income individuals or families, the tax can push the overall cost of a vehicle beyond their means, making it challenging to secure reliable transportation.

In such cases, consumers may opt for used vehicles, which typically have a lower purchase price and thus a lower tax liability. However, it's essential to consider the trade-offs, as older vehicles may require more frequent repairs and maintenance.

Comparison with Other States

Connecticut’s sales tax rate is relatively competitive compared to other states. For instance, neighboring Massachusetts has a higher rate of 6.25%, while New York’s rate can vary based on the county, ranging from 4% to 8.875%. However, it’s essential to consider the overall cost of living and other factors when comparing states for vehicle purchases.

When moving to a new state, it's crucial to research and understand the local sales tax rates and any potential exemptions or deductions. This ensures a smooth transition and helps avoid unexpected costs when purchasing a vehicle.

The Future of Ct Car Sales Tax

The Ct Car Sales Tax is subject to change, influenced by economic conditions, political decisions, and shifts in the automotive industry. While the current rate of 6.35% has remained stable for several years, future adjustments cannot be ruled out.

One potential area of change is the classification and taxation of electric vehicles (EVs) and other alternative fuel vehicles. As these vehicles become more popular and their production costs decrease, there may be a push to adjust the tax rate or introduce new incentives to promote their adoption. This could include further reducing the sales tax rate or introducing rebates and incentives for EV purchases.

Additionally, the state may consider adjusting the sales tax rate for all vehicles to align with economic trends or to generate additional revenue. While such changes are typically announced in advance, it's essential for consumers to stay informed about any potential shifts in tax policy.

For those considering a move to Connecticut or planning a significant vehicle purchase, staying updated on tax policy changes is crucial. This ensures that financial planning and budgeting are accurate and aligned with the current tax landscape.

Are there any online resources to help calculate the Ct Car Sales Tax for my vehicle purchase?

+

Yes, the Connecticut Department of Revenue Services provides an online calculator to estimate the sales tax on a vehicle purchase. This tool can be a helpful resource for budgeting and financial planning.

How often does the Ct Car Sales Tax rate change, and when was the last adjustment made?

+

The sales tax rate can change annually, typically as part of the state’s budgetary process. The last adjustment to the current rate of 6.35% was made in 2020.

Are there any plans to introduce new tax incentives for electric vehicles in Connecticut?

+

Yes, there have been discussions and proposals to introduce or expand tax incentives for electric vehicles. These incentives could take the form of reduced sales tax rates or rebate programs. It’s advisable to monitor legislative updates for any changes.