Utah State Tax Refund Status

For residents of Utah, understanding the status of your state tax refund is crucial, especially during tax season. The Utah State Tax Commission provides an efficient and transparent process for taxpayers to check the status of their refunds, ensuring timely and accurate information. This article aims to guide you through the process, offering a comprehensive insight into the steps involved and the factors that may impact the timing of your refund.

Understanding the Utah State Tax Refund Process

The Utah State Tax Commission is responsible for processing tax returns and issuing refunds to eligible taxpayers. The process typically begins with the filing of your state income tax return, either electronically or through traditional mail methods. Once the return is received, the Commission reviews it for accuracy and compliance with state tax laws.

During this review process, the Commission may identify errors or discrepancies, which can lead to delays in refund issuance. Common issues include incorrect Social Security numbers, math errors, or missing forms and schedules. To avoid these delays, it is crucial to carefully review your tax return before submission.

The Commission aims to process returns within 30 days, but this timeline can vary depending on the complexity of the return and the volume of submissions. For instance, returns with business income or multiple schedules may take longer to process.

It's important to note that refunds are typically issued via direct deposit or check, as selected by the taxpayer on their return. Direct deposit is the fastest option, usually taking around 10 days from the date of filing, while checks may take up to three weeks to arrive.

Factors Affecting Refund Timing

Several factors can influence the timing of your Utah state tax refund. One significant factor is the volume of tax returns received during a given period. The Commission experiences peak periods, particularly during the traditional tax season (January to April), which can result in longer processing times.

| Processing Method | Estimated Timeline |

|---|---|

| Electronic Filing with Direct Deposit | 10–14 days |

| Paper Filing with Direct Deposit | 3–4 weeks |

| Electronic Filing with Check | 3–4 weeks |

| Paper Filing with Check | 6–8 weeks |

Additionally, certain types of tax returns, such as those with complex business structures or substantial capital gains, may require more extensive review, leading to longer processing times.

Another factor to consider is the accuracy of your tax return. Returns with errors or discrepancies, as mentioned earlier, may require additional review, resulting in delays. To expedite the process, it's essential to ensure your return is complete and accurate before submission.

Checking Your Utah State Tax Refund Status

The Utah State Tax Commission provides an online tool called Tax Refund Status, which allows taxpayers to track the progress of their refund. This tool is accessible through the Commission’s official website and is designed to provide real-time updates on the status of your refund.

To use the Tax Refund Status tool, you'll need to provide certain information, including your Social Security number, filing status, and the exact amount of your expected refund. This information is crucial for security purposes and to ensure that you receive accurate and personalized refund status updates.

The tool will display one of several possible refund statuses, such as "Return Received", "Return In Process", "Refund Approved", or "Refund Sent". Each status provides a clear indication of where your refund is in the processing timeline.

If you encounter any issues or have specific questions about your refund status, the Utah State Tax Commission offers a dedicated Refund Hotline at (801) 297-2200 or (800) 662-4335 (toll-free). The hotline is staffed by knowledgeable representatives who can assist with refund-related inquiries.

Troubleshooting Common Refund Issues

While the Tax Refund Status tool and the Refund Hotline are valuable resources, there may be instances where your refund is delayed or you encounter other issues. Here are some common scenarios and suggested troubleshooting steps:

-

Refund Not Received: If your refund status shows "Refund Sent" but you have not received it, first check your bank account or mailbox (depending on your selected refund method). If the refund is not found, contact the Utah State Tax Commission to report the issue. They may need to issue a replacement refund.

-

Return Errors: If your return has errors, the Commission will send a notice explaining the issue. You'll need to correct the errors and resubmit your return. Ensure that you understand the error message and take the necessary steps to resolve it.

-

Identity Verification: In some cases, the Commission may require additional identity verification, especially if there are discrepancies in your tax return. This process can delay your refund, so be prepared to provide the necessary documentation.

-

Complex Returns: If your tax return involves complex business structures or other unique circumstances, it may take longer to process. In such cases, patience is key. Regularly check your refund status and reach out to the Commission if you have specific concerns.

Conclusion: Staying Informed and Taking Action

Understanding the Utah State Tax Refund process and staying informed about the status of your refund is essential for a smooth and stress-free tax season. By utilizing the Tax Refund Status tool, you can track the progress of your refund and take prompt action if any issues arise.

Remember, the Utah State Tax Commission is dedicated to providing efficient and accurate tax refund services. By ensuring the accuracy of your tax return and staying informed, you can navigate the refund process with ease and confidence.

Frequently Asked Questions

How long does it typically take to receive a Utah state tax refund?

+

The processing time for Utah state tax refunds varies, but on average, it takes around 2-3 weeks from the date of filing. However, this timeline can be affected by factors such as the volume of tax returns, the complexity of your return, and any errors or discrepancies found during the review process.

Can I check the status of my Utah state tax refund online?

+

Yes, you can check the status of your Utah state tax refund online through the Tax Refund Status tool provided by the Utah State Tax Commission. This tool allows you to track the progress of your refund in real-time, providing updates on whether your return has been received, is in process, or if your refund has been approved and sent.

What if I don’t receive my Utah state tax refund within the estimated timeline?

+

If you don’t receive your Utah state tax refund within the estimated timeline, it’s recommended to first check your bank account (for direct deposit refunds) or mailbox (for check refunds). If the refund is not found, you can contact the Utah State Tax Commission’s Refund Hotline at (801) 297-2200 or (800) 662-4335 to report the issue and request assistance.

Are there any penalties for filing my Utah state tax return late?

+

Yes, filing your Utah state tax return late may result in penalties and interest charges. The Utah State Tax Commission imposes a late filing penalty of 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid tax balance from the original due date until the tax is paid in full.

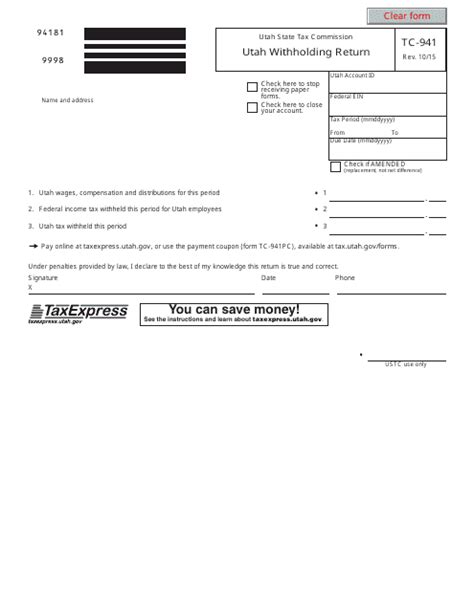

Can I file an amended Utah state tax return if I made a mistake on my original return?

+

Yes, you can file an amended Utah state tax return if you discover an error or need to make changes to your original return. You should use Form TC-40X to amend your return and provide detailed explanations of the changes being made. The Utah State Tax Commission will then process your amended return and adjust your tax liability accordingly.