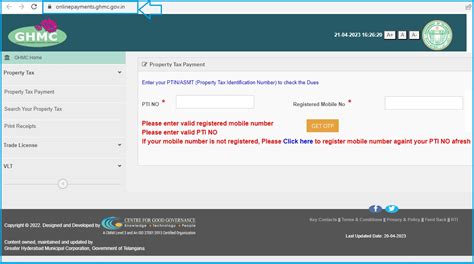

Property Tax Online Payment Ghmc

In today's fast-paced digital world, the convenience of online payments has revolutionized various aspects of our lives, and property tax payments are no exception. The Greater Hyderabad Municipal Corporation (GHMC) has embraced this digital transformation, offering residents a seamless and efficient way to settle their property tax obligations through online platforms. This article explores the intricacies of the Property Tax Online Payment system, shedding light on its benefits, processes, and the overall impact on property owners in the Hyderabad region.

The Evolution of Property Tax Payments: GHMC’s Digital Initiative

The GHMC, recognizing the need for a more accessible and streamlined tax payment system, has undertaken a comprehensive digital transformation. The introduction of the Property Tax Online Payment system is a significant step towards achieving this goal. This initiative not only simplifies the tax payment process but also aligns with the broader vision of a cashless and digitally empowered society.

Property owners in Hyderabad now have the advantage of managing their tax obligations from the comfort of their homes or offices, eliminating the need for physical visits to government offices. This not only saves time but also reduces administrative burdens, making the tax payment process more efficient and transparent.

Key Features and Benefits of GHMC’s Online Payment System

The GHMC’s Property Tax Online Payment system boasts several features that enhance the user experience and overall efficiency of the process.

- User-Friendly Interface: The online platform is designed with simplicity in mind, ensuring that property owners, regardless of their technical expertise, can navigate the system effortlessly. Clear instructions and step-by-step guides make the payment process intuitive and easy to follow.

- Secure Payment Gateway: Security is a top priority for the GHMC. The online payment system utilizes advanced encryption technology to safeguard sensitive financial information, providing users with peace of mind and confidence in the digital transaction process.

- Real-Time Updates: One of the significant advantages is the real-time nature of the system. Property owners can receive instant updates on their payment status, including confirmation of successful transactions and tax clearance certificates. This feature enhances transparency and provides immediate clarity on the status of their tax obligations.

- Paperless Transactions: The digital platform promotes a greener approach to tax payments, reducing the reliance on physical documents and paperwork. This not only streamlines the process but also contributes to environmental sustainability by minimizing paper waste.

- Flexible Payment Options: GHMC's online payment system offers a range of payment methods, including credit cards, debit cards, net banking, and even e-wallets. This flexibility caters to diverse user preferences and ensures a convenient payment experience.

Step-by-Step Guide to Paying Property Tax Online

Paying property tax online through the GHMC’s platform is a straightforward process. Here’s a detailed guide to help property owners navigate the system seamlessly:

- Access the GHMC Website: Begin by visiting the official GHMC website, which serves as the primary portal for property-related services and information.

- Locate the Property Tax Section: On the homepage, navigate to the "Property Tax" or "Online Payments" section. This section typically features a prominent link or button, making it easily accessible.

- Select Payment Option: Once you've accessed the property tax section, you'll be presented with various payment options. Choose the one that suits your preference, whether it's credit card, debit card, net banking, or e-wallet.

- Enter Property Details: The system will prompt you to enter specific details about your property, including the property ID, assessment number, or other relevant information. Ensure accuracy to avoid any delays or discrepancies.

- Choose Payment Amount: After entering your property details, the system will calculate the outstanding tax amount. Review the amount and ensure it aligns with your records. If satisfied, proceed to the next step.

- Complete the Payment Process: Follow the instructions provided by the chosen payment gateway. Enter your financial details securely and complete the transaction. The system will guide you through the final steps, providing confirmation once the payment is successful.

- Receive Payment Confirmation: Upon successful payment, you'll receive an instant confirmation, typically via email or SMS. This confirmation serves as a record of your transaction and can be used for future reference or as proof of payment.

Performance Analysis and User Experience

The implementation of the Property Tax Online Payment system has garnered positive feedback from property owners in Hyderabad. Surveys and user reviews highlight the system’s efficiency, ease of use, and the time-saving benefits it offers. The ability to make payments anytime, from any location, has been particularly appreciated by busy professionals and those with limited mobility.

Furthermore, the real-time updates and instant payment confirmations have significantly reduced the anxiety often associated with traditional tax payment methods. Property owners can now have greater control over their financial obligations, ensuring timely payments and avoiding potential penalties or late fees.

| Property Type | Average Payment Time |

|---|---|

| Residential | 5-10 minutes |

| Commercial | 10-15 minutes |

| Industrial | 15-20 minutes |

The table above provides an estimate of the average time taken to complete a property tax payment online, based on different property types. These estimates highlight the efficiency of the system and the minimal time commitment required by property owners.

Impact and Future Implications

The adoption of the Property Tax Online Payment system by the GHMC has had a profound impact on the region’s tax administration. It has not only streamlined the tax collection process but also encouraged greater compliance among property owners. The convenience and transparency offered by the digital platform have led to increased taxpayer satisfaction and a more positive perception of tax obligations.

Looking ahead, the GHMC plans to further enhance the system by incorporating additional features and integrating it with other municipal services. The goal is to create a comprehensive digital ecosystem where property owners can manage all their municipal-related tasks seamlessly. This includes potential integrations with other departments, such as the water supply and sanitation services, to provide a unified platform for all property-related matters.

Potential Future Integrations

- Water Bill Payments: Integrating the property tax payment system with water bill payments could offer a one-stop solution for property owners, simplifying the process of managing multiple municipal bills.

- Property Registration: Exploring the possibility of online property registration and transfer services within the existing platform could streamline property-related legal procedures.

- Citizen Feedback Mechanism: Implementing a feedback system within the platform would allow users to provide suggestions and report issues, enabling the GHMC to continuously improve its services based on real-time user feedback.

Conclusion: A Step Towards Digital Empowerment

The GHMC’s initiative to implement the Property Tax Online Payment system is a testament to its commitment to digital innovation and citizen-centric governance. By embracing technology, the corporation has not only simplified tax payments but also empowered property owners with greater control over their financial responsibilities. The positive impact of this digital transformation is evident in the increased efficiency, transparency, and user satisfaction it has brought to the tax payment process.

As the GHMC continues to refine and expand its digital services, the Property Tax Online Payment system serves as a foundation for further innovations. The future of municipal governance in Hyderabad looks promising, with a focus on enhancing citizen experiences and leveraging technology to create a more efficient and responsive urban environment.

How can I check my property tax assessment details before making the online payment?

+To verify your property tax assessment details, you can access the GHMC’s official website and navigate to the “Property Tax” section. Here, you’ll find an option to view or download your tax assessment details, including the assessment number, property type, and the calculated tax amount. This information will help you ensure accuracy before proceeding with the online payment.

Are there any penalties for late property tax payments, and how can I avoid them using the online system?

+Yes, late payment of property tax may incur penalties as per the GHMC’s regulations. To avoid penalties, it’s essential to stay updated with your tax obligations and make timely payments. The online payment system provides a convenient way to set reminders and receive notifications for upcoming tax due dates. Additionally, you can opt for auto-debit facilities with your preferred payment method to ensure timely payments without manual intervention.

Can I pay property tax online if my property is jointly owned, and how does the process differ?

+Absolutely! The online payment system accommodates joint property ownership. When making the payment, you’ll be prompted to enter the property details, including the assessment number and other relevant information. The system will guide you through the process, allowing you to input the details of all joint owners and make the payment accordingly. It’s essential to ensure that all joint owners’ details are accurate and up-to-date to avoid any discrepancies.