Tax Preparation Checklist Pdf

As the end of the financial year approaches, many individuals and businesses start preparing for their tax obligations. A well-organized tax preparation checklist can be a valuable tool to ensure a smooth and accurate process. This article aims to provide an expert-level guide, complete with a downloadable Tax Preparation Checklist PDF, to assist you in navigating the complex world of tax compliance.

The Importance of a Tax Preparation Checklist

Tax preparation can be a daunting task, especially for those who are not well-versed in financial matters. A comprehensive checklist serves as a roadmap, guiding individuals and businesses through the necessary steps to gather all relevant information and documents, calculate taxes accurately, and ensure timely submission. By following a structured checklist, you can avoid common mistakes, reduce the risk of audits, and save time and resources.

Understanding the Components of a Tax Preparation Checklist

A tax preparation checklist is more than just a list of tasks; it is a strategic tool that covers various aspects of tax compliance. Here’s a breakdown of the key components you should expect to find in a well-designed checklist:

Gathering Financial Documents

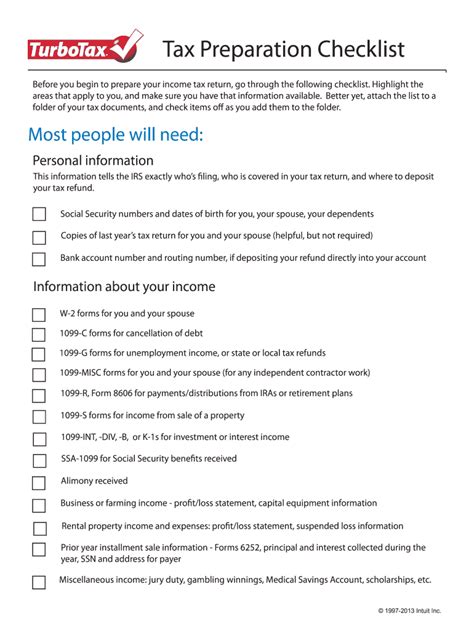

The foundation of any tax preparation process lies in collecting and organizing financial records. This section of the checklist should include a detailed list of all the documents you need to gather, such as:

- Income statements (e.g., W-2 forms, 1099 forms)

- Expenses records (e.g., receipts, invoices, bank statements)

- Investment documents (e.g., stock statements, dividend records)

- Property ownership or rental agreements

- Business-related records (for self-employed individuals or businesses)

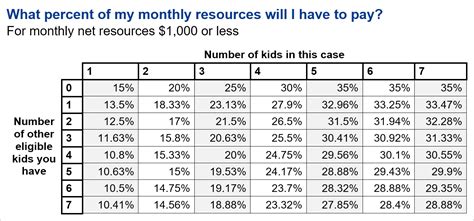

Calculating Income and Deductions

The next crucial step is to calculate your total income and identify any deductions or credits you may be eligible for. The checklist should guide you through this process, providing a clear understanding of the various income sources and potential deductions, including:

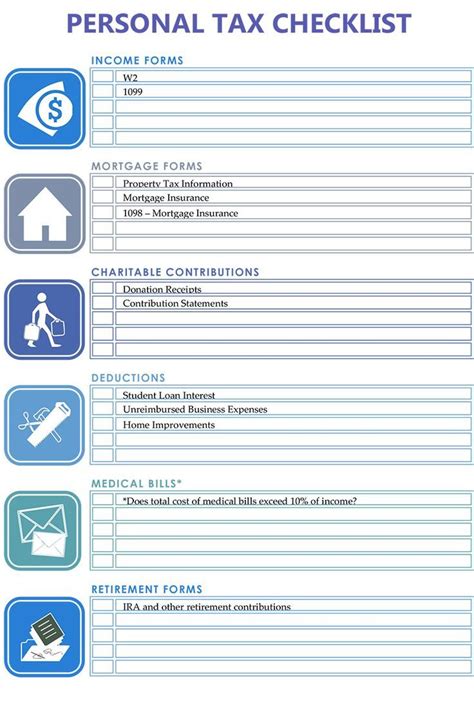

- Wages, salaries, and tips

- Interest and dividend income

- Business income and expenses

- Retirement plan contributions

- Education-related expenses

- Medical and dental expenses

Tax Form Preparation

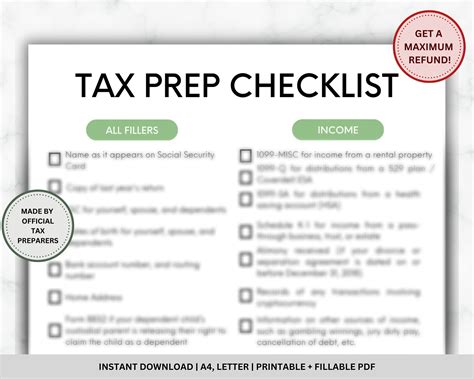

Once you have gathered all the necessary documents and calculated your income and deductions, it’s time to fill out the appropriate tax forms. The checklist should provide a step-by-step guide to completing these forms accurately, covering topics such as:

- Selecting the right tax form (e.g., 1040, 1040-ES, 1040-NR)

- Filling out personal information accurately

- Reporting income sources

- Claiming deductions and credits

- Calculating tax liability

Review and Submission

Before submitting your tax returns, a thorough review is essential to ensure accuracy and completeness. The checklist should encourage a meticulous examination of the following aspects:

- Double-checking calculations

- Verifying all personal and financial information

- Ensuring all required forms and schedules are included

- Preparing supporting documentation for potential audits

Download Your Tax Preparation Checklist PDF

To assist you in your tax preparation journey, we have created a comprehensive Tax Preparation Checklist PDF that covers all the essential steps and components discussed above. This checklist is designed to be user-friendly and adaptable to your specific tax situation. Download it now and get started on your tax preparation with confidence.

Click the link below to access the Tax Preparation Checklist PDF and take control of your tax obligations:

Download Tax Preparation Checklist PDF

Remember, staying organized and following a structured checklist can significantly simplify the tax preparation process. By utilizing this checklist, you can ensure a more efficient and accurate tax filing experience.

Tax Preparation Tips and Strategies

In addition to using a checklist, here are some valuable tips and strategies to enhance your tax preparation process:

Start Early

Tax preparation is not something you want to leave until the last minute. Begin gathering your financial documents and assessing your tax situation well in advance of the deadline. This gives you ample time to address any potential issues and seek professional advice if needed.

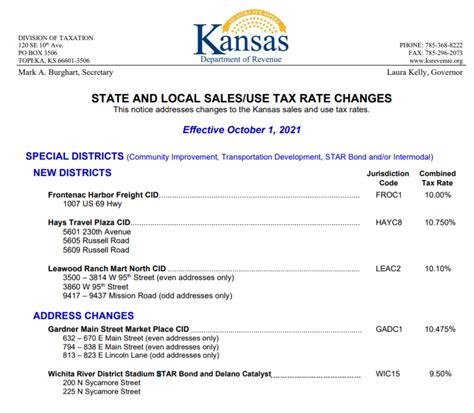

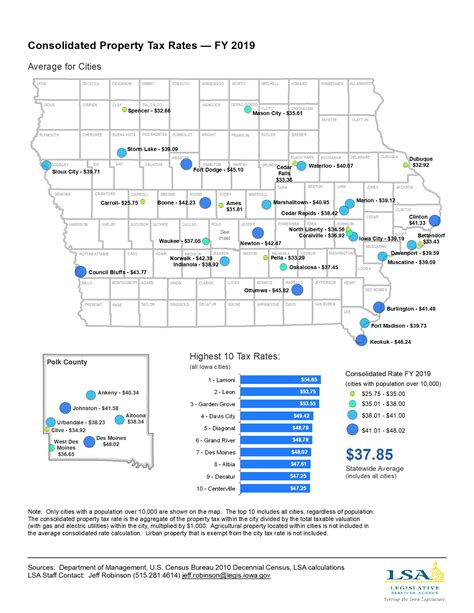

Stay Informed About Tax Laws

Tax laws and regulations can change from year to year. Stay updated on any new rules or changes that may impact your tax obligations. This ensures you are aware of any potential benefits or challenges and can plan accordingly.

Consider Professional Help

If you have a complex tax situation or simply prefer expert guidance, consider seeking the assistance of a certified tax professional. They can provide personalized advice, ensure accuracy, and help you maximize your tax benefits.

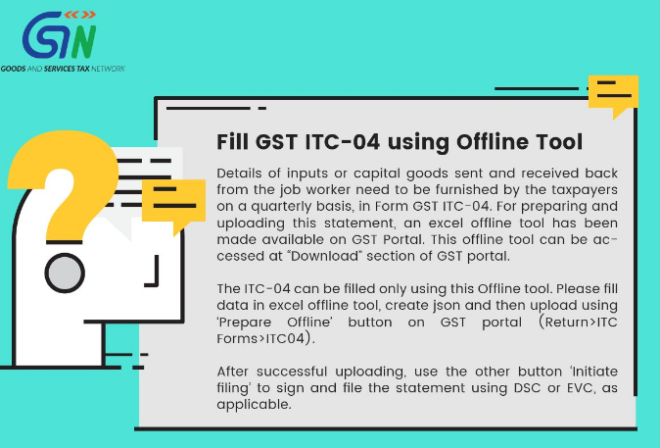

Utilize Tax Software

Tax preparation software can be a valuable tool, especially for those with simpler tax returns. These programs guide you through the process, help calculate deductions, and ensure accurate filing. However, always double-check the calculations and review the final return before submission.

Future Implications and Tax Planning

Tax preparation is not just about the current financial year. It is an opportunity to assess your financial situation and plan for the future. By analyzing your tax obligations and outcomes, you can make informed decisions to optimize your tax strategy moving forward.

Consider the following future-oriented tax planning strategies:

- Reviewing investment strategies to minimize tax liabilities

- Exploring retirement plan options and their tax benefits

- Optimizing business expenses to maximize deductions

- Planning for potential life changes (e.g., marriage, homeownership) and their tax implications

By incorporating tax planning into your financial strategy, you can not only ensure compliance but also work towards financial goals and optimize your overall financial well-being.

FAQs

What is the best time to start tax preparation?

+

It is advisable to start tax preparation as early as possible, ideally several months before the tax deadline. This allows ample time for gathering documents, calculating deductions, and seeking professional advice if needed.

Can I use tax preparation software for complex tax situations?

+

Tax preparation software can be a great tool for simpler tax returns, but complex situations may require professional assistance. It’s important to assess your needs and consider seeking advice from a certified tax professional.

How can I stay updated on tax law changes?

+

Staying informed about tax law changes is crucial. You can subscribe to tax newsletters, follow reputable tax websites, and consult with tax professionals or financial advisors to ensure you are aware of any updates that may impact your tax obligations.

What happens if I miss the tax filing deadline?

+

Missing the tax filing deadline can result in penalties and interest charges. It’s important to file your tax return as soon as possible to minimize any potential penalties. If you cannot file on time, consider requesting an extension to buy yourself some time.

Can I claim deductions for personal expenses related to my job?

+

Some personal expenses related to your job may be deductible, such as work-related travel or professional development costs. However, it’s crucial to understand the specific rules and regulations regarding deductibility. Consult with a tax professional to ensure you are claiming eligible deductions accurately.