Child Support Taxes: Building a Financial Bridge for Families

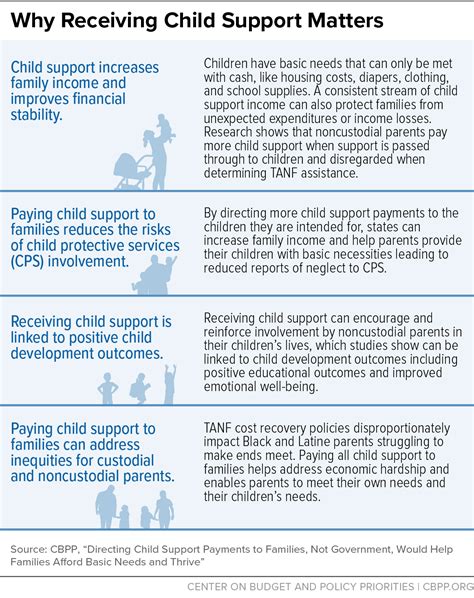

In the intricate ecosystem of household economics, child support taxes emerge as a pivotal instrument, functioning as a financial bridge that sustains families navigating the complex terrains of parenting and economic stability. At their core, these policies symbolize more than revenue mechanisms; they embody societal commitments to familial cohesion, child welfare, and economic justice. The broad philosophical principles underlying child support taxes revolve around notions of equity, redistribution, and social responsibility—concepts that have evolved within legal, economic, and ethical frameworks over centuries. These principles serve as foundational pillars that inform contemporary debates, policy designs, and practical implementations aimed at constructing sustainable financial infrastructures for families.

Understanding Child Support Taxes within the Broader Socioeconomic Framework

Before delving into the specifics of how child support taxes function as building blocks for family stability, it is essential to contextualize their role in the grander landscape of social welfare and economic policy. Historically, societal disruptions—be they due to war, economic upheaval, or demographic shifts—have driven the evolution of mechanisms through which states support vulnerable populations, including children. Child support systems have grown increasingly sophisticated, evolving from informal community arrangements to formalized legal regimes supported by tax policies. These policies aim to balance the interests of custodial and non-custodial parents, ensure the child’s rights, and maintain the economic fabric that sustains familial units.

Theoretical Foundations of Child Support Tax Policies

Broadly, child support taxes operate under the principles of fiscal redistributive justice, wherein tax revenues are utilized to offset disparities in family income, support child welfare, and promote societal equity. The philosophical underpinning can be traced back to social contract theories that emphasize collective responsibility for individual and familial well-being. Moreover, the concept of the ‘economic bridge’ embodies a pragmatic application of these philosophies, facilitating the transfer of resources across generational and social boundaries.

From Moral Philosophy to Policy Design

Fundamentally, moral philosophers like John Rawls have argued for arrangements that promote justice as fairness, which in the context of child support taxes, translates into policy measures that prevent child poverty and reduce inequalities. These principles manifest in progressive tax structures, income deductions, and targeted credits designed explicitly to enhance child welfare outcomes. The integration of moral philosophy into policy underscores the societal consensus that investing in children through effective tax policies is an investment in a just and resilient society.

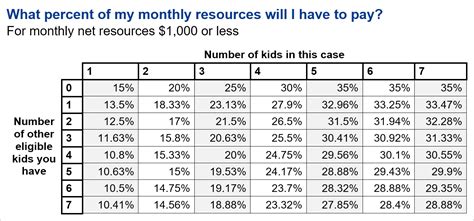

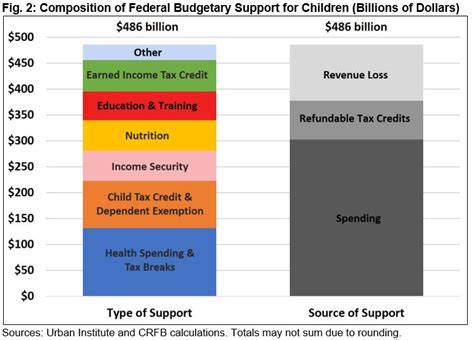

Specific Mechanisms and Tax Policies Supporting Child Welfare

The operationalization of child support as a financial bridge involves multiple tax-related instruments, each tailored to specific socioeconomic contexts. These include child-specific tax credits, deductions for custodial parents, and targeted subsidy programs. Their effectiveness hinges on carefully calibrated policies that respond to demographic trends, economic fluctuations, and administrative practicalities.

Child Tax Credits and Their Role in Financial Stability

Child tax credits serve as a cornerstone in this ecosystem, providing direct financial support to families. For instance, in the United States, the Child Tax Credit (CTC) can reduce the tax liability for eligible families by up to $2,000 per child, with provisions for refundable credits that can significantly impact low-income households. Similarly, other countries like the United Kingdom and Canada have implemented comparable programs, emphasizing the universal acknowledgment of child support taxes as vital for reducing child poverty and fostering social mobility.

| Relevant Category | Substantive Data |

|---|---|

| Child Tax Credit (CTC) | Up to $2,000 per child; refundable for low-income families; increased during COVID-19 pandemic to aid economic recovery. |

Economic Impact and Policy Effectiveness

Empirical data substantiates the positive correlation between well-structured child support tax policies and reductions in poverty rates. For instance, OECD countries that harness targeted tax credits demonstrate a 10-15% decrease in child poverty levels, informing best practice benchmarks. Furthermore, these policies often generate multiplier effects—stimulating local economies through increased disposable income and reducing reliance on social safety nets.

Measurement and Evaluation Challenges

Yet, quantifying the precise impact of child support taxes requires sophisticated analytical models that account for variables like household composition, regional economic conditions, and the structural barriers faced by single-parent families. Longitudinal studies show that while immediate income support enhances child well-being, lasting effects depend on complementary policies like affordable housing, accessible healthcare, and quality education.

Implementation Challenges and Policy Innovations

Despite broad consensus, deploying effective child support tax systems faces hurdles—administrative complexity, fiscal sustainability, and political resistance among stakeholders. Innovative approaches include integrating digital tax systems to streamline claims, deploying targeted incentives for non-custodial parents to contribute, and experimenting with universal basic income-like schemes to provide a broader safety net.

Case Study: Nordic Countries’ Holistic Approach

Nordic nations exemplify integrated policy environments, where the confluence of generous child support taxes, parental leave policies, and early childhood education programs synergistically bolster family stability. Their comprehensive systems often outperform counterparts in reducing child poverty and promoting social equality, underscoring the importance of a multi-layered approach.

| Relevant Category | Substantive Data |

|---|---|

| Nordic Policy Model | Combined high tax revenue, family allowances, and universal services; results in less than 3% child poverty rate, among lowest worldwide. |

Legal and Ethical Dimensions of Child Support Taxation

Legal frameworks underpin these fiscal measures, requiring rigorous safeguarding of children’s rights, anti-discrimination statutes, and equitable enforcement mechanisms. Ethical considerations surface around privacy, the risk of stigmatization, and the balance between individual parental responsibilities and societal obligations.

Balancing Rights and Responsibilities

Legal debates often center on the extent to which taxes should incentivize parental contribution versus ensuring that the child’s welfare remains paramount. Ethical scholars argue that policies must transcend punitive or incentivized models, fostering a culture that views child support as a societal moral duty rather than merely a fiscal obligation.

Future Directions and Policy Recommendations

Looking forward, the landscape of child support taxes could benefit from technological innovations, data-driven policy refinement, and international cooperation. Embracing blockchain for transparent transactions, leveraging big data for targeted interventions, and harmonizing cross-border support arrangements are emergent trends that can propel these fiscal mechanisms into more effective, equitable realms.

Strategic Considerations for Stakeholders

Policymakers should prioritize stakeholder engagement—listening to parents, social workers, and advocacy groups—to design adaptable, culturally sensitive systems. Simultaneously, rigorous impact assessments and experimental pilot programs are invaluable for iterative improvement and shared learning.

Key Points

- Effective child support taxes serve as vital financial bridges, embodying societal commitments to child welfare and economic equity.

- Integrated policy approaches in Nordic countries exemplify how combining generous support with social infrastructure reduces child poverty.

- Technological innovations like blockchain and big data can optimize transparency, efficiency, and personalization of child support systems.

- Legal and ethical frameworks must safeguard rights, promote fairness, and foster societal trust in support mechanisms.

- Future policies should focus on adaptability, cross-sector collaboration, and data-driven refinements for maximal impact.

How do child support taxes impact low-income families?

+Child support taxes, particularly through credits and deductions, can significantly reduce financial burdens for low-income families, providing vital income support that improves child welfare and economic stability.

What are common challenges in implementing child support tax policies?

+Major challenges include administrative complexity, ensuring equitable enforcement, fiscal sustainability, and overcoming political resistance. Innovative digital solutions and stakeholder engagement are often necessary to address these issues.

Can child support taxes reduce child poverty universally?

+While they are a powerful tool, child support taxes alone cannot eliminate child poverty. Their effectiveness is maximized when integrated with comprehensive social infrastructure, healthcare, and education policies.