Sales Tax License Texas

Understanding the intricacies of sales tax compliance is crucial for businesses operating in Texas, a state known for its vibrant economy and diverse business landscape. The Sales Tax License in Texas is a key component for any business entity engaged in taxable sales, and obtaining it is a fundamental step towards legal compliance and financial stability.

The Importance of a Sales Tax License in Texas

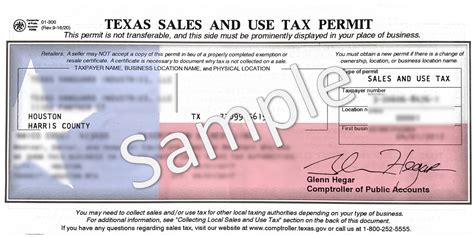

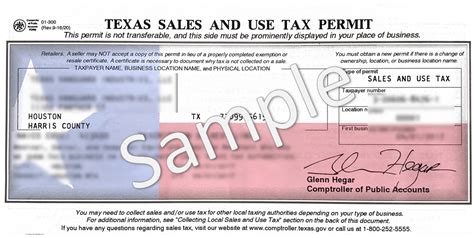

A Sales Tax License, officially known as a Sales and Use Tax Permit in Texas, is a legal document issued by the Texas Comptroller of Public Accounts. This permit authorizes businesses to collect and remit sales tax on behalf of the state. It is a critical aspect of tax compliance, ensuring that businesses fulfill their legal obligations and contribute to the state’s revenue.

For businesses, the Sales Tax License serves as a foundation for financial stability and growth. By legally collecting and remitting sales tax, businesses can avoid penalties, fines, and potential legal issues that could disrupt their operations. Moreover, a valid sales tax permit demonstrates a business's commitment to ethical practices and enhances its reputation among customers and stakeholders.

Who Needs a Sales Tax License in Texas

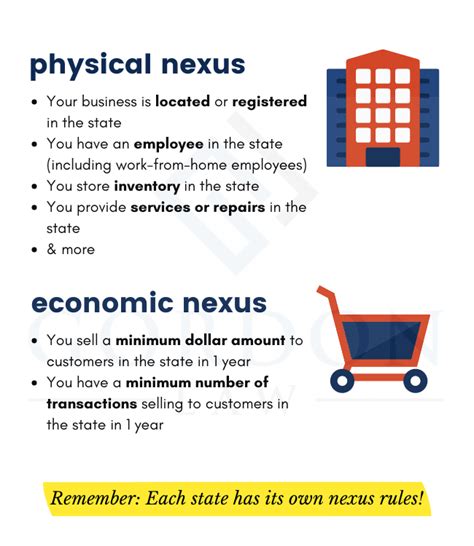

Any business that engages in taxable sales within Texas is generally required to obtain a Sales Tax License. This includes, but is not limited to, retailers, wholesalers, manufacturers, and service providers. Even if a business is primarily e-commerce-based, if it has a physical presence or significant economic nexus in Texas, it may be subject to sales tax obligations.

It's important to note that the requirement for a Sales Tax License applies not only to traditional brick-and-mortar stores but also to online platforms and remote sellers. With the increasing popularity of e-commerce, the Texas Comptroller's office has implemented measures to ensure that all businesses with substantial sales in the state comply with sales tax regulations.

| Business Type | Sales Tax License Requirement |

|---|---|

| Retail Stores | Mandatory |

| Online Retailers | Based on Economic Nexus |

| Wholesalers | Required for Taxable Sales |

| Manufacturers | Necessary for Sales to Consumers |

| Service Providers | Depends on Service Type and Location |

The Application Process: A Step-by-Step Guide

Obtaining a Sales Tax License in Texas is a straightforward process, although it requires careful attention to detail. Here’s a comprehensive guide to help businesses navigate the application journey smoothly.

Step 1: Determine Eligibility

The first step is to understand whether your business is eligible for a Sales Tax License. This primarily depends on the nature of your business activities and your connection to the state of Texas. If your business sells taxable goods or services within the state, you likely need a permit. However, certain businesses, such as those providing professional services, may be exempt.

Step 2: Gather Necessary Documents

To apply for a Sales Tax License, you’ll need to provide specific documentation. This typically includes:

- A valid government-issued ID (e.g., driver’s license, passport)

- Proof of business registration or formation documents

- Taxpayer identification number (TIN) or employer identification number (EIN)

- Business bank account information

- Detailed description of your business activities and products/services offered

Step 3: Complete the Application Form

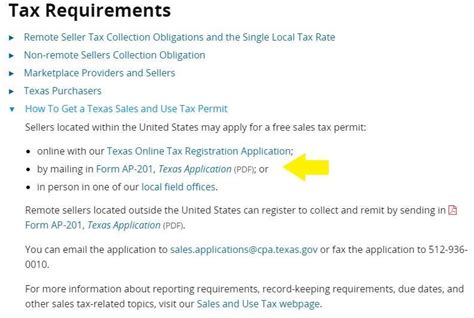

The application form for a Sales Tax License in Texas is available online through the Texas Comptroller’s website. It’s crucial to fill out the form accurately and completely. Provide all the required information, including your business details, sales tax estimates, and the expected start date of your taxable sales activities.

Step 4: Submit the Application

Once you’ve completed the application form, submit it through the online portal. You may also have the option to print and mail the form, along with any supporting documents, to the Texas Comptroller’s office. Ensure that all information is correct and that you meet the submission deadline.

Step 5: Await Approval and Receive Your Permit

After submitting your application, the Texas Comptroller’s office will review it. The processing time can vary, but typically, you can expect a response within a few weeks. If your application is approved, you will receive your Sales Tax License, which will include your unique permit number and other important details.

Navigating the Legal Landscape: Sales Tax Laws in Texas

Texas has a comprehensive set of sales tax laws and regulations that businesses must adhere to. Understanding these laws is crucial for maintaining compliance and avoiding legal issues.

Sales Tax Rates

The sales tax rate in Texas varies depending on the location of the sale. The state sales tax rate is currently set at 6.25%, but local jurisdictions can impose additional taxes, resulting in a combined rate that can exceed 8%. It’s essential for businesses to be aware of the specific rates applicable to their locations.

Taxable and Exempt Sales

Not all sales are taxable in Texas. Certain goods and services are exempt from sales tax, such as most groceries, prescription drugs, and some agricultural products. It’s crucial for businesses to understand which items are taxable and which are exempt to avoid overcharging customers or underpaying the state.

Reporting and Remittance

Businesses with a Sales Tax License in Texas are required to file sales tax returns and remit the collected tax to the state. The frequency of filing and remittance depends on the business’s sales volume. Generally, businesses with higher sales must file more frequently. Late filing or non-payment of sales tax can result in penalties and interest charges.

Compliance and Best Practices

Maintaining compliance with sales tax laws is not only a legal obligation but also a strategic advantage for businesses. Here are some best practices to ensure compliance and optimize your sales tax management.

Accurate Record-Keeping

Maintaining detailed and accurate records of all sales transactions is crucial. This includes keeping track of the date, location, and nature of each sale, as well as the applicable tax rate. Proper record-keeping simplifies the process of filing sales tax returns and helps businesses identify potential areas of non-compliance.

Regular Sales Tax Training

Staying updated with the latest sales tax laws and regulations is essential. Provide regular training to your staff, especially those involved in sales and accounting, to ensure they understand the importance of sales tax compliance and their roles in maintaining it.

Utilize Sales Tax Software

Investing in sales tax software can significantly streamline the process of collecting, calculating, and remitting sales tax. These tools can automate many of the tasks associated with sales tax management, reducing the risk of errors and ensuring timely compliance.

Seek Professional Guidance

Navigating the complex world of sales tax can be challenging, especially for businesses with complex structures or operations. Consider seeking advice from tax professionals or consultants who specialize in sales tax to ensure your business remains compliant and takes advantage of all available tax incentives.

FAQ

What happens if I don’t register for a Sales Tax License in Texas when I should have?

+Failing to register for a Sales Tax License when required can result in significant penalties and interest charges. The Texas Comptroller’s office may also assess back taxes, and in some cases, businesses may face criminal charges. It’s crucial to register as soon as you start making taxable sales in Texas to avoid these consequences.

Are there any sales tax holidays in Texas, and how do they affect businesses with a Sales Tax License?

+Texas does observe sales tax holidays, typically for back-to-school shopping and energy-efficient appliances. During these periods, certain items are exempt from sales tax. While this can be a boon for consumers, businesses with a Sales Tax License must ensure they are aware of these holidays and adjust their pricing and sales strategies accordingly.

How often do businesses need to file sales tax returns in Texas?

+The frequency of filing sales tax returns in Texas depends on the business’s sales volume. Businesses with higher sales typically need to file more frequently. The Texas Comptroller’s office provides a guide that outlines the filing frequencies based on sales volume. It’s important for businesses to understand their filing obligations to avoid late filing penalties.

Can I apply for a Sales Tax License online, or do I need to visit a government office?

+Businesses can apply for a Sales Tax License in Texas entirely online through the Texas Comptroller’s website. However, in some cases, especially for complex business structures or if additional information is required, the Comptroller’s office may request further documentation or an in-person visit. The online application process is generally straightforward and efficient.

Are there any tax incentives or exemptions available for businesses in Texas, and how do they relate to the Sales Tax License?

+Texas offers various tax incentives and exemptions to encourage business growth and investment. These can include sales tax exemptions for specific industries, research and development activities, or capital investments. However, to qualify for these incentives, businesses must meet certain criteria and maintain compliance with their Sales Tax License obligations. It’s advisable to consult with a tax professional to understand the eligibility criteria and benefits of these incentives.