Texas Tax Lien Sales

Texas, the second most populous state in the United States, has a unique system for handling tax-delinquent properties through tax lien sales. These sales, often referred to as "Tax Lien Auctions," are a critical mechanism for local governments to recoup unpaid property taxes and provide an intriguing investment opportunity for those familiar with the process.

Tax lien sales in Texas offer a fascinating insight into the intersection of finance and real estate, with a process that is both intricate and rewarding for those who navigate it successfully. This article will delve into the specifics of Texas tax lien sales, exploring the legal framework, the auction process, the rights and responsibilities of lien holders, and the potential returns and risks associated with this investment avenue.

Understanding Texas Tax Lien Sales

A tax lien is a legal claim against a property that arises when the property owner fails to pay their property taxes. In Texas, when a property owner becomes delinquent on their taxes, the county tax assessor-collector initiates the process of selling the tax lien on the property to recoup the unpaid taxes. This is where the concept of a tax lien sale comes into play.

The Texas Tax Code, particularly Chapter 32, governs the procedures and regulations for tax lien sales. It outlines the steps from the initial delinquency to the actual sale, including the notice requirements, the priority of liens, and the rights of redemption.

The Tax Lien Sale Process

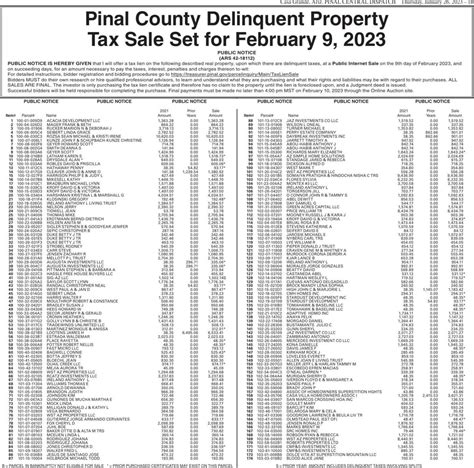

The tax lien sale process in Texas is a well-defined sequence of events. It begins with the property owner's failure to pay their property taxes by the delinquency date, typically set as January 31st of the year following the tax year.

After the delinquency date, the county tax assessor-collector initiates the tax lien process by sending a notice of delinquency to the property owner. This notice serves as a warning and provides information on the potential sale of the tax lien.

| Step | Description |

|---|---|

| 1. Notice of Delinquency | The county sends a notice to the property owner informing them of the delinquency and the potential for a tax lien sale. |

| 2. Publication of Sale | The county publishes a notice of the upcoming tax lien sale in a local newspaper and posts it on their website. This notice includes details such as the property's location, the amount owed, and the date of the sale. |

| 3. Tax Lien Sale | On the designated sale date, typically set by the county, the tax lien is offered for sale to the highest bidder. Bidders compete by offering to pay the delinquent taxes, plus interest and fees. |

| 4. Lien Redemption | After the sale, the property owner has a redemption period, typically two years, to pay off the lien holder and regain ownership. If the property owner redeems the lien, the lien holder receives their investment back with interest. |

| 5. Foreclosure | If the property owner fails to redeem the lien within the redemption period, the lien holder can initiate foreclosure proceedings to take ownership of the property. The lien holder then has the option to sell the property to recoup their investment and any additional costs incurred. |

It's important to note that the specific procedures and timelines can vary by county, so investors must familiarize themselves with the local rules and regulations.

Investor's Guide to Texas Tax Lien Sales

For investors, Texas tax lien sales present an intriguing opportunity to generate income with a potentially low risk. The process allows investors to purchase tax liens on properties, providing a secured investment with the possibility of substantial returns if the property owner fails to redeem the lien.

Rights and Responsibilities of Lien Holders

A lien holder in Texas tax lien sales has certain rights and responsibilities. They are entitled to receive the amount they invested, plus interest and penalties, if the property owner redeems the lien within the redemption period. If the property owner does not redeem, the lien holder has the right to initiate foreclosure proceedings and take ownership of the property.

However, lien holders also have specific responsibilities. They must ensure they are in compliance with the legal requirements, such as providing proper notices to the property owner and following the prescribed procedures. Lien holders should also be aware of the potential risks, including the possibility of the property owner redeeming the lien or facing legal challenges.

Potential Returns and Risks

Texas tax lien sales can offer attractive returns for investors. The interest rates on tax liens are typically set by the county and can be substantial, often ranging from 18% to 25% annually. This provides a stable and predictable income stream for investors.

However, there are also risks associated with tax lien investments. One of the primary risks is the potential for the property owner to redeem the lien, in which case the investor receives their initial investment plus interest, but no additional profits. Additionally, there is the risk of the property being unredeemed, which could lead to foreclosure and the potential for owning a property with unknown issues or liabilities.

Success Stories and Case Studies

To illustrate the potential of Texas tax lien sales, let's explore a couple of success stories.

Case Study 1: The Smith Family

The Smith family, seasoned investors in Texas tax lien sales, consistently achieves success through their strategic approach. They focus on researching properties in desirable neighborhoods, ensuring the potential for higher returns if the property is not redeemed. By understanding the local market and trends, they've been able to achieve an average annual return of 22% on their investments.

Case Study 2: John's Tax Lien Adventure

John, a first-time investor, approached tax lien sales with caution. He started with a small investment, thoroughly researching the process and local regulations. By bidding strategically and focusing on properties with low redemption rates, he was able to achieve a 28% return on his initial investment within the first year. John's success story highlights the potential for high returns with careful planning and a solid understanding of the market.

Future Outlook and Industry Insights

The future of Texas tax lien sales looks promising. As the population continues to grow and property values rise, the potential for delinquent taxes also increases, creating a steady stream of investment opportunities. Additionally, with the increasing popularity of online auction platforms, the process is becoming more accessible and transparent for investors.

Industry experts predict a shift towards more sophisticated investment strategies in the Texas tax lien market. Investors are expected to utilize advanced analytics and data-driven approaches to identify the most lucrative properties and optimize their returns. This shift towards a more tech-savvy approach will likely lead to increased competition but also greater efficiency in the market.

FAQs

How do I participate in Texas tax lien sales?

+

To participate, you must register with the county tax office. The registration process typically involves providing your contact information and agreeing to the terms and conditions of the sale. You’ll also need to familiarize yourself with the local rules and regulations, as each county may have slightly different procedures.

What happens if the property owner redeems the lien?

+

If the property owner redeems the lien within the redemption period, you, as the lien holder, will receive your initial investment plus interest and any penalties. The property owner regains ownership, and the lien is satisfied.

Can I foreclose on the property if the lien is not redeemed?

+

Yes, if the property owner fails to redeem the lien within the prescribed redemption period, you can initiate foreclosure proceedings. This process allows you to take ownership of the property and sell it to recoup your investment and any additional costs incurred.

Are there any tax implications for investors in tax lien sales?

+

Yes, investors in tax lien sales must consider the tax implications. The interest and penalties received from the property owner upon redemption are considered income and are subject to federal and state income taxes. It’s advisable to consult with a tax professional to understand the specific tax obligations.

What resources are available for new investors in Texas tax lien sales?

+

New investors can find a wealth of information online, including websites dedicated to tax lien investing. Additionally, many counties provide detailed guidelines and resources on their websites. It’s also beneficial to connect with experienced investors or attend workshops and seminars to gain a deeper understanding of the process.