Greenville Sc Property Tax

Welcome to an in-depth exploration of Greenville, South Carolina's property tax landscape. As a crucial component of the city's economic structure, property taxes play a significant role in shaping the local real estate market and the lives of Greenville residents. In this comprehensive guide, we'll delve into the intricacies of Greenville's property tax system, offering a detailed analysis of rates, assessments, exemptions, and more. Whether you're a homeowner, a prospective buyer, or simply curious about the financial aspects of life in Greenville, this article aims to provide you with the knowledge and insights you need to navigate the property tax scene with confidence.

Understanding Greenville’s Property Tax System

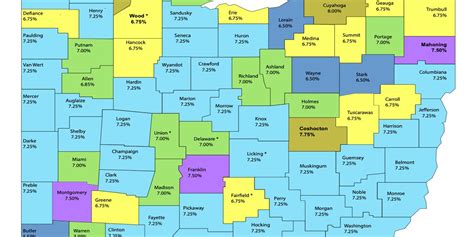

Greenville, known for its vibrant culture, thriving business environment, and picturesque scenery, boasts a unique property tax system that varies across different jurisdictions within the city. The city of Greenville itself, along with Greenville County, each have their own tax authorities responsible for setting tax rates and administering the property tax process. Additionally, special tax districts within the county may also levy taxes on specific properties.

At the core of Greenville's property tax system is the assessed value of a property, which serves as the basis for calculating the annual tax bill. This assessed value is determined by the Greenville County Assessor's Office, which conducts regular assessments to ensure property values remain up-to-date. The assessment process considers factors such as the property's location, size, improvements, and recent sales data to determine its fair market value.

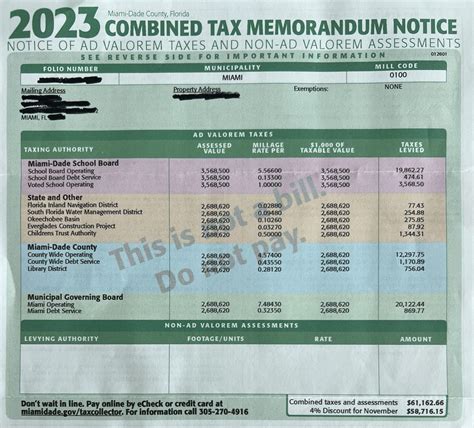

Once the assessed value is established, the applicable tax rate is applied to calculate the property tax liability. These tax rates are set by the various taxing authorities and are typically expressed as a millage rate, representing the amount of tax per $1,000 of assessed value. For instance, a millage rate of 100 mills equates to $10 in tax for every $1,000 of assessed value.

Tax Rate Breakdown

Greenville’s property tax rates can vary significantly depending on the specific jurisdiction and the purpose of the tax. Here’s a breakdown of the key tax rates in the city and county:

| Taxing Authority | Millage Rate |

|---|---|

| Greenville City | 63.2 mills (as of 2023) |

| Greenville County | 245.7 mills (as of 2023) |

| Greenville County School District | 117.8 mills (as of 2023) |

| Greenville County Special Districts | Varies by district |

It's important to note that these rates are subject to change annually, so it's advisable to consult the official sources for the most up-to-date information.

Property Tax Calculation

To calculate your property tax bill, you’ll need to know your property’s assessed value and the applicable tax rates. Here’s a simple formula to estimate your tax liability:

Property Tax = Assessed Value x (Sum of Applicable Millage Rates) / 1,000

Let's consider an example. If your property has an assessed value of $250,000 and is located within the city of Greenville, you can estimate your tax bill as follows:

Property Tax = $250,000 x (63.2 mills + 245.7 mills + 117.8 mills) / 1,000 = $12,500

This calculation provides a rough estimate, and the actual tax bill may vary based on additional factors and potential exemptions.

Exemptions and Relief Programs

Greenville offers a range of exemptions and relief programs designed to ease the property tax burden for eligible homeowners. These programs can significantly reduce the taxable value of a property, resulting in lower tax bills.

One notable exemption is the Homestead Exemption, which reduces the taxable value of a primary residence by a set amount. This exemption is available to homeowners who meet certain residency and income criteria. Additionally, Greenville County offers a Disabled Veterans Exemption, providing a full or partial exemption from property taxes for qualifying veterans.

Greenville also participates in the South Carolina Property Tax Relief Program, which provides state-funded relief to eligible low-income homeowners. This program can reduce the taxable value of a property, making it an essential resource for those struggling to afford their property taxes.

The Impact of Property Taxes on Greenville’s Real Estate Market

Property taxes play a pivotal role in shaping Greenville’s real estate landscape. They influence buying decisions, investment strategies, and the overall affordability of homes in the area. Understanding the impact of property taxes is essential for both buyers and investors.

Affordability and Homeownership

Greenville’s property tax rates can significantly impact the affordability of homes for prospective buyers. While the city and county offer a range of amenities and a thriving economy, high property taxes can make homeownership less attainable for some residents. This is particularly true for those on fixed incomes or with limited financial resources.

For example, a homeowner with a $250,000 home in Greenville City would pay approximately $12,500 in annual property taxes (based on the 2023 rates). This represents a substantial portion of the median household income in the area, potentially making homeownership a challenge for many.

Investment Opportunities

From an investment perspective, Greenville’s property tax structure can present both opportunities and challenges. Investors seeking rental properties may find that higher property taxes can eat into their potential profits. On the other hand, the city’s attractive amenities and strong economy can make it a desirable location for real estate investment, potentially offsetting the tax burden.

Furthermore, Greenville's participation in the South Carolina Property Tax Relief Program can make investment properties more affordable for low-income buyers or investors. This program can reduce the taxable value of investment properties, making them more accessible to a wider range of buyers.

The Role of Property Taxes in Community Development

Property taxes are a significant source of revenue for Greenville and its surrounding areas. This revenue is vital for funding essential public services, infrastructure development, and community initiatives. The tax dollars collected go towards maintaining roads, parks, schools, emergency services, and other public amenities that enhance the quality of life for residents.

For instance, the Greenville County School District, with its dedicated millage rate, ensures that property taxes contribute to providing quality education for local students. Similarly, the city's tax revenue supports initiatives such as downtown revitalization projects, arts and culture programs, and community development efforts.

Property Tax Appeals and Challenges

Property tax assessments are not without their complexities, and occasionally, homeowners may find themselves in disagreement with the assessed value of their property. In such cases, the property tax appeal process provides a mechanism for challenging the assessment and potentially reducing the tax liability.

The Appeal Process

The first step in the appeal process is to review the property’s assessed value and identify any discrepancies or errors. This can be done by obtaining a copy of the property’s assessment record from the Greenville County Assessor’s Office. Homeowners should carefully examine the assessment for accuracy, ensuring that the property’s characteristics, such as size, improvements, and condition, are correctly represented.

If discrepancies are found, the next step is to gather supporting evidence to strengthen the appeal. This may include recent sales data of similar properties, appraisals, or professional opinions of value. It's essential to present a strong case to increase the chances of a successful appeal.

Once the evidence is gathered, the homeowner can file an appeal with the Greenville County Board of Assessment Appeals. The board will review the appeal and make a determination based on the evidence presented. If the appeal is denied, homeowners have the option to appeal further to the Administrative Law Court.

Challenges and Considerations

It’s important to note that the property tax appeal process can be complex and time-consuming. Engaging the services of a professional appraiser or tax consultant can be beneficial, as they can provide expert guidance and increase the likelihood of a successful appeal.

Additionally, it's crucial to understand the potential consequences of a property tax appeal. While a successful appeal can result in a reduced tax bill, it may also lead to increased taxes in future years if the assessed value is adjusted upward. Homeowners should carefully weigh the benefits and risks before proceeding with an appeal.

Future Outlook and Potential Changes

As Greenville continues to thrive and evolve, its property tax landscape is likely to undergo changes and adjustments. The city and county authorities regularly review tax rates and assessments to ensure fairness and adequacy. Here are some potential developments and considerations for the future:

Tax Rate Adjustments

Greenville’s tax rates may be subject to periodic reviews and adjustments to account for changing economic conditions, inflation, and the need for public services. While it’s challenging to predict specific rate changes, homeowners should expect occasional adjustments to align with the city’s financial needs and goals.

Assessment Reforms

The assessment process is an essential component of the property tax system, and ongoing reforms can enhance its accuracy and fairness. Greenville County may explore new assessment methods, technology, or data sources to ensure that property values are assessed consistently and accurately. These reforms can lead to more equitable tax burdens across the community.

Exemption and Relief Program Updates

Greenville’s exemption and relief programs play a vital role in supporting homeowners, especially those with limited means. As the city and county continue to address affordability concerns, these programs may undergo updates and expansions to provide greater assistance to eligible residents. Keeping abreast of these changes is essential for homeowners to maximize their tax savings.

Community Engagement and Transparency

Maintaining open communication and transparency between the taxing authorities and the community is crucial for building trust and understanding. Greenville can benefit from increased public engagement and dialogue regarding property taxes, allowing residents to voice their concerns and provide input on tax-related matters. This collaborative approach can lead to more informed decision-making and a stronger sense of community involvement.

Conclusion

Greenville’s property tax system is a complex yet integral part of the city’s economic and community fabric. From understanding the assessment process and tax rates to exploring exemptions and relief programs, this guide has provided a comprehensive overview of Greenville’s property tax landscape. As Greenville continues to grow and evolve, staying informed about property taxes will remain essential for homeowners, buyers, and investors alike.

By navigating the property tax system with knowledge and expertise, residents and stakeholders can make informed decisions, advocate for their interests, and contribute to the vibrant and thriving community that Greenville is known for.

How often are property taxes assessed in Greenville, SC?

+Property taxes in Greenville, SC are typically assessed annually. The Greenville County Assessor’s Office conducts regular assessments to determine the fair market value of properties, which forms the basis for calculating property taxes.

Are there any tax breaks or exemptions available for homeowners in Greenville?

+Yes, Greenville offers various tax exemptions and relief programs. These include the Homestead Exemption for primary residences and the Disabled Veterans Exemption. Additionally, Greenville participates in the South Carolina Property Tax Relief Program, providing relief to eligible low-income homeowners.

How can I appeal my property tax assessment in Greenville?

+To appeal your property tax assessment, you’ll need to review your property’s assessed value and gather evidence of any discrepancies. You can then file an appeal with the Greenville County Board of Assessment Appeals. If your appeal is denied, you may further appeal to the Administrative Law Court.

What are the potential consequences of a successful property tax appeal in Greenville?

+A successful property tax appeal can result in a reduced tax bill for the current year. However, it’s important to note that future assessments may be adjusted upward, leading to higher taxes in subsequent years. Therefore, it’s crucial to carefully consider the potential long-term impact before pursuing an appeal.

How can I stay informed about changes to Greenville’s property tax system?

+To stay informed about changes to Greenville’s property tax system, you can regularly check the official websites of the city and county, as well as subscribe to their newsletters or follow their social media accounts. Additionally, attending public meetings or engaging in community forums can provide valuable insights into upcoming tax-related developments.