Vermont State Income Tax Refund

Vermont, nestled in the picturesque New England region of the United States, is renowned for its stunning landscapes, vibrant fall foliage, and a unique tax system that sets it apart from many other states. Among the various tax obligations, the Vermont state income tax is an essential aspect that residents and businesses operating within the state must navigate. While it can be a complex topic, understanding the process, especially when it comes to claiming a refund, is crucial for individuals and entities alike.

Understanding Vermont State Income Tax

The Vermont Department of Taxes is responsible for administering the state's income tax system, which is an essential revenue stream for the state's budget. The income tax is levied on individuals, trusts, estates, and businesses, with rates varying based on the type of income and the taxpayer's residency status.

Vermont employs a graduated income tax system, meaning that higher income levels are taxed at progressively higher rates. This structure aims to ensure a fair distribution of the tax burden among residents. The state's income tax rates are generally lower compared to some of its neighboring states, but the specific rates can change annually based on legislative decisions and economic factors.

For the fiscal year 2023, Vermont's income tax rates range from 3.55% to 8.75%, with the highest rate applying to taxable income over $500,000. These rates are applied to various types of income, including wages, salaries, interest, dividends, and capital gains. However, certain types of income, such as Social Security benefits, are exempt from state income tax in Vermont.

Vermont's Unique "Add-Back" System

One distinctive feature of Vermont's income tax system is its "add-back" provision, which is designed to prevent tax evasion and ensure fairness. This system requires taxpayers to add back certain deductions or credits claimed on their federal income tax returns when calculating their Vermont taxable income. This ensures that Vermont residents are taxed on a broader base of income, avoiding strategies that might otherwise reduce their state tax liability.

| Income Type | Vermont Tax Rate (2023) |

|---|---|

| Ordinary Income (up to $10,000) | 3.55% |

| Ordinary Income ($10,001 - $25,000) | 6.50% |

| Ordinary Income ($25,001 - $100,000) | 7.65% |

| Ordinary Income ($100,001 - $500,000) | 8.2% |

| Ordinary Income (over $500,000) | 8.75% |

The Process of Claiming a Vermont State Income Tax Refund

Claiming a refund for overpaid Vermont state income tax is a straightforward process, although it requires attention to detail and timely action. The first step is to ensure that you've overpaid your taxes, which can happen due to various reasons, including changes in income, deductions, or tax credits during the tax year.

Here's a step-by-step guide to claiming your Vermont state income tax refund:

Step 1: Gather Necessary Documentation

Before you begin the refund process, ensure you have the following documents readily available:

- Your latest Vermont state income tax return (Form VT-1040)

- W-2 forms from all employers for the tax year in question

- 1099 forms for any interest, dividends, or other income

- Receipts or documentation for any deductions or credits you're claiming

Step 2: Calculate Your Overpayment

Review your tax return and calculate the amount you overpaid. This can be done by comparing your total tax liability with the amount you've paid throughout the year, including any estimated tax payments or withholdings.

Step 3: File an Amended Return (if necessary)

If you realize that your original tax return contained errors or omissions that led to an overpayment, you'll need to file an amended return. In Vermont, this is done using Form VT-1040X, which is available on the Vermont Department of Taxes website. Ensure you follow the instructions carefully and provide all necessary supporting documentation.

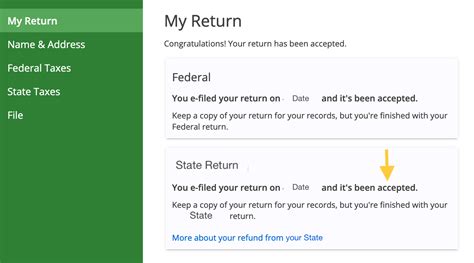

Step 4: Submit Your Refund Request

Once you've confirmed the overpayment and, if necessary, filed an amended return, you can submit your refund request. You can do this online through the Vermont Taxpayer Access Point (VT TAP) system, by mail, or in person at a Vermont Department of Taxes office.

Step 5: Track Your Refund Status

After submitting your refund request, you can track its status online using the VT TAP system. This platform provides real-time updates on the processing of your refund, allowing you to stay informed throughout the process.

Understanding Refund Processing Times

The time it takes for the Vermont Department of Taxes to process your refund can vary depending on several factors, including the complexity of your tax return, the volume of refund requests, and whether you filed your return on time.

Generally, if you file your return electronically and choose direct deposit as your refund method, you can expect to receive your refund within 4-6 weeks. However, if you filed a paper return or chose a refund by check, it may take longer, typically 8-12 weeks.

Factors Affecting Refund Processing Times

- Complexity of tax return: Returns with complex transactions, such as business income or significant deductions, may take longer to process.

- Volume of refund requests: During peak tax seasons, the department may experience a higher volume of refund requests, leading to potential delays.

- Filing status: Timely filing of your tax return is crucial. Late filings may result in delays or penalties.

Common Issues and Solutions

While the process of claiming a Vermont state income tax refund is generally straightforward, there are a few common issues that taxpayers may encounter. Understanding these issues and their potential solutions can help streamline the process and avoid unnecessary delays.

Issue 1: Incorrect Tax Calculations

One of the most common reasons for overpayment is incorrect tax calculations. This can happen due to errors in reporting income, deductions, or credits. To avoid this, ensure you have accurate records and double-check your calculations before filing your tax return.

Solution: Review and Verify Your Tax Return

Before submitting your tax return, take the time to thoroughly review it. Ensure that all income, deductions, and credits are accurately reported and calculated. If you're unsure about any aspect of your return, consider seeking professional advice from a tax preparer or accountant.

Issue 2: Delayed or Missing Refund Checks

In some cases, taxpayers may experience delays in receiving their refund checks or may not receive them at all. This can be due to various reasons, including mailing address changes, incorrect bank account information, or errors in the refund processing system.

Solution: Contact the Vermont Department of Taxes

If you haven't received your refund check within the expected timeframe, or if you believe there's an error with your refund, contact the Vermont Department of Taxes immediately. You can reach them by phone or email, and they'll be able to provide you with an update on your refund status and assist with any necessary corrections.

Maximizing Your Vermont State Income Tax Refund

While claiming a refund for overpaid taxes is essential, it's equally important to ensure you're taking advantage of all available deductions and credits to minimize your tax liability in the first place.

Deductions and Credits to Consider

- Vermont Property Tax Refund: Residents who own their homes may be eligible for a property tax refund, which can significantly reduce their state income tax liability.

- Vermont Earned Income Tax Credit (EITC): This credit is designed to benefit low- to moderate-income working individuals and families, providing a refund or reducing their tax liability.

- Education Credits: Vermont offers several education credits, including the Vermont Tuition and Fees Deduction and the American Opportunity Credit, which can help offset the cost of higher education.

Maximizing Deductions and Credits

To maximize your deductions and credits, ensure you understand the eligibility criteria and requirements for each. Keep detailed records of your expenses and income throughout the year to facilitate accurate reporting on your tax return. If you're unsure about your eligibility for certain deductions or credits, consult a tax professional for guidance.

Future Implications and Tax Planning

Understanding the process of claiming a Vermont state income tax refund is not only beneficial for recovering overpaid taxes but also for effective tax planning moving forward. By analyzing your past tax returns and refund claims, you can identify areas where you might be overpaying and take steps to adjust your tax strategy accordingly.

Key Takeaways for Future Tax Planning

- Review your tax returns annually to identify potential areas for improvement.

- Stay informed about changes in Vermont's tax laws and regulations.

- Consider working with a tax professional to optimize your tax strategy and ensure compliance.

Conclusion

The process of claiming a Vermont state income tax refund may seem daunting, especially for those unfamiliar with the state's unique tax system. However, by understanding the steps involved, keeping accurate records, and staying informed about tax laws, you can navigate the process with confidence. Remember, effective tax planning is an ongoing process, and seeking professional advice when needed can help ensure you're making the most of your financial situation.

Frequently Asked Questions

What is the Vermont state income tax rate for 2023?

+

For the fiscal year 2023, Vermont’s income tax rates range from 3.55% to 8.75%, with the highest rate applying to taxable income over $500,000. These rates are applied to various types of income, including wages, salaries, interest, dividends, and capital gains.

How long does it typically take to receive a Vermont state income tax refund?

+

Generally, if you file your return electronically and choose direct deposit, you can expect to receive your refund within 4-6 weeks. For paper returns or refund by check, it may take 8-12 weeks.

What are some common reasons for overpayment of Vermont state income tax?

+

Common reasons for overpayment include errors in reporting income, deductions, or credits; changes in income or deductions during the tax year; and not taking advantage of available deductions or credits.

How can I track the status of my Vermont state income tax refund?

+

You can track your refund status online using the Vermont Taxpayer Access Point (VT TAP) system. This platform provides real-time updates on the processing of your refund.

What should I do if I haven’t received my Vermont state income tax refund within the expected timeframe?

+

If you haven’t received your refund within the expected timeframe, contact the Vermont Department of Taxes immediately. They can provide you with an update on your refund status and assist with any necessary corrections.