Md Sales Tax

The state of Maryland, often referred to as MD, has a comprehensive sales and use tax system in place to generate revenue for the state and local governments. This tax is an essential component of Maryland's economy, impacting businesses and consumers alike. Understanding the intricacies of Maryland's sales tax is crucial for both residents and businesses operating within the state, as it affects pricing, tax compliance, and overall financial planning.

Overview of Maryland’s Sales Tax Structure

Maryland’s sales tax is a state-level tax, but it is also supplemented by local taxes, resulting in varying tax rates across different counties and jurisdictions within the state. The state sales tax rate is 6%, which is applicable across most goods and services. However, it’s important to note that specific items, such as certain groceries, prescription drugs, and non-prepared foods, are exempt from this tax.

In addition to the state tax, local jurisdictions can levy their own taxes, typically ranging from 1% to 3%. These local tax rates are added to the state tax rate, resulting in a combined sales tax that can vary significantly depending on the location of the purchase. For instance, while the city of Baltimore has a local tax rate of 7%, Montgomery County has a local tax rate of 2%, leading to a combined sales tax of 8% and 7%, respectively.

Maryland's sales tax system also includes provisions for special tax districts, which are specific geographic areas within the state that may have additional taxes or tax exemptions. These districts are established to support specific initiatives or projects, such as transportation improvements or economic development.

| Sales Tax Type | Tax Rate |

|---|---|

| State Sales Tax | 6% |

| Average Local Tax | 1% - 3% |

| Baltimore City Local Tax | 7% |

| Montgomery County Local Tax | 2% |

Exemptions and Special Considerations

Maryland’s sales tax system includes a range of exemptions and special considerations. As mentioned earlier, certain groceries, prescription drugs, and non-prepared foods are exempt from sales tax. Additionally, there are exemptions for specific industries, such as manufacturing and agriculture, as well as for certain purchases made by non-profit organizations and government entities.

Furthermore, Maryland has a use tax that complements the sales tax. The use tax is applicable when goods or services are purchased from out-of-state vendors and used, stored, or consumed within Maryland. This tax ensures that all purchases, regardless of where they are made, contribute to the state's revenue.

Compliance and Reporting for Businesses

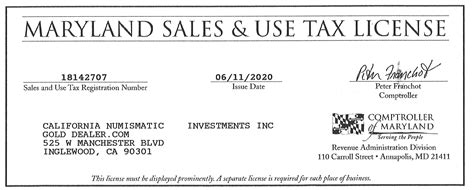

Businesses operating in Maryland are responsible for collecting, remitting, and reporting sales tax to the Maryland Comptroller of Maryland. This process involves registering for a sales and use tax permit, which allows businesses to legally collect and remit sales tax. The permit application requires detailed information about the business, including its legal structure, location, and expected sales.

Once registered, businesses must collect sales tax from customers at the point of sale, ensuring that the appropriate tax rate, including both state and local components, is applied. The collected tax must then be remitted to the state on a regular basis, typically quarterly or monthly, depending on the business's tax liability. Along with the tax payment, businesses are required to file a sales and use tax return, providing detailed information about sales, exemptions, and tax calculations.

The Comptroller of Maryland provides resources and guidelines to assist businesses in understanding their sales tax obligations. These resources include detailed instructions, frequently asked questions, and even online seminars to help businesses navigate the complexities of sales tax compliance.

Registration and Permit Process

The registration process for a sales and use tax permit in Maryland is straightforward and can be completed online through the Maryland Business Express portal. This portal provides a user-friendly interface for businesses to register, manage their accounts, and access resources related to tax compliance.

Upon successful registration, businesses receive their permit, which includes a unique permit number and other relevant information. This permit authorizes the business to collect and remit sales tax, and it must be displayed prominently at the business location.

Impact on Consumers and Pricing Strategies

For consumers, understanding Maryland’s sales tax is essential for budgeting and financial planning. The varying tax rates across the state can significantly impact the total cost of purchases, especially for high-value items. Consumers should be aware of the sales tax rates in their specific jurisdictions to make informed purchasing decisions.

From a pricing perspective, businesses often include sales tax in the displayed price of goods and services. This practice, known as tax-inclusive pricing, simplifies the purchasing process for consumers, as they can see the total cost of an item upfront. However, it's important for businesses to clearly indicate the tax component to avoid any confusion or misunderstandings.

Online Sales and Remote Transactions

With the rise of e-commerce, Maryland has implemented regulations for online sales and remote transactions to ensure that sales tax is collected and remitted for these transactions as well. This includes sales made by out-of-state businesses to Maryland residents, ensuring that all purchases, regardless of their origin, contribute to the state’s revenue.

Online businesses are required to register for a sales tax permit in Maryland if they meet certain criteria, such as having a substantial nexus or connection with the state. This nexus can be established through various factors, including the number of transactions, the value of sales, or the presence of physical assets in the state.

Future Implications and Potential Changes

Maryland’s sales tax system is subject to ongoing review and potential changes, influenced by economic conditions, legislative decisions, and changing consumer behaviors. In recent years, there have been discussions and proposals to modify the sales tax structure, including the introduction of new tax categories or the revision of existing rates.

One potential area of change is the expansion of sales tax to certain services, which could broaden the tax base and increase revenue for the state. Additionally, with the increasing importance of e-commerce, there may be further developments in the regulations surrounding online sales and remote transactions to ensure fair tax collection.

Staying informed about any updates or proposed changes to Maryland's sales tax system is crucial for both businesses and consumers. This ensures compliance with the latest regulations and allows for effective financial planning and budgeting.

What is the sales tax rate in Maryland for specific items like clothing or electronics?

+

The sales tax rate for most goods, including clothing and electronics, is the combined state and local tax rate, which can vary depending on the location. The state sales tax rate is 6%, and local tax rates typically range from 1% to 3%. Therefore, the total sales tax rate for these items can range from 7% to 9% or more, depending on the specific county or jurisdiction.

Are there any special considerations for remote sellers doing business in Maryland?

+

Yes, remote sellers who have a substantial nexus with Maryland, such as through a certain number of transactions or sales value, are required to register for a sales tax permit and collect sales tax on their Maryland sales. This includes online retailers who ship goods to Maryland residents.

How often do businesses need to remit sales tax to the state?

+

The frequency of sales tax remittance depends on the business’s tax liability. Businesses with a high tax liability typically remit sales tax monthly, while those with a lower liability remit quarterly. However, businesses can request to change their remittance frequency based on their sales volume and tax obligations.