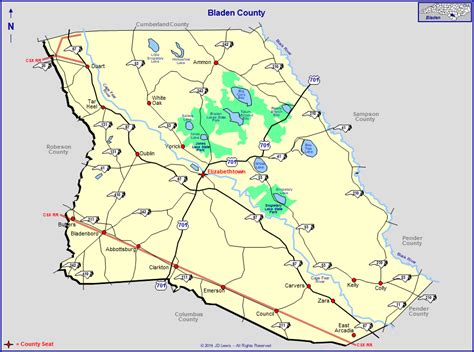

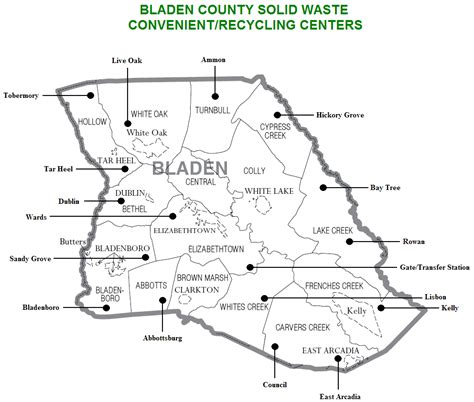

Bladen County Tax Office

The Bladen County Tax Office is an essential administrative body in North Carolina, responsible for assessing and collecting property taxes to fund various public services and infrastructure within the county. This article aims to provide an in-depth look at the operations, services, and impact of the Bladen County Tax Office, shedding light on its crucial role in the community's financial ecosystem.

Navigating the Complexities of Property Taxation

Property taxation is a cornerstone of local government finances, and the Bladen County Tax Office plays a pivotal role in ensuring that the process is fair, efficient, and transparent. The office is tasked with the intricate job of determining the taxable value of properties within the county, a process that involves assessing the market value of each property and applying the appropriate tax rates.

Assessment Methodology

The assessment process begins with a comprehensive analysis of each property’s characteristics, including its location, size, and features. The office employs a team of trained assessors who utilize advanced valuation techniques and tools to ensure accuracy. They take into account recent sales of similar properties, construction costs, and any improvements made to the property.

To maintain fairness, the Bladen County Tax Office adheres to a uniform assessment procedure, ensuring that similar properties are valued similarly. This uniformity is crucial to preventing disparities in tax burdens across the county.

Tax Rate Determination

Once the taxable value of a property is determined, the applicable tax rate is applied. This rate is set by the county commissioners and is based on the revenue needs of the county and its various municipalities. The tax rate includes components for funding schools, roads, public safety, and other essential services.

The Bladen County Tax Office ensures that taxpayers are aware of these rates and provides clear explanations of how their tax liabilities are calculated. This transparency fosters trust and understanding among taxpayers.

Data Management and Technology

The Bladen County Tax Office leverages modern technology to streamline its operations and enhance efficiency. They utilize advanced property information systems to store and manage data, ensuring accurate record-keeping and easy retrieval of property details.

| System Feature | Benefits |

|---|---|

| Online Property Search | Taxpayers can easily access property information and tax details online, enhancing convenience and transparency. |

| Digital Assessment Tools | Assessors can utilize digital tools for more accurate and efficient valuation, reducing potential errors. |

| Automated Data Updates | Regular data updates ensure that property records are up-to-date, minimizing the risk of obsolete information. |

Services Offered by the Bladen County Tax Office

Beyond property tax assessment and collection, the Bladen County Tax Office provides a range of services to assist taxpayers and ensure compliance with tax laws.

Tax Payment Options

Taxpayers have several convenient options for paying their property taxes. The office accepts payments online, through secure payment portals, which offer flexibility and round-the-clock accessibility. Additionally, taxpayers can pay in person at the tax office or via mail. The office also provides the option of setting up automatic payments, reducing the risk of late payments and associated penalties.

Tax Relief Programs

Recognizing the diverse financial situations of taxpayers, the Bladen County Tax Office administers several tax relief programs. These programs aim to assist seniors, disabled individuals, and low-income families by reducing their property tax burdens. The office ensures that eligible taxpayers are aware of these programs and provides guidance on the application process.

Appeals and Dispute Resolution

The Bladen County Tax Office understands that property owners may have concerns or disputes regarding their tax assessments. To address these, the office has a well-defined appeals process. Taxpayers can file an appeal if they believe their property has been overvalued or if they have concerns about their tax liability. The office provides clear guidelines and assistance throughout the appeals process, ensuring a fair and transparent resolution.

Property Tax Exemptions

Certain properties are eligible for tax exemptions, and the Bladen County Tax Office manages these exemptions. These can include exemptions for religious institutions, charitable organizations, and certain types of agricultural land. The office ensures that eligible properties are correctly identified and receive the appropriate exemptions.

Community Engagement and Outreach

The Bladen County Tax Office is committed to fostering a positive relationship with the community it serves. They actively engage with taxpayers through various outreach initiatives, aiming to improve understanding of the tax process and promote compliance.

Educational Workshops

The office organizes educational workshops and seminars to demystify the property tax process. These sessions cover topics such as understanding tax assessments, payment options, and available relief programs. By empowering taxpayers with knowledge, the office aims to reduce confusion and potential disputes.

Community Partnerships

The Bladen County Tax Office collaborates with local community organizations and businesses to enhance its outreach efforts. These partnerships enable the office to reach a wider audience and provide tailored assistance to specific community groups. For instance, they might work with senior centers to ensure that older adults understand their tax obligations and available relief programs.

Online Resources and Support

The office maintains a comprehensive website with a wealth of resources, including tax guides, frequently asked questions, and important dates. This online presence ensures that taxpayers have easy access to information and can quickly find answers to their queries. The website also features a live chat feature, allowing taxpayers to connect with office staff for immediate assistance.

Performance Analysis and Future Outlook

The Bladen County Tax Office consistently strives for excellence in its operations, aiming to improve efficiency, accuracy, and taxpayer satisfaction. Regular performance evaluations and audits ensure that the office meets its goals and maintains a high standard of service.

Key Performance Indicators

To measure its performance, the office tracks several key indicators, including:

- Accuracy of Assessments: The office aims for a high level of accuracy in property valuations, minimizing errors and ensuring fairness.

- Timeliness of Assessments: Assessments are completed within defined timelines, ensuring that taxpayers receive their tax bills on time.

- Tax Collection Rates: A high collection rate indicates effective tax administration and taxpayer compliance.

- Taxpayer Satisfaction: Regular surveys and feedback mechanisms help gauge taxpayer satisfaction with the office's services.

Future Initiatives

Looking ahead, the Bladen County Tax Office plans to continue its digital transformation journey, exploring new technologies to further enhance its services. This includes the potential integration of artificial intelligence for more efficient data analysis and the development of mobile apps for improved taxpayer engagement.

Additionally, the office aims to expand its community outreach programs, particularly in underserved areas, to ensure that all taxpayers have access to the resources and support they need. This proactive approach to community engagement will foster a stronger sense of trust and collaboration.

What is the role of the Bladen County Tax Office?

+

The Bladen County Tax Office is responsible for assessing and collecting property taxes within the county. It ensures fair valuation of properties, sets tax rates, and provides various services to assist taxpayers in understanding and complying with tax laws.

How does the tax assessment process work in Bladen County?

+

The tax assessment process involves a comprehensive analysis of each property’s characteristics, including its location, size, and features. Trained assessors utilize advanced valuation techniques to determine the taxable value, which is then used to calculate the tax liability.

What are some of the tax relief programs offered by the Bladen County Tax Office?

+

The office offers programs such as the Elderly and Disabled Tax Exemption, the Homestead Exemption, and the Agriculture and Forestland Exemption. These programs aim to reduce the tax burden for eligible taxpayers.

How can I pay my property taxes in Bladen County?

+

You can pay your property taxes online through the Bladen County Tax Office’s secure payment portal, in person at the tax office, via mail, or through automatic payments. The office provides various options to ensure convenience and flexibility for taxpayers.

What should I do if I have a dispute regarding my property tax assessment?

+

If you have concerns about your property tax assessment, you can file an appeal with the Bladen County Tax Office. They provide a well-defined appeals process and offer assistance to guide you through the steps.