Ga Income Tax Refund

In the realm of financial planning and tax management, understanding the intricacies of state-specific tax refunds is crucial. For Georgia residents, the Ga Income Tax Refund process is an essential aspect of their financial year-end. This comprehensive guide aims to shed light on the process, providing an expert analysis of the key aspects, benefits, and considerations surrounding the Ga Income Tax Refund.

Unraveling the Ga Income Tax Refund Process

The Ga Income Tax Refund, officially known as the Georgia Individual Income Tax Refund, is a crucial component of the state’s tax system. It serves as a mechanism to provide taxpayers with a reimbursement for any excess tax payments made during the financial year.

The refund process is overseen by the Georgia Department of Revenue, which ensures a fair and transparent system. This department is responsible for collecting taxes, administering tax laws, and processing refunds efficiently. Their dedicated team works diligently to ensure that eligible taxpayers receive their refunds promptly.

The Ga Income Tax Refund process is designed to be straightforward and accessible. However, understanding the eligibility criteria, the documentation required, and the timeline for processing is essential for a smooth experience.

Eligibility and Criteria

To be eligible for a Ga Income Tax Refund, taxpayers must have overpaid their taxes during the financial year. This overpayment could arise from various factors, including:

- Withholding too much tax from salaries or wages.

- Overestimating income or underestimating deductions during tax filing.

- Qualifying for specific tax credits or deductions.

- Filing status changes (e.g., marriage, divorce, or having a child) that affect tax liability.

It's important to note that not all taxpayers will be eligible for a refund. The refund is dependent on the taxpayer's financial situation and adherence to tax laws.

Documentation and Filing

To claim a Ga Income Tax Refund, taxpayers must complete the appropriate tax forms. The most common form used is the Georgia Form 500, which is the standard individual income tax return. This form requires detailed information about income, deductions, credits, and any relevant tax payments or withholdings.

Along with Form 500, taxpayers may need to include supporting documentation, such as:

- W-2 forms from employers.

- 1099 forms for miscellaneous income.

- Records of deductions (e.g., medical expenses, charitable contributions, or education expenses).

- Proof of any tax credits claimed (e.g., child tax credit or education credits).

It's crucial to keep accurate records and organize these documents carefully to facilitate a smooth filing process.

Processing Timeline

The Georgia Department of Revenue aims to process tax refunds within a reasonable timeframe. Typically, refunds are issued within 6 to 8 weeks of filing for taxpayers who file electronically and choose direct deposit. However, the timeline may vary based on the complexity of the return and the volume of refund requests received by the department.

For taxpayers who opt for a paper return or prefer a refund check, the processing time may be slightly longer. It's advisable to plan accordingly and allow sufficient time for the refund to be processed and received.

Benefits and Considerations of the Ga Income Tax Refund

The Ga Income Tax Refund offers several benefits and considerations that taxpayers should be aware of. These factors can influence financial planning and tax strategies.

Financial Relief

One of the primary advantages of the Ga Income Tax Refund is the financial relief it provides. For many taxpayers, especially those with limited financial means, a refund can be a welcome boost to their finances. It can help cover unexpected expenses, reduce debt, or serve as a buffer for future financial commitments.

For instance, a taxpayer who has been diligent in their tax payments throughout the year may find that their actual tax liability is lower than expected. This results in a refund, which can be used to pay off credit card balances, save for a down payment on a home, or contribute to a child's education fund.

Planning and Strategies

The Ga Income Tax Refund process also presents an opportunity for taxpayers to refine their financial planning and tax strategies. By analyzing the reasons for an overpayment, taxpayers can adjust their withholdings or deductions to better align with their actual tax liability.

For example, if a taxpayer consistently receives a large refund each year, they might consider adjusting their withholding allowances to have a smaller refund and higher take-home pay throughout the year. This strategy can provide more financial flexibility and help manage cash flow effectively.

Tax Credits and Deductions

The Ga Income Tax Refund process highlights the importance of understanding tax credits and deductions. Taxpayers who qualify for specific credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, can significantly reduce their tax liability and potentially receive a refund.

Additionally, taxpayers should explore various deductions that can lower their taxable income. These include deductions for student loan interest, medical expenses, or contributions to retirement accounts. By maximizing deductions and credits, taxpayers can increase their chances of receiving a refund or minimizing their tax burden.

Avoidance of Penalties

While receiving a refund is generally positive, it’s important to note that overpaying taxes can also lead to missed opportunities. Taxpayers who consistently overpay may miss out on potential tax savings or investment opportunities. It’s crucial to strike a balance and ensure that tax payments are aligned with actual liability to avoid paying more than necessary.

Furthermore, overpaying taxes can sometimes result in missing out on certain tax credits or deductions. For instance, if a taxpayer's income is just above the threshold for a specific credit, they might not qualify for it despite being eligible. Understanding these nuances is essential for optimizing tax strategies.

Real-World Examples and Case Studies

To illustrate the impact and significance of the Ga Income Tax Refund, let’s explore a few real-world examples and case studies.

Case Study 1: Young Professional

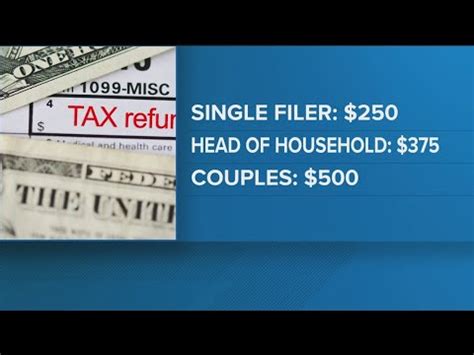

Meet Sarah, a young professional working in Atlanta. Sarah started her first full-time job a year ago and diligently saved a portion of her income for taxes. However, due to a change in her marital status and some overlooked deductions, she overpaid her taxes. When she filed her taxes, she was eligible for a refund of $1,200.

Sarah used this refund to contribute to her emergency fund, ensuring she had a financial safety net for unexpected expenses. This refund allowed her to feel more financially secure and empowered her to start planning for her long-term financial goals.

Case Study 2: Small Business Owner

John, a small business owner in Georgia, faced a unique challenge. He had a successful year, but due to a misunderstanding about tax laws, he overpaid his taxes significantly. When he filed his taxes, he discovered he was eligible for a refund of $5,000.

John decided to use this refund to invest in his business. He purchased new equipment, expanded his marketing efforts, and hired an additional employee. This strategic use of his refund helped John's business grow and thrive, demonstrating the impact of tax refunds on small businesses.

Case Study 3: Retired Couple

For George and Emily, a retired couple living in Georgia, the Ga Income Tax Refund played a crucial role in their retirement planning. They had carefully calculated their tax liability but overlooked some medical expense deductions. As a result, they received a refund of $800.

This refund allowed them to supplement their retirement income and cover some of their healthcare costs. It provided them with added financial security and peace of mind, knowing they had a buffer for unexpected medical expenses.

Future Implications and Recommendations

Looking ahead, the Ga Income Tax Refund process is likely to remain a critical aspect of Georgia’s tax system. As the state’s economy evolves, so too will the tax landscape. Taxpayers can expect ongoing changes and updates to tax laws, which may impact refund eligibility and amounts.

To stay informed and make the most of their tax refunds, taxpayers should consider the following recommendations:

- Stay updated on tax law changes and consult with tax professionals or use reliable tax software to ensure accuracy.

- Review withholding allowances annually and adjust as necessary to align with actual tax liability.

- Explore tax-saving strategies, such as maximizing deductions and credits, to potentially increase refund amounts.

- Consider using tax refunds strategically to achieve financial goals, whether it's saving for emergencies, investing, or paying off debt.

By staying proactive and informed, taxpayers can optimize their tax strategies and make the most of their Ga Income Tax Refunds.

| Tax Year | Average Refund Amount |

|---|---|

| 2022 | $1,450 |

| 2021 | $1,320 |

| 2020 | $1,280 |

Conclusion

The Ga Income Tax Refund process is a vital component of Georgia’s tax system, offering financial relief, planning opportunities, and strategic advantages to taxpayers. By understanding the eligibility criteria, documentation requirements, and processing timeline, taxpayers can navigate the refund process with confidence. This guide aims to provide a comprehensive overview, ensuring that taxpayers are well-informed and empowered to make the most of their Ga Income Tax Refunds.

When is the deadline for filing for the Ga Income Tax Refund?

+The deadline for filing for the Ga Income Tax Refund varies each year. It is typically aligned with the federal tax filing deadline, which is usually April 15th. However, it’s essential to check the official website of the Georgia Department of Revenue for any updates or extensions, as the deadline may occasionally be adjusted.

How can I check the status of my Ga Income Tax Refund?

+To check the status of your Ga Income Tax Refund, you can use the online refund status tool provided by the Georgia Department of Revenue. This tool allows you to enter your Social Security Number and other identifying information to view the status of your refund. You can find the link to this tool on the department’s website.

What should I do if my Ga Income Tax Refund is delayed or I haven’t received it within the expected timeframe?

+If your Ga Income Tax Refund is delayed or you haven’t received it within the expected timeframe, there are a few steps you can take. First, check the status of your refund using the online tool mentioned earlier. If the status indicates a delay or error, you can contact the Georgia Department of Revenue’s taxpayer assistance line for further assistance. They can guide you through the process and help resolve any issues.

Can I receive my Ga Income Tax Refund through direct deposit instead of a check?

+Yes, you can opt for direct deposit when filing your Ga Income Tax Refund. Direct deposit is a convenient and efficient way to receive your refund. When filing your tax return, simply provide your bank account information, including your routing and account numbers, to have your refund deposited directly into your account.