Collin County Property Tax Lookup

Welcome to the comprehensive guide on the Collin County Property Tax Lookup system. As an expert in property taxation, I will delve into the intricacies of this process, offering a detailed and engaging analysis. Collin County, located in Texas, is renowned for its thriving communities and diverse property landscape. Understanding the property tax system is crucial for homeowners, investors, and anyone interested in the real estate market.

Unveiling the Collin County Property Tax Landscape

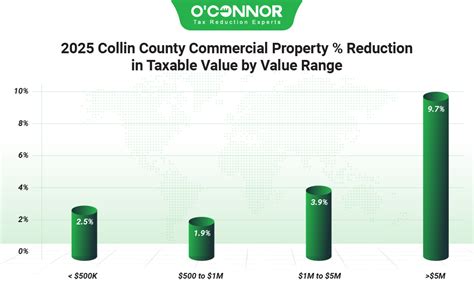

Collin County boasts a dynamic real estate market, with a wide range of residential, commercial, and industrial properties. The property tax system in this county plays a vital role in funding essential services, including schools, infrastructure, and public safety. Let’s explore the key aspects of the Collin County Property Tax Lookup process.

Understanding Property Tax Assessments

The foundation of the property tax system lies in accurate assessments. Collin County employs a team of professional assessors who evaluate each property based on its characteristics, such as size, location, improvements, and market value. These assessments determine the property’s taxable value, which serves as the basis for calculating property taxes.

To ensure fairness, the county conducts regular reassessments to keep up with market fluctuations and property improvements. This process involves analyzing recent sales data, comparable properties, and other relevant factors. Property owners can access their assessment information through the online Property Tax Lookup portal, offering transparency and ease of access.

| Assessment Type | Description |

|---|---|

| Market Value Assessment | The property's value is determined by recent sales and market trends. |

| Cost Approach Assessment | Estimates the cost to replace the property, considering depreciation. |

| Income Approach Assessment | Used for income-generating properties, calculating value based on potential income. |

Property Tax Rates and Calculations

Once the taxable value of a property is established, the county applies a tax rate to determine the property taxes owed. The tax rate is set annually by the Collin County Tax Assessor-Collector’s Office and is influenced by various factors, including the county’s budget, school district needs, and other governmental entities.

The tax rate is typically expressed as a percentage and is applied to the taxable value. For example, if the tax rate is set at 2%, and a property has a taxable value of 200,000, the property taxes would amount to 4,000. The tax rate can vary across different areas within the county, reflecting the specific needs and services provided.

Online Property Tax Lookup: A Convenient Tool

Collin County has implemented an innovative online Property Tax Lookup system, making it easier for property owners and interested parties to access vital information. This user-friendly platform offers a wealth of data, including:

- Property Details: Comprehensive information about the property, such as address, legal description, square footage, and improvements.

- Taxable Value: The assessed value of the property, used for tax calculation purposes.

- Tax Rate and Amount: Current and historical tax rates, along with the calculated tax amount for the property.

- Payment History: A record of tax payments made, including due dates and methods of payment.

- Exemptions and Deductions: Details on any applicable exemptions or deductions, such as homestead exemptions or senior citizen discounts.

The online Property Tax Lookup system also provides valuable tools for comparing properties within the county, allowing users to analyze tax rates and values across different neighborhoods and property types.

The Role of Property Tax Payments

Property taxes are a significant source of revenue for local governments and play a crucial role in funding public services. In Collin County, property owners are responsible for paying their taxes by the specified due dates to avoid penalties and interest charges.

The county offers convenient payment options, including online payments, in-person payments at designated locations, and even payment plans for eligible taxpayers. Property owners can also explore various tax relief programs, such as the homestead exemption, which provides a reduction in taxable value for primary residences.

Property Tax Appeals: Ensuring Fairness

In cases where property owners believe their assessment or tax amount is inaccurate, Collin County provides a fair and transparent appeals process. Property owners can file an appeal with the Appraisal Review Board (ARB), presenting evidence and arguments to support their case.

The ARB reviews each appeal independently and makes a determination based on the available information. If the appeal is successful, the taxable value or tax amount can be adjusted, resulting in potential savings for the property owner. Understanding the appeals process and gathering the necessary evidence is crucial for a successful outcome.

Future Outlook and Innovations

Collin County continues to enhance its property tax system, leveraging technology and data analytics to improve accuracy and efficiency. The county aims to streamline processes, enhance transparency, and provide even better services to its residents.

One notable initiative is the implementation of advanced GIS (Geographic Information System) technology, which integrates mapping and property data. This innovation allows for more precise assessments, easier property identification, and improved decision-making for both property owners and governmental entities.

FAQs

How often are property assessments conducted in Collin County?

+Property assessments in Collin County are conducted annually. The assessors review and update property values based on market trends and other relevant factors.

Can I contest my property’s assessed value if I disagree with it?

+Absolutely! Collin County provides a formal appeals process through the Appraisal Review Board. Property owners can present their case, along with supporting evidence, to request a review of their assessment.

Are there any tax relief programs available for senior citizens in Collin County?

+Yes, Collin County offers the Over-65 Homestead Exemption, which provides a reduction in taxable value for qualifying senior citizens. This exemption can significantly lower property tax burdens for eligible individuals.

How can I stay informed about changes in tax rates and due dates in the county?

+The best way to stay updated is to regularly visit the Collin County Tax Assessor-Collector’s Office website. They provide timely information on tax rates, due dates, and any changes or announcements related to property taxes.

In conclusion, the Collin County Property Tax Lookup system is a vital tool for understanding and managing property taxes. With its transparent assessments, convenient online access, and fair appeals process, the county ensures a balanced and efficient tax system. As the real estate market continues to evolve, staying informed about property taxes is essential for making informed decisions and contributing to the vibrant community of Collin County.