Michigan Tax Forms

Navigating the world of taxes can be a daunting task, especially when it comes to understanding and completing the necessary forms for your state. In the case of Michigan, the tax system and the forms required can vary depending on individual circumstances. This comprehensive guide aims to provide an in-depth analysis of Michigan tax forms, offering valuable insights and practical tips to help taxpayers navigate this complex process.

Understanding Michigan’s Tax Landscape

Michigan, like many other states, has its own set of tax laws and regulations. The Michigan Department of Treasury is responsible for administering and enforcing these tax policies, ensuring compliance and collecting revenue for the state. Understanding the state’s tax structure is crucial before diving into the specifics of tax forms.

Michigan's tax system consists of various taxes, including income tax, sales and use tax, property tax, and various other taxes such as the Michigan Business Tax (MBT) and the Single Business Tax (SBT), which have been replaced by the Corporate Income Tax (CIT) and the Pass-Through Entity Tax (PTET) respectively.

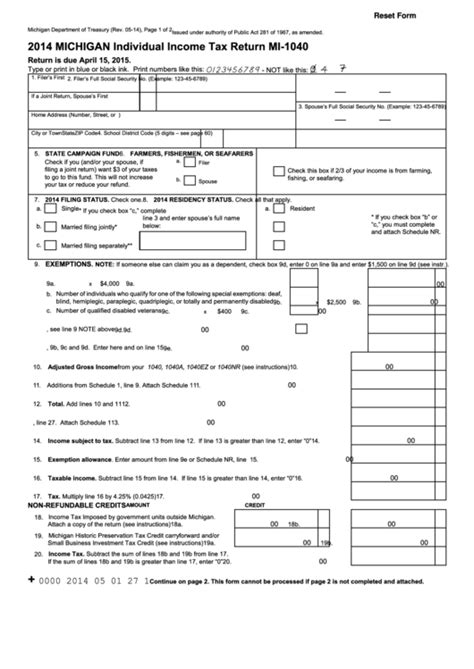

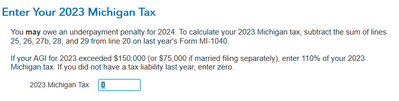

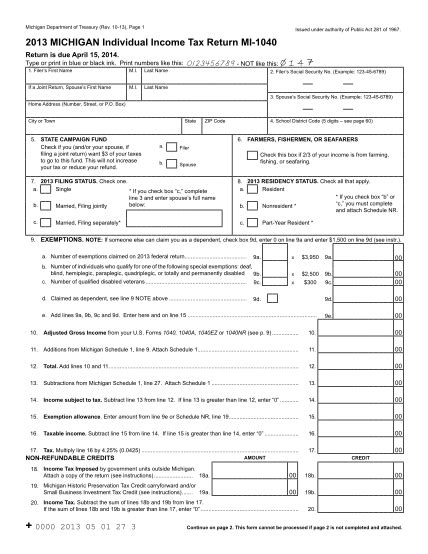

For individual taxpayers, the most common tax form is the Michigan Individual Income Tax Return (Form 1040). This form is used to report and calculate the state income tax liability for residents and non-residents with Michigan-sourced income. The state also offers various deductions, credits, and exemptions to reduce the tax burden on individuals and promote economic growth.

Key Michigan Tax Forms and Their Purposes

The Michigan tax system employs a range of forms to collect and process tax information. Here are some of the most common forms and their specific purposes:

Form 1040: Individual Income Tax Return

This is the primary tax form for individuals, used to report wages, salaries, tips, dividends, capital gains, and other income sources. It also allows taxpayers to claim deductions, credits, and exemptions, reducing their tax liability. Form 1040 comes with various schedules and worksheets to address specific situations, such as Schedule A for itemized deductions or Schedule C for business income.

Form 4250: Business Income and Loss

Designed for sole proprietors, partnerships, and S corporations, this form is used to report business income, expenses, and losses. It is a crucial form for small business owners and self-employed individuals, as it helps determine their business-related tax obligations and deductions.

Form 5100: Corporate Income Tax Return

Form 5100 is for corporations doing business in Michigan. It is used to calculate the corporate income tax liability, taking into account the corporation’s income, deductions, and tax credits. This form is essential for businesses to fulfill their tax obligations and ensure compliance with state regulations.

Form 5000: Sales and Use Tax Return

Sales and use tax is an important revenue source for the state. Form 5000 is used by businesses to report and pay the sales tax collected from customers. It also covers use tax, which is applicable when goods are purchased from out-of-state vendors and used in Michigan.

Form 2024: Property Transfer Affidavit

Property transfers in Michigan require the completion of this form. It is used to provide information about the property being transferred, including its value, any exemptions, and the relationship between the buyer and seller. This form is crucial for the state to assess the proper amount of transfer tax due.

| Form Number | Purpose |

|---|---|

| 1040 | Individual Income Tax Return |

| 4250 | Business Income and Loss |

| 5100 | Corporate Income Tax Return |

| 5000 | Sales and Use Tax Return |

| 2024 | Property Transfer Affidavit |

Navigating the Complexity of Michigan Tax Forms

Completing tax forms can be a complex process, especially for those who are new to the system or have unique circumstances. Here are some tips and strategies to navigate the Michigan tax form landscape effectively:

Stay Informed and Updated

Tax laws and regulations can change frequently. It is crucial to stay informed about any updates or changes that may impact your tax obligations. The Michigan Department of Treasury website is an excellent resource for the latest information, forms, and guidelines.

Understand Your Tax Situation

Before filling out any tax forms, take the time to understand your specific tax situation. Consider factors such as your residency status, income sources, deductions, and credits you may be eligible for. This knowledge will help you choose the correct forms and ensure accurate reporting.

Utilize Online Resources and Tools

The Michigan Department of Treasury offers online tools and resources to assist taxpayers. These include tax calculators, instructional videos, and interactive forms. Utilizing these resources can streamline the tax preparation process and provide valuable guidance.

Seek Professional Assistance

If you find the tax form process overwhelming or have complex financial circumstances, seeking the help of a tax professional can be beneficial. Tax preparers, accountants, and attorneys can provide expert guidance, ensuring your forms are completed accurately and maximizing your potential deductions and credits.

Keep Organized Records

Maintaining organized financial records is essential for accurate tax reporting. Keep track of your income, expenses, deductions, and any relevant documents. This practice will make the tax form completion process smoother and more efficient.

Conclusion: Empowering Michigan Taxpayers

Understanding and completing Michigan tax forms is an essential part of being a responsible taxpayer. By familiarizing yourself with the state’s tax landscape, staying informed about changes, and utilizing the resources available, you can navigate the process with confidence. Remember, accurate reporting not only ensures compliance but also maximizes your potential deductions and credits, making the most of your hard-earned income.

Frequently Asked Questions

When is the Michigan tax filing deadline for individuals?

+

The Michigan tax filing deadline for individuals is typically April 15th, aligning with the federal tax deadline. However, it’s important to note that this date can vary based on the day of the week and whether it falls on a weekend or holiday. Always refer to the official Michigan Department of Treasury website for the most up-to-date information.

Are there any online options for filing Michigan tax returns?

+

Yes, Michigan offers online filing options through the Michigan Online Tax System (MOTS). This secure system allows individuals and businesses to file their tax returns electronically, providing a convenient and efficient alternative to traditional paper filing.

What is the penalty for late tax filing in Michigan?

+

Late filing penalties in Michigan can vary based on the specific tax and the amount of time the return is filed after the deadline. Generally, the penalty for late filing is 5% of the tax due, with a minimum penalty of $10. Additionally, interest may accrue on any unpaid tax amount. It’s important to file on time to avoid these penalties and potential further complications.

Are there any tax credits or deductions available for Michigan residents?

+

Yes, Michigan offers various tax credits and deductions to help reduce the tax burden on residents. These include the Homestead Property Tax Credit, the Michigan Education Tax Credit, and deductions for medical expenses, charitable contributions, and more. It’s important to review your eligibility and understand the specific requirements for each credit or deduction.

How can I stay updated on changes to Michigan tax laws and forms?

+

To stay informed about changes to Michigan tax laws and forms, it’s recommended to regularly visit the Michigan Department of Treasury website. They provide up-to-date information, news releases, and updates on tax law changes. Additionally, subscribing to their email updates or following their social media accounts can ensure you receive timely notifications about any important tax-related developments.