Hamilton County Tax

Welcome to this in-depth exploration of Hamilton County's tax system and its implications for residents and businesses alike. With a focus on clarity and comprehensive understanding, this article aims to provide an expert-level guide to navigating the tax landscape in Hamilton County.

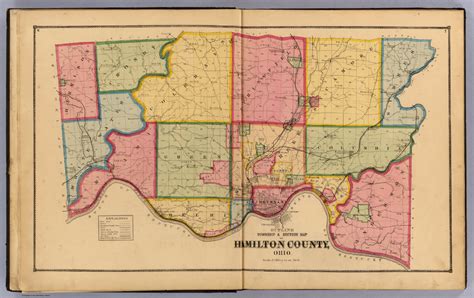

Understanding Hamilton County’s Tax Structure

Hamilton County, nestled in the vibrant state of Ohio, boasts a diverse tax system that plays a pivotal role in shaping the local economy and community. From property taxes to sales taxes and various other levies, understanding this intricate web is essential for individuals and businesses operating within the county.

The county's tax structure is designed to fund essential services, infrastructure development, and community initiatives. It's a complex yet carefully balanced system, with each component contributing to the overall financial health and growth of the region.

Property Taxes: A Cornerstone of Hamilton County’s Revenue

Property taxes are a significant source of revenue for Hamilton County. These taxes are levied on both real estate and personal property, with rates varying across different areas within the county. The revenue generated from property taxes goes towards critical services such as education, public safety, and infrastructure maintenance.

The county employs a comprehensive assessment process to determine the taxable value of properties. This process ensures fairness and accuracy in taxation, taking into account factors like location, size, and improvements made to the property. The assessed value is then multiplied by the applicable tax rate to calculate the annual property tax liability.

For homeowners, understanding the property tax process is crucial. It involves regular assessments, tax rate adjustments, and timely payments. The county provides resources and support to assist homeowners in navigating the property tax landscape, ensuring transparency and clarity.

In addition to residential properties, commercial and industrial properties also contribute significantly to Hamilton County's tax base. The county works closely with businesses to facilitate compliance and provide incentives for economic growth. This collaborative approach fosters a business-friendly environment, attracting investments and contributing to the county's prosperity.

| Property Type | Tax Rate (Effective Rate) |

|---|---|

| Residential Properties | 2.2% |

| Commercial Properties | 2.5% |

| Industrial Properties | 2.7% |

Sales and Use Taxes: Funding Essential Services

Sales and use taxes are another vital component of Hamilton County’s tax structure. These taxes are imposed on the sale of goods and services, as well as on the use of certain products within the county. The revenue generated from these taxes is directed towards funding essential services such as healthcare, transportation, and social welfare programs.

The county's sales tax rate is comprised of a combination of state, county, and municipal taxes. While the state sales tax is a uniform rate across Ohio, Hamilton County and its municipalities have the authority to impose additional taxes to support local initiatives. This decentralized approach allows for tailored funding of specific community needs.

For businesses operating within Hamilton County, understanding the sales tax landscape is crucial. It involves registering for sales tax permits, collecting and remitting taxes on eligible transactions, and staying updated on any changes in tax rates or regulations. The county provides comprehensive resources and support to guide businesses through the sales tax compliance process.

Residents also play a role in sales and use taxes, as they contribute to the tax base through their daily purchases. The county ensures transparency in the use of sales tax revenue, providing regular updates on how funds are allocated and the impact they have on community development.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 5.75% |

| Hamilton County Sales Tax | 0.75% |

| Municipal Sales Tax (Average) | 1.5% |

Other Taxes and Levies: A Comprehensive Approach

Beyond property and sales taxes, Hamilton County employs a range of other taxes and levies to fund specific programs and initiatives. These include:

- Income Tax: The county imposes an income tax on individuals and businesses operating within its borders. This tax contributes to the general fund, supporting a wide range of services and infrastructure projects.

- Excise Taxes: Certain goods and services, such as tobacco products and alcohol, are subject to excise taxes. These taxes are levied at various stages of production or distribution, providing dedicated funding for public health and safety initiatives.

- Motor Vehicle Taxes: Registration and licensing of motor vehicles within the county are subject to specific taxes. These funds are allocated towards transportation infrastructure, road maintenance, and public transit improvements.

- Special Assessments: In certain cases, the county may impose special assessments on properties that benefit from specific improvements or infrastructure projects. These assessments are designed to equitably distribute the costs of such projects among the beneficiaries.

Each of these taxes and levies plays a unique role in shaping the financial landscape of Hamilton County. By adopting a comprehensive approach, the county ensures a balanced and sustainable funding model for its operations and community initiatives.

Tax Incentives and Programs: Attracting Growth

Hamilton County recognizes the importance of fostering economic growth and development. As such, it offers a range of tax incentives and programs to attract businesses, create jobs, and stimulate the local economy.

Tax Abatement Programs

The county provides tax abatement programs for businesses investing in new construction, renovations, or expansions. These programs offer a reduction or exemption from property taxes for a specified period, encouraging businesses to make significant investments in the community.

By providing tax abatements, Hamilton County creates an attractive environment for businesses looking to establish or expand their operations. This incentive not only benefits the businesses but also contributes to job creation and economic growth within the county.

The tax abatement programs are tailored to meet the needs of different industries and business sizes. The county works closely with businesses to determine eligibility and the scope of the abatement, ensuring a fair and equitable process.

Enterprise Zone Incentives

Hamilton County has designated specific enterprise zones throughout the region. These zones offer a range of incentives, including reduced tax rates and streamlined permitting processes, to encourage economic development and job creation.

Businesses operating within these zones can benefit from tax credits, exemptions, or deferrals. The county actively promotes these enterprise zones, providing resources and support to businesses looking to capitalize on the incentives.

The enterprise zone program is designed to stimulate investment in areas that may have faced economic challenges. By offering a range of incentives, the county aims to attract businesses, create jobs, and revitalize these communities.

Job Creation and Training Programs

In addition to tax incentives, Hamilton County invests in job creation and training programs. These initiatives are aimed at providing residents with the skills and opportunities needed to thrive in a dynamic job market.

The county collaborates with local businesses, educational institutions, and workforce development organizations to identify emerging industries and skill gaps. By offering targeted training programs, Hamilton County ensures that its residents are equipped with the necessary skills to meet the demands of the local job market.

These job creation and training initiatives not only benefit individuals by enhancing their employability but also contribute to the overall economic growth of the county. A skilled and adaptable workforce attracts businesses and fosters a vibrant, sustainable economy.

Tax Administration and Compliance

Effective tax administration and compliance are essential for the smooth functioning of Hamilton County’s tax system. The county employs a dedicated team of professionals to ensure that taxes are assessed, collected, and distributed fairly and efficiently.

Tax Assessment and Collection Process

The county’s tax assessment process is rigorous and transparent. It involves a thorough evaluation of properties, businesses, and other taxable entities to determine their fair market value. This process ensures that taxes are levied based on accurate and up-to-date information.

The tax collection process is streamlined, with various payment options available to taxpayers. The county provides online payment portals, direct debit facilities, and in-person payment centers to accommodate different preferences and needs.

To ensure compliance, the county employs a robust audit process. Auditors review tax returns and financial records to verify the accuracy of reported information. This process helps identify any potential errors or instances of non-compliance, ensuring the integrity of the tax system.

Taxpayer Support and Education

Hamilton County recognizes the importance of taxpayer support and education. The county provides a wealth of resources and assistance to help individuals and businesses navigate the tax landscape.

Taxpayer assistance centers are available to provide personalized guidance and support. These centers offer help with tax filings, offer clarification on tax regulations, and provide assistance with any tax-related queries.

The county also invests in educational initiatives to promote tax literacy among residents. Workshops, seminars, and online resources are made available to ensure that taxpayers understand their rights and responsibilities, as well as the benefits and implications of the tax system.

By providing comprehensive support and education, Hamilton County empowers taxpayers to make informed decisions and comply with tax regulations effectively.

Community Impact and Economic Development

The revenue generated through Hamilton County’s tax system has a significant impact on the local community and its economic development.

Funding Essential Services

Tax revenues play a critical role in funding essential services that directly impact the well-being of residents. These services include education, healthcare, public safety, and social welfare programs. By investing in these areas, the county ensures that its residents have access to quality services and a high standard of living.

For instance, property taxes are a major source of funding for public schools. This investment in education not only benefits current students but also contributes to the development of a skilled and knowledgeable workforce for the future.

Infrastructure Development

Hamilton County’s tax revenues are also directed towards infrastructure development and maintenance. This includes projects such as road improvements, bridge repairs, public transportation upgrades, and the development of recreational facilities.

Well-maintained infrastructure not only enhances the quality of life for residents but also attracts businesses and investments. A robust infrastructure network contributes to economic growth and creates a positive business environment.

Community Initiatives and Programs

Beyond essential services and infrastructure, tax revenues fund a range of community initiatives and programs. These initiatives aim to address social issues, promote cultural activities, and support local businesses.

For example, the county may allocate funds towards affordable housing programs, community development grants, and initiatives that promote sustainability and environmental stewardship. These investments contribute to the overall vitality and resilience of the community.

Furthermore, tax revenues support local arts and culture, sponsoring events and programs that enrich the community's cultural landscape. These initiatives not only provide entertainment and enrichment but also attract visitors and boost the local economy.

Looking Ahead: Future Implications and Opportunities

As Hamilton County continues to evolve and adapt to changing economic and social landscapes, its tax system will play a crucial role in shaping its future.

Economic Growth and Sustainability

The county’s tax structure and incentives are designed to attract and retain businesses, fostering economic growth and job creation. By offering a competitive tax environment and targeted incentives, Hamilton County positions itself as an attractive destination for investments.

However, as the economy evolves, the county must remain agile and responsive to changing business needs. This involves regularly reviewing and updating tax policies to ensure they remain relevant and effective in attracting businesses and supporting economic growth.

Social Equity and Community Development

Hamilton County’s tax system plays a critical role in promoting social equity and community development. The revenue generated through taxes enables the county to invest in initiatives that address social disparities and enhance the overall well-being of its residents.

By prioritizing funding for affordable housing, healthcare, and social services, the county can reduce socioeconomic gaps and create a more equitable community. This, in turn, fosters a sense of belonging and empowers residents to actively contribute to the local economy.

Environmental Sustainability and Green Initiatives

In today’s world, environmental sustainability is a key consideration for communities and businesses alike. Hamilton County can leverage its tax system to promote green initiatives and support environmentally conscious practices.

The county can offer incentives for businesses that adopt sustainable practices, such as tax breaks for companies investing in renewable energy or implementing waste reduction strategies. By doing so, Hamilton County can position itself as a leader in environmental stewardship and attract businesses that share these values.

Collaboration and Regional Partnerships

As Hamilton County navigates the complexities of the modern economy, collaboration and regional partnerships will be crucial. By working together with neighboring counties and municipalities, the county can pool resources and address regional challenges more effectively.

For instance, collaborative efforts in infrastructure development, transportation planning, and economic growth strategies can lead to more efficient and sustainable outcomes. By leveraging the strengths and resources of multiple jurisdictions, Hamilton County can enhance its competitiveness and resilience.

How can I calculate my property tax liability in Hamilton County?

+To calculate your property tax liability, you'll need to determine the assessed value of your property. This value is determined by the county assessor's office and takes into account factors such as location, size, and improvements. Once you have the assessed value, you can multiply it by the applicable tax rate for your property type to arrive at your annual tax liability.

What are the sales tax rates for Hamilton County, and how often do they change?

+The sales tax rate in Hamilton County is comprised of state, county, and municipal taxes. The state sales tax rate is set by the state government and remains consistent across Ohio. However, the county and municipal sales tax rates can vary. These rates are subject to change, and it's important to stay updated on any adjustments to ensure compliance.

Are there any tax incentives or programs for businesses in Hamilton County?

+Yes, Hamilton County offers a range of tax incentives and programs to attract and support businesses. These include tax abatement programs, enterprise zone incentives, and job creation initiatives. Businesses can benefit from reduced tax rates, tax exemptions, and streamlined permitting processes, depending on their location and the nature of their operations.

How can I access taxpayer support and resources in Hamilton County?

+Hamilton County provides comprehensive taxpayer support through dedicated assistance centers. These centers offer personalized guidance on tax filings, regulations, and compliance. Additionally, the county's website provides a wealth of resources, including online payment portals, tax calculators, and educational materials. Residents and businesses can access these resources to navigate the tax landscape effectively.

What are some key community initiatives funded by Hamilton County's tax revenues?

+Hamilton County's tax revenues fund a wide range of community initiatives. These include affordable housing programs, community development grants, cultural and arts initiatives, and environmental sustainability projects. The county allocates funds to address social issues, promote community engagement, and support local businesses, contributing to the overall vitality and well-being of its residents.

In conclusion, Hamilton County’s tax system is a complex yet vital component of its economic and social landscape. From funding essential services to fostering economic growth and community development, the county’s tax structure plays a pivotal role in shaping its future. By understanding the intricacies of the tax system and leveraging the opportunities it presents, residents and businesses can actively contribute to the prosperity and well-being of Hamilton County.