International Fuel Tax Agreement

The International Fuel Tax Agreement (IFTA) is a critical agreement that simplifies the fuel tax reporting process for interstate motor carriers operating in the United States and Canada. Established in 1983, IFTA aims to streamline fuel tax collection and distribution, benefiting both motor carriers and state and provincial jurisdictions. By standardizing fuel tax reporting and payment, IFTA significantly reduces administrative burdens and costs for businesses engaged in interstate commerce.

With the increasing demand for efficient and sustainable transportation solutions, IFTA plays a pivotal role in facilitating the seamless movement of goods across North America. This article delves into the intricacies of IFTA, exploring its history, purpose, benefits, and its evolving role in the modern transportation industry.

The Evolution of IFTA: A Historical Perspective

The origins of IFTA can be traced back to the complexities of fuel taxation in the early 1980s. As interstate trucking operations expanded, carriers faced the challenge of managing multiple fuel tax reporting requirements across different states and provinces. Recognizing the need for standardization, the American Association of Motor Vehicle Administrators (AAMVA) and the Canadian Council of Motor Transport Administrators (CCMTA) collaborated to develop a unified system.

In 1983, the IFTA was established as a reciprocal agreement between participating jurisdictions. The initial goal was to simplify fuel tax reporting, ensuring that carriers only needed to file a single quarterly return and remit taxes to their base jurisdiction. This not only reduced administrative burdens but also promoted fair competition among carriers operating across borders.

Key Components and Benefits of IFTA

IFTA’s primary objective is to streamline fuel tax collection and distribution for carriers traveling in multiple jurisdictions. Here’s an overview of its key components and the benefits it offers:

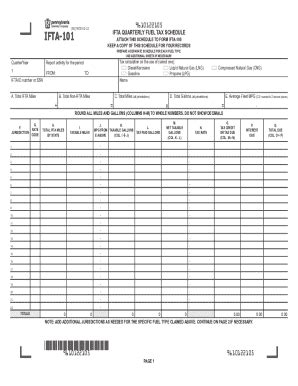

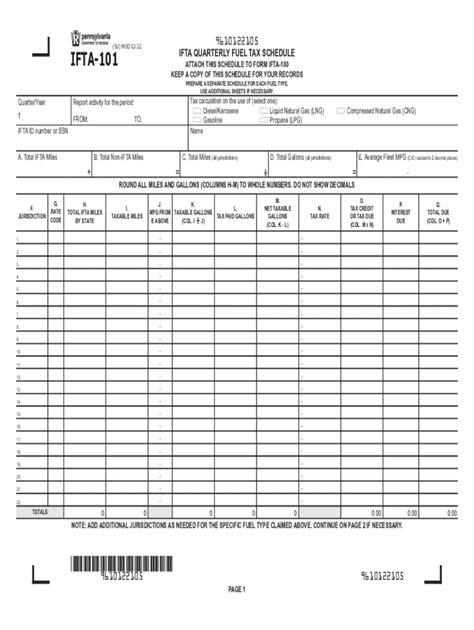

Standardized Fuel Tax Reporting

IFTA introduces a uniform reporting system, eliminating the need for carriers to maintain separate records for each state or province they operate in. Carriers are required to file a single quarterly tax return, known as the IFTA Tax Return and Report, to their base jurisdiction. This return includes information on fuel purchases, mileage, and fuel tax rates for all jurisdictions traveled.

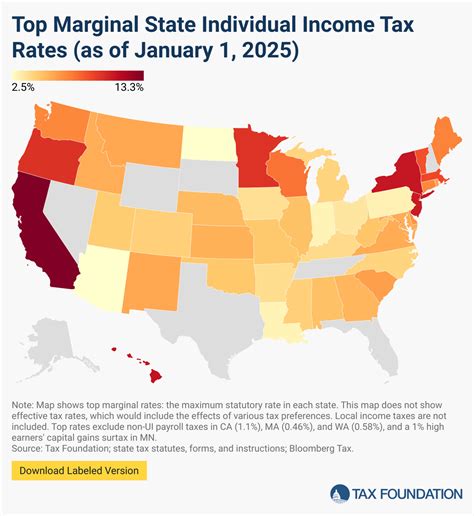

| Jurisdiction | Fuel Tax Rate (Example) |

|---|---|

| California | 0.525 USD/gallon |

| Texas | 0.29 USD/gallon |

| Ontario | 0.34 CAD/liter |

Fuel Tax Distribution

The IFTA agreement ensures that fuel taxes collected from carriers are distributed back to the appropriate jurisdictions based on the mileage traveled. This distribution process is facilitated by the IFTA License and Decal, which carriers must obtain from their base jurisdiction. The decal displays the carrier’s license number and is displayed on the vehicle, providing a visual indication of IFTA compliance.

Cost Savings and Efficiency

By consolidating fuel tax reporting and payment, IFTA significantly reduces administrative costs for carriers. Carriers no longer need to navigate complex tax regulations in each jurisdiction, saving time and resources. Additionally, the agreement promotes fairness and consistency, ensuring that carriers pay the appropriate fuel taxes based on their actual mileage.

IFTA’s Impact on the Transportation Industry

The implementation of IFTA has had a profound impact on the transportation industry, particularly for interstate motor carriers. Here’s how IFTA has shaped the industry:

Facilitating Interstate Commerce

IFTA has played a crucial role in fostering the growth of interstate commerce by removing barriers to cross-border operations. Carriers can now operate seamlessly across North America without the burden of multiple fuel tax reporting systems. This efficiency has led to increased trade and improved logistics for businesses relying on interstate transportation.

Promoting Compliance and Fair Competition

The standardized reporting and distribution system of IFTA ensures that carriers operate within a fair and regulated environment. By requiring carriers to adhere to a single set of rules, IFTA promotes compliance and prevents carriers from gaining an unfair advantage by avoiding fuel taxes in certain jurisdictions. This level playing field benefits both carriers and jurisdictions.

Enhancing Sustainability

With the increasing focus on environmental sustainability, IFTA has contributed to the development of more sustainable transportation practices. By accurately tracking fuel consumption and mileage, IFTA provides valuable data for jurisdictions to analyze and implement fuel-efficient initiatives. Additionally, the agreement encourages carriers to adopt fuel-efficient technologies and practices, reducing their carbon footprint.

The Future of IFTA: Technological Advancements and Challenges

As the transportation industry continues to evolve, IFTA must adapt to emerging technologies and changing regulatory landscapes. Here are some key considerations for the future of IFTA:

Electronic Logging Devices (ELDs)

The implementation of Electronic Logging Devices (ELDs) has revolutionized the way carriers track their hours of service and mileage. IFTA can leverage ELD data to enhance the accuracy and efficiency of fuel tax reporting. By integrating ELDs with IFTA systems, carriers can automate mileage tracking, reducing the potential for errors and simplifying the reporting process.

Data Analytics and Insights

The vast amount of data generated by IFTA can be harnessed to provide valuable insights for both carriers and jurisdictions. Advanced data analytics can help identify trends, optimize routes, and improve fuel efficiency. Additionally, data-driven decision-making can assist jurisdictions in formulating effective fuel tax policies and infrastructure investments.

Addressing Regulatory Challenges

While IFTA has successfully standardized fuel tax reporting, there are ongoing challenges related to varying fuel tax rates and regulations across jurisdictions. Keeping pace with these changes and ensuring that carriers remain compliant with evolving tax laws is essential. Regular updates and communication between jurisdictions and industry stakeholders are crucial for maintaining a harmonious and efficient IFTA system.

Frequently Asked Questions

How often do carriers need to file IFTA returns?

+Carriers are required to file IFTA returns on a quarterly basis. The filing deadline is typically the last day of the month following the end of the quarter.

What are the penalties for non-compliance with IFTA regulations?

+Penalties for non-compliance can vary depending on the jurisdiction and the severity of the violation. Common penalties include fines, license suspension, and revocation of the IFTA license and decal.

How can carriers ensure accurate mileage tracking for IFTA reporting?

+Carriers can utilize various methods for accurate mileage tracking, including GPS tracking systems, Electronic Logging Devices (ELDs), and manual odometer readings. Regular maintenance and calibration of these systems are essential for accurate reporting.

What happens if a carrier operates in a non-IFTA jurisdiction?

+Carriers operating in non-IFTA jurisdictions must comply with the fuel tax regulations of those specific jurisdictions. It is important to research and understand the fuel tax requirements in each non-IFTA jurisdiction to ensure compliance.

How can carriers stay updated with changing IFTA regulations and rates?

+Carriers should stay informed by regularly checking the official websites of their base jurisdiction and the American Association of Motor Vehicle Administrators (AAMVA). Additionally, subscribing to industry newsletters and seeking guidance from transportation associations can provide valuable updates.