State Tax Rate Michigan

The state of Michigan has a unique tax system, which includes various taxes that affect individuals and businesses alike. The state's tax structure plays a crucial role in shaping the economy and providing revenue for essential services. Understanding Michigan's tax rates is essential for residents, businesses, and anyone considering relocating to or investing in the Great Lakes State.

Unraveling Michigan's State Tax Structure

Michigan's state tax system is composed of several key components, each serving a specific purpose and contributing to the overall tax landscape. Let's delve into the primary taxes that comprise Michigan's revenue generation.

Individual Income Tax: A Progressive Approach

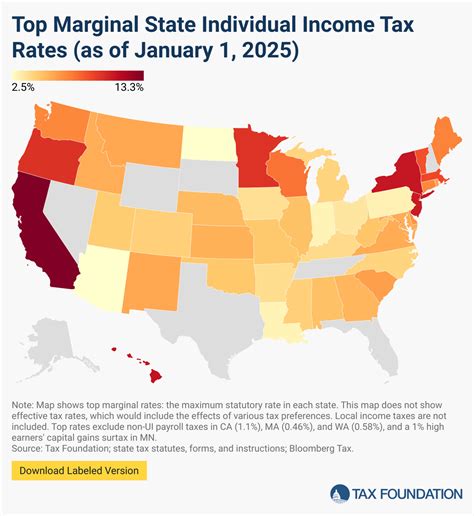

Michigan's individual income tax is a fundamental part of its tax structure. As of my last update in January 2023, the state levies a 4.25% income tax on all taxable income. However, it's important to note that this rate is subject to change, as tax policies can evolve over time.

The state's income tax system is progressive, meaning that higher income earners pay a larger proportion of their income in taxes. This approach aims to ensure a fair distribution of tax burden across different income levels.

| Income Bracket | Tax Rate |

|---|---|

| Up to $35,000 | 4.25% |

| $35,001 - $50,000 | 4.25% |

| $50,001 and above | 4.25% |

Sales and Use Tax: A Dual Approach

The sales and use tax is another significant component of Michigan's tax system. This tax applies to the sale of tangible personal property and certain services within the state. As of my knowledge cutoff, the statewide sales tax rate is 6%, which is applied uniformly across the state.

However, it's important to note that Michigan also allows for local sales tax rates to be added on top of the state rate. These local taxes can vary from one jurisdiction to another, leading to slight differences in the total sales tax rate across the state.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Sales Tax | Varies by jurisdiction |

For example, the city of Detroit imposes an additional 2% local sales tax, resulting in a total sales tax rate of 8% for consumers in that area. These local taxes are often used to fund specific initiatives or infrastructure projects, providing an additional revenue stream for local governments.

Corporate Income Tax: A Competitive Rate

Michigan also imposes a corporate income tax on businesses operating within the state. As of my knowledge cutoff, the corporate income tax rate is 6%, which applies to the taxable income of corporations, including C corporations and S corporations.

This competitive tax rate is designed to attract businesses and promote economic growth in the state. It's worth noting that Michigan has taken steps to simplify its corporate tax structure, making it more appealing to businesses considering relocation or expansion.

| Tax Type | Rate |

|---|---|

| Corporate Income Tax | 6% |

Other Taxes: A Comprehensive Overview

In addition to the taxes mentioned above, Michigan has several other tax categories that contribute to its overall tax structure. These taxes are designed to fund specific initiatives or support particular industries.

- Intangibles Tax: This tax applies to the transfer of certain intangible properties, such as stocks, bonds, and notes, with a rate of 0.12% as of my knowledge cutoff.

- Use Tax: The use tax is levied on the storage, use, or consumption of tangible personal property purchased from out-of-state vendors. It ensures that residents pay taxes on goods acquired online or outside Michigan. The use tax rate matches the sales tax rate at 6% as of my last update.

- Real Estate Transfer Tax: When real estate is sold or transferred in Michigan, a real estate transfer tax is imposed. The rate varies depending on the type of transfer and the property's value, but it typically ranges from 0.05% to 1%.

- Gasoline Tax: The state levies a gasoline tax to fund road and infrastructure projects. As of my knowledge cutoff, the gasoline tax rate is 26.35 cents per gallon, making it a significant contributor to Michigan's transportation budget.

Impact and Implications of Michigan's Tax Rates

Michigan's tax rates have a profound impact on various aspects of the state's economy and society. Let's explore some of the key implications and how they shape the lives of Michigan residents and businesses.

Economic Growth and Business Attraction

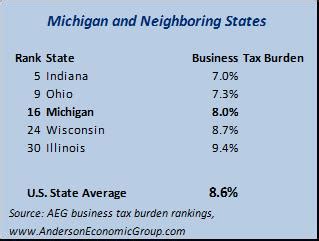

Michigan's relatively low corporate income tax rate has been a strategic move to attract businesses and promote economic growth. A competitive tax environment can encourage companies to establish or expand their operations within the state, leading to job creation and increased economic activity.

Additionally, the state's progressive income tax system ensures that higher-income earners contribute a larger share of their income to state revenues, providing resources for essential services like education, healthcare, and infrastructure development.

Consumer Spending and Sales Tax Impact

The sales tax rate in Michigan directly affects consumer spending habits. A higher sales tax rate can discourage spending, especially on big-ticket items, as consumers may opt to purchase goods in neighboring states with lower tax rates. Conversely, a lower sales tax rate can encourage spending and stimulate the local economy.

The variation in local sales tax rates across Michigan also influences consumer behavior. Residents may choose to shop in areas with lower local tax rates, leading to potential shifts in consumer traffic and revenue for businesses.

Tax Incentives and Economic Development

Michigan offers various tax incentives and programs to support economic development and attract specific industries. These incentives can include tax credits, deductions, or exemptions for businesses operating in targeted sectors or regions.

For instance, the Michigan Business Tax Credit provides tax credits to businesses that create or retain jobs in the state. Similarly, the Michigan Economic Development Corporation (MEDC) offers a range of incentives to encourage business investment and job creation.

Local Government Funding and Property Taxes

While Michigan's state taxes play a significant role, local governments also rely on property taxes to fund essential services and infrastructure. Property taxes are a primary source of revenue for municipalities, school districts, and other local entities.

The assessment and collection of property taxes can vary across jurisdictions, leading to differences in the tax burden for homeowners and businesses. Understanding the local tax landscape is crucial for individuals and businesses considering relocation or expansion within Michigan.

Future Outlook and Potential Changes

Michigan's tax structure is subject to ongoing discussions and potential changes as economic conditions evolve and new legislative initiatives emerge. Here are some key considerations for the future of Michigan's tax landscape.

Budget Considerations and Tax Reform

As Michigan's economy continues to recover from the impacts of the COVID-19 pandemic, budget considerations may drive discussions around tax reform. The state may explore options to balance its budget while ensuring the tax system remains fair and competitive.

Tax reform initiatives could include adjusting tax rates, revising tax brackets, or implementing new taxes to generate additional revenue. These changes aim to address budgetary needs while maintaining a business-friendly environment.

Economic Shifts and Tax Base Fluctuations

Economic shifts, such as changes in the housing market or fluctuations in certain industries, can impact Michigan's tax base. For instance, a decline in the real estate market could affect property tax revenues, while a surge in certain sectors could lead to increased corporate tax collections.

Monitoring these economic shifts is crucial for policymakers to make informed decisions about tax policies and ensure the state's tax structure remains adaptable to changing circumstances.

Infrastructure Investment and Tax Funding

Michigan's infrastructure, particularly its road and bridge network, is a key focus for the state. Investing in infrastructure requires significant funding, and taxes play a critical role in generating the necessary revenue.

Discussions around infrastructure funding may lead to proposals for dedicated taxes or increased tax rates to support these investments. Balancing the need for infrastructure upgrades with the potential impact on taxpayers is a delicate task for policymakers.

Tax Incentives and Business Competition

Michigan's tax incentives play a significant role in attracting businesses, but they also create a competitive environment with neighboring states. Other states may offer more attractive tax packages, leading to a dynamic where businesses weigh various factors, including tax rates, when making location decisions.

Maintaining a competitive tax environment while ensuring the state's long-term fiscal health is a challenge that policymakers must navigate carefully.

Conclusion: Navigating Michigan's Tax Landscape

Michigan's tax structure is a complex yet essential component of the state's economy. From individual income taxes to sales and use taxes, each element plays a unique role in funding essential services and supporting economic growth.

Understanding Michigan's tax rates is crucial for individuals and businesses alike. Whether you're a resident navigating your tax obligations or a business considering relocation, staying informed about the state's tax landscape is key to making informed decisions.

As Michigan continues to evolve and adapt to economic shifts, its tax system will likely undergo changes to meet the needs of its residents and businesses. Staying abreast of these developments ensures that taxpayers can navigate the tax landscape with confidence and contribute to the state's vibrant economy.

What is the current individual income tax rate in Michigan?

+As of my last update in January 2023, the individual income tax rate in Michigan is 4.25%.

Are there any local sales tax rates in Michigan?

+Yes, Michigan allows for local sales tax rates, which can vary by jurisdiction. These local taxes are in addition to the statewide sales tax rate of 6%.

What is the corporate income tax rate in Michigan?

+The corporate income tax rate in Michigan is 6% as of my knowledge cutoff. This rate applies to the taxable income of corporations, including C corporations and S corporations.

Are there any other significant taxes in Michigan?

+Yes, Michigan has several other tax categories, including intangibles tax, use tax, real estate transfer tax, and gasoline tax. Each of these taxes serves a specific purpose and contributes to the state’s revenue.