Vegas Resort Tax

The Vegas Resort Tax, commonly known as the Las Vegas Resort Fee, is a unique and often misunderstood aspect of the hospitality industry in Las Vegas, Nevada. It is a mandatory fee charged by many hotels and resorts in the city, adding an additional cost to visitors' stays. This tax, although sometimes a point of contention for tourists, plays a significant role in the local economy and the operations of these establishments. This article aims to delve into the intricacies of the Vegas Resort Tax, exploring its history, purpose, and impact on both visitors and the vibrant Las Vegas tourism industry.

Understanding the Vegas Resort Tax

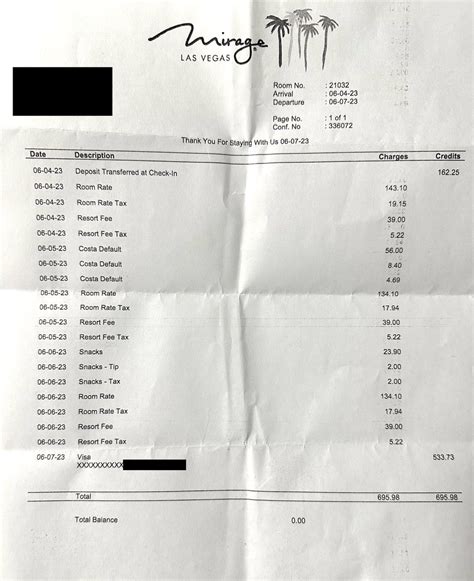

The Vegas Resort Tax, officially termed the “Las Vegas Resort Fee,” is a mandatory daily charge levied by hotels and resorts in the Las Vegas metropolitan area. It is separate from the standard room rate and typically ranges from 25 to 50 per night, depending on the property and its amenities. This fee is not optional and is often added to the room rate after guests have made their reservations, leading to some surprise and disappointment upon arrival.

The concept of a resort fee originated in the late 1990s when hotels began charging a fee to cover the costs of amenities such as fitness centers, pools, and internet access. Over time, this fee has become a standard practice in Las Vegas, with a majority of hotels and resorts adopting it as a means to enhance their revenue streams. Today, the Vegas Resort Tax is an integral part of the Las Vegas hospitality landscape, generating significant funds for hotel operations and contributing to the city's thriving tourism sector.

The Purpose and Benefits of the Resort Fee

The primary purpose of the Vegas Resort Tax is to provide hotels with an additional source of revenue to cover the costs of maintaining their extensive amenities and services. Las Vegas resorts are renowned for their luxurious offerings, including lavish pools, exclusive clubs, top-tier restaurants, and state-of-the-art fitness facilities. These amenities require substantial investment and ongoing maintenance, and the resort fee helps to ensure that these costs are covered.

Beyond covering operational expenses, the resort fee also benefits visitors by providing access to a wide range of services and facilities. For instance, many resorts offer complimentary services such as Wi-Fi, local phone calls, fitness center access, and even shuttle services to and from the airport, all included in the resort fee. Additionally, the fee often grants guests discounted rates for entertainment venues, restaurants, and attractions within the resort, offering a more comprehensive and cost-effective vacation experience.

Legal Status and Transparency

The legality of the Vegas Resort Tax has been a topic of discussion and debate. While it is mandatory for guests to pay this fee, the transparency surrounding its existence and implementation has been a focus of consumer protection advocates. Many argue that the fee should be included in the advertised room rate to provide a clearer understanding of the total cost of a stay. However, hotels maintain that the resort fee is a separate charge, much like taxes, and is not a part of the base room rate.

In recent years, there have been efforts to increase transparency and provide better disclosure of the resort fee. Some hotels now list the resort fee alongside the room rate on their websites, ensuring that guests are aware of the total cost of their stay. Additionally, third-party booking platforms have also begun to display the resort fee more prominently, helping travelers make more informed decisions about their accommodations.

Impact on Tourism and the Local Economy

The Vegas Resort Tax has a significant impact on the tourism industry and the local economy of Las Vegas. The revenue generated from this fee contributes to the overall economic growth of the city, supporting jobs and businesses in the hospitality sector. It also helps to maintain the world-class standards of Las Vegas resorts, ensuring that visitors continue to be drawn to the city for its unparalleled entertainment and luxury offerings.

However, the impact of the resort fee is not without its critics. Some argue that the fee discourages tourism, as it adds a substantial cost to a vacation in Las Vegas. Others suggest that the fee should be more fairly distributed, benefiting not only the hotels but also the wider community through investment in public infrastructure and services. Despite these criticisms, the Vegas Resort Tax remains a vital part of the city's revenue stream, shaping the experiences of millions of visitors each year.

Comparative Analysis with Other Destinations

Las Vegas is not the only destination to implement a resort fee. Many popular vacation spots, particularly those with extensive resort amenities, have adopted similar fees to cover operational costs and enhance the guest experience. However, the implementation and perception of these fees can vary greatly across different locations.

Florida Resorts

In Florida, a state known for its sunny beaches and family-friendly resorts, the resort fee is a common practice. These fees, similar to those in Las Vegas, are used to cover amenities such as beach access, water parks, and recreational activities. While some guests may view these fees as an additional cost, others appreciate the enhanced experience and services they receive in return.

| Resort | Resort Fee (USD) |

|---|---|

| Universal Orlando Resort | $25–$40 |

| Walt Disney World Resort | $30–$50 |

| SeaWorld Orlando | $25–$35 |

Caribbean Destinations

In the Caribbean, resort fees are often included in the overall cost of a vacation package, providing guests with an all-inclusive experience. These fees cover a wide range of services, from meals and drinks to activities and entertainment. While the fee may be higher, it offers a seamless and stress-free vacation, ensuring that guests can enjoy their trip without worrying about additional costs.

| Resort | All-Inclusive Fee (USD) |

|---|---|

| Sandals Royal Bahamian | $180–$220 per person, per night |

| Couples Negril Resort & Spa | $200–$250 per person, per night |

| Beaches Turks & Caicos | $250–$300 per person, per night |

European Cities

In Europe, particularly in cities like Paris and Rome, a city tax or “tourist tax” is often levied on visitors. This tax is included in the room rate and is used to fund local infrastructure, cultural attractions, and tourism promotion. While it may not be specifically termed a “resort fee,” the concept is similar, as it contributes to the maintenance and enhancement of the city’s tourism offerings.

| City | City Tax (EUR) |

|---|---|

| Paris | €1.50–€4.50 per person, per night |

| Rome | €3.50–€7.00 per person, per night |

| Venice | €4.50–€10.00 per person, per night |

Tips for Managing the Vegas Resort Tax

For visitors to Las Vegas, the Vegas Resort Tax can be a significant consideration when planning a trip. Here are some tips to help manage this additional cost and make the most of your vacation:

- Research and Compare: Before booking your accommodation, research the resort fees of different properties. Some resorts may offer better value for money, especially if you plan to utilize their amenities extensively.

- Negotiate: While resort fees are typically non-negotiable, you can sometimes negotiate them down, especially if you are a returning guest or have a loyalty program membership with the hotel.

- Consider Alternatives: If the resort fee is a significant concern, you can opt for budget-friendly accommodations or explore options outside the city center, where resort fees may be lower or non-existent.

- Utilize Amenities: Make the most of the amenities included in your resort fee. From free Wi-Fi and gym access to discounted entertainment, these perks can enhance your vacation experience without breaking the bank.

- Plan Your Budget: Factor in the resort fee when planning your overall budget for the trip. This will help you allocate your spending wisely and ensure a more enjoyable and stress-free vacation.

The Future of the Vegas Resort Tax

The Vegas Resort Tax is an integral part of the Las Vegas hospitality industry, and its future is closely tied to the city’s evolving tourism landscape. As consumer preferences and expectations continue to shift, hotels and resorts will need to adapt their strategies to remain competitive and appealing to visitors.

One potential development is the increased focus on transparency and disclosure. As travelers become more informed and price-conscious, hotels may need to provide clearer information about the total cost of a stay, including the resort fee. This could lead to a more inclusive room rate, where the fee is incorporated into the advertised price, providing a more straightforward and honest pricing structure.

Additionally, the ongoing trend of offering value-added services and experiences may continue to shape the resort fee. Hotels could explore innovative ways to enhance guest experiences, such as providing exclusive access to events, offering personalized services, or developing unique amenities that set them apart from competitors. By doing so, they can justify the resort fee as a worthwhile investment in an exceptional vacation.

Lastly, the potential impact of technological advancements should not be overlooked. With the rise of online booking platforms and direct-to-consumer services, hotels may need to adapt their fee structures to remain competitive in an increasingly digital marketplace. This could involve dynamic pricing models, where resort fees are adjusted based on demand and seasonality, or the development of loyalty programs that offer fee waivers or discounts to repeat guests.

Is the Vegas Resort Tax mandatory for all hotels in Las Vegas?

+No, the Vegas Resort Tax is not mandatory for all hotels in Las Vegas. While many hotels and resorts charge this fee, there are some properties, particularly budget-friendly options, that do not impose a resort fee. It is always recommended to check with the specific hotel or resort you are considering to understand their fee structure.

Can the Vegas Resort Tax be waived or negotiated?

+In most cases, the Vegas Resort Tax is non-negotiable and must be paid by all guests. However, there may be occasions where hotels are willing to waive or reduce the fee, especially for loyal customers or during slower periods. It is worth inquiring about potential discounts or promotions when booking your stay.

What services and amenities are typically included in the Vegas Resort Tax?

+The services and amenities covered by the Vegas Resort Tax can vary depending on the hotel. Typically, it includes access to facilities like gyms, pools, and business centers, as well as complimentary services such as Wi-Fi, local phone calls, and sometimes even shuttle services. Some resorts may also offer discounts on entertainment and dining options.

How can I avoid paying the Vegas Resort Tax?

+Avoiding the Vegas Resort Tax entirely may be challenging, as it is a standard practice for many hotels in Las Vegas. However, you can minimize its impact by researching and comparing different hotels to find those with lower or more inclusive resort fees. Additionally, some properties offer promotions or loyalty programs that waive the fee for certain guests.