California San Francisco Sales Tax

Welcome to the comprehensive guide on the California San Francisco Sales Tax, a critical component of the state's revenue system and a key factor in the financial landscape of one of the world's most vibrant and innovative cities. This article will delve into the intricacies of the sales tax structure in San Francisco, offering an in-depth analysis of rates, applicability, and its impact on businesses and consumers alike.

Understanding the San Francisco Sales Tax

The sales tax in San Francisco, like the rest of California, is a consumption tax levied on the sale of tangible personal property and some services. It is a vital source of revenue for the city, contributing significantly to the funding of essential public services and infrastructure projects.

The California Board of Equalization (BOE) is the governing body responsible for the administration and collection of sales and use taxes in the state. The BOE sets the tax rates and provides guidelines for businesses and consumers to ensure compliance with the tax laws.

Sales Tax Rates in San Francisco

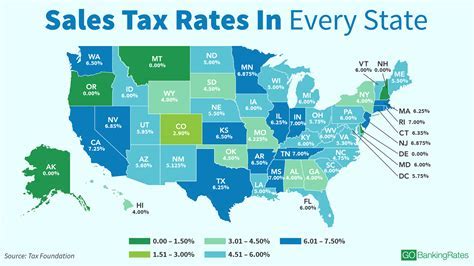

The sales tax rate in San Francisco is determined by a combination of state, county, and city rates. As of [Current Year], the combined sales tax rate in San Francisco is [Combined Tax Rate]%, which includes:

| Tax Level | Tax Rate |

|---|---|

| State Sales Tax | [State Tax Rate]% |

| County Sales Tax | [County Tax Rate]% |

| City Sales Tax | [City Tax Rate]% |

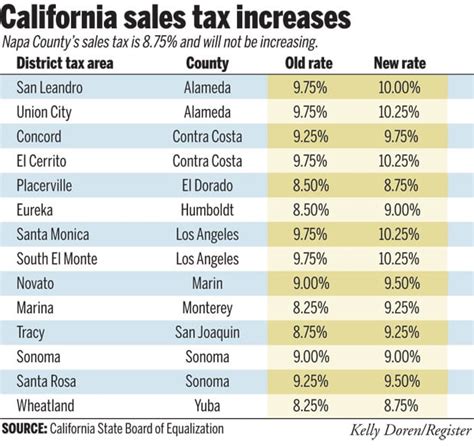

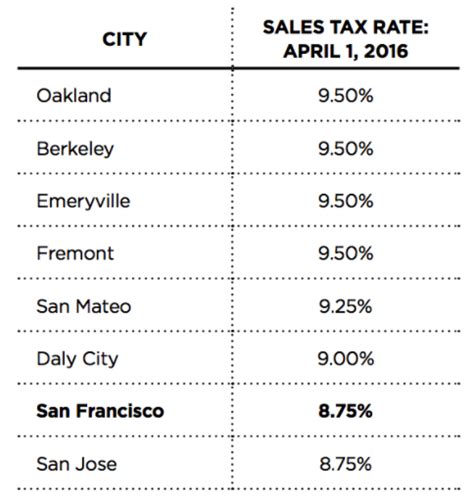

It's important to note that the city sales tax rate can vary within California, as some cities impose additional taxes to fund specific projects or initiatives. San Francisco's city sales tax rate is [City Tax Rate]%, which is relatively higher compared to some other cities in the state.

Applicability and Exemptions

The sales tax in San Francisco applies to a broad range of goods and services, including retail sales, rentals, and leases. However, there are certain exemptions and special rules that businesses and consumers should be aware of.

- Food and Beverage: Prepared meals and beverages are generally subject to sales tax. However, groceries and certain non-prepared food items are exempt.

- Clothing and Shoes: Sales of clothing and footwear items priced under $100 are exempt from sales tax in California, including San Francisco.

- Prescription Drugs: Sales of prescription drugs are exempt from sales tax, but over-the-counter medications are taxable.

- Construction Materials: Materials used for construction, repair, or improvement of real property are generally exempt if purchased by the contractor. However, if sold to the homeowner, they are taxable.

There are also specific rules for online sales, out-of-state sellers, and drop-shipping, which businesses should carefully consider to ensure compliance.

Impact on Businesses

For businesses operating in San Francisco, the sales tax has a significant impact on their financial operations and overall profitability. Here are some key considerations:

Revenue Generation

The sales tax is a substantial source of revenue for businesses, especially those with a strong presence in the city. By collecting and remitting sales tax, businesses contribute to the economic growth and development of San Francisco.

Compliance and Reporting

Businesses are responsible for accurately calculating and remitting sales tax to the appropriate tax authorities. This involves understanding the tax rates, keeping detailed records of sales, and filing periodic tax returns. Non-compliance can result in penalties and legal consequences.

Pricing Strategies

The sales tax rate can influence pricing strategies for businesses. Some companies may choose to absorb the tax in their pricing, while others may pass it on to the consumer. The decision often depends on the industry, competitive landscape, and consumer expectations.

Technology and Automation

With the complexity of sales tax regulations, many businesses are turning to sales tax automation software to streamline their tax compliance processes. These tools can automate tax calculations, filing, and remittance, reducing the risk of errors and saving time and resources.

Impact on Consumers

The sales tax in San Francisco also has a direct impact on consumers, affecting their purchasing decisions and overall spending power.

Cost of Living

The sales tax adds to the cost of living in San Francisco, especially for those with higher consumption patterns. While the tax rate may not be as noticeable on smaller purchases, it can significantly impact larger purchases, such as vehicles, electronics, or home appliances.

Budgeting and Financial Planning

Consumers must factor in the sales tax when budgeting for purchases. This is particularly important for large, planned purchases, as the tax can add a substantial amount to the final cost. Financial planners often advise clients to consider sales tax when creating budgets and financial plans.

Online Shopping

With the rise of e-commerce, consumers now have the option to shop online, often from out-of-state sellers. In such cases, the sales tax rules can become more complex, with potential differences in tax rates and compliance requirements. Consumers should be aware of these nuances to ensure they are paying the correct amount of tax.

Sales Tax Trends and Future Outlook

The sales tax landscape in San Francisco, and California as a whole, is dynamic and subject to change. Here are some key trends and potential future developments:

Technological Advancements

The use of technology, such as automation and AI, is expected to continue growing in the sales tax domain. This can lead to more efficient tax compliance processes and potentially reduce the administrative burden on businesses and consumers.

E-Commerce Growth

The rise of e-commerce is a significant trend, with more consumers turning to online shopping. This presents challenges and opportunities for tax authorities and businesses alike. The state of California is actively working on streamlining tax regulations for online sales to ensure fair tax collection and compliance.

Tax Policy Changes

Sales tax rates and policies are subject to change based on economic conditions, political factors, and public opinion. While it’s challenging to predict future policy changes, staying informed about tax reforms and proposals is essential for businesses and consumers to adapt their strategies accordingly.

Conclusion

The sales tax in San Francisco is a complex yet critical component of the city’s economic landscape. It impacts both businesses and consumers, influencing revenue generation, pricing strategies, and purchasing decisions. By understanding the sales tax structure, businesses can ensure compliance and leverage opportunities, while consumers can make informed choices and plan their finances effectively.

As San Francisco continues to thrive as a global hub of innovation and economic activity, the sales tax will remain a vital part of its financial ecosystem, supporting the city's growth and development.

What is the current sales tax rate in San Francisco for 2023?

+As of January 1, 2023, the combined sales tax rate in San Francisco is 9.25%, which includes the state tax rate of 7.25%, the county tax rate of 0.9%, and the city tax rate of 1.1%.

Are there any special tax rates for certain industries or products in San Francisco?

+Yes, there are specific tax rates for certain industries and products in San Francisco. For example, the tax rate for utilities is 8.25%, and the tax rate for hotel occupancy is 14%. Additionally, certain products like alcohol and tobacco have their own specific tax rates.

How often do sales tax rates change in San Francisco?

+Sales tax rates in San Francisco can change annually, typically effective from January 1 of each year. However, in some cases, tax rates may be adjusted mid-year due to special circumstances or legislative changes.