Kansas Income Tax Brackets

Understanding income tax brackets is crucial for individuals and businesses, as they determine the rate at which your income is taxed. In this article, we will delve into the Kansas income tax brackets, exploring the different rates, thresholds, and how they impact taxpayers in the Sunflower State. By the end of this comprehensive guide, you'll have a clear understanding of the Kansas tax system and its implications.

Unraveling the Kansas Income Tax Structure

The state of Kansas operates a progressive income tax system, meaning that higher incomes are taxed at increasingly higher rates. This structure aims to ensure fairness and balance in the tax burden across different income levels. Let’s break down the key components of the Kansas income tax brackets.

Tax Rates and Brackets for Individuals

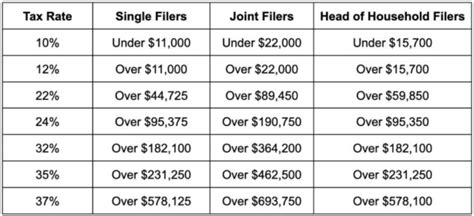

As of the 2023 tax year, Kansas has five income tax brackets for individuals, each with its own tax rate. These brackets are as follows:

- Tax Bracket 1: 3.1% - Applicable to taxable income between 0 and 15,000.

- Tax Bracket 2: 5.25% - For taxable income between 15,001 and 30,000.

- Tax Bracket 3: 5.7% - Applicable to incomes ranging from 30,001 to 50,000.

- Tax Bracket 4: 6.25% - This bracket covers taxable income between 50,001 and 75,000.

- Tax Bracket 5: 6.5% - The highest income tax rate, applicable to taxable income above $75,000.

These tax rates are subject to change, so it's essential to refer to the latest tax guidelines provided by the Kansas Department of Revenue for the most accurate and up-to-date information.

Example: Understanding Tax Brackets with Real Numbers

Let’s illustrate how these tax brackets work with a practical example. Suppose we have an individual, Jane, with a taxable income of $45,000 for the 2023 tax year. Here’s how her income would be taxed under the Kansas system:

| Tax Bracket | Taxable Income Range | Tax Rate | Tax Calculation |

|---|---|---|---|

| Bracket 1 | $0 - $15,000 | 3.1% | $0 - $465 |

| Bracket 2 | $15,001 - $30,000 | 5.25% | $465 - $787.50 |

| Bracket 3 | $30,001 - $50,000 | 5.7% | $787.50 - $1,890 |

| Bracket 4 | $50,001 - $75,000 | 6.25% | $1,890 - $2,812.50 |

| Bracket 5 | Above $75,000 | 6.5% | No income falls into this bracket for Jane. |

| Total Tax Liability | $5,955 | ||

As you can see, Jane's income is taxed at different rates depending on which bracket her income falls into. This progressive tax system ensures that individuals with higher incomes contribute a larger portion of their earnings to the state's revenue.

Kansas Income Tax Brackets for Married Filing Jointly

For married couples filing their taxes jointly, the income tax brackets are slightly different. Here’s an overview of the tax rates and brackets for this filing status:

- Tax Bracket 1: 3.1% - Applicable to taxable income between $0 and $30,000.

- Tax Bracket 2: 5.25% - For taxable income between $30,001 and $60,000.

- Tax Bracket 3: 5.7% - Applicable to incomes ranging from $60,001 to $100,000.

- Tax Bracket 4: 6.25% - This bracket covers taxable income between $100,001 and $150,000.

- Tax Bracket 5: 6.5% - The highest income tax rate, applicable to taxable income above $150,000.

Again, it's important to note that these tax rates and brackets may change over time, so it's advisable to consult the official Kansas tax guidelines for the most current information.

Tax Breaks and Deductions

Kansas offers various tax breaks and deductions to alleviate the tax burden on its residents. Some common deductions include:

- Standard Deduction - Taxpayers can opt for a standard deduction, which provides a fixed amount of tax relief based on their filing status. This simplifies the tax filing process for many individuals.

- Itemized Deductions - For those with significant expenses or specific circumstances, itemizing deductions can reduce their taxable income. This includes deductions for medical expenses, state and local taxes, charitable contributions, and more.

- Personal Exemptions - Kansas allows personal exemptions, which reduce taxable income based on the number of dependents a taxpayer has. This helps lower-income families manage their tax obligations.

Additionally, Kansas offers tax credits for specific circumstances, such as the Earned Income Tax Credit (EITC) for low- to moderate-income workers and families, and tax incentives for businesses and certain industries.

Filing Your Kansas Income Taxes

When it comes to filing your Kansas income taxes, there are a few key considerations to keep in mind:

Filing Deadlines

The deadline for filing your Kansas income tax return typically aligns with the federal tax filing deadline. For the 2023 tax year, the deadline is April 15, 2024. However, it’s crucial to check for any updates or extensions announced by the Kansas Department of Revenue, as these deadlines can change due to various factors.

Online Filing Options

Kansas provides several convenient online filing options, making the tax filing process more accessible and efficient. You can choose from authorized e-file providers or utilize the Kansas Department of Revenue’s online filing system. These options often offer real-time updates on your refund status and can streamline the entire filing process.

Paper Returns and Assistance

If you prefer filing a paper return, you can download the necessary forms from the Kansas Department of Revenue’s website or request them by mail. Additionally, the department provides resources and assistance for taxpayers who need help with their returns. This includes taxpayer assistance centers, online resources, and helplines to guide you through the filing process.

Exploring the Impact and Implications

The Kansas income tax brackets have a significant impact on the state’s economy and its residents’ financial well-being. Here are some key considerations and implications to explore further:

Progressive Tax System and Economic Fairness

The progressive nature of the Kansas income tax system aims to promote economic fairness. By taxing higher incomes at higher rates, the state ensures that those with greater financial means contribute a larger share of their income to support public services and infrastructure. This approach helps distribute the tax burden more equitably across different income levels.

Impact on Personal Finances

For individuals and families, understanding the Kansas income tax brackets is crucial for financial planning. By knowing which bracket your income falls into, you can estimate your tax liability and make informed decisions about savings, investments, and budgeting. Additionally, being aware of tax breaks and deductions can help you optimize your tax returns and potentially reduce your overall tax burden.

State Revenue and Public Services

The revenue generated through the Kansas income tax system plays a vital role in funding essential public services. These funds support education, healthcare, infrastructure development, and various social programs. The tax brackets and rates, therefore, directly influence the state’s ability to provide these services and maintain a high quality of life for its residents.

Comparative Analysis with Other States

Comparing Kansas’ income tax brackets with those of other states provides valuable insights into the overall tax landscape. While Kansas’ progressive tax system is similar to many other states, the specific rates and brackets can vary significantly. This analysis allows individuals and businesses to make informed decisions about their tax obligations and potential relocation opportunities.

Future Trends and Potential Changes

The Kansas income tax system is subject to ongoing evaluation and potential reforms. Factors such as economic conditions, political priorities, and public opinion can influence future changes to the tax brackets and rates. Staying informed about these potential changes is essential for individuals and businesses to adapt their financial strategies accordingly.

FAQs

Are there any income tax brackets for businesses in Kansas?

+Yes, Kansas imposes a corporate income tax on businesses operating within the state. The tax rates for corporations are different from those for individuals. As of the 2023 tax year, the corporate income tax rate in Kansas is 4.0%.

How often are the Kansas income tax brackets updated or revised?

+The Kansas income tax brackets are typically revised annually to account for inflation and other economic factors. These revisions are made by the Kansas Legislature and signed into law by the Governor. It’s essential to stay updated with the latest tax guidelines to ensure accuracy in your tax calculations.

Can I use tax software to calculate my Kansas income tax liability?

+Absolutely! Tax software can simplify the process of calculating your Kansas income tax liability. These programs often have built-in tools to help you determine which tax bracket your income falls into and estimate your tax obligation accurately. Additionally, they can assist with filing your return online.

Are there any special tax considerations for remote workers in Kansas?

+Yes, remote workers in Kansas should be aware of the state’s income tax laws. Kansas follows the “convenience of the employer” rule, which means that if your employer considers Kansas your home state, you may be subject to Kansas income tax, even if you work remotely from another state. It’s important to consult with a tax professional to understand your specific situation.

How can I stay updated with the latest Kansas tax information and guidelines?

+The best way to stay informed about Kansas tax laws and guidelines is to regularly visit the Kansas Department of Revenue’s official website. They provide the most up-to-date information, including tax rates, brackets, deadlines, and any recent changes or updates. Additionally, subscribing to their newsletters or following their social media accounts can ensure you receive timely tax-related notifications.