Does Government Agencies Pay Taxes

The taxation landscape for government agencies is a complex and intriguing aspect of public finance, raising questions about the interplay between governmental entities and the revenue collection systems they oversee. This article aims to shed light on this often-overlooked aspect, providing a comprehensive understanding of how government agencies navigate the tax system.

Understanding the Role of Government Agencies in Taxation

Government agencies, although integral to the implementation and regulation of various tax policies, are not exempt from their own financial obligations. These entities, which include departments, commissions, and boards, often have a dual role: enforcing tax laws and contributing to the public treasury through their own financial activities.

The relationship between government agencies and taxation is multifaceted. While they are instrumental in tax administration, ensuring compliance and collecting revenue, they are also subject to certain taxes themselves. This dual role can lead to unique scenarios where agencies are both enforcers and taxpayers.

Taxation of Government Agencies: An Overview

The taxation of government agencies varies significantly across jurisdictions and depends on several factors, including the type of agency, its functions, and the specific tax laws in place.

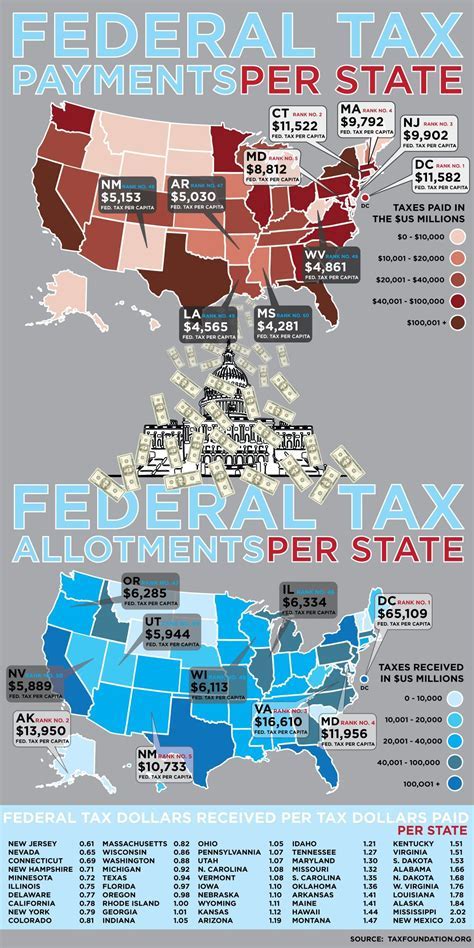

Federal Government Agencies

At the federal level, agencies are generally exempt from most federal taxes, including income tax. This exemption is a result of the principle of sovereign immunity, which holds that the government cannot tax itself. However, this does not mean that federal agencies are completely immune to all forms of taxation.

Federal agencies may still be subject to certain excise taxes, such as those on fuel or communication services. They might also face property taxes if they own or lease property in certain jurisdictions. Additionally, agencies may need to pay employment taxes for their employees, including Social Security and Medicare taxes.

| Tax Type | Applicability to Federal Agencies |

|---|---|

| Income Tax | Generally Exempt |

| Excise Taxes | Varies by Type (e.g., Fuel, Communication) |

| Property Taxes | May Apply if Own or Lease Property |

| Employment Taxes | Usually Applicable |

State and Local Government Agencies

The taxation of state and local government agencies is even more diverse. While some states may follow the federal model and exempt their agencies from most taxes, others may subject them to various forms of taxation.

For instance, some states impose a form of income tax on their agencies, often to support specific programs or to ensure that agencies contribute to the general fund. This can include a flat rate, a percentage of revenue, or a profit-based tax. State and local agencies may also face sales taxes, property taxes, or even payroll taxes.

| Tax Type | Potential Applicability to State/Local Agencies |

|---|---|

| Income Tax | Varies by State (Some States Exempt, Others Tax) |

| Sales Tax | May Apply to Agency Sales |

| Property Tax | Usually Applicable if Agency Owns Property |

| Payroll Taxes | Commonly Applicable |

Unique Tax Challenges for Government Agencies

Navigating the tax system can present unique challenges for government agencies. They must understand not only their tax obligations but also their rights and potential exemptions. This often requires a delicate balance, ensuring that agencies fulfill their financial responsibilities without compromising their public service mission.

Exemptions and Benefits

Government agencies often benefit from various tax exemptions and incentives. These can include exemptions from sales tax on purchases, property tax abatements, and income tax breaks for specific activities or revenue sources. For instance, agencies might be exempt from paying sales tax on vehicles or office equipment.

Agencies also have access to tax incentives designed to encourage specific activities. This could include tax credits for research and development, incentives for energy-efficient practices, or tax breaks for community development initiatives.

Compliance and Reporting

Despite these exemptions and benefits, agencies must still adhere to strict tax compliance and reporting requirements. This includes accurate record-keeping, timely filing of tax returns, and compliance with all applicable tax laws and regulations. Non-compliance can lead to significant penalties and legal issues.

The Future of Taxation for Government Agencies

The taxation landscape for government agencies is likely to continue evolving, driven by changing economic conditions, political priorities, and legal interpretations. As governments seek to balance their budgets and fund public services, the tax obligations of their agencies may become a more prominent issue.

The increasing complexity of the tax system and the growing importance of tax revenue in public finance make it crucial for government agencies to stay informed about their tax obligations. This includes understanding not only the current tax laws but also the potential impact of proposed legislative changes and court rulings.

Potential Changes and Impacts

Potential changes in the taxation of government agencies could include the introduction of new taxes, the expansion of existing taxes to cover more agency activities, or the reduction or elimination of certain exemptions. These changes could have significant financial implications for agencies, affecting their budgets and operations.

For instance, if a state were to introduce a new tax on government agency revenue, it could significantly impact the agency's financial health and its ability to deliver services. Alternatively, the removal of a sales tax exemption could increase the cost of agency operations, requiring adjustments in budgeting and spending.

Are federal government agencies completely exempt from all taxes?

+While federal agencies are generally exempt from federal income tax due to sovereign immunity, they may still be subject to other types of taxes, such as excise taxes, property taxes, and employment taxes.

Do state and local government agencies pay income tax?

+The taxation of state and local agencies varies by jurisdiction. Some states exempt their agencies from income tax, while others impose a form of income tax to support general funds or specific programs.

What tax incentives are available to government agencies?

+Agencies may benefit from various tax incentives, including exemptions from sales tax on purchases, property tax abatements, and tax credits for specific activities like research and development or community development initiatives.