Washington Dc City Tax Rate

The city of Washington, D.C., officially known as the District of Columbia, operates under a unique tax structure due to its status as a federal district and the capital of the United States. Understanding the city's tax rates is essential for residents, businesses, and visitors alike, as it directly impacts their financial obligations and planning.

Understanding Washington D.C.’s Tax Landscape

The District of Columbia, or D.C. for short, has its own tax code and is responsible for collecting and administering taxes within its boundaries. This includes income taxes, sales taxes, property taxes, and various other levies. The city’s tax rates can vary based on factors such as income levels, property values, and the nature of business operations.

One distinctive feature of D.C.'s tax system is its progressive income tax structure. This means that as taxable income increases, so does the tax rate applied to that income. The District offers multiple tax brackets, ensuring that those with higher incomes contribute a larger proportion of their earnings to the city's revenue.

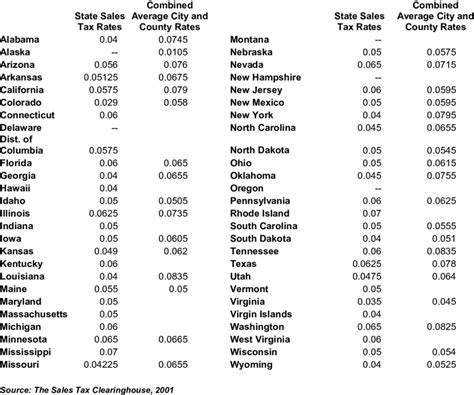

Additionally, D.C. imposes a sales and use tax on most goods and services sold or leased within its limits. This tax is levied on both residents and visitors, making it an important revenue stream for the city. The sales tax rate is uniform across the District, but there are certain exemptions and special provisions for specific types of goods and services.

Income Tax Rates in Washington D.C.

For the fiscal year 2023, Washington D.C. has established the following income tax rates:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 4.00% |

| $10,001 - $40,000 | 6.00% |

| $40,001 - $60,000 | 8.25% |

| $60,001 and above | 8.75% |

These rates are applicable to both individuals and married couples filing jointly. However, it's important to note that the District offers various deductions, credits, and exemptions that can reduce the overall tax liability. For instance, D.C. residents can claim deductions for federal income taxes paid, certain business expenses, and contributions to retirement accounts.

Additionally, the city provides tax credits for low- and moderate-income individuals and families, as well as for those who invest in D.C.'s Economic Development Zones. These credits can significantly reduce the tax burden for eligible taxpayers.

Sales and Use Tax in Washington D.C.

Washington D.C.’s sales and use tax rate for the current fiscal year is a flat 6%. This means that when you purchase goods or services within the District, you will generally be charged an additional 6% on top of the listed price. However, certain items are exempt from this tax, such as most groceries, prescription drugs, and residential utilities.

The District also imposes a transient room tax on accommodations, which is an additional levy on top of the sales tax. This tax is applied to the rent of rooms or space in hotels, motels, or other transient accommodations. The rate varies based on the type of accommodation and can range from 8% to 14.8%.

Furthermore, D.C. has implemented a plastic bag tax, which aims to reduce the environmental impact of single-use plastic bags. Retailers are required to charge customers 5 cents for each plastic bag provided at the point of sale. This tax encourages the use of reusable bags and promotes sustainability.

Property Taxes in Washington D.C.

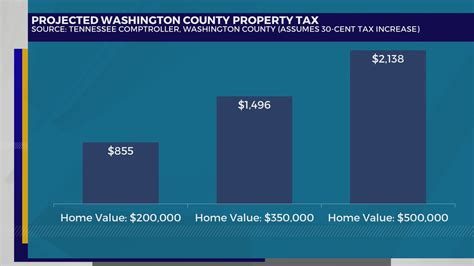

Property taxes in Washington D.C. are assessed based on the value of real estate properties, including land and buildings. The District uses a two-step process to calculate property taxes. First, the assessor determines the property’s assessed value, which is typically a percentage of its fair market value. Then, the tax rate is applied to this assessed value to calculate the tax liability.

The tax rate for residential properties in D.C. is 0.85% of the assessed value, while the rate for commercial properties is 1.45%. However, the District offers several tax relief programs for eligible homeowners, including a homestead deduction, which reduces the taxable value of a homeowner's primary residence.

Additionally, D.C. provides property tax credits for low-income homeowners and certain tax exemptions for senior citizens and disabled individuals. These programs aim to make homeownership more affordable and sustainable for specific segments of the population.

Conclusion: Navigating Washington D.C.’s Tax Landscape

Washington D.C.’s tax system, while comprehensive and complex, is designed to support the city’s operations and provide essential services to its residents. From income taxes to sales taxes and property taxes, each component plays a crucial role in funding infrastructure, education, healthcare, and other public services.

As a resident or business owner in D.C., staying informed about the city's tax rates and regulations is essential for compliance and financial planning. It's advisable to consult with tax professionals or the District's official tax authorities for accurate and up-to-date information. Understanding the tax landscape empowers individuals and businesses to make informed decisions and contribute effectively to the vibrant community of Washington D.C.

Are there any tax incentives for small businesses in Washington D.C.?

+Yes, the District offers a range of tax incentives and programs to support small businesses. These include tax credits for job creation, investment in targeted industries, and certain business expenses. Additionally, the city provides tax abatement programs for businesses that locate or expand in specific areas.

How often are tax rates updated in Washington D.C.?

+Tax rates in Washington D.C. are typically updated annually. The city’s government reviews and adjusts tax rates based on economic factors, budget requirements, and legislative decisions. It’s important to stay informed about these changes to ensure compliance and financial planning.

Are there any special tax considerations for remote workers in D.C.?

+Yes, remote workers who are not residents of Washington D.C. but work for D.C.-based companies may be subject to D.C. income tax. This situation is known as “remote worker taxation.” The District has specific guidelines and rules regarding the taxation of remote workers, and it’s advisable to consult with a tax professional to understand your specific obligations.