8332 Tax Form

The 8332 tax form, officially known as the "Child Support Payments" form, is a critical document for divorced or separated parents in the United States who are navigating the complex world of child custody and tax obligations. This form plays a pivotal role in determining which parent can claim a dependent child as a tax exemption, a crucial decision that can significantly impact the financial landscape for both parents.

Introduced by the Internal Revenue Service (IRS), the 8332 form is a legal instrument that allows parents to release their claim to the dependency exemption for a child, transferring this right to the other parent. This transfer is not a mere administrative task but a strategic move with profound financial implications, affecting the tax liabilities and refunds of both parties.

Understanding the 8332 Form

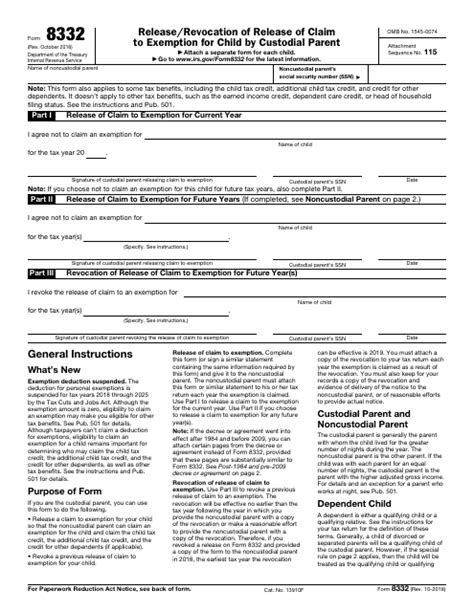

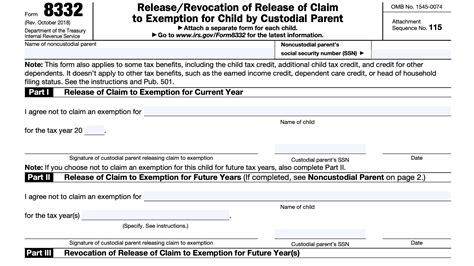

The 8332 form is a relatively straightforward document, designed to be completed by the custodial parent or the parent with primary custody of the child. By signing and submitting this form, the custodial parent is effectively releasing their right to claim the child as a dependent on their tax return. This action is not taken lightly, as it involves a conscious decision to relinquish a significant tax benefit.

The form requires specific information, including the names and Social Security numbers of both the child and the parent claiming the exemption. It also needs to specify the tax year for which the exemption is being released and the number of years the exemption is being transferred. This level of detail ensures that the IRS can accurately process the transfer and apply it to the correct tax years.

Eligibility and Considerations

Not every parent is eligible to complete and file the 8332 form. The custodial parent must have the legal authority to make such a decision, and the transfer of the exemption must be done voluntarily. The form cannot be used to assign the exemption to a third party or to someone who is not the child's parent.

Furthermore, the transfer is not a permanent arrangement. It is specific to the tax year(s) indicated on the form and does not automatically renew. Therefore, if the non-custodial parent wishes to continue claiming the exemption in subsequent years, a new 8332 form must be filed for each additional year.

| Form Field | Details |

|---|---|

| Child's Name and SSN | Full legal name and Social Security Number of the dependent child. |

| Parent's Name and SSN | Full legal name and Social Security Number of the parent claiming the exemption. |

| Tax Year(s) | The specific tax year(s) for which the exemption is being released. Multiple years can be listed. |

| Number of Years | The number of consecutive years the exemption is being transferred. |

Implications and Benefits

The decision to transfer the dependency exemption via the 8332 form is often part of a broader tax and financial strategy. By relinquishing the exemption, the custodial parent is effectively allowing the non-custodial parent to claim a significant tax benefit, which can lead to a larger refund or a reduced tax liability. This can be particularly advantageous for the non-custodial parent, especially if they have a higher taxable income.

For the custodial parent, the decision to release the exemption is not solely a financial one. It can also be influenced by various factors, including the desire to foster a positive co-parenting relationship, the financial needs of the other parent, or the potential for the child to receive additional financial support.

Financial Considerations

From a financial perspective, the 8332 form can be a strategic tool for maximizing tax benefits. For instance, if the non-custodial parent has a higher income, they may fall into a higher tax bracket, making the dependency exemption more valuable. By claiming the exemption, they can reduce their taxable income, potentially resulting in a larger refund or a lower tax bill.

Conversely, for the custodial parent, releasing the exemption may mean a smaller tax refund or a higher tax liability. However, this decision can be part of a larger financial agreement, where the non-custodial parent agrees to increase child support payments or contribute more to the child's education or other expenses.

Legal and Tax Planning

The 8332 form is not just a tax document; it also has legal implications. It is often part of a larger child custody and support agreement, where the transfer of the dependency exemption is negotiated and agreed upon by both parents. This agreement can be incorporated into the divorce decree or a separate legal document.

From a tax planning perspective, the 8332 form provides a degree of flexibility and control. Parents can strategically decide which parent claims the exemption in a given year, based on their financial circumstances and tax obligations. This can be particularly beneficial when tax laws change or when one parent's financial situation undergoes significant fluctuations.

Future Planning and Adjustments

The transfer of the dependency exemption is not set in stone. While it is a legal and binding agreement for the specified tax year(s), parents can renegotiate and adjust their arrangements for future years. This flexibility allows parents to adapt their tax strategies as their financial situations evolve.

For instance, if the custodial parent's financial situation improves, they may choose to reclaim the dependency exemption in future years. Similarly, if the non-custodial parent's income decreases, they may agree to transfer the exemption back to the custodial parent, ensuring that the child's financial support remains a priority.

Can I transfer the dependency exemption to someone other than the child’s parent?

+No, the 8332 form is designed for use between the child’s parents only. It cannot be used to transfer the exemption to a third party or a non-parent.

What happens if I forget to file the 8332 form for a particular tax year?

+If you fail to file the 8332 form, the custodial parent will retain the right to claim the child as a dependent. To transfer the exemption for that tax year, you’ll need to file an amended return.

Can I transfer the exemption for only part of the year, such as a quarter or a semester?

+No, the 8332 form is designed for full tax years. If you need to adjust the exemption for a specific period, it’s best to consult with a tax professional for alternative solutions.