Setc Tax Credits

The SETC (Self-Employment Tax Credit) is a crucial incentive program designed to encourage and support individuals who choose the path of self-employment. In a world where traditional employment structures are transforming, this credit plays a pivotal role in fostering entrepreneurship and empowering individuals to pursue their business ventures.

Understanding the SETC: A Comprehensive Guide

The Self-Employment Tax Credit is a federal initiative that aims to reduce the tax burden on self-employed individuals, providing a financial boost during the initial stages of business development. It is an essential tool for those embarking on their entrepreneurial journey, offering much-needed support and resources.

In this comprehensive guide, we will delve into the intricacies of the SETC, exploring its eligibility criteria, application process, and the myriad benefits it offers. By understanding this credit, aspiring entrepreneurs can make informed decisions and maximize their potential for success.

Eligibility and Qualifications

The SETC is not a universal benefit; it is specifically tailored for certain categories of self-employed individuals. To be eligible, applicants must meet the following criteria:

- Individuals must operate as sole proprietors, independent contractors, or in a similar self-employed capacity.

- The business must be registered and compliant with all legal requirements in the jurisdiction where it operates.

- Eligible applicants must demonstrate a certain level of annual income derived from their self-employment activities. This threshold varies based on the tax year and the specific regulations in place.

- Additionally, applicants may need to provide documentation showcasing their business expenses, such as equipment purchases, office rental costs, or marketing expenses.

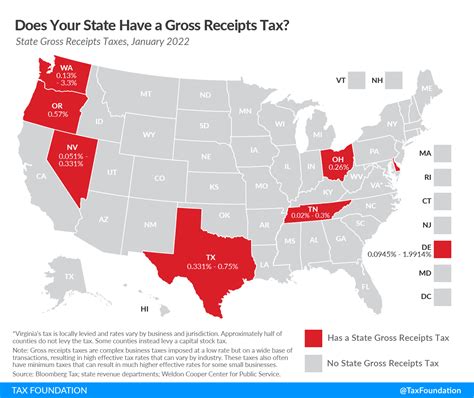

It is important to note that eligibility criteria can vary based on the jurisdiction and the specific program in place. For instance, some states or provinces may have additional requirements or offer variations of the SETC to cater to local business needs.

Application Process: A Step-by-Step Guide

Applying for the SETC involves a straightforward process, ensuring accessibility for all eligible applicants. Here’s a step-by-step breakdown:

- Research and Understand: Begin by thoroughly researching the SETC program in your region. Familiarize yourself with the eligibility criteria, application deadlines, and any specific documentation requirements.

- Gather Documentation: Collect all necessary documents, including business registration certificates, tax returns, and records of business expenses. Ensure that all information is accurate and up-to-date.

- Complete the Application Form: Download and fill out the official SETC application form, which can typically be found on the government's website or through local business support centers. Provide all required information, being meticulous and honest in your responses.

- Submit Your Application: Submit your completed application, along with the supporting documentation, through the designated channels. This can be done online, by mail, or in person, depending on the available options in your region.

- Wait for Processing: Once submitted, your application will undergo a review process. This typically takes a few weeks, during which you may be contacted for additional information or clarifications.

- Receive Your Decision: Upon completion of the review process, you will receive a decision regarding your application. If approved, you will be informed of the credit amount and any further steps required to claim the benefit.

It is crucial to stay organized and keep track of application deadlines to ensure a smooth and timely process. Additionally, being proactive in gathering the necessary documentation can expedite the application review, increasing the chances of a swift and positive decision.

Benefits and Impact of the SETC

The SETC offers a range of advantages to eligible self-employed individuals, providing much-needed financial support and resources to nurture their businesses. Here are some key benefits:

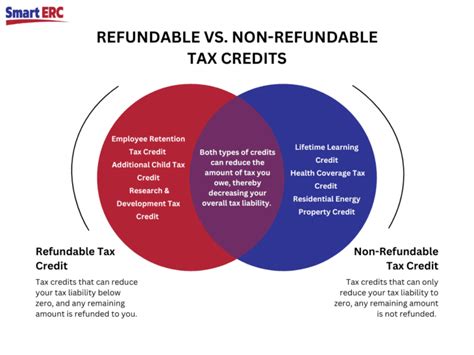

- Tax Relief: The primary purpose of the SETC is to provide tax relief, reducing the financial burden on self-employed individuals. This credit can significantly lower the tax liability, freeing up funds for business growth and expansion.

- Capital for Business Growth: The financial support received through the SETC can be reinvested into the business, allowing for the purchase of new equipment, hiring additional staff, or investing in marketing and advertising initiatives.

- Increased Business Stability: By alleviating financial pressures, the SETC contributes to the overall stability of the business. This stability fosters a more secure environment for business growth and long-term sustainability.

- Encouragement for Entrepreneurship: The SETC acts as an incentive for individuals to take the leap into self-employment. By offering financial support, it reduces the risks associated with starting a business, encouraging more people to pursue their entrepreneurial dreams.

- Contribution to Local Economy: The growth of self-employed individuals and their businesses has a positive impact on the local economy. The SETC indirectly contributes to job creation, increased tax revenue, and the overall economic vitality of the region.

The SETC is a powerful tool that empowers individuals to pursue their business aspirations. By understanding its benefits and following the application process, aspiring entrepreneurs can unlock a wealth of opportunities and contribute to the growth of the local business ecosystem.

Real-Life Success Stories

The impact of the SETC is best illustrated through the stories of those who have successfully utilized it to propel their businesses forward. Here are two inspiring success stories:

Case Study 1: Emma’s Floral Boutique

Emma, a passionate florist, decided to turn her hobby into a thriving business. With the help of the SETC, she was able to secure the necessary funding to establish her floral boutique. The credit allowed her to purchase high-quality flowers, hire a part-time assistant, and invest in marketing campaigns. Within a year, Emma’s Floral Boutique became a go-to destination for special occasions, and her business expanded rapidly.

Case Study 2: Michael’s Tech Solutions

Michael, a tech-savvy entrepreneur, had a vision to provide innovative IT solutions to small businesses. However, starting his venture was a challenge due to limited funds. The SETC provided him with the financial boost he needed to develop his business plan, purchase essential equipment, and hire a small team. Today, Michael’s Tech Solutions is a renowned IT service provider, offering cutting-edge solutions to businesses across the region.

These success stories demonstrate the transformative power of the SETC, showcasing how it can turn entrepreneurial dreams into reality.

The Future of Self-Employment and SETC

As the world of work continues to evolve, the role of self-employment and initiatives like the SETC become increasingly vital. Here’s a glimpse into the future of self-employment and the potential impact of the SETC:

- Growing Trend of Self-Employment: With the rise of remote work and digital entrepreneurship, self-employment is expected to grow. The SETC will continue to play a pivotal role in supporting this trend, providing financial incentives and resources to aspiring entrepreneurs.

- Adaptability and Innovation: As business landscapes change, the SETC may adapt to meet the evolving needs of self-employed individuals. This could involve expanding eligibility criteria, introducing new incentives, or providing additional support for specific industries.

- Collaboration and Networking: The SETC can foster a sense of community among self-employed individuals. By connecting entrepreneurs through support programs and networking events, the credit can encourage collaboration, knowledge sharing, and the development of innovative business solutions.

- Long-Term Sustainability: With the support of the SETC, self-employed individuals can establish stable and sustainable businesses. This long-term sustainability contributes to the overall economic health and resilience of communities, making them less vulnerable to economic downturns.

The future of self-employment looks promising, and the SETC will undoubtedly continue to be a driving force behind this growth. By providing financial support, encouraging entrepreneurship, and fostering collaboration, the SETC contributes to a thriving business ecosystem.

Maximizing the Benefits: Tips and Strategies

To make the most of the SETC, here are some valuable tips and strategies for self-employed individuals:

- Stay Informed: Keep yourself updated on the latest regulations and changes to the SETC program. This ensures that you can take advantage of any new benefits or incentives introduced.

- Plan and Budget: Create a comprehensive business plan and budget to effectively utilize the SETC funds. Allocate resources wisely, prioritizing areas that will have the most significant impact on your business growth.

- Seek Professional Advice: Consult with tax professionals or business advisors who specialize in self-employment. They can provide tailored guidance on maximizing the benefits of the SETC and ensuring compliance with tax regulations.

- Network and Collaborate: Engage with other self-employed individuals and entrepreneurs. Networking events, online forums, and industry associations can provide valuable insights, support, and potential business opportunities.

- Continuous Learning: Stay updated with industry trends and best practices. Invest in your professional development by attending workshops, webinars, or courses that enhance your skills and knowledge.

By implementing these strategies, self-employed individuals can optimize the benefits of the SETC, fostering the growth and success of their businesses.

Conclusion: Empowering Self-Employment

The SETC is a powerful tool that empowers individuals to pursue their entrepreneurial dreams. By offering financial support, tax relief, and resources, it creates a supportive environment for self-employed individuals to thrive. As the world embraces the changing dynamics of work, initiatives like the SETC become essential in fostering innovation, collaboration, and economic growth.

For aspiring entrepreneurs, the SETC serves as a beacon of hope, providing the necessary resources to turn ideas into successful businesses. With the right knowledge, preparation, and strategies, the SETC can unlock a world of opportunities, contributing to a vibrant and thriving business landscape.

Frequently Asked Questions (FAQ)

How often can I apply for the SETC?

+

You can typically apply for the SETC annually, provided you meet the eligibility criteria each year. The application process and deadlines may vary based on your jurisdiction, so it’s essential to stay updated with the latest regulations.

Are there any income restrictions for SETC eligibility?

+

Yes, there are income restrictions in place to ensure that the SETC benefits those who need it most. The specific income thresholds vary based on the tax year and your region. It’s advisable to consult the official guidelines or seek professional advice to determine your eligibility.

Can I use the SETC funds for personal expenses?

+

No, the SETC funds are specifically allocated for business-related expenses. Personal expenses are not eligible for this credit. It’s crucial to use the funds wisely and in accordance with the program guidelines to avoid any complications.

How long does the SETC application process typically take?

+

The duration of the SETC application process can vary based on several factors, including the volume of applications, the complexity of your business, and the efficiency of the processing team. On average, it can take several weeks to receive a decision. However, staying organized and providing all necessary documentation can expedite the process.

What happens if I don’t use all the SETC funds in a year?

+

Any unused SETC funds cannot be carried over to the following year. It’s important to plan and utilize the credit effectively to maximize its benefits. If you have surplus funds, consider reinvesting them into your business or exploring other eligible expenses to ensure you make the most of the credit.