Tax At Las Vegas

Welcome to the ultimate guide on navigating the complex world of taxation in the vibrant city of Las Vegas. As one of the most iconic destinations in the United States, Las Vegas offers a unique blend of entertainment, tourism, and business opportunities. However, with its bustling economy and diverse range of industries, understanding the tax landscape is crucial for individuals and businesses alike.

In this comprehensive article, we will delve into the intricacies of tax laws and regulations specific to Las Vegas, providing you with the knowledge and insights needed to navigate this dynamic city's tax environment. From personal income taxes to business taxation, real estate considerations, and unique tax incentives, we will cover it all.

Taxation in Las Vegas: An Overview

Las Vegas, often referred to as Sin City, boasts a vibrant economy driven by tourism, hospitality, gaming, and a thriving business community. The city's tax system is designed to support these industries while ensuring compliance with state and federal regulations. Let's explore the key aspects of taxation in Las Vegas.

Personal Income Tax

For residents and individuals earning income in Las Vegas, understanding personal income tax is essential. Nevada, the state in which Las Vegas is located, is one of the seven states in the U.S. with no personal income tax. This means that individuals do not pay state income tax on their earnings, which can be a significant advantage for those seeking tax-friendly jurisdictions.

However, it's important to note that federal income tax still applies to residents of Las Vegas. The Internal Revenue Service (IRS) imposes federal income tax on all U.S. citizens and residents, and individuals are required to file annual tax returns and pay their fair share. The tax rates and brackets vary based on income levels and filing status.

| Income Range | Tax Rate |

|---|---|

| $0 - $9,950 | 10% |

| $9,951 - $40,525 | 12% |

| $40,526 - $86,375 | 22% |

| $86,376 - $164,925 | 24% |

| Above $164,925 | 28% - 37% |

These tax rates are applicable for the 2023 tax year and may be subject to changes in future years. It's crucial for individuals to stay informed about any updates to tax laws and consult professional tax advisors for accurate guidance.

Business Taxation in Las Vegas

Las Vegas is a hub for businesses of all sizes and industries. The city's tax system provides a competitive environment for companies, offering various tax incentives and a relatively low tax burden compared to other states.

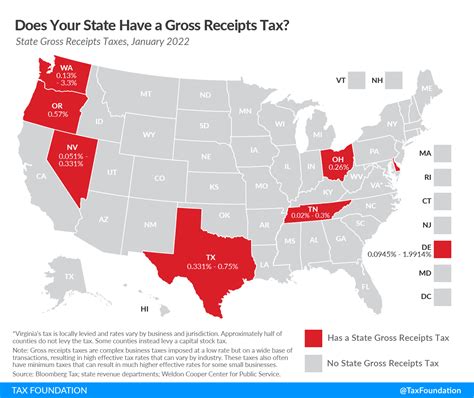

Nevada's corporate income tax rate is set at 6.85%, which is lower than the national average. This tax rate applies to C-corporations and S-corporations, while sole proprietorships and partnerships are not subject to corporate income tax. However, these entities may be required to pay other taxes, such as payroll taxes and sales taxes.

| Business Entity | Taxation |

|---|---|

| C-Corporations | 6.85% corporate income tax |

| S-Corporations | 6.85% corporate income tax |

| Sole Proprietorships | No corporate income tax |

| Partnerships | No corporate income tax |

In addition to corporate income tax, businesses in Las Vegas are subject to various other taxes, including:

- Sales and Use Tax: Nevada imposes a 6.85% sales tax rate on most goods and services. This tax is collected by businesses and remitted to the state.

- Payroll Taxes: Employers are responsible for withholding and paying federal and state payroll taxes, including Social Security, Medicare, and federal unemployment taxes.

- Property Tax: Real and personal property in Las Vegas is subject to property tax, which is assessed and collected by local governments.

Businesses should carefully consider the tax implications of their operations and consult tax professionals to ensure compliance and optimize their tax strategies.

Real Estate Taxation in Las Vegas

Las Vegas has a thriving real estate market, attracting investors and homeowners alike. Understanding the tax implications of owning property in this dynamic city is crucial for both personal and investment purposes.

Property Taxes

Property taxes in Las Vegas are assessed based on the value of the property and are used to fund local government services, including schools, infrastructure, and public safety. The tax rate varies depending on the county in which the property is located.

| County | Property Tax Rate |

|---|---|

| Clark County | 1.15% - 1.35% (varies by jurisdiction) |

| North Las Vegas | 1.17% - 1.37% |

| Henderson | 1.20% - 1.40% |

It's important to note that property tax rates may change annually, and property owners are responsible for paying their assessed taxes. Failure to pay property taxes can result in penalties and even foreclosure.

Capital Gains Tax on Real Estate Sales

When selling a property in Las Vegas, individuals may be subject to capital gains tax on the profit made from the sale. The federal capital gains tax rate depends on the individual's income tax bracket and the holding period of the property. Long-term capital gains, held for over one year, are generally taxed at lower rates than short-term gains.

| Income Tax Bracket | Capital Gains Tax Rate |

|---|---|

| 10% - 15% Bracket | 0% |

| 25% - 35% Bracket | 15% |

| Above 35% Bracket | 20% |

Additionally, Nevada does not impose a state-level capital gains tax, making it an attractive jurisdiction for real estate investors.

Unique Tax Incentives in Las Vegas

Las Vegas offers a range of tax incentives to attract businesses and promote economic growth. These incentives can significantly reduce the tax burden for eligible businesses and provide opportunities for expansion and job creation.

Nevada's Enterprise Zone Program

The Nevada Enterprise Zone (EZ) Program is designed to encourage economic development and job creation in designated areas of the state. Businesses operating within these zones may be eligible for various tax benefits, including:

- Sales and Use Tax Abatement: Qualified businesses can receive a partial or full abatement of sales and use tax on certain purchases.

- Employment Tax Credits: Businesses may be eligible for tax credits based on the number of jobs created and the wages paid to employees.

- Property Tax Abatement: In some cases, businesses may qualify for reduced property tax rates.

To take advantage of these incentives, businesses must meet specific criteria and operate within designated enterprise zones. Consulting with tax advisors and local economic development offices can provide valuable insights into the eligibility requirements and potential benefits.

Research and Development Tax Credits

Nevada offers tax credits for research and development activities conducted within the state. Businesses engaged in eligible R&D projects may be entitled to a tax credit of up to 15% of qualified research expenses. This incentive aims to encourage innovation and technological advancements.

To qualify for the research and development tax credit, businesses must meet specific criteria and maintain proper documentation of their research activities. Consulting a tax professional is recommended to ensure compliance and maximize the benefits of this incentive.

Navigating Tax Compliance in Las Vegas

With a complex tax landscape, ensuring compliance with tax laws and regulations is crucial for individuals and businesses in Las Vegas. Here are some key considerations for maintaining tax compliance:

- Stay Informed: Keep up-to-date with tax law changes and updates. Subscribe to relevant newsletters, follow tax authorities on social media, and consult trusted sources for accurate information.

- Hire a Professional: Engaging the services of a qualified tax advisor or accountant can provide invaluable guidance and ensure compliance with complex tax regulations. They can help with tax planning, filing, and representation in case of audits.

- Keep Records: Maintain organized and accurate financial records. Proper record-keeping is essential for tax purposes and can simplify the tax preparation process.

- File Timely: Meet all tax filing deadlines to avoid penalties and interest. Mark your calendar with important tax dates and set reminders to ensure timely submissions.

- Understand Tax Forms: Familiarize yourself with the tax forms relevant to your situation. Whether it's personal income tax returns or business tax filings, understanding the requirements and completing them accurately is crucial.

Conclusion: Embracing the Tax Opportunities in Las Vegas

Las Vegas offers a unique tax environment with its absence of personal income tax and a range of business incentives. By understanding the tax landscape and taking advantage of the available opportunities, individuals and businesses can thrive in this dynamic city.

Whether you're a resident, a business owner, or an investor, seeking professional tax advice and staying informed about tax regulations is essential. With the right strategies and compliance, you can navigate the tax landscape of Las Vegas successfully and unlock the city's economic potential.

How often do tax laws change in Las Vegas and Nevada?

+Tax laws can change annually or even more frequently. It’s crucial to stay updated with any amendments or new regulations. The state of Nevada and local governments may introduce tax reforms, so monitoring official sources and consulting tax professionals is advisable.

Are there any tax incentives for startups in Las Vegas?

+Yes, Las Vegas offers various tax incentives for startups, including the Nevada Governor’s Office of Economic Development (GOED) tax abatement programs. These programs provide tax breaks and credits to eligible startups, helping them reduce their tax burden and focus on growth.

What are the consequences of not paying property taxes in Las Vegas?

+Failure to pay property taxes can lead to significant penalties, interest, and potential foreclosure. It’s essential to pay property taxes on time to avoid legal complications and maintain good standing with local authorities.