Tax Act Reviews

Welcome to a comprehensive review of the Tax Act, a vital piece of legislation that shapes the financial landscape for individuals, businesses, and the government. The Tax Act, an intricate set of laws and regulations, plays a pivotal role in determining how we manage our finances, plan for the future, and contribute to the economy. In this expert-driven analysis, we delve into the intricacies of the Tax Act, exploring its impact, implications, and the strategies it influences. Join us as we navigate the complex world of taxation, offering insights and guidance to help you make informed financial decisions.

Understanding the Tax Act: A Comprehensive Overview

The Tax Act is a cornerstone of fiscal policy, outlining the rules and regulations governing the collection of taxes. It serves as a roadmap for taxpayers, providing clarity on their obligations and entitlements. This intricate legislation impacts every aspect of our financial lives, from personal income taxes to corporate levies, property taxes, and beyond. A thorough understanding of the Tax Act is essential for individuals and businesses to navigate the complex tax landscape effectively.

Key Components of the Tax Act

The Tax Act encompasses a wide range of provisions, each designed to address specific aspects of taxation. Here’s a breakdown of some of the key components:

- Income Tax Rates and Brackets: The Act defines the tax rates applicable to different income levels, often divided into brackets. These rates determine the amount of tax owed based on an individual’s or business’s taxable income.

- Deductions and Credits: Taxpayers can reduce their taxable income or overall tax liability through various deductions and credits. These include standard deductions, itemized deductions for specific expenses, and credits for things like child care or energy-efficient improvements.

- Capital Gains Taxation: The Tax Act outlines how gains from the sale of assets, such as stocks or real estate, are taxed. It sets different rates for short-term and long-term capital gains, impacting investment strategies.

- Business Taxation: Businesses face a range of tax obligations, including corporate income taxes, payroll taxes, and excise taxes. The Tax Act details these requirements, providing guidelines for businesses to comply with their tax responsibilities.

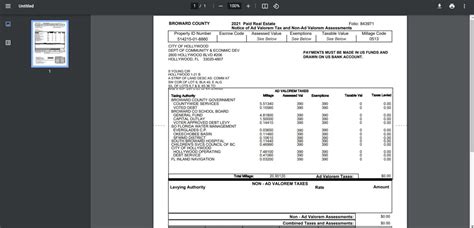

- Property Taxes: Real estate and personal property are subject to taxation. The Tax Act specifies how property values are assessed and the rates at which these taxes are levied, impacting homeowners and property owners.

| Tax Category | Key Provisions |

|---|---|

| Income Tax | Progressive tax rates, standard deductions, and various credits. |

| Capital Gains | Differentiated rates for short-term and long-term gains. |

| Business Taxes | Corporate income tax, payroll taxes, and excise duties. |

| Property Taxes | Assessment methods and rates for real estate and personal property. |

Navigating the Tax Landscape

Understanding the Tax Act is crucial for effective financial planning. It allows individuals and businesses to optimize their tax strategies, taking advantage of deductions, credits, and other incentives. For instance, businesses can structure their operations to minimize tax burdens, while individuals can plan their investments and expenditures to reduce their taxable income.

Impact of the Tax Act on Individuals and Businesses

The Tax Act has a profound influence on the financial well-being of individuals and the operations of businesses. Let’s explore these impacts in more detail.

Financial Planning for Individuals

For individuals, the Tax Act is a critical factor in financial planning. It determines how much of their income is subject to taxation and the strategies they can employ to minimize their tax burden. Here are some key considerations:

- Taxable Income and Deductions: Understanding the taxable income thresholds and eligible deductions is essential. Individuals can reduce their taxable income by maximizing deductions for expenses like medical costs, state and local taxes, and charitable contributions.

- Investment Strategies: The Tax Act influences investment decisions. For instance, capital gains taxes can impact the timing of asset sales, while tax-advantaged accounts like IRAs or 401(k)s offer opportunities for tax-efficient savings.

- Filing Status and Dependency: The Act recognizes different filing statuses (single, married filing jointly, etc.) and allows for claiming dependents, which can result in lower tax liabilities.

Tax Considerations for Businesses

Businesses face a complex web of tax obligations under the Tax Act. These obligations impact their bottom line and can influence strategic decisions. Here are some key points:

- Corporate Tax Rates: The Act sets corporate tax rates, which can vary based on the type of business entity. Lower tax rates can incentivize investment and expansion, while higher rates may impact profitability.

- Payroll and Employment Taxes: Businesses must comply with payroll tax obligations, including withholding taxes from employee wages and remitting them to the government. These taxes fund social security and Medicare programs.

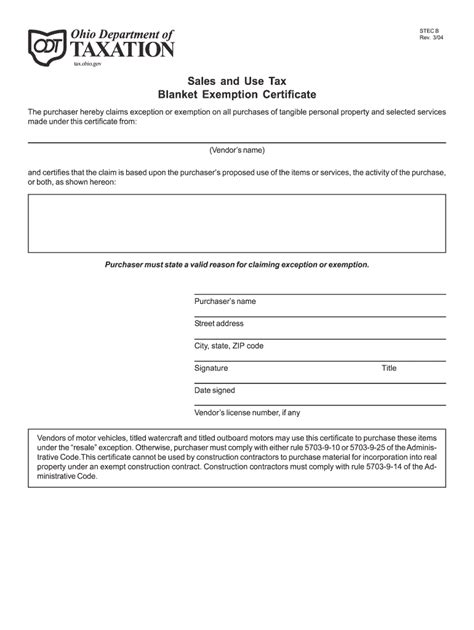

- Sales and Excise Taxes: Businesses often collect sales taxes on behalf of the government and may be subject to excise taxes on specific goods or services they provide.

- Tax Planning and Strategy: Businesses engage in tax planning to minimize their tax liabilities. This includes optimizing business structures, utilizing tax incentives, and implementing tax-efficient strategies for operations and investments.

Compliance and Enforcement: Ensuring Adherence to the Tax Act

The Tax Act is not merely a set of guidelines; it is a legal obligation that carries consequences for non-compliance. Let’s delve into the world of tax compliance and enforcement.

Tax Compliance: A Shared Responsibility

Compliance with the Tax Act is a shared responsibility between taxpayers and the government. Taxpayers are expected to understand and adhere to the provisions of the Act, accurately reporting their income and taxes owed. The government, in turn, provides guidance and resources to assist taxpayers in meeting their obligations.

Key aspects of tax compliance include:

- Accurate Record-Keeping: Taxpayers must maintain detailed records of their financial transactions, including income, expenses, and deductions. These records are essential for preparing tax returns and supporting the reported information.

- Timely Filing and Payment: Taxpayers have specific deadlines for filing their tax returns and making payments. Late filings and payments can result in penalties and interest charges.

- Reporting Requirements: Different taxpayers have varying reporting requirements. For instance, businesses may need to file quarterly estimated tax payments, while individuals typically file annual returns.

Enforcement Mechanisms

To ensure compliance, governments employ various enforcement mechanisms. These mechanisms range from educational resources and outreach to more stringent measures like audits and penalties.

- Education and Outreach: Tax authorities provide educational materials, workshops, and online resources to help taxpayers understand their obligations and navigate the tax system.

- Audits and Investigations: In cases of suspected non-compliance, tax authorities may conduct audits or investigations. These processes involve a detailed examination of a taxpayer’s financial records to ensure accuracy and compliance.

- Penalties and Interest: Non-compliance with the Tax Act can result in penalties and interest charges. These financial consequences serve as a deterrent and help ensure taxpayers take their obligations seriously.

The Future of Taxation: Trends and Developments

The world of taxation is dynamic, with ongoing changes and developments shaping the landscape. Here, we explore some of the trends and future implications of the Tax Act.

Emerging Trends in Taxation

Several trends are influencing the evolution of taxation, including:

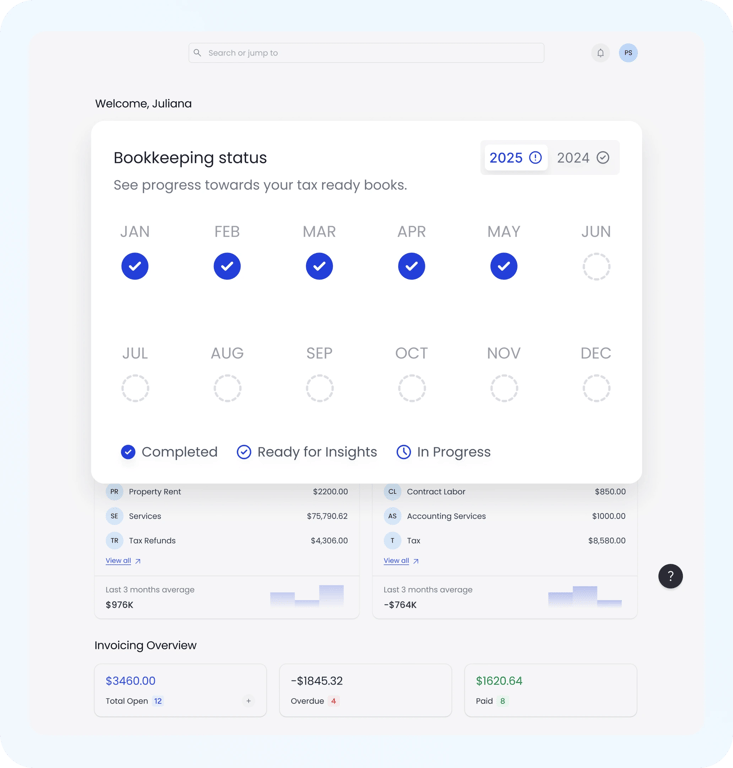

- Digitalization: The rise of digital technologies is transforming tax administration. Online filing systems, digital record-keeping, and data analytics are enhancing efficiency and accuracy in tax processes.

- Global Tax Reforms: International tax reforms are gaining momentum. Efforts to combat tax evasion and promote fairness in the global economy are leading to changes in cross-border taxation and corporate tax policies.

- Sustainable Taxation: The concept of sustainable taxation is gaining prominence. This involves aligning tax policies with environmental and social goals, such as encouraging investments in renewable energy or promoting fair labor practices.

Future Implications

The future of taxation holds both opportunities and challenges. Some potential implications include:

- Simplification and Efficiency: Ongoing efforts to simplify tax codes and improve efficiency can reduce compliance burdens and enhance taxpayer experience.

- Technology Integration: The increasing role of technology in taxation can lead to more accurate and timely tax administration, but it also raises concerns about privacy and cybersecurity.

- International Cooperation: As global tax reforms gain traction, international cooperation in tax matters may become more prevalent, impacting cross-border transactions and tax planning strategies.

Conclusion: Navigating the Tax Landscape

The Tax Act is a complex and ever-evolving set of regulations that significantly impact our financial lives. Understanding its provisions and staying informed about changes is crucial for effective financial planning. Whether you’re an individual taxpayer or a business owner, a solid grasp of the Tax Act empowers you to make informed decisions and optimize your financial strategies.

As we’ve explored, the Tax Act influences everything from personal financial planning to business operations. It shapes the way we manage our income, investments, and expenditures, and compliance with its provisions is essential. The future of taxation holds exciting possibilities, with ongoing reforms and technological advancements promising to streamline processes and promote fairness.

Stay tuned to the latest developments, consult with tax professionals, and embrace the opportunities that a solid understanding of the Tax Act can bring. With knowledge and proactive planning, you can navigate the tax landscape with confidence and ensure your financial well-being.

How often are tax laws updated, and where can I find the latest information?

+Tax laws are subject to frequent updates and amendments. It’s crucial to stay informed about these changes. Official government websites and tax authority portals provide the most accurate and up-to-date information on tax legislation. Additionally, reputable tax software and services often offer updates and notifications about changes to tax laws.

What are some common tax deductions individuals can take advantage of?

+Common tax deductions for individuals include deductions for medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain education-related expenses. These deductions can help reduce taxable income and lower overall tax liability.

How do businesses structure their operations to minimize tax burdens?

+Businesses employ various strategies to minimize tax burdens. These include optimizing business structures (e.g., choosing the right entity type), utilizing tax incentives and credits, and implementing tax-efficient practices for operations and investments. Consulting with tax professionals can help businesses navigate these strategies effectively.

What are the consequences of non-compliance with the Tax Act?

+Non-compliance with the Tax Act can result in severe consequences, including penalties, interest charges, and even legal action. Tax authorities have mechanisms in place to enforce compliance, such as audits and investigations. It’s crucial to adhere to tax obligations to avoid these penalties and maintain good standing with tax authorities.