Ct Sales Tax Rate

Connecticut, often referred to as the "Constitution State," boasts a rich history and a diverse economy. One critical aspect of its economic framework is the sales tax, a vital revenue source for the state government. The sales tax rate in Connecticut is a fundamental piece of information for both residents and businesses, impacting daily transactions and financial planning. This article aims to provide an in-depth analysis of the Connecticut sales tax rate, its historical context, current regulations, and future implications.

Understanding the Connecticut Sales Tax

The sales tax in Connecticut is a consumption tax levied on the sale of goods and services within the state. It is an essential component of the state’s revenue system, contributing significantly to the funding of various public services and infrastructure projects. The tax rate is uniform across the state, ensuring a consistent tax environment for businesses and consumers.

The Connecticut Department of Revenue Services (CT DRS) is the governing body responsible for administering and enforcing the sales tax regulations. They provide comprehensive guidelines and resources for taxpayers, ensuring compliance and transparency in the tax system.

Sales Tax Exemptions and Special Considerations

While the sales tax applies to most transactions, Connecticut has a list of exemptions and special considerations. Certain goods and services are exempt from sales tax, including:

- Prescription medications

- Residential electricity and gas

- Clothing and footwear under $50

- Agricultural equipment and supplies

- Some educational services

Additionally, Connecticut has implemented a use tax to ensure fairness and capture revenue from certain transactions. The use tax applies when goods or services are not subject to sales tax but are used, stored, or consumed in Connecticut. This includes online purchases, out-of-state purchases, and services rendered outside the state.

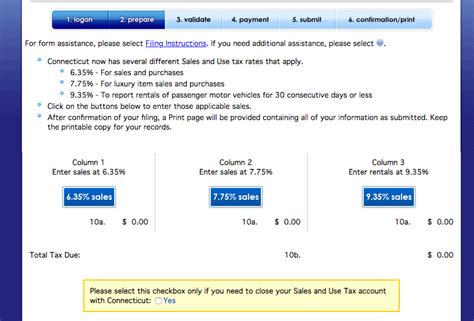

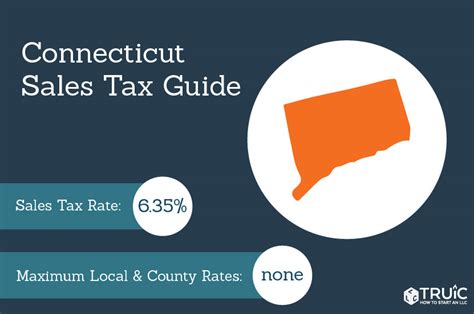

Connecticut’s Current Sales Tax Rate

As of [Current Date], the general sales tax rate in Connecticut is 6.35%. This rate is applied to most retail sales, including tangible personal property and some services. The state sales tax rate is consistent across all counties and municipalities, ensuring a standardized tax environment.

However, it's important to note that certain jurisdictions within Connecticut may have additional local sales taxes. These local taxes are imposed by municipalities and can vary from one location to another. For instance, cities like Hartford and Bridgeport have a local sales tax of 0.5%, bringing the total sales tax rate to 6.85% in those areas.

| Statewide Sales Tax Rate | 6.35% |

|---|---|

| Local Sales Tax (Select Cities) | 0.5% |

| Total Sales Tax (e.g., Hartford, Bridgeport) | 6.85% |

Businesses operating in Connecticut are responsible for collecting and remitting the appropriate sales tax to the CT DRS. They must also keep accurate records of sales transactions and tax collections to ensure compliance with state regulations.

Historical Perspective: Evolution of Connecticut’s Sales Tax

Connecticut’s sales tax has undergone several transformations since its inception. The state first implemented a sales tax in the 1940s, with an initial rate of 3%. Over the decades, the rate has been adjusted multiple times to meet the changing economic needs and fiscal responsibilities of the state.

One notable change occurred in 1991 when the state sales tax rate was increased to 6%, a move aimed at addressing budget deficits and funding public projects. Since then, there have been minor adjustments, including the addition of local sales taxes in certain municipalities.

The history of Connecticut's sales tax is a testament to the state's commitment to balancing its budget and providing essential services to its residents. The tax rate has been a crucial tool in achieving these goals, allowing the state to invest in infrastructure, education, and social services.

Impact of Sales Tax on the Connecticut Economy

The sales tax plays a pivotal role in the Connecticut economy, influencing consumer behavior, business strategies, and overall economic growth. Here’s a closer look at its impact:

Consumer Spending

The sales tax directly affects consumer spending habits. When the tax rate is higher, consumers may be more inclined to make larger purchases less frequently or seek out tax-free alternatives. On the other hand, a lower tax rate can stimulate spending, encouraging consumers to make more frequent purchases.

Business Operations

Businesses operating in Connecticut must consider the sales tax rate when setting their pricing strategies. A higher tax rate can impact profit margins, especially for small businesses. However, businesses can also leverage the sales tax to their advantage by offering tax-inclusive pricing or promoting tax-free periods to boost sales.

Revenue Generation

The sales tax is a significant source of revenue for the state, funding critical public services and infrastructure projects. The revenue generated from the sales tax contributes to education, healthcare, transportation, and other essential areas. A higher sales tax rate can result in increased revenue, enabling the state to invest more in these sectors.

Sales Tax Compliance and Enforcement

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Connecticut. The CT DRS takes a proactive approach to tax compliance, offering resources and guidance to help businesses understand their obligations.

Businesses are required to register with the CT DRS, obtain a sales tax permit, and collect the appropriate sales tax from customers. They must also file regular sales tax returns and remit the collected tax to the state. Failure to comply with these regulations can result in penalties and interest charges.

The CT DRS conducts audits and investigations to ensure tax compliance. Businesses found to be non-compliant may face significant financial penalties and legal consequences.

Future Outlook: Connecticut’s Sales Tax

Looking ahead, the future of Connecticut’s sales tax rate is a topic of ongoing discussion and speculation. Several factors could influence the direction of the tax rate, including:

- Economic Conditions: The state's economic health and growth can impact the need for revenue generation.

- Budgetary Requirements: Changing budgetary needs, such as increased investments in public services, may necessitate adjustments to the tax rate.

- Political Landscape: Political decisions and public opinion can influence tax policies, leading to potential changes in the sales tax rate.

While it's challenging to predict the exact future of the sales tax rate, it's essential for businesses and consumers to stay informed and adaptable. Monitoring legislative changes and economic trends can help stakeholders prepare for potential shifts in the tax landscape.

Frequently Asked Questions (FAQ)

Are there any special sales tax holidays in Connecticut?

+Yes, Connecticut has designated sales tax holidays for certain periods. During these holidays, specific items are exempt from sales tax, typically including school supplies, clothing, and energy-efficient appliances. These holidays are an excellent opportunity for consumers to save on essential purchases.

How often are sales tax rates adjusted in Connecticut?

+Sales tax rates in Connecticut are not adjusted frequently. Major adjustments are typically made in response to changing economic conditions or budgetary needs. The state strives for stability and predictability in its tax policies, ensuring businesses and consumers can plan effectively.

What happens if a business fails to collect or remit sales tax?

+Businesses that fail to collect or remit sales tax may face severe consequences. The CT DRS can impose penalties, interest charges, and even criminal charges for non-compliance. It’s crucial for businesses to stay informed about their tax obligations and seek professional advice if needed.

In conclusion, the sales tax rate in Connecticut is a critical component of the state’s economic framework, influencing consumer behavior, business strategies, and revenue generation. Understanding the current rate, its historical context, and its potential future trajectory is essential for both businesses and consumers. Staying informed and adaptable ensures that stakeholders can navigate the changing tax landscape effectively.