Georgia Automotive Sales Tax

When it comes to automotive sales, understanding the tax landscape is crucial for both consumers and businesses. In the state of Georgia, automotive sales tax plays a significant role in the purchasing process. This article aims to delve into the intricacies of Georgia's automotive sales tax, exploring its rates, exemptions, and the impact it has on the industry and consumers alike.

Understanding Georgia’s Automotive Sales Tax Structure

Georgia’s automotive sales tax is a vital component of the state’s revenue generation. It is a consumption tax, meaning it is imposed on the purchase of vehicles, whether new or used. The tax is collected by the Georgia Department of Revenue and is an essential source of funding for various state programs and infrastructure projects.

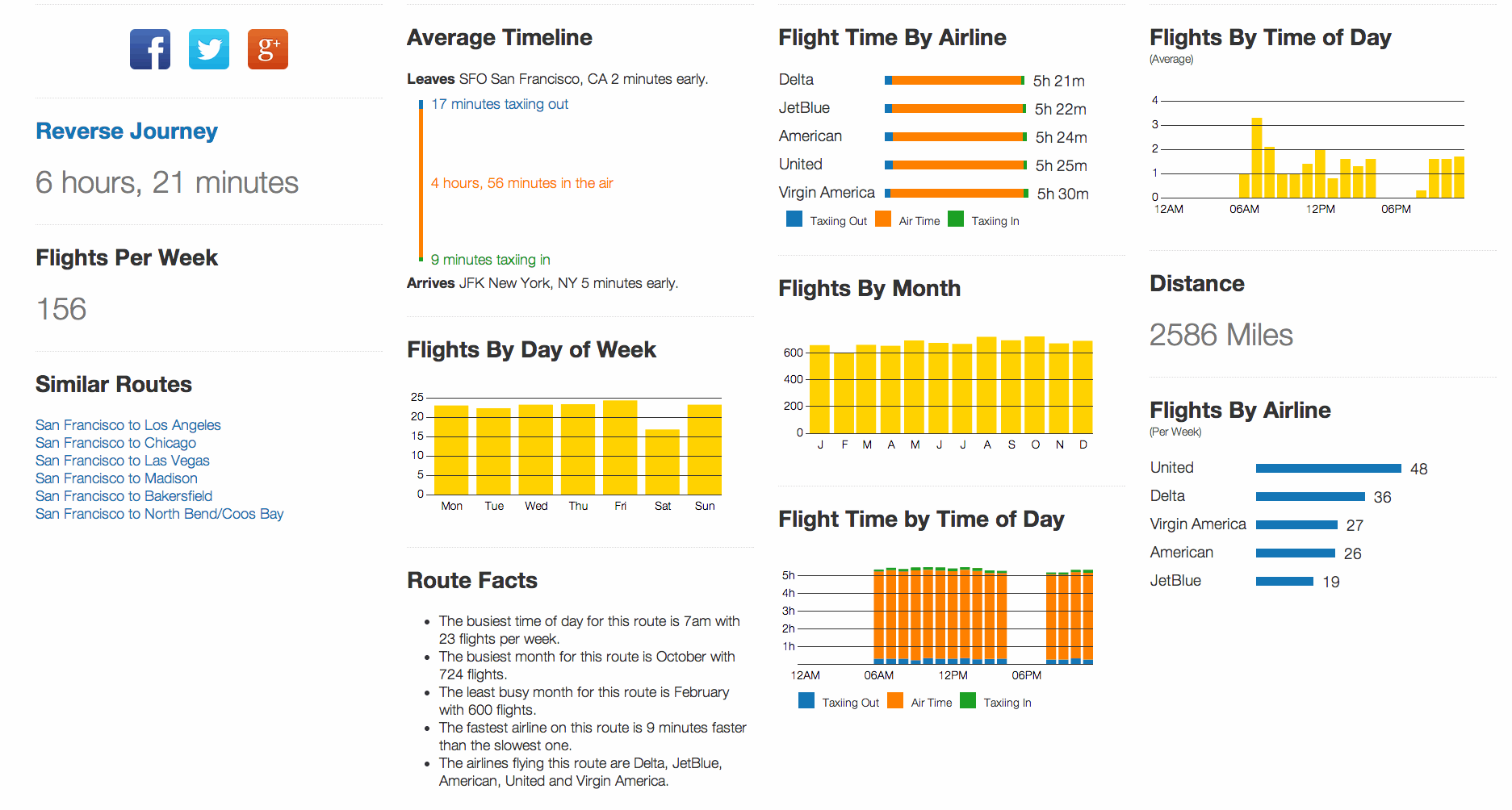

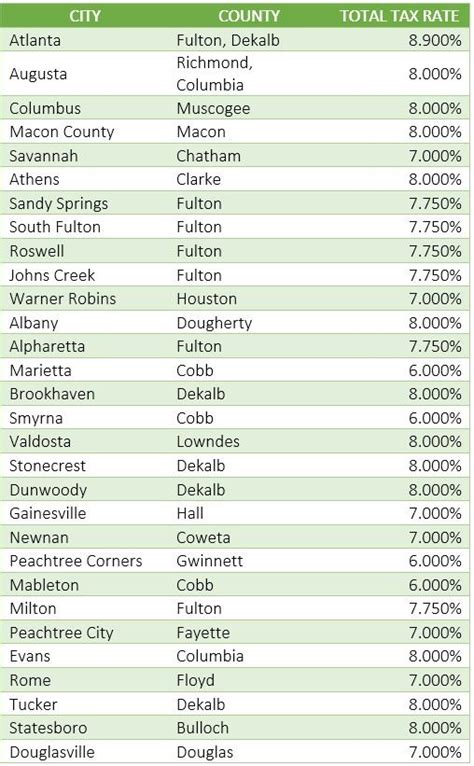

The automotive sales tax in Georgia operates on a percentage-based system, with the tax rate varying depending on the location of the purchase. The state sets a base sales tax rate, and this is supplemented by local taxes applied by counties and municipalities. This means that the total sales tax rate can differ across the state, impacting consumers' out-of-pocket expenses.

Sales Tax Rates by Location

As of [date of latest information], the base sales tax rate in Georgia stands at 4%. However, when combined with local taxes, the total sales tax rate can range from approximately 6% to 8% depending on the county. For instance, the city of Atlanta has a local sales tax rate of 3%, bringing the total sales tax to 7% for purchases made within the city limits.

| County/Municipality | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Fulton County (including Atlanta) | 3% | 7% |

| Gwinnett County | 2% | 6% |

| Cobb County | 1% | 5% |

It is essential for consumers to be aware of the specific sales tax rates in their areas to accurately calculate the total cost of their vehicle purchases.

Exemptions and Special Considerations

While the automotive sales tax is a standard requirement for most vehicle purchases, Georgia offers certain exemptions and special considerations that can provide relief to specific groups of buyers.

Vehicle Type Exemptions

Georgia provides exemptions for the purchase of certain types of vehicles. For example, electric vehicles (EVs) are exempt from sales tax up to a certain purchase price. This incentive aims to encourage the adoption of environmentally friendly transportation options.

| Vehicle Type | Exemption Details |

|---|---|

| Electric Vehicles | Sales tax exemption for EVs with a purchase price below $50,000. |

| Alternative Fuel Vehicles | Potential tax credits or incentives for vehicles running on alternative fuels. |

Military and Veteran Benefits

Georgia extends special considerations to military personnel and veterans. Active-duty military members and their spouses may be eligible for a sales tax exemption on the purchase of a vehicle, providing a significant cost savings. This benefit recognizes the service and sacrifice of those who serve our country.

Impact on Automotive Industry and Consumers

The automotive sales tax in Georgia has a notable impact on both the industry and consumers. For dealerships and automotive businesses, the tax influences pricing strategies and customer negotiations. It is a critical factor in determining the final cost of a vehicle and can impact sales volumes and market competitiveness.

For consumers, the sales tax adds to the overall expense of purchasing a vehicle. However, it is essential to consider the tax in the context of the entire vehicle ownership experience. The revenue generated from automotive sales tax contributes to the state's infrastructure, education, and public services, indirectly benefiting all residents.

Consumer Tips for Navigating Automotive Sales Tax

- Research the specific sales tax rate in your area to accurately calculate the total cost of your vehicle purchase.

- Explore exemptions and incentives offered by the state, especially if you qualify for military benefits or are considering an environmentally friendly vehicle.

- Consider the long-term benefits of the sales tax revenue, which supports essential public services and infrastructure improvements.

- Engage with reputable dealerships and negotiate pricing to ensure you receive the best value for your vehicle purchase.

Conclusion

Georgia’s automotive sales tax plays a pivotal role in the state’s economy and automotive industry. By understanding the tax structure, rates, and exemptions, consumers can navigate the purchasing process more effectively. Additionally, recognizing the broader impact of the sales tax on public services and infrastructure underscores the interconnectedness of economic decisions and community well-being.

Frequently Asked Questions

How often are automotive sales tax rates updated in Georgia?

+Automotive sales tax rates in Georgia are typically updated annually, reflecting changes in state and local budgets. The Georgia Department of Revenue announces any adjustments to the tax rates, ensuring transparency for consumers and businesses.

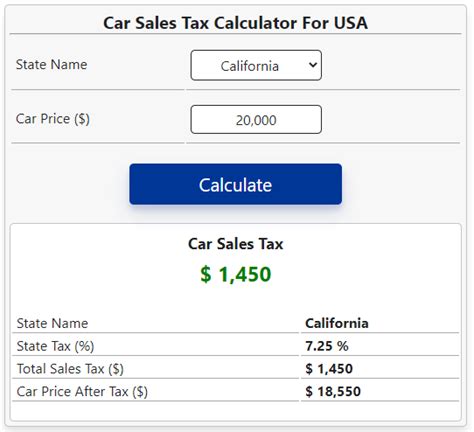

Are there any online resources to help calculate the total sales tax for my vehicle purchase in Georgia?

+Yes, the Georgia Department of Revenue provides an online sales tax calculator on their website. This tool allows consumers to input the purchase price and location to estimate the total sales tax owed. It’s a convenient way to get an accurate estimate before finalizing a vehicle purchase.

Can I apply for a refund if I believe I overpaid on automotive sales tax in Georgia?

+Yes, Georgia offers a sales tax refund program for certain circumstances. If you believe you overpaid due to an error in calculation or qualification for an exemption, you can submit a refund request to the Georgia Department of Revenue. It’s important to keep records and receipts to support your claim.